How Do Economists Think About How People Think (and make... Ten Principles of Economics (and Economists): Chapter 1

advertisement

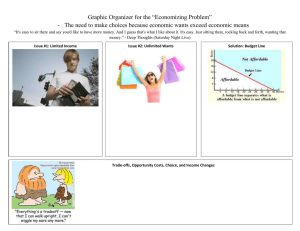

How Do Economists Think About How People Think (and make decisions) Ten Principles of Economics (and Economists): Chapter 1 In Chapter 1 Greg describes several basic premises (or principles) that underlie, or frame, how economists construct models of the way people behave in the marketplace, i.e., what are the fundamental principles of the market’s participants (consumers and firms) that drives their decisions. The first and most fundamental principle, from which most of the modeling flows, is that people face trade-offs when making decisions, such as which goods to purchase and consume. That is, when you choose to buy one good you also take into account what else you could have bought with your money. This means that the consumer (buyer) considers the trade-off in the value (in consumption or use) of the purchased good and what else might have been purchased with the money. The rational consumer chooses the good that gives the highest “value-in-use” for the dollars spent on the good. This point emphasize that the fundamental objective of the consumer is choose the highest valued alternative given the amount spent (or, more broadly their budget). The second principle flows from the notion the first principle, that all decisions involve trade-offs. The second principle goes one step further and measures the cost of making a decision, or choice. That is, “the cost of something (the alternative chosen) is what you give up (to get it)”. Now we tend to think that we have measured the cost of what we gave up by the amount of money paid to obtain the good. But that is only part of the story. The true measure is what is the second highest valued good that you could have bought, but didn’t. That is the highest valued alternative “foregone” (not chosen). If you choose good A over good B and both cost $10, then I not only know that good A is worth more than $10 to you, but also that good B is worth less than good A. Thus, I have even more information to model your behavior and use it for both explaining your past decision and predicting what you will do in the future. The third principle states that “rational people think at the margin”. What this means is that we (economist) think that people make decisions on how much to buy of a given good based on comparing the “value-in-use” of the last unit purchased to it’s market price. If the value of the last unit is greater than it’s market price then the consumer will buy it. If not, the consumer won’t. So, when we’re at the store and have to decide how many bottles of soda to buy, and suppose I decide to buy 6, then the value of the last bottle bought (the 6th) is equal to or greater than the market price. But the 7th bottle’s value is less, than it “value-in-use” is less than the market price and it’s left on the shelf. An alternative “hypothesis” would be that the consumer tries to maximize the benefits of consumption, but buying the number of bottles that would maximize the total benefits of consumption, i.e., the difference between the value-in-use of all of the bottles purchased minus their purchase price.