Chapter 19

Using

Securities

Markets for

Financing

and Investing

Opportunities

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

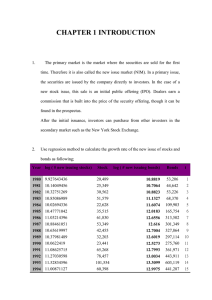

Chapter

Nineteen

LEARNING GOALS

1. Describe the role of securities markets.

2. Advantages & disadvantages of equity financing by

issuing stock, and the differences between common

and preferred stock.

3. Advantages & disadvantages of obtaining debt

financing by issuing bonds, and identify types and

features of bonds.

4. Explain investing in securities markets, setting &

balancing investment objectives, and managing risks.

5. Analyze investment opportunities stocks, bonds,

mutual funds, and exchange-traded funds (ETFs).

6. Describe market indicators like the Dow Jones

Industrial Average, NASDAQ, and S&P 500.

19-2

The Function

of Securities

Markets

LG1

The BASICS of

SECURITIES MARKETS

• Securities markets are

financial marketplaces for

stocks and bonds and serve

two primary functions:

1. Assist businesses in finding

long-term funding to finance

capital needs.

2. Provide private investors a place

to buy and sell securities such

as stocks and bonds.

19-3

Securities

Regulations

and the SEC

LG2

The SECURITIES and

EXCHANGE COMMISSION

• Securities and Exchange Commission (SEC) - The federal agency responsible for regulating the

various stock exchanges; created in 1934 through the

Securities and Exchange Act.

• Prospectus -- A condensed version of economic

and financial information that a company must file

with the SEC before issuing stock; the prospectus

must be sent to prospective investors.

• Initial Public Offering (IPO) -- The first offering of

a corporation’s stock, usually managed by an

investment banker.

19-4

Understanding

Stock Market

Indicators

LG9

KEY STOCK MARKET

INDICATORS

• Dow Jones Industrial Average -- The average

cost of 30 selected industrial stocks.

• Critics say the 30-company Dow is too small a

sample and suggest following the S&P 500.

• S&P 500 tracks the performance of 400

industrial, 40 financial, 40 public utility, and 20

transportation stocks.

19-5

Stock

Exchanges

STOCK EXCHANGES

LG2

• Stock Exchange -- An organization whose

members can buy and sell (exchange) securities on

behalf of companies and individual investors.

• Over-the-Counter (OTC) Markets -- Provides

smaller publically traded companies and investors

with a means to trade stocks not listed on the

national securities exchanges.

• NASDAQ -- A telecommunications network that links

dealers across the nation so they can exchange

securities electronically.

19-6

Stock

Exchanges

TOP STOCK EXCHANGES

LG2

• NYSE Euronext

• NASDAQ

• London Stock

Exchange

• Tokyo Stock Exchange

• Deutsche Borse

19-7

How Businesses

Raise Capital by

Selling Stock

LG3

LEARNING the

LANGUAGE of STOCKS

• Stocks -- Shares of

ownership in a company.

• Stock Certificate -Evidence of stock ownership.

• Dividends -- Part of a firm’s

profits that the firm may

distribute to stockholders as

either cash or additional

shares.

19-8

Advantages &

Disadvantages

of Issuing Stock

LG3

ADVANTAGES of

ISSUING STOCK

• Stockholders are owners of

a firm and never have to be

repaid their investment.

• There’s no legal obligation

to pay dividends.

• Issuing stock can improve a

firm’s balance sheet since

stock creates no debt.

19-9

Advantages &

Disadvantages

of Issuing Stock

LG3

DISADVANTAGES of

ISSUING STOCK

• Stockholders have the right to vote for a

company’s board of directors.

• Issuing new shares of stock can alter the control

of the firm.

• Dividends are paid from after-tax profits and are

not tax deductible.

• The need to keep stockholders happy can affect

management’s decisions.

19-10

Issuing Shares

of Common and

Preferred Stock

TWO CLASSES of STOCK

LG3

• Common Stock -- The most basic form; holders

have the right to vote for the board of directors and

share in the profits if dividends are approved.

