RTO 101: Session 5 How RTOs Use Markets to Achieve Short-run Reliability and

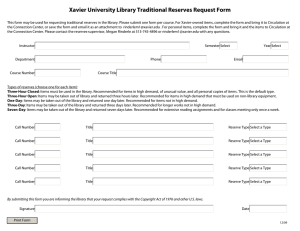

advertisement

RTO 101: Session 5 How RTOs Use Markets to Achieve Short-run Reliability and Long-run Resource Adequacy Prepared by John Chandley for PJM and Midwest ISO States May 2008 Part I How Much Capacity Do We Need? Setting the Target and It’s Impact on Retail Rates Who Decides the Res. Adequacy Target? Setting the RA Target drives fixed/capital costs and has a large impact on rates, as well as affecting quality of service. These issues are normally thought of as state responsibilities. However . . . Under the Energy Policy Act of 2005, Electric Reliability Organizations, like Reliability First Corporation (RFC) and Midwest Reliability Organization (MRO), are also authorized to set the RA target. EROs thus affect a significant part of the level of retail rates and indirectly, the reliability of service. 3 Let the Engineers Decide Traditional “reliability standards” are not economically based. They are strictly engineering standards based on historic practices. No one claims they are cost justified. A traditional engineering standard for “adequacy” is to carry enough capacity so that on average, the system does not run short of capacity – loss of load expectation -- more than once in 10 years: 1-day in 10-yr LOLE = reserve margins of about 15%-18%. 4 Let the Economics Decide An alternative is to allow economics to define the RA Target. The principle is to allow the reliability or reserve target to be based on what consumers (or states speaking for them) would be willing to pay for reliability – i.e, to avoid being short of capacity. We’d need a way to figure out what consumers want. This could lead to reserve margins more, but probably less than 15%. (that is, consumers might not be willing to pay for 1 day in 10 year LOLE) 5 RA Target Defines the Revenue Requirement Suppose PJM/MISO accept 1-day in 10-year LOLE . . . e.g., a 15% - 18% reserve margin (RM) requirement. Then every state must set retail rates to recover the full revenue requirements for that level of capacity. Once the RM is set, rates have to recover about the same total revenues whether we have markets or regulation (assuming both structures are efficient). In regulated states, retail rates must recover the utilities’ full revenue requirements for building/operating that much capacity to cover their loads plus the RA target reserve margin. If not, utilities won’t build. For market-based investments, wholesale market prices must also recover full revenue requirements, and retail rates must recover these same wholesale costs. Otherwise, the investments won’t occur. 6 Part II The “Missing Money” Problem: Alternative Ways to Solve It and Why the Choices Matter Generators Depend on the Highest-Price Hours To Recover Most of Their Fixed Costs $/MWh Contributions to Fixed Costs PShortage Shortage hours PPeak Demand Supply offers Peak hours PShoulder POff-peak Off-peak hours Shoulder hours Low-price hours barely cover operating costs 8 A “Missing Money Problem” Arises If the RTO Does Not Use Shortage-cost Pricing $/MWh Lost Contributions to Fixed Costs PShortage PCap Shortage hours PPeak Demand Supply offers Peak hours PShoulder POff-peak Off-peak hours Shoulder hours Implicit “caps” on energy prices prevent generators from receiving a significant contribution to their fixed/capital costs 9 A “Missing Money” Problem Arises In Shortages If There Is No Shortage Pricing DPeak Clearing Price “Capped” Price The “missing money” = lost contributions to fixed costs for every plant Price set by demand PATH A Price set by supply offer caps PATH B Peaker Intermediate Base-load Quantity The “missing money” problem undermines both long-run investment and short-run reliable dispatch 10 Path A or Path B? A key design choice depends on how energy and operating reserve prices are set. What happens when the ISO dispatch runs short of plants to supply the total demand for energy plus operating reserves? Path A: Allow scarcity prices to clear the markets for energy and operating reserves based on demand. Path B: Cap the energy prices, but recover the “missing revenues” from capacity payments and other mechanisms. PJM, NY, NE chose Path B. MISO is trying Path A. 11 Original ISOs Evolved Into Path B In the Eastern ISOs, the original “power pools” had an installed capacity (ICAP) requirement. PJM, NYPP, and NEPOOL were shared reserve pools. The “pool” imposed an ICAP requirement on each utility-member to cover its own loads + reserve margin It supported reserve sharing between the pool members It prevented free-riding, which could otherwise occur because regional dispatch allows “leaning” on others’ resources in real time. That is, the pool dispatch meets everyone’s load, and draws from whatever plants are available for dispatch. 