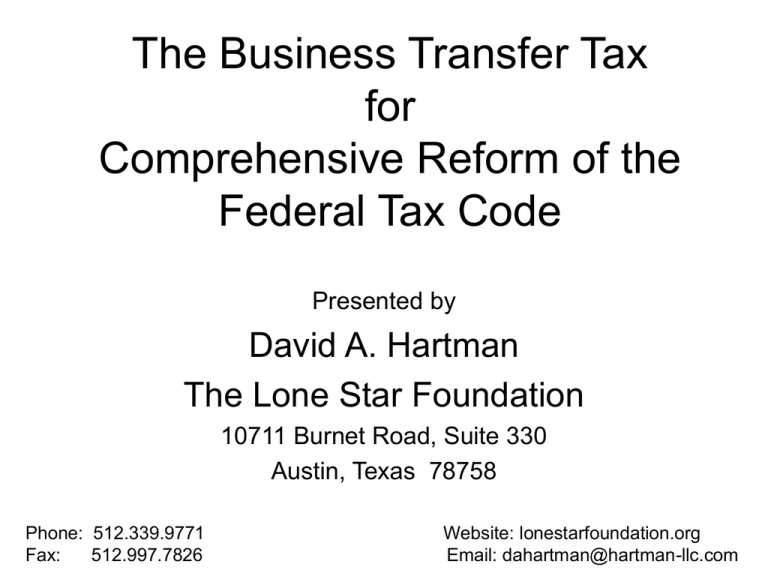

The Business Transfer Tax for Comprehensive Reform of the Federal Tax Code

advertisement

The Business Transfer Tax for Comprehensive Reform of the Federal Tax Code Presented by David A. Hartman The Lone Star Foundation 10711 Burnet Road, Suite 330 Austin, Texas 78758 Phone: 512.339.9771 Fax: 512.997.7826 Website: lonestarfoundation.org Email: dahartman@hartman-llc.com Recommendation For Comprehensive Reform of the Federal Tax Code by Adoption of the “Business Transfer Tax” (BTT): •A Subtraction Method Value Added Tax (VAT) •Consumption Based by Expensing Fixed Investment •Border Adjusted by Taxation of Imports and Crediting of Exports •Replaces Three Quarters of Federal Taxes •Supersedes all Income and Wealth Taxation (other than Individual Social Insurance Taxes) The BTT Base is Determined: for Commercial Activities: All Revenues less: Export Sales less: Purchase of Goods & Services (Including Fixed Investment) plus: All Imported Purchases equals: BTT BASE for Governments & Not-For-Profits: All Employment Expenses plus: All Imported Purchases equals: BTT BASE The BTT Supersedes the following Federal Taxes: • Individual Income Taxes • Corporate Income Taxes • Employer Social Insurance Taxes • Estate and Gift Taxes • Custom Duties BTT SINGLE TAX RATES Tax Revenue Neutral: 17.0% BTT Tax Burden Neutral: 18.2% BTT Note: Both Rates Provide “Found Money” From Taxing Net Foreign Trade; 18.2 % provides funding for transition or deficit reduction at the present tax burden on U.S. Citizens. The BTT Prevents Regressivity • Provides rebates to all citizens of the BTT tax on: – Family based poverty level income – Charitable giving – Home mortgage interest • Taxes income above poverty level proportionate to consumption • Terminates Capped Employer Social Insurance (but Retains Federal Match of Individual Contributions) MISCONCEPTIONS ABOUT THE BTT • Border Adjusted Taxation via the BTT is NOT Protectionism – It Only equalizes the Competitive Hurdles for U.S. Producers. • VAT Taxation was NOT the Cause of Runaway Welfare Spending in Europe – It was Due to Adopting VAT Taxes In Addition to Rather Than Replacement of Income Taxation As Proposed for the BTT. • Border Adjusted Taxation is the Only Realistic Basis for Equalizing Prices to End the Trade Deficit Hemorrhage and the Manufacturing Crisis. ECONOMIC PROBLEMS Addressed by BTT REMEDIES ● The Manufacturing Crisis ● Border Adjusted Taxation ● Saving for Investment Deficit ● Consumption Taxation ● Outsourcing of Services ● Border Adjusted Taxation ● Relocation of Corporations ● End Corporate Income Tax ● Declining Labor Incomes Share ● Exempt Investment for Growth ● Increase Growth of all Incomes ● All BTT Remedies ●Terminate Complex and Inefficient Income Taxes ●Simple, Broadest Base for Lowest Rate BTT (See Appendix for Details) APPENDIX APPENDIX A The Manufacturing Crisis •Foreign Producers are More Competitive than U.S. Producers Due to the Price Advantage of Border Adjusted VAT Taxes. (see EXHIBIT A-I & A-II) •Manufacturing has declined more than 50% as % GDP from the Mid-Sixties to present. (see EXHIBIT A-III) •Since 1998 alone the Manufacturing Sector