Edhec European Asset Management Practices Survey Noel Amenc

advertisement

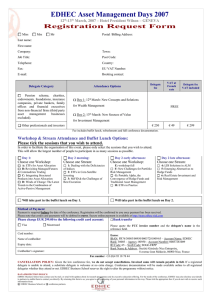

Edhec European Asset Management Practices Survey Noel Amenc Professor of Finance, Director of the “Edhec Risk and Asset Management Research Centre” Head of Research, Misys Asset Management Systems 21st May 2003 © Edhec 2003 030521 - 1 Outline • • • • • • Objectives Methodology Investment services Portfolio management process Performance analysis Risk management © Edhec 2003 030521 - 2 Objectives of the study • Assess the degree to which European asset management firms’ practices correspond to the most recent research in the asset management field; • Identify the potential gaps with regard to the strategic and regulatory environments of the respondents; • Establish a basis for a permanent observatory of asset management companies’ practices. © Edhec 2003 030521 - 3 Methodology Organisation of the research • “Industry Intelligence” - Edhec/MAMS cooperation; • “Legal Intelligence”; • Detailed summary of strategic, institutional and conceptual challenges (June 2002); • Survey of current practices of the 400 leading European asset management companies (July to October 2002); • Construction of the report (December 2002 to March 2003). © Edhec 2003 030521 - 4 Methodology Survey on asset management companies’ practices How the questionnaires were administered: 3 questionnaires: – Strategy and Management Process – Risk Management – Organisation and Information Systems • Anonymity guaranteed; • 1,200 professionals contacted within the 400 largest European asset management firms (CIO, IT Director, Risk Director, etc.). © Edhec 2003 030521 - 5 Methodology Survey on asset management companies’ practices Sample • 60 asset management firms responded to the survey; • AUM of respondents totals 6,211.62 billion Euros; • The structure of the sample is very similar to the structure of the whole survey population; • The number of responses allows for a pan-European analysis; • Comparisons between countries should be considered with care. © Edhec 2003 030521 - 6 Methodology Survey on asset management companies practices Appropriateness of the sample • The sample shows a size bias but a fairly good geographic representation Percentage of AUM by country in the group of respondents and in the group of contacted companies Breakdown by size in terms of assets under management (USD) 43 42 United Kingdom 11 France 12 Germany 10 49 48 AUM between 10bn and 50bn 15 AUM between 50bn and 100bn 10 AUM in excess of 100bn 10 28 20 In the group of respondents 30 33 40 In the group contacted 50 31 17 15 Others 0 AUM between 5bn and 10bn 0 Percentage of respondents 10 14 21 20 30 40 50 60 Percentage in the group contacted • 38% of respondents have an AIMR or GIPS certificate © Edhec 2003 030521 - 7 The management offerings Global or niche offering © Edhec 2003 60% 50% 40% 30% 20% No answer A service that is mainly based on delegation and selecting specialists (subcontracted multi-management or partnership An active investment service 0% A service mainly based on index or passive investment 10% A global service covering all investment styles and strategies • Most asset management firms position their offering as global offers, whatever their size; • Strategic thinking on the question of critical size has not yet had a dramatic impact on the market. How would you best describe the investment services proposed by your company? 030521 - 8 The management offerings Active vs Passive • Development of passive offerings – Passive offerings represent 23% of “Equity” products and nearly 10% of all products; – These results are consistent with other market analysis (Morgan Stanley, Watson Wyatt) Country Index Management - Equities Index Management - Bonds Active Investment - Equities Active Investment - Bonds Multi-Management - Traditional Multi-Management - Alternative Alternative Investment Currency overlay Private equity Money market Investment Others No answer © Edhec 2003 France Germany UK 3.18% 4.25% 2.06% 0.75% 36.25% 27.95% 36.42% 45.66% 0.53% 2.50% 0.86% 1.25% 1.16% 1.25% 0.12% 7.64% 0.00% 0.00% 17.22% 3.00% 2.35% 5.75% 28.57% 0.00% 13.06% 0.45% 46.40% 29.00% 1.73% 0.00% 0.88% 0.00% 0.81% 3.87% 3.79% 0.00% Others Europe 11.55% 9.89% 4.97% 2.29% 25.85% 35.45% 33.09% 33.65% 7.54% 3.64% 0.60% 0.50% 1.06% 1.03% 1.26% 1.41% 0.58% 0.50% 