12 Features of First Generation ICAP Markets ISO (or Reliability Authority) sets the required level of capacity. Pool region must maintain (e.g.) a 15 % reserve margin ISO allocates to each LSE its share of capacity requirement. Based on LSE’s share at peak, adjusted for retail switching. ISO conducts an auction market for LSEs/Generators. Typically a monthly auction, but could be daily, seasonal, etc. Used to buy/sell capacity and set price for “overs” and “unders.” ISO penalizes LSEs/Generators who fail to meet the rules. “Short” LSE must pay deficiency charge each MW it is short. Generators that fail to be available pay high penalty. 13 All the First ICAP Markets Failed! Why? They ignored the underlying incentive problems . . . Capped energy prices plus ICAP payments => . . . • Poor incentives to gencos to be available when needed in RT. • Poor incentives to provide the right operational features. • Poor incentives for demand-side response. Uniform ICAP payments ignored locational differences So all ICAP mechanisms are moving to multi-zonal “LICAP.” And fixed ICAP demand created other problems . . . Volatility -- inevitable with fixed capacity requirements. Market power -- it’s easy to exercise in earlier capacity markets. 14 ICAP Investment Needed At Right Locations If there are transmission constraints on delivering power to load pockets, non-locational ICAP payments cannot allocate the missing money to the right locations. Instead, uniform ICAP prices result in: Not enough investment at the right locations (Boston, SWConn, New Jersey, Wisconsin, etc.) Too much investment at the wrong locations (Maine, Western NY/PA) The resulting generation cannot sustain reliable operations because its power can’t all be delivered to loads. Lesson: If we use ICAP to restore missing money, ICAP payments need to be locationally different (LICAP) to reflect transmission limits. 15 Every ICAP Reform Added LICAP Zones New York ISO: Created three zones with different prices in each zone. New York City, Long Island and “Rest of New York” New England ISO – earlier LICAP proposal proposed five fixed LICAP zones. In 2006 settlement, ISO will define zones before each auction. PJM RPM Settlement – starts with 4 LICAP zones and expands number in 3 years up to 23 zones. Eastern MACC, SW MACC, AP & MACC, Rest of PJM 16 RPM May Have Multiple Deliverability Areas MAAC Western MAAC PJM West Eastern MAAC Southwestern MAAC AP PJM South Initial Proposal Transition ComEd PSEG North RE JCPL PPL PENELEC PSEG DQE PECO Dayton ME AE BGE AP DPL Dominion AEP DPL South 17 Can LICAP Designs Improve Efficiency? Locational ICAP (LICAP) can lessen the problems with non-locational ICAP, but there is a tradeoff. With many interconnected zones, it is not obvious how one allocates deliverability rights to constrained transmission. Transfer capacity is not a fixed number. PJM’s RPM with many LICAP zones may confront this problem, and there may not be an efficient solution. Any large RTO may need many LICAP zones if it follows Path B. 18 Price Volatility in Earlier ICAP Markets Original ICAP markets could skip between very low (near zero) prices and very high prices at deficiency. ICAP Price When there is a surplus, the capacity price tends to be very low, or near zero. PCap When there is a slight shortage of capacity, the price rises to the deficiency charge (Pcap) – a price cap. The more vertical the supply/ demand curves, the more price volatility occurs. P Investment risks are high. S D Quantity 19 Market Power Incentives in ICAP Markets The combination of a vertical demand curve and a near-vertical supply curve presents strong incentives to exercise market power. Price Any withheld supply shifts the Supply curve to the left. S Pcap A slight shift of the supply curve to the left causes a large increase in price. This can easily offset the revenues foregone as a result of P withholding. D Quantity 20 Two Approaches To Lessen Market Power Use a downward-sloping curve for ICAP demand. A sloping demand curve reduces the incentives for market power. Recognizes that capacity beyond the “target” has value. Recognizes that capacity is more valuable when short. Use a forward auction (extend the supply curve). Define “product” to be delivered 3-4 years from now. New entrants can compete with existing resources. May facilitate competition with transmission? 21 NY ISO ICAP Demand Curve ICAP Price Price Ceiling Net Cost of Entry Minimum ZeroNYCA Crossing Requirement Point ICAP Quantity 22 Proposed ISO-NE Demand Curve (Not included in Settlement) 23 PJM Initial Demand Curve for Variable Resource Requirement Note: The settlement did not adopt this curve. 