Document 15703158

advertisement

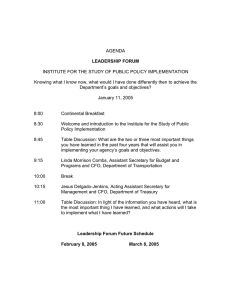

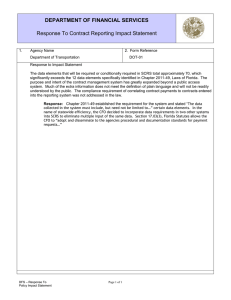

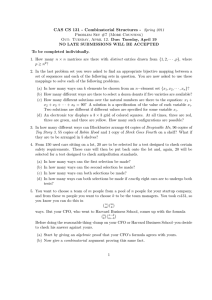

FINANCIAL LEADERSHIP: THE CFO OF TOMORROW LEADERSHIP THE FINANCE LEADER ADDING VALUE OPTIMISATION Strategic direction and understanding to the organisation to drive shareholder value Business Profile & Strategy 1 Finance Influence Finance IT Business Model Analysis Skills Regulatory Custodial Protects and controls assets, driving asset returns, managing risks Finance Leadership Business Environment Finance Strategy Operation s Business Size and Lifecycle 3 Strateg y Key: 2 Business Drivers Finance Enhancers Dynamic Value-Added Strateg y Operation s Regulatory Analysis Skills Custodial The 5 domains of finance can be used to identify where finance adds most value. From this a target operating model for finance can be developed, at the heart of which is the skills, competencies, knowledge profile of professional accountants in the organisation NOW Strategy Regulatory Custodial Operations Analysis - Perceived Value (Weighted) + KEY ROLES TOP 5 FINANCE ROLES THAT ADD MOST VALUE TO ORGANISATIONS Finance Director / CFO Financial Controller Management Accountant Financial Accountant Head of Risk Management 65% 44% 34% 22% 18% What have been the major outcomes for your and/or your clients' organisations as a result of the changes to the global economy? (Please tick all that apply to your organisation/your clients' organisations.) How the top 5 roles add value strategically 100% CFO 91% FC 81% MA FA RM 61% 47% 38% 86% 78% 77% 59% 54% 48% 66% 64% 67% 57% 51% 47% 54% 53% 47% 66% 60% 55% 45% 44% 76% 72% 69% 57% 74% 68% 53% 52% 48% 38% 71% 58% 57% 38% 65% 64% 53% 38% 28% 0% Provides Links finance Aligns Shapes the effective activities to resources to finance leadership drive service model shareholder outcomes value Acts as a change agent, shaping business structures Aids strategic decision making Drives Builds Drives the forward financial people commercial management agenda strategy capacity across the organisation Base: those rating the Finance Director / CFO as one of the top 3 most important roles How the top 5 roles add value operationally 100% CFO FC MA FA 78% 77% 68% 53% 50% 84% 77% 74% 61% 57% 75% 73% 70% 51% 47% RM 75% 71% 69% 59% 51% 48% 47% 55% 49% 39% 66% 65% 57% 51% 49% 0% ChampioningEnsuring core Ensuring financial financial effective operational processes arebalance sheet excellence undertaken management efficiently Effectively Driving Achieving managing improvements value for cash and in Finance IT money treasury systems operations Base: those rating the Finance Director / CFO as one of the top 3 most important roles How the top 5 roles add value - analytics 100% CFO FC MA FA 86% 84% 73% 77% 76% 77% 78% 74% 68% 58% 73% 72% 68% 63% 40% 82% 82% 80% 78% 57% 49% 46% 43% 38% 46% RM 0% Provides Ensures the Helps reduce Helps grow Effectively decision effective costs organisationcommunicates support management of revenue financial analysis finance information projects Base: those rating the Finance Director / CFO as one of the top 3 most important roles How the top 5 roles add value - custodial 100% 92% CFO FC 79% 76% 75% 68% MA 41% FA 74% 66% 63% 56% 51% 48% 64% 55% 46% 69% 63% 62% 31% 71% 54% 48% 79% 75% 74% 56% 72% 66% 60% 59% 44% 29% RM 0% Protects the Drives better Ensures the Ensures Ensure the Strengthems Ensures organisation'sreturns on the organisation organisational organisation internal performance financial organisation's manages its tax efficient has an financial and targets are assets assets risk effectively effective busines achieved capital controls structure Base: those rating the Finance Director / CFO as one of the top 3 most important roles How the top 5 roles add value regulatory 100% CFO FC 78% 69% 62% MA FA 37% 26% 74% 59% 49% 43% 78% 75% 73% 74% 73% 71% 65% 33% 24% 83% 82% 80% 50% 39% 49% 41% 40% 26% 46% 31% 78% 78% 74% 40% 33% RM 0% Ensures the Improves Ensures Ensures Champions Ensures tax Ensures organisation investor governance statutory corporate regulations effective maintains confidence requirements accounting social are met management effective and relations are met obligations responsibility of the banking are met issues external audit relationships relationship Base: those rating the Finance Director / CFO as one of the top 3 most important roles THE CFO: ADDED-VALUE VALUE OF A FINANCE DIRECTOR / CFO Strategic 5% 75% Analytical 7% Operational 7% Custodial 6% 72% Regulatory 7% 73% 100% 72% 70% 0% Low value 100% High value Base: those rating the Finance Director / CFO as one of the top 3 most important roles VALUE OF A FINANCE DIRECTOR / CFO – STRATEGIC 100% 91% 86% 78% 77% 66% 74% 68% 66% 65% 0% Provides Links finance Aligns Shapes the effective activities to resources to finance leadership drive service model shareholder outcomes value Acts as a change agent, shaping business structures Aids strategic decision making Drives Builds Drives the forward financial people commercial management agenda strategy capacity across the organisation Base: those rating the Finance Director / CFO as one of the top 3 most important roles VALUE OF A FINANCE DIRECTOR / CFO – ANALYTICAL Effectively communicates financial information 82% Helps grow organisation revenue 57% Helps reduce costs 68% Ensures the effective management of finance projects 77% Provides decision support analysis 77% 0% Base: those rating