Chapter

7-1

Chapter

15

Accounting Principles

Financial Accounting, Seventh Edition

Chapter

7-2

Study Objectives

1. Explain the meaning of GAAP and identify the key items

of the conceptual framework.

2. Describe the basic objectives of financial reporting.

3. Discuss the qualitative characteristics of accounting

information and elements of financial statements.

4. Identify the basic assumptions used by accountants.

5. Identify the basic principles of accounting.

6. Identify the two constraints in accounting.

7. Explain the accounting principles used in international

operations.

Chapter

7-3

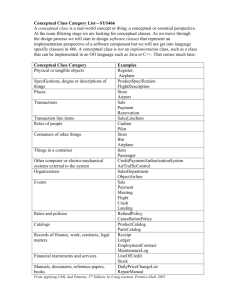

Accounting Principles

The

Conceptual

Framework of

Accounting

Objectives of

reporting

Qualitative

characteristics

Elements of

financial

statements

Operating

guidelines

Chapter

7-4

Constraints

in

Accounting

An

International

Perspective

Assumptions

Principles

Monetary unit

Revenue

recognition

Materiality

Differences

Cost-benefit

Uniformity

Expense

recognition

(matching)

Summary of

conceptual

framework

Economic

entity

Time period

Going

concern

Full

disclosure

Measurement

The Conceptual Framework of Accounting

Financial Statements

Various users

need financial

information

Balance Sheet

Income Statement

Statement of Retained Earnings

Statement of Cash Flows

Note Disclosure

The accounting profession

has attempted to develop

a set of standards that

are generally accepted

and universally practiced.

Chapter

7-5

Generally Accepted

Accounting

Principles (GAAP)

SO 1 Explain the meaning of GAAP and identify the

key items of the conceptual framework.

The Conceptual Framework of Accounting

Organizations Involved in Standard Setting:

Securities and Exchange Commission (SEC)

http://www.sec.gov/

Financial Accounting Standards Board (FASB)

http://www.fasb.org/

Chapter

7-6

SO 1 Explain the meaning of GAAP and identify the

key items of the conceptual framework.

The Conceptual Framework of Accounting

Conceptual Framework - “…a constitution, a coherent

system of interrelated objectives and fundamentals.”

FASB’s conceptual framework consists of the following:

Chapter

7-7

1.

Objectives of financial reporting.

2.

Qualitative characteristics of accounting

information.

3.

Elements of financial statements.

4.

Operating guidelines (assumptions, principles, and

constraints).

SO 1 Explain the meaning of GAAP and identify the

key items of the conceptual framework.

Conceptual Framework

Review:

A conceptual framework underlying financial

accounting is important because it can lead to

consistent standards and it prescribes the

nature, function, and limits of financial

accounting and financial statements.

True

Chapter

7-8

False

SO 1 Explain the meaning of GAAP and identify the

key items of the conceptual framework.

Conceptual Framework

Review:

A conceptual framework underlying financial

accounting is necessary because future

accounting practice problems can be solved by

reference to the conceptual framework and a

formal standard-setting body will not be

necessary.

True

Chapter

7-9

False

SO 1 Explain the meaning of GAAP and identify the

key items of the conceptual framework.

Conceptual Framework

Review:

What are the Statements of Financial Accounting

Concepts intended to establish?

a. Generally accepted accounting principles in

financial reporting by business enterprises.

b. The meaning of “Present fairly in accordance with

generally accepted accounting principles.”

c. The objectives and concepts for use in developing

standards of financial accounting and reporting.

d. The hierarchy of sources of generally accepted

accounting principles.

(CPA adapted)

Chapter

7-10

SO 1 Explain the meaning of GAAP and identify the

key items of the conceptual framework.

Conceptual Framework

Objectives of Financial Reporting

a) Useful to those making investment and credit decisions.

b) Helpful in assessing future cash flows.

c) Identify the economic resources (assets), the claims to

those resources (liabilities), and the changes in those

resources and claims.