24 PJM Final Demand Curve for Variable Resource Requirement Final Shape (not to scale) 25 Why the Demand Curves Matter Changing the demand curve changes investment and risks. No matter what, the implicit or explicit demand curve for energy and reserves (or capacity) will drive the level of investment. Moving the curve down and/or left => less investment Moving the curve up and/or right => more investment If the demand curves don’t reflect the investment requirements, they can’t achieve the RA goal. 26 Market Power Solution II: Change the Supply Curve A joint PJM-NY-NE study developed the concept of holding the ICAP auctions 3-4 years in advance. If the ICAP “product” does not have to be delivered for 3-4 years, then new entrants could compete against existing plants. New entry/competition would limit the ability of existing plants to exercise market power, such as by withholding capacity from monthly auctions. PJM’s RPM and ISO-NE’s Settlement use this forward auction approach. 27 Proposed Timing of RPM Auctions 3 Years 23 months 13 months 4 months June Self- Supply & Bilateral Designation EFORd Fixed Planning Year ILR Base Residual Auction Incremental Auction Incremental Auction Incremental Auction Ongoing Bilateral Market – (shorter-term reconfiguration) Source: PJM 28 Recent Results in PJM Capacity Auctions PJM first held auctions for the 2007-08, 2008-09, and 2009-10 years. PJM is still in “surplus” for most regions, which means the clearing prices are often below the “break-even” points to support new investments. Since little new capacity can be offered from this year to next, the surplus will diminish, and prices gradually rise above the breakeven point where new investments would make sense. And PJM recently filed to raise the Net CONE – higher prices A downward sloping curve yields higher LICAP prices than would have occurred with a vertical curve when there is a surplus . . .but about the same prices on average over time. 29 Availability Incentives: How Should We Measure and Reward Availability? In the past, ICAP availability has been measured by EFORd What was your unit’s average availability during the last 12 months, given its various outages as measured by EFORd? In the LICAP case, ISO-NE proposed to use availability during operating reserve “shortage hours” to replace EFORd Was your unit available during an hour in which the operating reserves fell below the normal requirement for OR? “Available” means producing energy or providing operating reserves. If you weren’t running or available for reserves during the shortage hour, you won’t be paid for that hour. (But the non-payment “penalty” may be spread out over time by reducing future monthly payments.) 30 Issues with UCAP and EFORd Adjustments There are concerns about continued use of EFORd as an effective measure of availability. EFORd is based on self reporting – can we trust this? The capacity that a supplier can sell is defined by UCAP. UCAP is ICAP adjusted by EFORd -- by outage hours. Do Sellers have an incentive to under-report outage hours? EFORd is an average measure. It ignores the fact that the value of availability is higher at some times than at others. Is a 10% outage rate good or bad? • Outages during non-peak periods mean little • Outages during peak demand hours mean a lot 31 Using “Shortage-Hours” to Replace EFORd Is Defining “Capacity” To Be Like “Energy” To be “available” during a “shortage hour,” a unit must: Be operating – producing energy in real time, or Be scheduled or eligible to provide operating reserve • Capacity that is capable of starting within 30 minutes could be eligible, because it could be used as 30 minute reserves. This metric encourages plants to be available when most needed, and to be the kinds of plants that are quick-start and flexible. If you’re not “available” you don’t get paid An energy+OR+scarcity pricing market would work the same way The “capacity” payment becomes a payment for “energy or operating reserves,” paid for the hours in which the energy or reserves are most valuable but prices would likely be capped. Pays the revenues missing in shortage hours because of price/bid caps Provides the availability incentives missing during those same hours 32 Part III Solving the Missing Money Problem With Shortage-cost Pricing (So-called “Energy-only” Market But it’s really energy plus operating reserves) Revisit the Strategic Decision: Avoid Missing Money With Shortage Pricing DPeak Uncapped Clearing Price Path A The “missing money” = lost contributions to fixed costs Price Cap Path B plus ICAP Base-load plants Quantity Path A = Energy and Op. Reserve Market with Shortage Prices Path B = Capped Energy Market with (L)ICAP, curves, RPM.34 What the Midwest ISO Is Proposing Regionalize procurement of operating reserves (OR) Create bid-based markets to procure OR Co-optimize procurement of OR and energy pick the least cost mix Apply shortage-cost pricing to energy and OR (PATH A). When supplies are short, prices can be set by demand – the willingness of consumers to pay -- not merely by the offers/bids of generators. And energy prices are affected by the level of operating reserves. If the ISO falls short of operating reserves, jeopardizing reliable dispatch, energy prices would rise to reflect that shortage. 