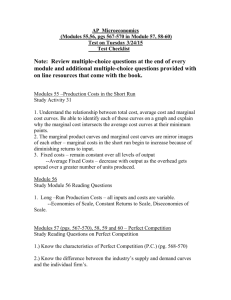

Econ 100 Lecture 4.1 Costs of Production

advertisement

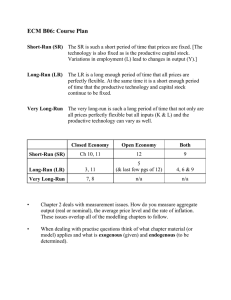

Econ 100 Lecture 4.1 Costs of Production Leftovers from Ch. 4 • • • • Opportunity Costs (OC) Supply Curves and OC Total and Marginal Value Costs: Fixed and Variable Costs – Which Affect Economic Decisions? Opportunity Costs • Opportunity cost or economic opportunity loss is the value of the next best alternative foregone as the result of making a decision – “things have no costs at all, only actions do – “only costs that matter are marginal costs” – “all opportunity costs are marginal costs and viceversa” – Sunk costs are irrelevant to decision of what to do next Questions to Ponder • Why does graduate school enrollment increase during recessions? I.e., why are more people willing to return to school during recessions? • What are the costs of an all volunteer military? The costs for a military staffed by a draft? Opportunity Costs and Resource Prices • “Costs you pay for a resource, e.g. land, are determined by the alternative opportunities that people perceive for its use” – How does the price of a lot in Seattle reflect its “alternative” opportunities (or opportunity costs)? – More generally, how does the price of any resource used in production reflect its opportunity cost, i.e., “opportunities that people perceive for its use” • E.g., corn as input for either food or ethanol Supply Curves and Opportunity Costs • “Supply curves are marginal opportunity cost curves of making various quantities of a good available” – How does the supply curve reflect opportunity costs? How Do Economist Classify Costs? • Are we talking about the short-run or the long-run? – Short-run: a period of time that is short enough that at least 1 input (factor of production) is fixed and can’t be adjusted to changes in demand/output • Inputs: Capital (K), Labor (L), Energy (E) and (raw) Materials (M) • E.g., usually capital is considered fix, too costly to adjust immediately How Do Economist Classify Costs? • Long-run – Period of time long enough that ALL inputs can be adjusted/varied Fixed versus Variable Costs • In the short-run: – Since some inputs are fixed => some costs are fixed (can’t be changed) – And some inputs are changeable/variable – Thus • Total Costs(Qs) = Fixed Costs + Variable Costs(Qs) • In the long-run • Total Costs(Qs) = Variable Costs(Qs) Total and Variable Costs on Average • Short-run – ATC(Qs) = TC(Qs)/Qs = 1/Qs [FC + VC(Qs)] – ATC = AFC + AVC – In the short-run only variable costs matter • Will produce if you can cover VC – Even if you can’t cover FC • Long-run – ATC(Qs) = AVC(Qs)] • In the long-run all costs matter • But all costs are variable costs Sunk Costs and Economic Decisions – “Sunk costs are irrelevant to decision of what to do next” • Sunk costs Fixed Costs • Are fixed costs irrelevant to a firm’s business decisions? – Costs (in the short-run) are composed of two elements • Fixed Costs – don’t vary with the amount supplied/produced (e.g., building rental) • Variable Costs – do vary (e.g., labor, fuel, other inputs into production) Fixed Costs and Decisions • If a firm can’t cover it’s fixed costs, but can cover it’s variable costs – will it produce any output? – Short-run versus long-run • Short-run: only variable (marginal costs) are relevant – If P >= MC then firm supplies up to Q* where P = MC(Q*) • Long-run: when lease is up, rental becomes a variable costs and firm will remain in business if and only if Total Revenues >= Total Costs