9.23% 7.69% 4.30% 3.98% 2.08% 8.57% 030521 - 9 The management offerings Active vs Passive • The drivers for the growth of passive offerings: – Active products seen as too passive, too close to indices => what justifies the fee premium ? – Current difficulties of “Stock Picking” approaches in the “Long Only” universe; – Cost of portfolio turnover not always offset by an enhanced risk/return profile (cf. Fitzrovia study 2003) © Edhec 2003 030521 - 10 The management offerings New forms of organisation: core-passive/active-satellite Organisation of “core passive – active satellite” allocation: – Clear separation of a major portfolio (core) managed passively from one or more very actively managed satellites; – Approach tightly linked to the development of ETFs; – Approach favoured by consultants for cost reasons. © Edhec 2003 030521 - 11 The management offerings New forms of organisation: core-passive/active-satellite – Example of cost reduction for an “International Equity” portfolio (€100m, 4% tracking error) • Traditional approach: 100bp = €1m • Core-satellite approach – – – – Core portfolio management fees: 20bp Satellite portfolio management fees: 100bp Core portfolio tracking error: 0% Satellite portfolio tracking error: 20% • In order to obtain ex-ante a core-satellite with a 4% tracking error, 20% of the invested capital should be allocated to the satellite and 80% to the core portfolio; • Overall management costs: 20 x 80% + 100 x 20% = 36bp © Edhec 2003 030521 - 12 The management offerings New forms of organisation: core-passive/active-satellite • Favoured by consultants for performance reasons: – Allows for a better distinction between good and poor performers – Allows for manager diversification in the satellite portfolio – Ease the risk management process, a 20% tracking error limit is easier to respect than a 4% limit • The core-satellite approach can result in a new segmentation of management offerings: – Core-satellite assembler – “Core” producer or “Beta” factories – “Satellite” producer or “Alpha” specialists. © Edhec 2003 030521 - 13 The management offerings Multi-management • Despite its popularity and success, multi-management only represents 4.14% of the existing offerings; • Alternative multi-management is barely present with 0.5% of responses; • Funds of funds represent the most popular way of implementing multi-management offerings (46% of responses) © Edhec 2003 030521 - 14 The management offerings Multi-management • Arguments used by funds of funds promoters are different from the ones used by multi-managers: – multi-managers = fund pickers • Selection by style, objective to avoid poor managers, diversify the best managers • Belief in a certain level of performance persistence for the best, or “the least bad” • The ongoing relationship with the managers does not allow for active allocation (style neutrality) © Edhec 2003 030521 - 15 The management offerings Multi-management As regards to multi-management in the traditional universe, which investment services do you favour? – Funds of funds = fund timer 50 • Use of both fund picking and tactical allocation • Use of allocation as main explanation factor for performance (style, geogra-phic or industry sector) 40 46 45 34 35 30 26 25 20 20 20 17 15 11 10 © Edhec 2003 No answer Multi-mgmt based on geogr diversification Multi-mgmt based on diversification )*( Multi-mgmt based on sector diversification Multi-mgmt based on style diversification Managers'funds 0 Funds of funds 5 030521 - 16 The management offerings Multi-management • New forms of multi-management: fund trackers – “Pure allocation” logic; – Low management fees; – Facilitates control over the risk of delegating management (no style drift). © Edhec 2003 030521 - 17 The management offerings Alternative Investments Perception of Alternative Investments © Edhec 2003 50% 40% 30% 20% 10% As an excellent diversification tool As a source of return that exhibits low correlation with traditional stock and bond markets As a more valuable source of alphas than that of the traditional universe 0% As an asset class that is part of global asset allocation – Only 17% of respondents mention the superior “alphas” of AI – 60% of respondents put forward the diversification and de-correlation properties of AI. 60% As a turn of events related to the general economic climate • A diversification