Credit Markets and Leveraged Buy-Outs: The Good, The Bad and... Fall 2014 – EMBA Fri/Sat Elective (Menu A)

advertisement

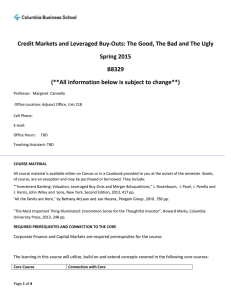

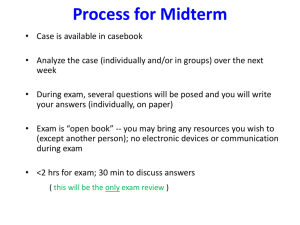

Credit Markets and Leveraged Buy-Outs: The Good, The Bad and The Ugly Fall 2014 – EMBA Fri/Sat Elective (Menu A) B7329-001 Professor: Margaret Cannella Office Location: Adjunct Office, Uris 218 Cell Phone: 973-951-4051 E-mail: margaret.cannella@gmail.com Office Hours: Monday 2:00-5:00pm or by appointment before class Teaching Assistant: Bharath Rajagopalan (brajagopalan15@gsb.columbia.edu) COURSE MATERIAL All course material is available either on Canvas or in a Casebook provided to you at the outset of the semester. Books, of course, are an exception and may be purchased or borrowed. Prescribed Textbook: "Investment Banking: Valuation, Leveraged Buy-Outs and Merger &Acquisitions" J. Rosenbaum, J. Pearl, J. Perella and J. Harris, John Wiley and Sons, New York, Second Edition, 2013, 417 pp. Mandatory by Class #3 – Review LBO Modeling Lecture Video (KKR/Gardner Denver Deal Example): Available on Canvas - https://cbs360.gsb.columbia.edu:8443/ess/echo/presentation/3664d7ea-a6f7-4990-8ddfb302aaa14a6e Students are expected to review this video and have an understanding of LBO Modeling before Class #3. Our Teaching Assistant will be available for any Q&A on the lecture video and further review sessions on LBO modeling. Mandatory Reading Assignment: “Stress Test: Reflections on Financial Crises”, Timothy F Geithner, Crown, 2014, 580 pp. Students strongly encouraged to buy a copy of this book. A 1-page critique and an in-class student debate will be based on “Stress Test”. See section on “Method of Evaluation” below for further details. Several optional readings are listed at the end of this document. Page 1 of 4 REQUIRED PREREQUISITES AND CONNECTION TO THE CORE Corporate Finance and Capital Markets are required prerequisites for the course. The learning in this course will utilize, build on and extend concepts covered in the following core courses: Core Course Corporate Finance Financial Accounting Global Economic Environment Decision Models Connection with Core 1. Firm Valuation Model 1. The Accounting Model 2. Resources and Obligations 1. What are the role of financial markets in the economy 1. Models in Practice Students will be expected to have mastered these concepts and be able to apply them in the course. COURSE DESCRIPTION The course looks at leveraged buy-outs from the vantage point of financial sponsors, the credit markets and fixed income investors as it prepares you to play a role in any of these capacities upon graduation. It will enable you to address – through casework and a final project - the fundamental question of how value is created in leveraged transactions in different credit market conditions, using different financing structures that facilitate different investment rationales. The casework introduces a broad array of transactions, some of which have been highly remunerative to the buy-out firms which invested ("the good"), while others may prove difficult to exit ("the bad") and still others might require extraordinary financial or operational engineering to salvage ("the ugly”). A final project enables you, playing the role of a buy-out firm, to pitch for financing of the transaction. COURSE OBJECTIVES To provide students the tools to make decisions relating to LBO transactions: 1. 2. 3. 4. 5. Identifying companies that make good LBO candidates Determining the appropriate price for an LBO transaction Structuring the LBO transaction Exiting the LBO transaction Investing in the LBO capital structure COURSE OUTLINE See course roadmap. Page 2 of 4 METHOD OF EVALUATION Final grades will be based on (1) the quality of your class participation (25%); (2) mandatory reading assignment (5%) (3) written responses to case questions (25%); (4) a team cross evaluation (10%); (5) a mid-term (15%) and (6) a final project (20%). Please note that, on this basis, 45% of your grade will be based on your individual contribution; 55% of your grade will be based on team contribution. For further detail, see below: Participation Readings Assignments Case Questions Cross Evaluation Mid-term Exam Final Project Total 25% 5% 25% 10% 15% 20% 100% Individual Team 45% 55% (1) Class Participation. (25%) Attendance and participation, the quality of your class participation in discussing readings and cases, and evidence of your extracurricular