Econ 201 Spring 2009 7.2b Market Failure:

advertisement

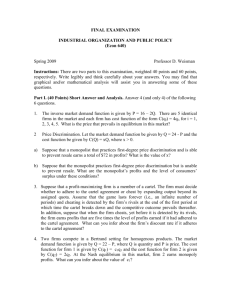

Econ 201 Spring 2009 7.2b Market Failure: Oligopolies (more) 1 Cooperative Oligopolies • Cartels (highly cooperative) – Firms act as single-firm monopolist • Stackelberg Price Leader (passive cooperation) - leader firm moves first and then the follower firms move sequentially – Stackelberg leader is sometimes referred to as the Market Leader. 2 Where We’re Going • How do we tell if a market is an oligopoly? – Market Concentration • CR4: market share for the 4 largest firms • Herfindahl Index (HHI): computed from the squares of the market shares • Strategic behavior (how do they behave in the market place) – Collusive: act together – Non-collusive: act separately and/or stratgeicially 3 How do we tell? • Market concentration refers to the size and distribution of firm market shares and the number of firms in the market. • Economists use two measures of industry concentration: – Four-firm Concentration Ratio – The Herfindahl-Hirschman Index 4 Four-Firm Concentration Ratio • The four-firm concentration ratio (CR4) measures market concentration by adding the market shares of the four largest firms in an industry. – If CR4 > 60, then the market is likely to be oligopolistic. 5 Example Firm Nike Market Share 62% New Balance 15.5% Asics 10% Adidas 4.3% CR 4 = 62 15.5 10 4.3 91.8 6 The Herfindahl-Hirschman Index • The Herfindahl-Hirschman index (HHI) is found by summing the squares of the market shares of all firms in an industry. – Advantages over the CR4 measure: • Captures changes in market shares • Uses data on all firms 7 Example Firm Market Share Nike 62% New Balance 15.5% Asics 10% Adidas 4.3% HHI 62 15.5 10 4.3 4,202.74 2 2 2 2 8 Example (cont’d) What happens if market shares are evenly distributed? Firm Market Share Nike 22.95% New Balance 22.95% Asics 22.95% Adidas 22.95% HHI 22.95 2 22.95 2 22.95 2 22.95 2 2,106.81 CR 4 91.8 9 Cartel Pricing Tactic • Reduce Qs to monopoly levels in order to: – a) obtain a higher price – b) earn monopoly rents 10 How do Cartels Operate? • Firms in the cartel need to agree on: – 1) Market price – 2) Quantity supplied by the Industry – 3) Each firm’s “quota” – 4) “Not to cheat” on either price or quantity supplied 11 How Does a Cartel Set Output and Price? • Just like a monopolist – Qty supplied set at point where MR = MC – Except: that it is set for the industry • MC(ind) = MC(firm 1) + MC(firm 2) + .. • Quotas are assigned such that – Marginal Costs at optimal Qs is the same for all firms in the cartel • MC(1) = MC(2) = MC(3) = … • Price is set along the Industry Demand Curve at the Cartel’s output 12 Figure 12.4 Duopoly Equilibrium in a Centralized Cartel 13 Conditions for cartel success • the cartel can significantly raise price • cartel controls market • low organizational costs – few firms (or a few large ones) – industry association • many small buyers: no monopsony power • cartel can be maintained – cheating can be detected and prevented – low expectation of severe government punishment 14 Firms “cheat” • luckily for consumers, cartels often fail because each firm in a cartel has an incentive to cheat on the cartel agreement • cheating firm – produces extra output or lowers its price – ignores the negative effect of its extra output on other firms’ profits 15 Factors that work against a Cartel - in the long run • Each firm has an incentive to cheat – Price that firm receives is still above MC of production • Could earn additional profits by slightly expanding output • However, when all firms do this – -> back at competitive market outcome • Qs up to point where MV=MC • See “prisoners dilemma” 16 An Example of a Cartel • Organization of the Petroleum Exporting Countries (OPEC) is an international cartel made up of Algeria, Angola, Ecuador, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela. • Principal aim of the organization, according to its Statute, is the determination of the best means for safeguarding their interests, individually and collectively; devising ways and means of ensuring the stabilization of prices in international oil markets with a view to eliminating harmful and unnecessary fluctuations • OPEC triggered high inflation across both the developing and developed world using oil embargoes in the 1973 oil crisis. • OPEC's ability to control the price of oil has diminished due to the subsequent discovery/development of large oil reserves in the Gulf of Mexico and the North Sea, the opening up of Russia, and market modernization. • OPEC nations still account for two-thirds of the world's oil reserves, and, in 2005, 41.7% of the world's oil production, 17 Cartels • A cartel is a formal (explicit) agreement among firms. – – • Cartel members may agree on such matters – – – – – • • as price fixing, total industry output, market shares, allocation of customers, allocation of territories aim of such collusion is to increase individual member's profits by reducing competition. – • usually occur in an oligopolistic industry, where there are a small number of sellers usually involve homogeneous products. Competition laws forbid cartels. Several economic studies and legal decisions of antitrust authorities have found that the median price increase achieved by cartels in the last 200 years is around 25%. Private international cartels (those with participants from two or more nations) had an average price increase of 28%, whereas domestic cartels averaged 18%. Less than 10% of all cartels in the sample failed to raise market prices 18 What market conditions make Cartels more likely? • Market demand is inelastic – higher prices lead to increase revenues for the cartel • Homogenous goods – easier to initially set/enforce cartel price • Small number of firms/high concentration of market share (easier to monitor, collude) – Fringe players could defeat cartel – More equal shares -> increase incentive to cheat 19