approach rather than a quest for out-performance 70% 030521 - 18 The management offerings Alternative Investments • The development of Alternative Investments favours outsourcing – Acceptance of the specifics of this form of management, including for alternative multi-management – The low level of volumes does not justify internalisation of the activity. Implementation of alternative investment services With a subsidiary company or a department within the asset management firm With the investment bank of the group the asset management firm belongs to With an external organisation No answer © Edhec 2003 37% 11% 31% 31% 030521 - 19 The management offerings Structured products • Structured management is perceived as a strategic offering for 34% of respondents and of interest for 31%. Do structured products play an important part in your company's strategy for the future? Country Yes No Of some interest Don't know © Edhec 2003 France Germany 57% 0% 29% 14% 0% 50% 50% 0% UK Others 25% 50% 25% 0% Europe 42% 25% 33% 0% 34% 31% 31% 3% 030521 - 20 The management offerings Structured products • Structured management does correspond to a more significant need for “risk profiling” from investors – Managers have to be able to manage the different moments of return distributions (especially the symmetry and extreme losses); – The use of derivatives appears as a new source of addedvalue; – The UCITS III directive should allow for “risk profiling” based on derivative instruments. © Edhec 2003 030521 - 21 The management offerings Structured products • The investment bank is a partner/competitor for asset managers in this field. The future of structured management products and the investment bank Management of the guaranteed part Investment Bank © Edhec 2003 Management of the underlying Underlying with "alpha", the Investment Bank acts like a multimanager Underlying without "alpha", the Investment Bank is a provider of ETFs or derivatives 030521 - 22 The management process Asset allocation • Confusion between benchmark and index – The benchmark can be different from the index. The academic studies very often mentioned by passive managers (Brinson, Singer, Beebower, 1991) did not say that nothing could be done outside of the indices, but that the benchmark, i.e. the strategic allocation, was a determining source of performance. © Edhec 2003 030521 - 23 The management process Asset allocation – The study does not conclude that one should not alter the initial allocation, but only that if one does not modify it, there is little hope of beating the classes in which the portfolio is invested. – This tautology has very often led management companies to neglect active allocation techniques which remain determinant. Explanation of return differences between funds 3.5% 11% 40% 45.5% Stock Picking Tactical Asset Allocation Strategic Asset Allocation Fees French mutual funds (1999-2001) (Source: Edhec 2001) © Edhec 2003 030521 - 24 The management process Asset allocation Which investment process do you favour? (Europe) • United Kingdom and Europe – Active asset allocation is favoured in the management process for all European countries, with the exception of United Kingdom (Investment Bank / Broker-Dealer culture) 33% 64% 3% Country A top/down approach separating the strategic and tactical allocation phase from the stock picking stage An opportunitic approach based on stock selection without reference to a process or to asset allocation constraints A bottom up approach based on stock selection with allocation constraints France Germany UK 100% 75% 37% 0% 0% 0% 0% 25% 63% A top/down approach separating the strategic and tactical allocation phase from the stock picking stage An opportunistic approach based on stock selection without reference to a process or to asset allocation constraints A bottom up approach based on stock selection with allocation constraints Percentage is established based on number of responses, eleven percent of respondents did not answer this question © Edhec 2003 030521 - 25 – The allocation privileges macro-economic forecasts (80%); – Despite academic results, quantitative approach for tactical allocation is not widely used (17%), with investment management firms preferring a qualitative approach. © Edhec 2003 0% Does it incorporate sector or microeconomic Forecasting? France Germany United Kingdom Others Is it