35 Shortage Cost Pricing Approach (Illustrative) Shortage Cost in $/MWh Demand Curve for Operating Reserves VOLL $1000 $500 $0 Rotating blackout warning Available Supply in MW Note: Actual ISO methods may use separate curves for each type of reserves, and simple steps for the “curve” Reserve shortage warning 0-1% 3% 5% X% Target % of Operating Reserves Above Demand 36 Reminders: Limited Spot Price Exposure Retail customers have little or no exposure to volatile spot prices. Only those who choose to rely on spot prices are exposed. In regulated states (no retail choice) . . . If a utility covers full load requirement, retail customers are not exposed. If utility purchases any energy from ISO spot market, it pays spot prices only for that amount; but retail customers are hedged by fixed rates. In states with retail choice . . . Largest customers might face hourly spot prices, but they can be hedged through contracts, own generation (self supply), demand response, to the degree they choose. Several states already doing this. For smaller customers: Regulators would ensure utility or competitive LSEs hedge default customers with longer-term contracts. (e.g., New Jersey/Illinois default supply model) 37 Market Power Mitigation Still Applies In an energy plus operating reserve market with scarcity pricing, market power mitigation would still apply. Offer caps would still apply to prevent price gouging bids, just as they do today. • Unit-specific conduct and impact tests still apply • $1000/MWh overall cap still applies. Must offer rules would prevent physical withholding, just as they do today. Shortage cost pricing does NOT mean removal of market power mitigation. It’s all still used. 38 How the PJM and MISO Models Could Merge 39 Market Revenues for Generators Come From Four ISO sources Energy market Primary source of revenues for most generators But price caps limit revenues from this source Operating reserve markets Supplemental source of revenues Extent depends on scarcity pricing Capacity market Needed if energy and OR markets not enough to support RA target (the “missing money” problem) Local reliability-must-run (RMR) contracts in load pockets Needed to cover local/other costs not covered by Energy, OR and (if any) Capacity markets. These RMR contracts tend to be based on cost-of-service principles. 40 Different Models Determine Where Generators Get Their $$$ . . . But Total Revenue Requirements Are The Same “RMR” Operating Reserve Energy MISO Proposed Cost of Service Monthly payments unless tied to shortages Payments depend on availability for real-time dispatch RMR LICAP RMR LICAP helps lower local RMR ICAP Operating Reserve Operating Reserve Energy Energy LICAP PJM/NE/NY ICAP Earlier ISOs 41 Difference Between ICAP and LICAP Approaches Compare the ICAP and LICAP columns in that slide. A locational ICAP approach tends to reallocate the source of revenues from non-market payments (RMR-type, cost-of-service contracts) to “market” payments for capacity. • Mostly, this is money paid to generators in transmission-constrained load pockets. That’s where most RMR units are. • Higher locational ICAP (LICAP) payments in load pockets help substitute for RMR contracts in those load pockets. The total revenue requirement for all generators combined stays about the same for the same level of capacity. 42 Different Models Cost About the Same First, the total revenue requirements are about the same for all three approaches, for a given RA target. It means aggregate retail rates should be about the same. Conversely, for the same level of revenues, all three approaches achieve about the same level of RA. That’s because, if total revenues are about the same, the total dollars available for investment is also about the same. (The mix of investments may be a little different, because investment incentives depend partly on where the revenues come from – i.e., what are we rewarding? Reliable energy producers? Or just countable capacity?) Bottom line: different models change the source of where generators get their revenues, but not the total. 43 Should We Care About Revenue Source? Better short run price signals improve reliability. If generators get most of their revenues from providing energy and operating reserves in real time, they have strong incentives to make their plants available for real-time dispatch and OR. They’ll make investment in features that improve availability. If generators get a large portion of their revenues from monthly capacity payments, whether or not they show up in RT, they have weaker incentives to make their plants available when and where most needed. They’ll invest less in reliable operations. Recent capacity market rules try to solve this problem by making capacity payments conditional on plants being bid in the DAM and being available for energy/OR during OR shortages. 