• Preferred Stock -- Owners are given preference in

the payment of company dividends before common

stock dividends are distributed. Preferred stock can

also be:

- Callable

- Convertible

- Cumulative

19-11

Stock Splits

STOCK SPLITS

LG6

• Stock Splits -- An action by a company that gives

stockholders two or more shares of additional stock

for every share that they own.

• Splits cause no change in the firm’s ownership

structure and no change in the investment’s

value.

• Firms can never be forced to spilt their stocks.

19-12

Learning the

Language of

Bonds

LG4

LEARNING the

LANGUAGE of BONDS

• Bond -- A corporate certificate indicating that an

investor has lent money to a firm (or a government).

• The principal is the face

value of the bond.

• Interest -- The payment the

bond issuer makes to the

bondholders to compensate

them for the use of their

money.

19-13

Advantages &

Disadvantages

of Issuing Bonds

LG4

ADVANTAGES of

ISSUING BONDS

• Bondholders are creditors, not owners of the

firm and can’t vote on corporate matters.

• Bond interest is tax deductible.

• Bonds are a temporary source of funding and

are eventually repaid.

• Bonds can be repaid before the maturity date if

they contain a call provision.

19-14

Advantages &

Disadvantages

of Issuing Bonds

LG4

DISADVANTAGES of

ISSUING BONDS

• Bonds increase debt and can affect the

market’s perception of the firm.

• Paying interest on bonds is a legal obligation.

• If interest isn’t paid, bondholders can take legal

action.

• The face value of the bond must be repaid on

the maturity date.

19-15

Different

Classes of

Bonds

LG4

DIFFERENT CLASSES of

CORPORATE BONDS

• Corporations can issue two classes of bonds:

1. Unsecured bonds

(debenture bonds):

not backed by

specific collateral.

2. Secured bonds:

backed by

collateral (land or

equipment).

19-16

Investing in

Bonds

IMPORTANT BOND QUESTIONS

LG7

• First-time bond investors generally ask two

questions:

- Do you have to hold a bond until the maturity date?

- How can I assess the investment risk of a particular bond

issue?

• Junk Bonds -- Bonds that are high-risk and

have high default rates.

19-17

Advantages &

Disadvantages

of Issuing Bonds

BOND RATINGS

LG4

Rating

Moody’s

S&P

Fitch

Description

Aaa

AAA

AAA

Highest Quality

Aa

AA

AA

High Quality

A

A

A

Upper-Medium Grade

Baa

BBB

BBB

Medium Grade

Ba

BB

BB

Lower-Medium Grade

B

B

B

Speculative

Caa

CCC, CC

CCC

Poor

Ca

C

DDD

Highly Speculative

C

D

D

Lowest Grade

19-18

How

Investors

Buy

Securities

LG5

BUYING SECURITIES

• Stockbroker -- A registered

representative who works as

a market intermediary to buy

and sell securities for clients.

• Online trading services,

such as TD Ameritrade,

E*Trade, and Scottrade,

offer securities trading

services online to buy and

sell stocks and bonds.

19-19

Reducing Risk

by Diversifying

Investments

LG5

PRIMARY INVESTMENT SERVICES

CONSUMERS NEED

• Savings and investing advice

• Help with 401k plans

• Retirement planning

• Tax planning

• Estate planning

• Education expense planning

Source: Investment Company Institute.

19-20

Investing in

Mutual Funds &

ExchangeTraded Funds

LG8

PERCENTAGE of HOUSEHOLDS

OWNING MUTUAL FUNDS

Year

% of Households

1980

5%

1990

24%

2000

43%

2005

42%

2010

48%

Source: Investment Company Institute Factbook.

19-21

Understanding

Stock

Quotations

LG6

TOP FINANICIAL NEWS and

RESEARCH SITES

• Yahoo Finance

• DailyFinance

• MSN Money

• Forbes

• Dow Jones & Co.

19-22

Choosing the

Right

Investment

Strategy

FIVE INVESTMENT CRITERIA

LG5

1. Investment risk

2. Yield

3. Duration

4. Liquidity

5. Tax consequences

19-23

Choosing the

Right

Investment

Strategy

LG5

AVERAGE ANNUAL RETURN of

ASSET CLASSES (Since 1926)

Investment

Return

Small company stocks

12.2%

Large company stocks

9.5%

Corporate bonds

6.0%

Long-term government bonds

5.8%

Treasury bills

4.1%

The greater the risk, the greater the rewards

Source: Ibbotson Associates and Morningstar.