mainly based on a quantitative process for tactical allocation? Is it mainly based on a quantitative process for strategic allocation? Does it include a tactical dimension by holding a monthly or quarterly investment committee Meeting? Does it take into account the extreme risks of allocation by means of simulations and/or Scenarios? Does it incorporate macroeconomic forecasting or scenarios? • Tactical allocation is widely used by asset management firms Is it associated with one or several allocation or investment committees? The management process Asset allocation The Asset Allocation Process 120% 100% 80% 60% 40% 20% Europe 030521 - 26 The management process Portfolio construction 80% 70% 60% 50% 40% 30% 20% France © Edhec 2003 Germany United Kingdom Others No quantitative methods for optimisation Others A relative risk approach compared to a benchmark that represents the long-term allocation policy The minimisation of extreme risk The minimisation of volatility risk 0% An approach based on a minimum acceptable level of risk or return 10% Optimisation of absolute risk based on a mean-VaR approach – This approach is usually supported by a Black & Littermann approach which compares the market portfolio (neutral view) to a market capitalisation weighted index. 90% Optimisation of absolute risk based on a mean-variance approach • The benchmark relative risk approach is favoured by respondents (74%) Is portfolio composition for one or more asset classes, categories or styles based on: Europe 030521 - 27 The management process Portfolio construction • Despite its weaknesses, 23% of management firms use the mean-variance approach; • Only 22% of respondents take extreme risks into consideration in the portfolio construction process. © Edhec 2003 030521 - 28 Performance analysis Success of GIPS standards • Implementation of “Country Version” (CVG) or “Translated Version” (TG) within most European countries • Acceptance of the unification process by European players (Gold GIPS - 2005) © Edhec 2003 030521 - 29 Performance analysis Risk-adjusted measure • An unsophisticated approach to measuring managers’ alphas – Low level of usage of multi-factor models (17%) – General use of Peer Groups (51%) – Measurement of out-performance with regard to a benchmark (97%) • The benchmark is usually a market index (97%) and rarely a normal portfolio representing the true risk exposures of a portfolio over the period (6%). © Edhec 2003 030521 - 30 © Edhec 2003 France Germany United Kingdom Others No answer By analysing absolute performance in a peer group By Sharpe-type style analysis By using market models (CAPM and Jensen's alpha) By analysis based on relative performance compared to the benchmark (information ratio, etc) By using a multi-factor model Performance analysis Risk-adjusted measure How are the manager's alphas analysed? 80% 70% 60% 50% 40% 30% 20% 10% 0% Europe 030521 - 31 Performance analysis Performance attribution • Not a genuinely global approach, strongly linked to “equity” offerings Are the sources of performance broken down? (Europe) 6% 14% 51% 29% For all investments No © Edhec 2003 For certain investments No answer 030521 - 32 Performance analysis Performance attribution • Absence of international standardisation Favour GIPS/AIMR-PPS recommending disclosure of attribution statistics? 90 80 70 60 50 40 30 20 10 0 Yes No Money Managers Investment Consultants Source: Spaulding (200) © Edhec 2003 Don't know Other Plan Sponsors 030521 - 33 Performance analysis Performance attribution • Multi-factor models for performance attribution dominate; • The arithmetic approach (Brinson et al.) is more often used for “client” reporting; • Multi-factor models sourced from the risk management discipline, also widely used for performance attribution (49%) are nevertheless neglected for published measures of managers’ alphas. © Edhec 2003 030521 - 34 Performance analysis Performance attribution Which performance attribution method and/or performance decomposition model do you use? 80% 70% 60% 50% 40% 30% 20% 10% France © Edhec 2003 Germany United Kingdom No answer Others Model based on multi-factor analysis (such as Barra) Arithmetic model ( such as Brinson, Singer or Beebower) Style analysis model (such as Sharpe) 0% Others Europe 030521 - 35 © Edhec 2003 France Germany United Kingdom Others 8 8 9 14 20% 0% 0 0 0 33 29 