44 Reserve Margin Target Is Set by ERO It Determines Total $$$ We Pay 15-17% Reserves 12-14% Reserves RMR RMR Operating Reserve LICAP Energy About the Same total costs Operating Reserve Energy MISO LICAP RMR A 3 Percent Difference costs about $1+ billions for a 100,000 MW system Same load = Almost same Operating cost LICAP Operating Reserve Energy LICAP 45 Factors Leading To Common Approach Regional reliability organizations covering PJM and MISO support a common RA criterion: • 1-day in 10 year LOLE => 15-18 % Reserve Margin It may not be practical for MISO to reach 15-18 % RM using only energy and OR markets with scarcity pricing. To get the extra few %, MISO may need to make capacity payments to cover the revenue requirements of the extra MW. Meanwhile, PJM is improving its OR markets and believes in shortage-cost pricing. If it implements better OR and shortage-cost pricing, more revenues will come from energy and OR markets, and less from capacity payments. Because any approach must solve the same problems, there is a likely convergence (next slide). 46 If All ISOs Must Meet Higher Reserves Then MISO and PJM May Converge 15-18% RM Mandated by ERO 12-14% RM RMR Operating Reserve RMR LICAP MISO can add LICAP to pay for higher RM RMR Operating Reserve PJM LICAP $$ get smaller as . . . LICAP Operating Reserve Energy MISO Improved energy and OR pricing supports dispatch Energy Convergence? . . . PJM improves energy and OR shortage pricing Energy 47 PJM w/LICAP Path C: “Belts and Suspenders” Model Combine both scarcity pricing (Path A) and some ICAP approach (Path B), at least for a transition period: Get the spot market prices right – solves most of the problem. • Apply shortage-cost pricing in the real-time and DA markets. • Co-optimze energy and operating reserve markets. • Energy prices rise when ISO is short of operating reserves. • Use regulatory means to ensure default loads are hedged. Use ICAP model to reach any non-economic reserve target. • Spot price supports “economic” but not “engineering” RA. • Use either short-run (NY) or forward (PJM) ICAP markets. • Sloped Demand curves are okay. (NY and PJM) • Contract hedges/options are fine. (NE) • ICAP payments are net of energy/OR profits. (All ISOs) 48 Extra Slides 49 Why Explicit Demand Curves Are Needed If spot prices during shortages can be set by the demand curves, then the ISO must have an explicit demand curve for setting prices. But consumers cannot yet define these demand curves. The ISO must define the curves. Some customers can tell us their preferences. But most (non-responsive) demand can’t. 50 Energy Demand Curve Components Price responsive demand Average VOLL Non-responsive demand Price-responsive demand includes: Price responsive demand (dispatchable) • Dispatchable loads • Loads with interruptible rates • Utility sponsored DSM • LSE-based demand-response Demand curve with no responsive demand • Customers responding (where they face spot prices) Quantity Price responsive loads (or their states, utilities, LSEs) decide what price they are willing to pay. 51 Some Portion of Demand Cannot Easily Respond to Price Price responsive demand Average VOLL Non-responsive demand Non-responsive demand cannot respond to prices because: Price responsive demand (dispatchable) • No interval metering • Don’t face spot prices • Bundled rates Someone must speak for them Quantity Some entity (states? ISO?) can estimate what price these customers would be willing to pay 52 Meaning of Average VOLL (Value of Lost Load) Price responsive demand Average VOLL Non-responsive demand Price responsive demand (dispatchable) Average VOLL = The average price for energy at which non-responsive loads would be indifferent to being served or curtailed, if they had the means to express their wishes. Quantity VOLL applies only when ISO can’t meet minimum operating reserve without rotating blackouts. 53 The ISO Must Specify a Demand Curve for Operating Reserves Operating reserve requirements are essentially engineering standards – not economic demands. We need enough to cover loss of largest contingency. We need X MW of 10-minute reserves and 30-minute reserves. A percent must be “spinning” (synchonized to grid). To implement shortage-cost pricing, ISO must translate these engineering standards into a set of demand curves for operating reserves that relates quantity to price. 54 Composite Demand Curve for OR Min OR Curve’s slope reflects value of reserve shortages Average VOLL Min OR = the lowest level of operating reserves the ISO will tolerate before starting rotating outages to prevent uncontrolled blackouts Target level of operating reserves Quantity Every ISO/SO has a curve. It’s not explicit or transparent. Proposal: make it transparent and allow it to affect prices. 