19-24

Understanding

Mutual Fund

Quotations

COMPARING INVESTMENTS

LG8

19-25

Reducing Risk

by Diversifying

Investments

DIVERSIFICATION

LG5

•

Diversification -- Buying several different types of

investments to spread the risk of investing.

•

If diversifying, an investor may put:

-

25% of his/her money into U.S. growth stocks

-

25% in government bonds

-

25% in dividend-paying stocks

-

10% in an international mutual fund

-

The rest in a savings account

19-26

Investing in

Mutual Funds &

ExchangeTraded Funds

LG8

INVESTING in MUTUAL FUNDS

and EXCHANGE-TRADED FUNDS

• Mutual Fund -- An organization the buys stocks

and bonds and then sells shares in those securities

to the public. The fund pools investors’ money and

buys stocks according to the fund’s purpose.

• Exchange-Traded Fund (ETF) -- Collections of

stocks and bonds that are traded on securities

exchanges, but are traded more like individual stocks

than mutual funds.

19-27

Investing in

Mutual Funds &

ExchangeTraded Funds

VARIETIES of ETFs

LG8

ETF

Traditional

Description

Most common; include large U.S.

stocks, small U.S. stocks,

international stocks, or investmentgrade bonds.

Niche

Focus on an individual sector like

healthcare, high-yield bonds, or a

single country.

Exotic

Invest in unusual, more volatile

sectors such as commodities like

gold and concepts like clean

technology.

Source: Schwab and E*Trade.

19-28

Choosing the

Right

Investment

Strategy

LG5

INVESTING 101

Things to Do Before Making Your First Investment

• Take an investing class.

• Join an investment club, or reputable web site

like Motley Fool, not Motley Crue.

• Attend a conference (be very careful in selecting).

• Head to the library and pick up these books:

- The Big Short

- The Intelligent Investor

- The Myth of the Rational Market

Source: Money, November 2010.

19-29

Investing in

Stocks

SELECTING STOCKS

LG6

• Capital Gains -- The positive difference between

the price at which you bought a stock and what you

sell it for.

• Investors can also choose stocks according to

their strategy:

-

Blue-chip stocks

Growth stocks

Income stocks

Penny stocks

19-30

The SUN NEVER SETS on

STOCK OPPORTUNITIES

(Reaching Beyond Our Borders)

• Suggestions for building your financial future:

- Invest in global companies you know and that have

solid performance records.

- Invest in global stocks listed on U.S. exchanges.

- Contact U.S. brokers about American Depository

Receipts (ADRs).

- Invest in global mutual funds that focus on specific

countries or regions.

- Use extreme caution if investing in unstable

countries!

19-31

Riding the

Market’s Roller

Coaster

MARKET TURMOIL

LG9

• The stock market has its shares of ups and

downs:

- October 29, 1929 - Black

Tuesday; the market lost 13%

of its value.

- October 19, 1987 - The market

suffered its worst one-day drop

when it lost 22% of its value.

- October 27, 1997 - Fears of an

economic crisis in Asia cause

widespread panic and losses.

19-32

Investing in

Stocks

LG6

PERCEPTIONS of the MARKET

“Animal Spirits”

• Bulls: Investors who

believe stock prices

are going to rise.

• Bears: Investors who

expect stock prices to

decline.

• Bull markets are all alike, but every bear

market is bad in its own way.

• Stock market is usually the messenger of

the problem, but not always.

• Lack of confidence

19-33

Investing in

Stocks

LG6

BEAR MARKET DECLINES

in the S&P 500

Time Period

% Drop in Prices

2007-2009

52.5%

2000-2002

51%

1973-1974

48.2%

1968-1970

36.1%

1987-1988

33.5%

Source: Stock Traders Almanac 2011.

19-34

Riding the

Market’s Roller

Coaster

TURMOIL in the 2000s

LG9

• The market collapsed into a deep decline in

2000-2002 when the dot-com bubble burst.

- Investors lost $7 trillion in market value.

• Starting in 2008, the collapse of the real estate

market sent financial markets into panic.

- The U.S. government made significant investments in

private banks and offered a large stimulus package to reenergize the economy.

