Trading on the Iowa Electronic Markets Introduction

advertisement

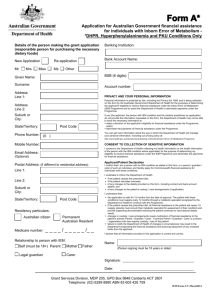

Trading on the Iowa Electronic Markets Introduction Introduction The IEM is an on-line futures market Payoffs are based on real-world events such as: – political outcomes – companies' earnings per share (EPS) – stock price returns Operated by University of Iowa Henry B. Tippie College of Business faculty as an educational and research project Agenda Signing up for an IEM account Connecting to the IEM Navigating in the IEM Trading with the IEM Getting Account Information Getting Market Information Signing Up for an IEM Account Start at http://iemweb.biz.uiowa.edu/signup Follow instructions provided in class – Warning: use only forms that you were instructed to use. – Using the wrong forms may result in additional fees Connecting to the IEM Connect using a web browser – Internet browsers are Microsoft Internet Explorer, Netscape, AOL, etc. Web address: – http://iemweb.biz.uiowa.edu/ Logging Into the IEM Address: – http://iemweb.biz.uiowa.edu – Select the “login and trade” link. Logging into the Practice Markets – Trader ID: aaa, bbb, ccc, … – Password: aaa, bbb, ccc, … Logging into your own account: – Use Trader ID and password received from the IEM – For security, CHANGE YOUR PASSWORD the first time you login! Logging out – REMEMBER to log out for security reasons! Using the IEM Trading screen divided into three sections – Market Window shows current market status – Trading Console where you enter your orders – Navigation Bar to move around between markets or generate reports The IEM Screen The WebEx Market Window The Market Window Top panel of your screen Shows – current market information – your holdings in cash and assets – your outstanding orders The WebEx Navigation Bar The WebEx Navigation Bar Bottom panel of your screen 5 buttons: – – – – – "Go To Market" Button "Market Info" Button "My Account" Button "Help" Button "Logout" Button Trading in the IEM Trading Rights – All traders can trade in political markets – Only academic traders can trade other markets Markets and the Objects Traded – IEM contains many markets Each market is related to some future event – Assets are the objects traded in the market The future event determines how assets in the market will payoff Trading in the IEM Three ways to buy and sell assets – Market Orders – Limit Orders – Bundle transactions Market Order: Definition Request to buy or sell an asset at the current ask and bid price Consists of: – Instruction to buy or sell – Asset ticker symbol – Quantity you wish to trade Placing a Market Order Use the market order menu Choose the asset you wish to buy or sell from the Action/Asset select list Specify the quantity Click on the Market Order button Market Orders in WebExchange Limit Order: Definition A request to buy or sell an asset at a specified price for a specified period of time Consists of: – – – – – an instruction to buy or sell an asset ticker symbol the quantity you wish to trade a price at which you are willing to trade an expiration date and time after which the order will not be traded Placing a Limit Order Use the limit order menu Choose the asset you wish to buy or sell from the Action/Asset List Specify – price – quantity – expiration date and time Click on the Limit Order button Limit Orders in WebExchange Buying and Selling Bundles A bundle – is a set of assets which can be purchased from or sold to the exchange at a fixed price – This fixed price is the guaranteed aggregate liquidation value of the assets – Processed as market orders in IEM Withdrawing Orders You can withdraw any of your bid and ask orders as long as they have not traded or expired. To withdraw an order – Access the market in which the order was placed. – Click on the bid or ask hypertext to the right of the appropriate asset – Find the order you wish to withdraw and click on the word delete to the right of the order – Once an order is deleted it cannot be retrieved Order Queues Limit Orders are maintained in queues Orders are listed in these queues in priority order. – Bid orders with higher prices have higher priority than orders with lower prices. – Ask orders with lower prices have higher priority than orders with higher prices. – Within a particular price, older orders (orders that were placed sooner) have higher priority than newer orders. Other Aspects of Trading Short Sales and Margins – You cannot sell short or buy on margin – Feasibility Checks Self Trades – You cannot trade with yourself Spinoffs and Splits – The IEM governors can declare asset spinoffs and splits Asset Liquidations by the Exchange – The liquidation formula describes how and when assets will payoff – Once assets are liquidated, they can no longer be traded Other Aspects of Trading Short Sales and Margins – You cannot sell short or buy on margin – Feasibility Checks Self Trades – You cannot trade with yourself Spinoffs and Splits – The IEM governors can declare asset spinoffs and splits Asset Liquidations by the Exchange – The liquidation formula describes how and when assets will payoff – Once assets are liquidated, they can no longer be traded Other Aspects of Trading Short Sales and Margins – You cannot sell short or buy on margin – Feasibility Checks Self Trades – You cannot trade with yourself Spinoffs and Splits – The IEM governors can declare asset spinoffs and splits Asset Liquidations by the Exchange – The liquidation formula describes how and when assets will payoff – Once assets are liquidated, they can no longer be traded Reports About Your Account Trades Report Outstanding Asks Report Outstanding Bids Report Orders and Order Resolution Report Portfolio Report Liquidation Report Reports About Your Account Trades Report Outstanding Asks Report Outstanding Bids Report Orders and Order Resolution Report Portfolio Report Liquidation Report Reports About Your Account Trades Report Outstanding Asks Report Outstanding Bids Report Orders and Order Resolution Report Portfolio Report Liquidation Report Reports About Your Account Trades Report Outstanding Asks Report Outstanding Bids Report Orders and Order Resolution Report Portfolio Report Liquidation Report Reports About the Market Price History – Daily contract volumes, dollar volumes, high prices, low prices, average prices and closing prices Current Quotes – Best bids, best asks and last trade prices Prospectus – READ IT BEFORE TRADING! Reports About the Market Price History – Daily contract volumes, dollar volumes, high prices, low prices, average prices and closing prices Current Quotes – Best bids, best asks and last trade prices Prospectus – READ IT BEFORE TRADING!