55 Pricing of Energy and Operating Reserves in a Market With Shortage-cost Pricing In a market that recognizes shortage costs, energy prices are set by supply and demand for both energy and operating reserves. If we have enough supply to meet all energy and operating reserve requirements, the prices remain moderate. If we start to run short of operating reserves, energy (and reserve) prices start to move up. *Note: the following slides are overly simplified, to illustrate the concept that operating reserve shortages can affect energy spot prices. 56 Prices With Ample Supplies These Apply Most of the Time Minimum OR Average VOLL Clearing Price Supply offers Quantity There is ample supply to meet demand for energy and operating reserves at low prices. 57 Prices With Tighter Supplies These Apply On Rare Occasions Minimum OR Average VOLL Clearing Price Supply offers Quantity With ISO unable to meet OR target at lower prices, prices rise. Some price-responsive load may reduce demand. 58 Prices During Severe Shortages With Some Curtailments – Extremely Rare Curtailment needed to maintain Minimum OR Clearing price equals Average VOLL Supply offers Quantity Unable to maintain minimum operating reserve without curtailment, ISO curtails enough non-responsive demand to maintain min. OR. Price rises to average VOLL. 59 Do Energy+OR Designs Help Efficiency? An energy-plus-OR market design with scarcity pricing could improve both operational and investment efficiency. We can get better reliability at lower costs. Operational efficiency: The real-time prices provide strong incentives for generators and demandside responses to be available when most needed. Investment efficiency: The energy and operating reserve prices are much more precise with respect to: Where to build (without the LICAP deliverability problems) What types of plants to build (flexible operational features) 60 What Does Adjusting VOLL Do for RA? The price used for average VOLL will allow a level of market revenues that corresponds to an “economic” level of investment. Adjusting VOLL affects investment and resulting reserve levels. If the level of average VOLL is set lower, the level of investment will be lower. It will support lower planning reserve margins. If the level of average VOLL is set higher, the level of investment will be higher. It will support higher planning reserve margins. 61 Adjusting VOLL to Achieve Adequacy Admin-set Average VOLL Price responsive demand Non-responsive demand Average VOLL Price responsive demand (dispatchable) The ISO could raise the “average VOLL” in order to support investments in higher reserve margins. With this higher demand curve, spot prices would be higher during reserve shortages. Quantity The level of planning reserves supported by prices is affected by how high/low ISO sets average VOLL 62 Adjusting Average VOLL Adjusting average VOLL is analogous to adjusting the demand curve for capacity, as in NYISO, NE LICAP and PJM RPM proposals. But there’s an important difference: Adjusting average VOLL affects energy and operating reserve prices, and the prices directly support reliable dispatch. But they also affect investment. So pricing for short-run reliability and long-run resource adequacy are consistent and mutually supportive. Adjusting a demand curve for capacity affects capacity payments, and these have little/no effect on reliable dispatch. Additional rules/incentives/penalties must be added to ensure: • Capacity available when needed (e.g., during shortages). • Capacity available where needed (reflect transmission limits). • Capacity available is the right type (load following, quick start, ramping). These problems are the hardest aspect of ICAP. 63 More Market Power Mitigation: NE Proposed to Set Prices by Demand Curve and Counting All Supply P Total ICAP This proposal was left out of Settlement 64 Why Setting RA Target Is Important If we adopt a “1-day in 10-year LOLE” reliability standard . . . that sets the resource adequacy target. It tells us how much capacity we have to build and pay for. There are dozens of issues in designing markets for resource adequacy. However . . . No other decision about RA approaches, such as whether to have an RPM, LICAP, monthly or forward auctions, shape of demand curves, etc., will have as large an impact on the level of retail rates. 65 RA Target Has Major Impact on Rates In both cost-of-service and market regimes . . . The fixed/capital cost of generation is driven largely by the resource adequacy target. For a system with 100,000 MW peak demand . . . A 12% reserve margin requires 112,000 MW of capacity. A 15% reserve margin requires 115,000 MW of capacity. The 3,000 MW difference may cost an additional $ billion or so. Note that in both cases, the operating costs are about the same, because the demand for energy/dispatch is about the same. 66