19-35

Riding the

Market’s Roller

Coaster

LG9

The UPS and DOWNS

of the MARKET

• Program Trading -- Giving instructions to

computers to automatically sell if the price of a stock

dips to a certain point to avoid potential losses.

‾ High Frequency Trading increases potential for

greater volatility.

• Analysts believe program trading caused the

turmoil in 1987.

• The exchanges created mechanisms to restrict

program trading.

19-36

Buying Stock

on Margin

BUYING STOCK on MARGIN

LG6

• Buying Stock on Margin -- Borrowing some of the

stock’s purchase cost from the brokerage firm.

• Margin is the portion of the

stock’s purchase price that

the investor must pay with

their own money.

• If a broker issues a margin

call, the investor has to come

up with money to cover

losses.

19-37

Riding the

Market’s Roller

Coaster LG9

WHO’S at FAULT for the

ECONOMIC CRISIS?

• Wall Street –

• Issued exotic securities;

− Securitization (Selling mortgages or contracts for upfront payment

(lead to bankruptcies of Enron ‘01 & Continental Illinois ‘84)

− Bond rating agencies gave AAA rating to MBS

• Paid excessive compensation based on bonuses

• Investment banks got the SEC to relax capital

requirements.

• Main Street –

•

•

•

•

Americans borrowed beyond their means;

Banks grew fast by giving favorable loans to homebuilders

Homeowners took out equity loans

ARM mortgage rates fueled Housing market bubble

Source: Fortune Magazine, www.fortune.com, accessed July 2011.

19-38

Riding the

Market’s Roller

Coaster

LG9

WHO’S at FAULT for the

ECONOMIC CRISIS?

• Washington

• Gramm-Leach-Billey Act allowed commercial & investment

banks to combined

• Fed kept interest rates low in a bid to boost economy

• Community Reinvestment Act required lending to people

with bad credit.

• FNMA (Fannie Mae) & FHLMC (Freddie Mac) expanded

significantly, buying ~ 90% of home mortgages

Source: Fortune Magazine, www.fortune.com, accessed July 2011.

19-39

The Role of

Investment

Bankers

LG1

INVESTMENT BANKERS

and INSTITUTIONAL INVESTORS

• Investment Bankers -- Specialists who assist in

the issue and sale of new securities.

• Institutional Investors -Large organizations such as

pension funds or mutual

funds that invest their own

funds or the funds of others.

19-

CLEANING UP the STREET

(Legal Briefcase)

• Congress passed the Dodd-Frank Financial Reform

and Consumer Protection Act into law on July 21,

2010.

• Gives the government power to seize and shutter

large financial institutions on the verge of collapse in

an effort to prevent further bailouts.

• Formed an independent consumer protection agency

housed within the Federal Reserve, protecting

borrowers against a host of financial abuses ranging

from payday loans to mortgages and credit cards.

19-41

Progress

Assessment

PROGRESS ASSESSMENT

• What’s the primary purpose of a securities

exchange?

• What does NASDAQ stand for? How does this

exchange work?

19-42

Progress

Assessment

PROGRESS ASSESSMENT

• Name at least two advantages and

disadvantages of a company’s issuing stock as a

form of equity financing.

• What are the major differences between common

stock and preferred stock?

19-43

Progress

Assessment

PROGRESS ASSESSMENT

• Why are bonds considered a form of debt

financing?

• What does it mean if a firm issues a 9%

debenture bond due in 2025?

• Explain the difference between an unsecured and

secured bond.

• Why are convertible bonds attractive to

investors?

19-44

Progress

Assessment

PROGRESS ASSESSMENT

• What is the key advantage of investing through

online brokers? What is the key disadvantage?

• What is the primary purpose of diversifying

investments?

19-45

Progress

Assessment

PROGRESS ASSESSMENT

• What is a stock split? Why do companies

sometimes split their stock?

• What does buying stock on margin mean?

• What are mutual funds and ETFs?

• What is the key benefit to investors in investing in

a mutual fund or ETF?

19-46

Progress

Assessment

PROGRESS ASSESSMENT

• What does the Dow Jones Industrial Average

measure? Why is it important?

• Why do the 30 companies comprising the Dow

change periodically?

• Explain program trading and the problems it can

create.

19-47