Basic Principles Behind Economic Models Chapter 1

advertisement

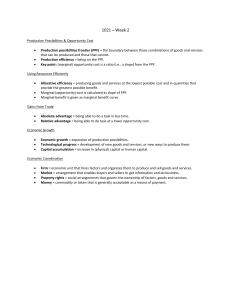

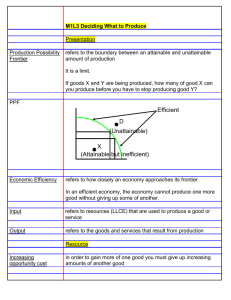

Basic Principles Behind Economic Models Chapter 1 With Illustrations from Ch. 3 and 4 Ten Principles Underlying Economic Models (Ch. 1) Today’s Focus How do We Model How People Make Decisions • The Basic Foundation • Key assumptions 1. 2. 3. For each person, some goods are scarce Tradeoffs Each person desires many goods Each person is willing to give up some of one economic good to get more of another economic good • Greg’s Second Principle Opportunity Cost • Cost of something is what you have to give up • “opportunity cost” – next best alternative/good given up when you chose a good • Benefit of good A (chosen) versus benefit of good B • Cost of good A includes the cost of not being able to purchase good B • Key to modelling decisions will incorporate this tradeoff A First Model of the Economy Production Possibilities Frontier Curve • DEFINITION of 'Production Possibility Frontier - PPF' A curve depicting all maximum output possibilities for two or more goods given a set of inputs (resources, labor, etc.). The PPF assumes that all inputs are used efficiently. • A production-possibility frontier is a budget constraint presented by the limitation of available factors of production. 4 Production Possibilities Frontier Production Possibilities Frontier • Why is the PPF downward-sloping? • • • • • Must give up one good to increase production of another • Opportunity Costs Why are we unable to produce certain combinations? • Scarcity and limited resources Efficient points • Points ON the PPF (A, B, C, and D) Inefficient points • Points INSIDE the PPF (F) • Workers goofing off, unused buildings Unattainable (for now) points • Points OUTSIDE the PPF (E) PPF and Opportunity Cost • Recall opportunity cost – Highest-valued alternative – What we give up as a result of an action • Opportunity cost in this case is the slope of the PPF – Slope = rise over run – ∆y/∆x = (y2-y1)/(x2-x1) Production Possibilities Frontier Linear PPF – Opp Costs are constant No Specialization of Labor (or any input) Principle 3: Rational decisions are made at the “margin” • What do we mean? • When making an economic decision, e.g. to purchase 1 more unit of a good, we compare the marginal (or incremental) benefits against the marginal costs • For example • When studying for an exam • Given you’ve already studied 8 hours, when deciding whether or not to study 1 more hour, you compare • the expected benefits (a “marginal” improvement in your grade • Versus the next best (highest valued) use of your time • E.g., sleeping, eating, time with friends Making Decisions at the Marginal • Back to the First Law of Demand • How much of a good do you buy? • If the marginal/incremental value of the next unit is less than what it costs, are you willing MV < price Don’t buy! to buy it? MV < price Do buy! Totals versus Marginals • When you make a “consumption” decision • You may be comparing Total Value of consuming x amount of the good (TV(x)) to the Total Cost (TC(x)) • But it’s really a step-wise comparison • If TV(9) > TC(9) • Buy at least 9 • then check at x =10 • If TV(10) < TC(10) • Stop at 9 • MV(10th unit) less than MC(10th unit) • Easier and faster (fewer calculations) to compare marginals than totals Optimal Decisions Made at the Margin • For consumers • If price > additional/incremental/marginal “use” value of the good -> don’t buy • If price < MV -> buy • For suppliers • If P > marginal costs of producing that last unit -> supply it to the marketplace (sell it!) • If P < MC then don’t produce it Principle 4: People Respond (rationally) to Economic Incentives • An example (Hubbard and O’Brien) • Average age of the populations of US, Japan and most Europeans countries are getting older • Declining birth rates (below replacement level) • People living longer • Post WWII baby boom (“mouse in the python”) • Challenge for governments as • Social security and medical care payments will increase as larger % of population retires • Fewer younger folks replacing them in the workforce • -> tax payments are decreasing An Interesting Solution • Estonia • UN estimated that population would decline by 0.7M by 2050 (from 1.4M to 0.7M) • Starting in 2007 • Working women paid entire salary up to 15 months for having a child • Non-working: $200 per month (avg income ~$650) • Impact • Birth rate increased from 1.6 to 2.1 children per woman • 45 other european countries in the process of adopting a similar set of incentives Learning Objective 1.1 Making the •Will Women Have More Babies if the Government Pays Them To? Connection The Estonian government is encouraged by the results of providing economic incentives and is looking for ways to provide additional incentives to raise the birthrate further.