the Finance Director / CFO as one of the top 3 most important roles 100% VALUE OF A FINANCE DIRECTOR / CFO – OPERATIONAL Achieves value for money 66% Drives improvements in Finance IT systems 55% Effectively manages cash and treasury operations 71% Ensures effective balance sheet management 73% Ensures core financial processes are undertaken efficiently 74% Champions financial operational excellence 78% 0% Base: those rating the Finance Director / CFO as one of the top 3 most important roles 100% VALUE OF A FINANCE DIRECTOR / CFO – CUSTODIAL Ensures performance targets are achieved 72% Strengthems internal financial and busines controls 75% Ensure the organisation has an effective capital structure 71% Ensures organisational tax efficient 69% Ensures the organisation manages its risk effectively 74% Drives better returns on the organisation's assets 66% Protects the organisation's financial assets 76% 0% Base: those rating the Finance Director / CFO as one of the top 3 most important roles 100% VALUE OF A FINANCE DIRECTOR / CFO – REGULATORY Ensures effective management of the external audit relationship 78% Ensures tax regulations are met 73% Champions corporate social responsibility issues 49% Ensures statutory accounting obligations are met 80% 78% Ensures governance requirements are met 74% Improves investor confidence and relations Ensures the organisation maintains effective banking relationships 78% 0% Base: those rating the Finance Director / CFO as one of the top 3 most important roles 100% THE CFO: SKILLS & BEHAVIOURS TOP 5 MOST IMPORTANT BUSINESS SKILLS OF A FINANCE DIRECTOR / CFO Leadership 79% Communication 61% Strategic business Analysis & modeling Change management 51% 40% 37% What have been the major outcomes for your and/or your clients' organisations as a result of the changes to the global economy? (Please tick all that apply to your organisation/your clients' organisations.) MOST IMPORTANT BUSINESS SKILLS OF A FINANCE DIRECTOR / CFO Leadership Communication Strategic business Analysis & modeling Change management Ethics Business culture Problem solving Influencing Negotiation Team building Conflict management Client relationship Presentation Networking Coaching Time management Project management Managing upwards IT/ data / computer Consulting Report writing Facilitation Line management 79% 61% 51% 40% 37% Top 5 31% 25% 24% 24% 17% 15% 13% 12% 11% 10% 9% 8% 8% 5% 5% 4% 4% 3% 3% 0% Base: those rating the Finance Director / CFO as one of the top 3 most important roles 100% TOP 3 MOST IMPORTANT BEHAVIOURS OF A FINANCE DIRECTOR / CFO Integrity Objective / unbiased Visionary 51% 44% 42% What have been the major outcomes for your and/or your clients' organisations as a result of the changes to the global economy? (Please tick all that apply to your organisation/your clients' organisations.) MOST IMPORTANT BEHAVIOURS OF A FINANCE DIRECTOR / CFO Integrity 51% Objective / unbiased 44% Visionary 42% Top 3 36% Ethically minded Empowering 26% Practical 20% Logical 19% Approachable 17% 15% Flexible Authoritative 13% Creative 10% Controlled 6% Intuitive 5% 4% Meritocratic Sensitive 3% 0% 100% Base: those rating the Finance Director / CFO as one of the top 3 most important roles What have been the major outcomes for your and/or your clients' organisations as a result of the changes to the global economy? (Please tick all that apply to your organisation/your clients' organisations.) THE CFO: VALUE ENABLERS 71% Effective finance leaders Finance structures aligned to the business 65% Support from senior management / the board 62% 52% Clear and visible finance strategy Superior IT systems 35% Visibility of value drivers within the business 33% 31% Standardised finance processes 27% Effective financial support from the business Leading analysis tools 24% Documented, accessible, visible finance policies 22% Balanced scorecards to measure finance performance 21% Visibility of the total cost of finance - system, process, people 20% Centres of excellence for specialist finance areas 13% Global owners of end-to-end finance processes 10% External benchmarking of its processes 10% Outsourcing of routine finance processes 3% 0% Base : all respondents answering 100% THE CFO: BARRIERS TO VALUE BARRIERS TO ADDING VALUE 35% No support for finance by senior management or the board 7% No belief in the value of external advice or consultancy 15% Ineffective line management Being viewed as "back office" and administrative by the rest of the business Insufficient financial support for the finance function 57% 17% 25% Too much regulation and compliance requirements Inadequate performance management and career development programmes No finance strategy 25% 31% Ineffective Finance IT systems 38% Inadequate analysis tools 24% No control / visibility of the costs fo the finance function 11% No clear ownership of finance processes 25% Ineffective finance leaders 41% Non-standard finance processes 24% Multiple stakeholder demands 35% Complexity of business operations 32% Finance structures not aligned to business 45% 0% Base : all respondents answering 100% THE CFO: TRAINING AND DEVELOPMENT Technical foundation Broad experience Networking Timing IN SUMMARY Don’t leave leadership development until you are at CFO level Experience is our best master and our best servant. Bringing your brain and calculator to work is not enough – you need to bring your heart and ears as well. MORE www.accaglobal.com/mhc