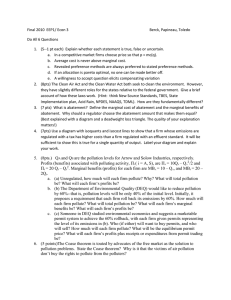

Econ 201 Lecture 10.1d Taxes, Standards and Tradable Permits

advertisement

Econ 201 Lecture 10.1d Taxes, Standards and Tradable Permits 6-09-2009 Things You Ought to Look At • http://facweb.northseattle.edu/dperry/econ 201/Harris_AER_EnvEcon.pdf • http://facweb.northseattle.edu/dperry/econ 201/The%20(Tuna)%20Tragedy%20of%2 0the%20Commons%20%20Dot%20Earth%20Blog%20%20NYTimes_com.mht Negative Externality • Marginal Private Costs < Marginal Social Costs Ideal Actual Pi Pa Remedies for Negative Externalities • Standards – Permissible level of emissions for each factory in an industry (each industry gets same target), or – Targets how much emissions must be reduced by each factory (again, same target for all) • Taxes – Direct tax on emissions • Indirect on input/output if there is a direct correlation between input/output and pollution – E.g., tax on gasoline, coal based on sulfur content • Tradable permits – Gives each firm the “right” to pollute to a certain level – Firms are allowed to trade/sell permits Negative Externalities & Taxes • How to Set the Optimal tax – Set at point where MBen = MCost of Pollution • Tax: equals difference between MSC and MPC and – “internalizes” it into the consumption decision • Firm’s cost = price*quantity of inputs plus tax*emissions/output Tax Coase’s Theorem • If property rights exist and transaction (bargaining) and information costs are low – Then parties will be able to bargain among themselves (without government intervention) to obtain an efficient outcome Comparison of Approaches • Standards – Can also produce optimal level of pollution • But set same standard for all firms (and are not productively efficient, e.g. min cost) • To set individual quotas: requires knowledge of each firm’s costs – But have higher administrative costs • Not only have to monitor emissions • Enforcement costs: legal proceedings (time delays and expense) • Not very flexible: regulatory process for changing standards – Provide no incentive for firms to reduce pollution below current “authorized” levels Comparison of Approaches • Standards – Are most useful when: • Problem is short-lived (“burn” bans for high pollution days) • Optimal level is zero Comparison of Approaches • Taxes – Can produce “optimal” amount of pollution at minimum costs and lower administrative costs • Kneese (1977): comparing taxes versus standards found that desired quality costs half as much using taxes – Automatically allocates pollution levels among firms based on their costs • Provides incentive for firms to reduce pollution levels through technological innovation – Easy to adjust/”tune” – Tax revenues can be used finance admin costs And They Are Endorsed by the Sierra Club! • • • • • • • • Sierra Club Conservation Policies Pollution Taxes make it less expensive for a polluter to adopt alternative processes or invest in additional equipment to curtail releases to the environment Taxes would supplement, and not replace, standards on maximum permissible emissions. Taxes should be imposed when the following conditions are found to prevail generally: for competitive or other reasons, cost-minimizing behavior tends to exist in the company or industry; the cost of abatement is significant, the quantity of the pollutant released can be determined with reasonable accuracy, – cost of monitoring should be small in relation to the tax revenue expected in the absence of abatement. • Adopted by the Board of Directors, February 13-14, 1997 Comparison of Approaches • Tradable Permits – Cost efficient • Firms will purchase permits from more efficient firms if permit cost < abatement (technology) costs – Technological incentive to reduce pollution • Marginal cost of abatement = permit cost – Similar to taxes – Administratively simpler • Require less information about the firms’ cost • Better able to handle “spatial” variation in pollution – Fewer permits auctioned in bad areas • Adjust “automatically” for changes in inflation and growth – If auctioned -> revenues for admin costs Text’s Taxonomy Distinguishing between private and public goods • Non-excludability: no way to prevent consumers from deriving benefits from provided good (e.g., national defense, parks?) • Non-rival consumption: my consumption of the good does not reduce the amount available to another Consumption Excluded Non-excluded Rival Private Goods Common Property Non-Rival Club Goods Pure Public Goods Positive Externality • Private Marginal Benefits < Social Marginal Benefits What’s the Regulatory Solution? • Problem is: – Since SMB > PMB • Underproduction of the good • “Free-rider” problem • Traditional Solution – Increase production by subsidizing production of the good (i.e., reducing its costs of production) – In this case: subsidy does not lead to inefficiency – Use of income taxes, license fees -> not linked directly to consumption of the good • Tax reductions – reduce taxes on good (e.g. low income housing, green buildings)