Chapter

7-11

SO 2 Describe the basic objectives of financial reporting.

Conceptual Framework

Review:

According to the FASB conceptual framework, the

objectives of financial reporting for business

enterprises are based on?

a. Generally accepted accounting principles

b. Reporting on management’s stewardship.

c. The need for conservatism.

d. The needs of the users of the information.

(CPA adapted)

Chapter

7-12

SO 2 Describe the basic objectives of financial reporting.

Conceptual Framework

Question:

How does a company choose an acceptable accounting

method, the amount and types of information to

disclose, and the format in which to present it?

Answer:

By determining which alternative provides the most

useful information for decision-making purposes

(decision usefulness).

Chapter

7-13

SO 3 Discuss the qualitative characteristics of accounting

information and elements of financial statements.

Conceptual Framework

Qualitative Characteristics

Relevance – making a difference in a decision.

Predictive value

Confirmatory value

Faithful Representation

Complete

Neutral

Free from error

Chapter

7-14

SO 3 Discuss the qualitative characteristics of accounting

information and elements of financial statements.

Conceptual Framework

Enhancing Qualitative Characteristics

Comparability – Information that is measured and

reported in a similar manner for different

companies is considered comparable.

Consistency - When a company applies the same

accounting treatment to similar events from period

to period.

Chapter

7-15

SO 3 Discuss the qualitative characteristics of accounting

information and elements of financial statements.

Conceptual Framework

Review:

Relevance and faithful representation are the

two primary qualities that make accounting

information useful for decision making.

True

False

To be faithful representation, accounting

information must be capable of making a

difference in a decision.

True

Chapter

7-16

False

SO 3 Discuss the qualitative characteristics of accounting

information and elements of financial statements.

Conceptual Framework

Review:

Adherence to the concept of consistency

requires that the same accounting principles be

applied to similar transactions for a minimum of

five years before any change in principle is

adopted.

True

Chapter

7-17

False

SO 3 Discuss the qualitative characteristics of accounting

information and elements of financial statements.

Conceptual Framework

Elements of Financial Statements

“Moment in Time”

Assets

Liabilities

Equity

Chapter

7-18

“Period of Time”

Revenue

Expenses

Gains

Losses

SO 3 Discuss the qualitative characteristics of accounting

information and elements of financial statements.

Conceptual Framework

Operating Guidelines

Chapter

7-19

Assumptions

Assumptions provide a foundation for the

accounting process.

Monetary Unit

Economic Entity

Time Period

Going Concern

Chapter

7-20

SO 4 Identify the basic assumptions used by accountants.

Assumptions

Monetary Unit

Only transaction data capable of being expressed in terms of

money should be included in the accounting records of the

economic entity.

Chapter

7-21

SO 4 Identify the basic assumptions used by accountants.

Assumptions

Economic Entity

Economic events can be

identified with

a particular unit of

accountability.

Chapter

7-22

SO 4 Identify the basic assumptions used by accountants.

Assumptions

Time Period

The economic life of a business can be divided into

artificial time periods.

Chapter

7-23

SO 4 Identify the basic assumptions used by accountants.

Assumptions

Going Concern

The enterprise will continue in operation long enough

to carry out its existing objectives.

Chapter

7-24

SO 4 Identify the basic assumptions used by accountants.

Assumptions

Identify which basic assumption of accounting is best

described in each item below.

(a) The economic activities of FedEx Corporation

are divided into 12-month periods for the

purpose of issuing annual reports.

(b) Solectron Corporation, Inc. does not adjust

amounts in its financial statements for the

effects of inflation.

(c) Walgreen Co. reports current and noncurrent

classifications in its balance sheet.

(d) The economic activities of General Electric

and its subsidiaries are merged for

accounting and reporting purposes.

Chapter

7-25

Time Period

Monetary

Unit

Going Concern

Economic

Entity

SO 4 Identify the basic assumptions used by accountants.