has terminated 20% of its employees – its worst layoff since the Great Depression. (see EXHIBIT A-III) •The U.S. now produces only $2 of every $3 of goods consumed. (see EXHIBIT A-IV) •NAM has cautioned that the decline of manufacturing “risks loss of critical mass”. EXHIBIT A-I FOREIGN VAT TAXATION Standard VAT RATE* EU-15 Countries, Average: 19% China: 17% Canada: 15% Mexico: 15% 30 OECD Countries: 18% *Or border adjusted tax equivalent (Source: EU-15 and OECD Data, Misc. Websites) EXHIBIT A-II COMPARISON OF U.S. VS. FOREIGN VAT ADJUSTED PRICES FOR COMPARABLE COST PRODUCERS (Assumes Average OECD VAT Rate) SOLD IN U.S. MARKET U.S. PRODUCTION SOLD IN FOREIGN MARKETS F.O.B. PRICE (Incl. U.S. Taxes) $1.00 F.O.B. PRICE plus: VAT ADDED $1.00 0.18 SELLING PRICE $1.00 SELLING PRICE $1.18 F.O.B. PRICE less: VAT REBATE $1.00 (0.18) SELLING PRICE $0.82 F.O.B. PRICE less: VAT REBATE plus: VAT ADDED SELLING PRICE $1.00 (0.18) 0.18 $1.00 FOREIGN PRODUCTION DAH/LSF/5-05 EXHIBIT A-III DAH/LSF/5-05 EXHIBIT A-IV 30 25 The Manufacturing Production Gap (The Trade Deficit in Goods as % GDP) U.S. Consumption of Goods Percent GDP 20 Production Gap 15 U.S. Production of Goods 10 5 Sources: 1. U.S. Department of Commerce, Bureau of Economic Analysis International Transactions 2. Statistics for All Manufacturing Establishments: 2001 & Earlier, U.S. Department of Commerce, Census Bureau 1970 1975 1980 1985 1990 1995 2000 2005 DAH/LSF/5-05 APPENDIX B EFFECT OF THE MANUFACTURING CRISIS ON U.S. EMPLOYMENT • The Average Hourly Real Wage of Production Workers, has Declined 13% since 1978. (Source: 2001Statistices for All Manufacturing, Census Bureau) • The Displacement of Manufacturing Employees to Highly Price Elastic Employment in Services has Contributed to Stagnation of Income for 90% of U.S. Employees. (see EXHIBIT B-D) • This Income Stagnation Coincides with both the Production Gap and the Preceding Adoption of Foreign VATs that are a Principal Cause. (see EXHIBIT A-IV) • Progressive Taxation as Measured by the Income Tax Share Top 10% of Incomes Appears to Negatively Effect Incomes of the Other 90% due to Real Incidence of Capital Taxation on Labor. (see EXHIBIT B-I) EXHIBIT B-I DAH/LSF for APPENDIX C OUTSOURCING OF SERVICES The surplus in Services is Declining due to flight of Corporations to Foreign Tax Havens with Territorial Corporate Taxation, and Outsourcing of White Collar Services Abroad (See EXHIBIT C-I) EXHIBIT C-I 200 100 Services -100 Goods Billion $ -200 -300 -400 Balance in Trade of Goods & Services -500 -600 -700 -800 -900 1970 Source: U.S. Department of Commerce, Bureau of Economic Analysis International Transactions 1975 1980 1985 1990 1995 2000 2005 est DAH/LSF/5-05 BTT ADVANTAGES OVER ALTERNATIVES Consumption Border Marginal Income Economic Simplicity Based Adjusted Rates Distribution Growth Current Tax Code No No Highest Worst Lowest Worst Flat Tax Yes No Lowest Improved Better Good Consumed Income Tax Yes No Lowest Improved Better Good Retail Sales Tax Yes Yes Higher Better Higher Best Credit Invoice VAT Yes Yes Higher Better Higher Good BTT & Retail (50/50) Yes Yes Lower Good Higher Good Business Transfer Tax Yes Yes Lowest Best Highest Good