Fiscal Policy in Europe : A Long View Marco Buti (European Commission)

advertisement

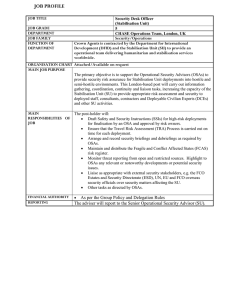

Marco Buti (European Commission) and André Sapir (Université Libre de Bruxelles, Bruegel and CEPR) Fiscal Policy in Europe : A Long View Second annual Berkeley-Vienna conference: The US and European Economies in Comparative Perspective Berkeley, September 12-13 2005 1 I. A CONCEPTUAL FRAMEWORK EUROPE SINCE WWII: Three sub-periods The Golden age : 1950-1973 The fall from heaven: 1973-1993 Maastricht stabilisation: 1993-2000-2004 4,5 2,5 1,5 Unemployment 2 8 8 Inflation 4 8 2 Public deficit <2 0 => 6 6 => 1,5 => 3 Government spending <35 37 => 51 51 => 46 => 44 Growth 3 _ ~ An interpretation: the Musgravian triangle Golden age Redistribution + Stabilisation + + Allocation • No trade offs: setting up of the welfare state allows improvement of allocation (correct market failures in unemployment and social insurance), redistribution (via the same programmes) and stabilisation (tax and welfare systems as automatic stabilisers) • Social welfare maximisation increases the chances of reelection: benevolent government = political economy approach 4 Fall from heaven Redistribution Stabilisation - - Allocation • Trade offs emerge: between allocation and redistribution/ stabilisation (work incentives hampered) • Social welfare maximisation ≠ politically motivated behaviour • Sustainability becomes a problem 5 Maastricht consolidation Redistribution Stabilisation - -/+ - Consolidation -/+ Allocation • Primary focus: discipline/sustainability • Maastricht consolidation: higher taxes, lower spending impact on Musgrave, in the short and longer run • Beyond a critical level, reducing taxes may improve allocation and stabilisation 6 II. THE PAST 30 YEARS 7 GDP growth 10 8 DE 6 FR 4 IT 2 UK 0 EUR-12 -2 -4 1961 1964 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 8 Unemployment rate 14 12 DE 10 FR 8 IT 6 UK 4 EUR-12 2 0 1960 1963 1966 1969 1972 1975 1978 1981 1984 1987 1990 1993 1996 1999 2002 9 Inflation 30 25 DE 20 FR 15 IT 10 UK 5 EUR-12 0 -5 1961 1964 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 10 Budget balance 6 % of GDP 4 2 0 DE -2 -4 FR -6 UK -8 EUR-12 IT -10 -12 -14 1961 1964 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 11 Cyclically adjusted primary balance 8.0 6.0 DE FR IT UK EUR-12 % of GDP 4.0 2.0 0.0 -2.0 -4.0 -6.0 -8.0 1970 1973 1976 1979 1982 1985 1988 1991 12 1994 1997 2000 2003 Public debt 140 % of GDP 120 100 DE 80 FR IT 60 UK 40 EUR-12 20 0 1970 1973 1976 1979 1982 1985 1988 1991 13 1994 1997 2000 2003 Total expenditure 60 % of GDP 55 50 DE 45 FR 40 IT 35 UK EUR-12 30 25 20 1960 1963 1966 1969 1972 1975 1978 1981 1984 1987 1990 1993 1996 1999 2002 14 Total revenue 60 % of GDP 50 DE FR 40 IT UK EUR-12 30 20 1961 1964 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 15 III. FUTURE PERSPECTIVES: AGEING KICKS IN 16 Demographic changes Old Age Dependency Ratio 2003 2025 2050 D 26 38 52 F 25 37 46 I 28 39 62 UK 24 33 45 25 37 53 EUR-12 17 LONG TERM BUDGETARY PROJECTIONS Non-age related exp. Age related expenditure Health care Pensions 2008 2050 2008 2050 Education 2008 2050 TOTAL Others 2008 2050 Constant 2008 2050 D 11 14,9 5,9 7,1 5,3 5,5 0,9 0,7 18,3 41,4 46,5 F 12,7 14,5 6,4 7,4 5,9 5,5 1 0,7 22,8 48,8 50,9 I 14 14,1 6,4 8,1 4,6 4,2 0,4 0,3 13,4 38,8 40,1 UK 5,1 5,3 7,7 9,7 5,4 5,4 1,4 1,5 20,4 40 42,3 11,1 14 6,1 7,6 5 4,8 1,4 1,2 18,5 42,1 46,1 EUR-12 18 The “maximum sustainable” level of debt is decreasing b s (a) r y(a) sM(a) ↓, y (a) ↓, r ? a = ageing 19 IV. EMU’S FISCAL FRAMEWORK: HELP OR HINDRANCE? 20 SGP spirit The approach chosen by the framers of the SGP was two-pronged: • The 3% of GDP reference value should be treated as much as possible a ‘hard ceiling’. • Member States should commit themselves to a “medium-term budgetary objective” of “close-tobalance or in surplus”. 21 In the steady state Sustainability ↓ public debt Stabilisation CTB + automatic stabilisers Allocation ↓ public spending … BUT WE NEVER GOT THERE 22 Lessons from the first 5 years of EMU Economic assessment • High structural deficits and debts • Lack of consolidation in good times • Somewhat better stabilisation (but largely in spite of the rules) Political assessment • Fading ‘ownership’ • Large countries/small countries divide • Enlargement of the EU heightens the problems 23 SGP reform: motivation • Sustainability ↓ public debt plus reforms for ageing • Stabilisation CTB + automatic stabilisers plus country differentiation • Allocation ↓ public spending plus expenditure quality 24 The reformed SGP 1. • • • • Economic governance Stability programme for the legislature Involvement of national parliaments Reliable forecasts Better statistical governance 2. • • Preventive arm Diversified MTOs At least 0.5% structural adjustment 3. • • • • Corrective arm Exceptional circumstances ‘All ORFs’, but only if d>3% is ‘close and temporary’ Debt and sustainability Repeatability of EDP steps 25 THE OLD AND THE NEW STABILITY PACT: two readings Old SGP New SGP: collusion 1. Public visibility High but fading New SGP: genuine Lower 2. Clear incentives Less clear Easier to get away with Better rationale 3. Political ownership Small MS High deficit MS: D+F+I All MS 4. Constraining calendar CTB in the medium term MTO de facto never MTO in the medium term 5. Collegial culture Acrimony prevailed From collegiality to collusion New collegiality based on trust 26