25 23 29 25 40% No answer Measurement of operational risk Ensuring that risk regulations and restrictions set by the client and/or investment firm are being respected Consolidation and evaluation of risk associated with off balance sheet positions per portfolio, per client, per manager and for the whole investment firm 42 42 57 51 50 50 83 83 71 75 77 71 69 67 80% Credit risk analysis 29 58 58 51 100 100 100% Measurement of the risk-adjusted return for each investment 43 60% portfolios are exposed 25 • The measurement of risk as required by the regulator or the mandate is a key constituent of the risk monitoring function; • Only 51% of respondents monitor the portfolio’s extreme risks; • Only 23% of respondents consolidate and assess the risks of off-balance sheet operations. Analysis of the extreme risks to which Risk management Risk monitoring Which of the following does risk analysis include? 120% Total Europe 030521 - 36 Risk management Future investment • Investment priorities are consistent across the various geographical zones: – Management of allocation constraints and risk limits (60%) – Measure and analysis of extreme risks (46%) – Evaluation and monitoring of off-balance sheet positions (52%) • It is also interesting to note that client reporting is widely seen as a key investment (71%) © Edhec 2003 030521 - 37 © Edhec 2003 France Germany United Kingdom Others No answer Others Measurement and analysis of extreme risks Measurement of operational risk Risk reports designed for clients Ensuring that asset allocation rules and risk limits are being respected Ensuring that the investment firm's guarantees are being respected 0 0 0 3 8 8 14 17 17 14 14 25 25 29 25 25 43 43 42 42 50 50 50 46 43 37 33 33 29 33 31 29 26 26 50 60 58 67 75 71 75 75 75 75 92 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Monitoring off balance sheet positions Improving models for OTC operations evaluation Risk management Future investment Which areas of risk management or analysis do you intend to invest in over the next three years? Total Europe 030521 - 38 Risk management Risk measurement • Two types of risks are not well represented: – Volatility risk (56%), for which the score is probably linked to the low usage of derivative instruments. France is an exception with regard to this question; – Liquidity risk (59%), for which the challenges are both conceptual (definition of a model for measuring liquidity risk) and technical (implementation of the consequences of liquidity risk on instrument pricing) (cf. CMRA study, 2001). © Edhec 2003 030521 - 39 Risk management Risk measurement Which financial risks do you take into account when analysing portfolio exposure? market risk interest rate volatility risk risk France Germany FX risk credit risk United Kingdom liquidity risk Others Others 22% 0% 3% 0% 0% 0% 12% 20% 0% 0% 20% © Edhec 2003 25% 59% 50% 40% 44% 40% 83% 100% 80% 78% 75% 82% 100% 88% 100% 40% 44% 60% 67% 58% 56% 75% 88% 92% 91% 100% 100% 78% 78% 80% 100% 100% 100% 100% 94% 120% No answer Total Europe 030521 - 40 Risk management Value at Risk (VaR) • Usage not widespread (51%) – No regulatory framework; – The systematisation of VaR requires the adaptation of complex tools initially designed for investment banking • Need to adapt the VaR calculations to the specific context of investment management firms (simple calculations but real inclusion of non-Gaussian risks) – VaR Cornish Fisher (Favre Galinao, 2000) – Style VaR (L’habitant, 2001) © Edhec 2003 030521 - 41 Risk management Risk measurement • An approach not really tailored to the measurement of extreme risks – Respondents favour parametric VaR (44%) – Very low usage of extreme value approaches (6%) – 21% of respondents trust the normal distribution laws to analyse the consequences of extreme risk variations. How do you assess the risk of extreme loss for your portfolio? 31% No answer 18% No VAR carried out 6% Extreme Value Theory 15% Simplified Monte Carlo VaR + scenarios 26% Monte Carlo simulation based VaR Historical simulation VaR 32% Parametric VaR 44% 0% © Edhec 2003 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 030521 - 42 Risk management Multi factor analysis • Factor Analysis is one of the areas where asset managers have invested the most so far. The usage of multi-factor models is consistent with the “risk relative” asset allocation approach. 