interest in the topic (e.g. evidence of outside reading, extensive discussion of recent transactions) will form the basis for your class participation grade. Class participation grades are individual and a formula for calculating the class participation grade will be explained in the first session. This is a highly interactive class and your participation is critical to your success and the success of the course. You should not take the course unless you recognize the need for participation. There will be substantial cold calling of both reading and case assignments. For transparency, I will notify you of your preliminary class participation grade immediately following the mid-term break and work closely with students who seek to improve their participation grade. Class participation grades are individual. (2) Mandatory Reading Assignment. (5%) On-time completion of the reading assignment (“Stress Test” by Tim Geithner). After a thorough reading of the book, you should prepare a one page list of its merits as well as opposing arguments. You should come prepared to defend either view in an in-class debate. (3) Written Responses to Case Questions. (25%) Case questions are assigned as your written responses, prepared in teams, should never exceed one-half page per question, not including back-up spread sheets. Cases, including questions to answer for each case, are assigned for most sessions. Grades for written responses to case questions are provided by team and the grade is awarded to the entire team. (4) Cross Evaluation. (10%) It is critical that your team has the time to complete their work. It is also critical that team members share the work among themselves. To enforce these qualities, a cross-evaluation will be done at mid-term and at semester end. This confidential survey will ask you to rate your team members. Cross evaluation grades are individual. (5) Mid-Term Examination and Final Projects. (35%) Your mid-term in-class, open-book and your final project will be graded on with a maximum of 15 and 20 points, respectively. The grading criteria for both will include 1) quality of conclusions; 2) accuracy of analysis; 3) presentation quality. (D) In the final project, you play the role of a PE firm pitching an idea for your investment and its financing to a debt capital markets team at a major firm; the final project is usually presented to the debt capital markets team at BofAMerrill in their offices. The grade on the mid-term is individual and the grade on the final project is awarded to the entire team. Page 3 of 4 CLASSROOM NORMS AND EXPECTATIONS For team casework, form teams in the number as directed the first day of class, usually no fewer than four and no more than five students. Take advantage of your classmate’s different backgrounds, experiences and interests. In-class, please demonstrate consideration for your classmates (and your instructors and guest speakers) by closing laptops during lectures and guest appearances, posting nameplates, and by being on time at the beginning of the class and at break. To ensure that I get to know you quickly, please sit in the same place in each class and use a nameplate. Cases, readings and related materials will be made available via a casebook; we will post original documents and, after the assignment is completed, sample answers to case questions. We will provide hard copies of slide presentations; these will also be posted on Canvas to view during class. Use the drop box for all casework, for the mid-term and for the final project; submit casework at least two hours prior to the start of class. Contact me or our teaching assistant in the event you have any questions and/or use our office hours to ask questions in person. OPTIONAL READINGS "DREAM BIG: How the Brazilian Trio behind 3G Capital - Jorge Paulo Lemann, Marcel Telles and Beto Sicupira acquired Anheuser-Busch, Burger King and Heinz" by Christine Correa, Primeira Pessoa, 2014, 235 pp. “Barbarians at the Gate: The Fall of RJR Nabisco”, Bryan Burrough and John Heylar, HarperCollins, 2009, 624 pp. “King of Capital: The Remarkable Rise, Fall, and Rise Again of Steve Schwarzman and Blackstone”, David Carey and John E. Morris, Crown Business, 2012 (Reprint edition), 400 pp. “The Predators' Ball: The Inside Story of Drexel Burnham and the Rise of the JunkBond Raiders”, Connie Bruck, Penguin Books, 1989, 400 pp. Guides to U.S. and European Loan Markets, S&P Leveraged Commentary and Data, 2013 (Included in casebook) Page 4 of 4