Debt Financing Chapter 12 Objectives:

advertisement

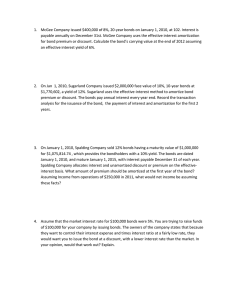

Debt Financing Chapter 12 Objectives: Understand the various classification and measurement issues associated with debt Account for short term obligations Apply present value concepts to account for long term debts Understand the various types of bonds and account for bond issuance, interest payment, and redemption Explain the various types of off balance sheet financing Analyze a firm’s debt position using ratios Review the notes to financial statements relative to debt FASB defines liabilities as “probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions of events.” Thus liabilities arise from past transactions or events and involve a probable future transfer of assets or services. Liabilities are classified as either current or non-current. Liabilities are considered current if current assets will be used to satisfy the obligation in one year or the operating cycle, whichever is longer. Other assets are considered non-current or long term. Proper classification is important as it affects the company’s current ratio. For measurement purposes, liabilities can be divided into three categories as follows: Liabilities of definite amount – A/P, interest payable, etc. Liabilities of estimated amount – warranty obligation Contingent liabilities - lawsuit Common examples of current liabilities include: Accounts Payable Short Term Notes Payable Sales Tax Payable Payroll Liabilities Unearned Revenue Current Portion of Long Term Debt Accrued Expenses (accrued liabilities) Liabilities that are classified as current are reported on the balance sheet at face value. Special rules apply to short-term obligations which are expected to be refinanced on a long-term basis. See Page 685-6. Many companies utilize lines of credit, negotiated arrangements with a lender where the terms are agreed upon upfront. Once the line a credit is approved, the company has access to the funds immediately. Lines of credit are not a liability but neither are they free in that the lender charges a fee for this type of standby credit. A long-term obligation is reported on a company’s balance sheet at its present value. Since money has a time value and because a dollar received today is always worth more than a dollar received in the future, future payments must be discounted back to the present when valuing long-term obligations. Mortgages payable are similar to notes payable except that mortgages payable are backed by a specific underlying asset such as a residence. A mortgage generally requires periodic (usually monthly) payments of principal and interest. During the life of the mortgage the interest payment decreases and the principal payment increases until maturity. Accounting for mortgages is discussed on Page 688-9 and an example of a mortgage amortization schedule is presented in Exhibit 12-5. Bonds are an important type of long-term liability. Bonds are essentially bundles of notes payable representing money borrowed by a corporation or governmental entity from the investing public. Bondholders loan their money for a price (interest) which is often paid on a semi annual basis. Investors buy and sell bonds on a daily basis through the bond markets. There are many types of bonds—term bonds, serial bonds, debentures, zero coupon bonds, etc. See Pages 691-3. Two interest rates, (1) the stated (contract) interest rate and (2) the market interest rate interact to set the price of a bond as follows: Bonds sell at par when the market interest rate = the contract interest rate. Bonds sell at a discount when the market interest rate > contract interest rate. Bonds sell at a premium when the market interest rate < contract interest rate. The contract rate printed on the face of the bond certificate is applied to the face value of the bond in determining interest payments. The bond premium or bond discount is the amount by which the bond will sell for more or less than its face value. Bonds are issued in the marketplace at par, at a discount, or at a premium. Bond prices are quoted as a percentage of their maturity value, i.e. a $1000 bond selling at $980 is quoted at 98. (As explained at the bottom of Page 693, U. S. government bonds are quoted in 32’s not 100’s.) As a bond nears maturity its market price moves toward par value. On maturity (redemption) date the market price of bonds will equal its par value. Please review the computation of the present value of a bond which is explained on Page 694. In this example because interest is paid semiannually, we must double the period and halve the market rate of interest to obtain the current PV factor. Bond discount really represents additional interest expense and bond premium really represents a reduction in interest expense. There are two methods to account for bond discount or bond premium as follows: Straight line method (approximation method) Effective interest method (GAAP) The general model for journalizing bonds payable follows: A. Bonds issued at par 1. 2. 3. Issuance Cash Bonds Payable Interest payment Interest Expense Cash Redemption Bonds Payable Cash B. Bonds issued at a discount 1. Issuance Cash Discount on Bonds Payable Bonds Payable 2. Interest payment Interest Expense Discount on Bonds Payable Cash 3. Redemption Bonds Payable Cash Discount on Bonds Payable is a contra account for Bonds Payable. The carrying value of a bond payable equals the face amount of the bond less the balance in the contra account. C. Bonds issued at a premium 1. Issuance Cash Bonds Payable Premium on Bonds Payable 2. Interest payment Interest Expense Premium on Bonds Payable Cash 3. Redemption Bonds Payable Cash To calculate the carrying value of a bond issued at a premium add the premium to the face amount of the bond payable account. The accounting for bond interest under both the straight-line method and the effective interest methods is explained on Pages 697-700. Please carefully review this section of the chapter. In preparing a cash flow statement by the indirect method, remember that bond amortization does not involve a cash flow and thus discount amortization must be added back to net income and premium amortization must be subtracted from net income. When bonds are extinguished prior to maturity, a gain or loss must be recognized for the difference between the carrying value of the bonds and the amount paid to satisfy the obligation. The accounting for convertible bonds is explained on Pages 703-6. Some companies employ off-balance sheet financing in order to improve their financial statements. Off-balance sheet financing can take various forms including the following: Operating leases versus capital leases Unconsolidated subsidiaries Variable Interest Entities (VIE’s) Joint ventures Research and development arrangements Project financing arrangements A company’s debt position can be analyzed various ways including through the use of ratios such as the debt to equity ratio, the debt to total assets ration, and the times interest earned ratio. You should know how to calculate each of these three ratios and be able to interpret results using each ratio. All significant matters relating to debt should be disclosed in the notes to the financial statements. This information should include the nature of the liabilities including maturity dates, interest rates, methods of liquidation, conversion privileges, borrowing and dividend restrictions, etc. Please skip the Expanded Material in Chapter 12 beginning on Page 715.