56 50 53 18 0 0 0 0 6 8 11 15 17 15 20 25 20 20 22 13 9 0 0 10% 0 8 12 20% 13 20 30% 22 25 33 40% 22 50% 40 60% 0 70% 63 Do you base your portfolio risk anlysis on a multi-factor model? © Edhec 2003 France Germany United Kingdom Others Total Europe No answer No, we do not consider this useful No, but we are planning to do so Yes, others Yes, implicit type (APT) Yes, explicit macroeconomic type (BIRR) Yes, explicit microeconomic type (BARRA) 0% 030521 - 43 Risk management Multi factor analysis • Even though explicit models (BARRA, BIRR, etc.) still dominate the market, the implicit approaches are growing in importance (9% in Europe and 22% in the United Kingdom). © Edhec 2003 030521 - 44 Risk management Credit risk • Quantitative approach not well represented; • Financial analysis privileged despite its “backward looking” approach. 60 70% 67 67 Is the specific approach to credit risk based on: 50 50 60% 12 11 No answer Others 0 0 0 risk between credit risk and liquidity Others 8 8 8 United Kingdom the links A modelling of department analysis the financial 0 0 An analysis, Germany carried out by published rating on the A model based approach 0 based France © Edhec 2003 25 15 15 13 an option- A model using 0 10% 0% 21 22 25 22 30% 33 33 38 33 40% 20% 38 50% Total Europe 030521 - 45 Risk Management Compliance: Level of compliance • The level of compliance is quite high so far due to regulatory evolutions; • Increasing importance of “contractual” compliance; • Implementation of financial constraint monitoring (VaR 53%, risk factors 24%). © Edhec 2003 030521 - 46 © Edhec 2003 30% 20% 10% 0% 3 6 Others None 6 Tracking error Extreme risk constraints (VaR) Leverage effect constraints Constraints linked to a risk factor identified by multi-factor analysis Counterparty limits 50 53 62 71 40% Constraints relating to the asset class defined within the allocation framework 50% 71 24 60% Constraints relating to an investment category 65 70% Constraints relating to a specific asset 80% 79 76 90% Mandate-related rules Company-related rules Risk Management Compliance: Level of compliance What risk constraints do you take into account? 030521 - 47 Risk Management Compliance: Pre or Post trade compliance • Pre-trade compliance becoming a strategic challenge for organisations and their portfolio management systems; • This pre-trade compliance takes not only regulatory requirements into account but also financial constraints. In your opinion, which of the following constraints require periodical control (post-trade) or alternatively should be systematically taken into account for each new trade (pre-trade)? © Edhec 2003 Total Europe Post trade Pre trade Both Type of investment 7% 32% Class or category related to allocation 11% 19% Counterparty 11% 22% Risk factor 27% 15% Leverage effect 16% 20% VaR 35% 12% 61% 70% 67% 58% 64% 54% No answer 18% 21% 21% 24% 26% 24% 030521 - 48 Risk Management Operational risk: What attention is given to Operational Risk ? • Only 50% of European management firms feel impacted by the consequences of Basel II, despite the CAD III initiative; • This lack of interest can be understood: – Investment Management companies are not the most exposed to operational risks (custodian role); – The implementation of new capital requirements to cope with an idiosyncratic risk is not supported by academic research, nor is it supported by industry studies (Oxera 2001, Biais et al., 2003); Do you think the Basel II Accord, which allows for the allocation of share capital to cover operational risks of banks and their asset management subsidiaries, will affect your activity? 3% 24% 50% 24% Yes © Edhec 2003 No Don't know No answer 030521 - 49 Risk Management Operational risk: Measures taken to respond to the new regulatory requirements • Despite their usefulness with regard to capital savings, internal models have not yet received attention from our respondents; Country Yes No We have not examined the issue yet France Germany UK 0% 20% 0% 0% 100% 80% 0% 22% 78% • Loss data collection is the current priority for investment management firms (53%). By definition, however, the data collection cannot serve as a basis for analysing extreme risks, which are supposed to be covered by capital charges. As a result, the question of operational risk is tackled from the operations efficiency angle. © Edhec 2003 030521 - 50