Principles

Accounting principles dictate how economic

events should be recorded and

reported.

Revenue Recognition

Expense Recognition

Full Disclosure

Measurement

Chapter

7-26

SO 5 Identify the basic principles of accounting.

Principles

Revenue Recognition

- companies should

recognize revenue in the accounting period in which it is

earned.

Chapter

7-27

SO 5 Identify the basic principles of accounting.

Principles

Expense recognition - efforts (expenses) should be

matched with accomplishment (revenues) whenever it

is reasonable and practicable to do so. “Let the

expense follow the revenues.”

Illustration 15-9

Expense Recognition

Chapter

7-28

SO 5 Identify the basic principles of accounting.

Principles

Matching

Principle

Chapter

7-29

SO 5 Identify the basic principles of accounting.

Principles

Full Disclosure – Provided through financial

statements, notes to the financial statements, and

supplementary information.

Chapter

7-30

SO 5 Identify the basic principles of accounting.

Principles

Measurement– the value of an asset to be recorded

can use one of two principles. Selection of which to use

is usually a trade-off between relevance and faithful

representation. The two principles are:

•Cost

Principle; recording assets at their cost.

•Fair Value Principle; recording assets at the price

received to sell an asset or settle a liability.

Chapter

7-31

SO 5 Identify the basic principles of accounting.

Principles

Identify which basic principle of accounting is best

described in each item below.

(a) Norfolk Southern Corporation reports revenue

in its income statement when it is earned instead of

when the cash is collected.

Revenue

Recognition

(b) Yahoo, Inc. recognizes depreciation expense for

a machine over the 2-year period during which that

machine helps the company earn revenue.

Expense

Recognition

(c) Oracle Corporation reports information about

pending lawsuits in the notes to its financial

statements.

(d) Eastman Kodak Company reports land on its

balance sheet at the amount paid to acquire it, even

though the estimated fair market value is greater.

Chapter

7-32

Full

Disclosure

Measurement

SO 5 Identify the basic principles of accounting.

Constraints in Accounting

Constraints permit a company to modify

generally accepted accounting principles

without reducing the usefulness of the

reported information.

Materiality

Cost-benefit

Chapter

7-33

SO 6 Identify the two constraints in accounting.

Constraints in Accounting

Materiality

- an item is material if its inclusion or

omission would influence or change the judgment of a

reasonable person.

Chapter

7-34

SO 6 Identify the two constraints in accounting.

Constraints in Accounting

Cost-benefit- Weigh the costs of providing the

information against the benefits that can be derived

from using it.

Chapter

7-35

SO 6 Identify the two constraints in accounting.

Constraints in Accounting

What accounting constraints are illustrated by the

items below?

(a) Crimson Tide Corporation does not accrue a

contingent lawsuit gain of $650,000.

Cost-benefit

(b) Sun Devil Corporation expenses the cost of

wastebaskets in the year they are acquired.

Materiality

Chapter

7-36

SO 6 Identify the two constraints in accounting.

Summary of Conceptual Framework

Constraints

Chapter

7-37

An International Perspective

Problem: Numerous multinational corporations (MNCs)

who are companies that conduct operations in more than

one country where the accounting standard are not

always uniform from country to country.

The International

Accounting Standards

Board

(IASB), of which the United States is a member,

is working to obtain conformity in international

accounting practices.

Many companies (>7,100) around the world now use IASB

standards.

Chapter

7-38

SO 7 Explain the accounting principles used in international operations.

Copyright

“Copyright © 2010 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted

in Section 117 of the 1976 United States Copyright Act without

the express written permission of the copyright owner is

unlawful. Request for further information should be addressed

to the Permissions Department, John Wiley & Sons, Inc. The

purchaser may make back-up copies for his/her own use only

and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the

use of these programs or from the use of the information

contained herein.”

Chapter

7-39