Emergency Financial Toolkit Financial Planning for Women March 2, 2016

advertisement

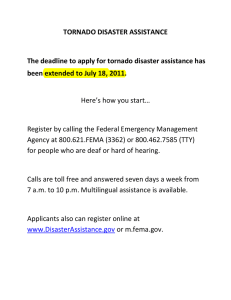

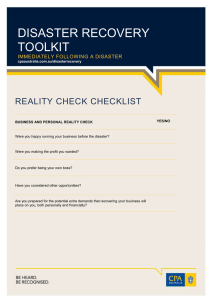

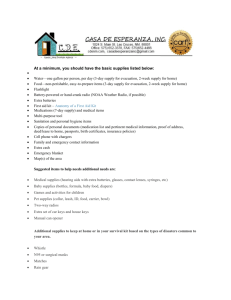

Emergency Financial Toolkit Financial Planning for Women March 2, 2016 Dr. Jean Lown Being Ready for Disaster is More Than Storing Water & Supplies You also need to be financially ready. Today’s program will present tools for developing a Portable File of Important Documents, & an Online Household Inventory accessible from any computer, to supplement your “grab & go kit.” What Disaster Risks Do Utahns Face? It Won’t Happen To Me… Is NOT An Emergency Plan Utah has: Earthquakes Floods Wild fires Wind storms & even a tornado! Winter storms- snow collapsing roof, heat cut-off causing pipes to burst… Landslides & debris flows… A recent gas leak in California forced families out of their homes for months! Natural Disaster= $ Problems • If you think your household finances are invulnerable to disaster, think again. • A flood, fire, or earthquake can wipe out savings. • Resolve to secure your finances from unexpected events of nature. You may have a 72 hour emergency kit, but… • Your cell phone & lap top batteries are dead… • Your financial records are not accessible • You can’t remember your passwords… • You need access to: insurance info, financial accounts, etc. 5 Steps To Protect Home & Finances 1. Get the right insurance (April & May FPW) 2. Keep "emergency fund" cash 3. Safeguard your home & property 4. Inventory your household possessions 5. Protect important financial documents 1. Get the right insurance FPW April 13: Life & health insurance speaker • Review policies • Know difference between replacement cost coverage & standard coverage (actual cash value) • Earthquake & flood damage NOT covered by HO insurance – These risks are specifically excluded – Buy separate coverage! 2. Emergency Cash • Small denomination bills • ATMs & credit/debit cards may not work if power out or hacker attack • Other ideas? 3. Safeguard Home & Property • Wildfire: Create defensible space • Earthquake: Retrofit house by securing to foundation • Remove/trim trees likely to blow onto house • Riverside? Shore up bank with rocks • Other examples? 4. Inventory Your Household Possessions • Written & visual record of major household items & valuables – Include contents of basement, attic, garage – serial numbers & receipts for appliances & electronics – Have jewelry and artwork appraised. • Home inventory: www.knowyourstuff.org – Know Your Stuff® software: Insurance Information Institute's free online home inventory software. – Free, secure online storage: have access to your inventory anywhere, any time. 5. Protect Important Financial Documents • Compile an inventory of financial documents – Financial accounts, wills, credit, mortgage… • HO: Creating a portable file of important documents – Originals in safe deposit box • Where is the key? • Home safe? (how secure?) – PDFs on thumb drive or in cloud Emergency Financial First Aid Kit (EFFAK) • The Emergency Financial First Aid Kit (EFFAK) Use EFFAK to identify your important documents, medical records, and household contracts. – include pictures or a video of your home & belongings; keep your documents in a safe space. • https://www.ready.gov/financial-preparedness • Following an emergency, having your personal documents & contact information easily available can make your recovery quicker & less stressful EFFAK: Checklists & forms • Fill out online & save electronically • 4 sections with a checklist & forms: 1. Household Identification 2. Financial & Legal Documentation 3. Medical Information 4. Household Contacts EFFAK has Tips on: • Safeguarding important information – https://emilms.fema.gov/IS909/assets/11_Saf eguardingValuables.pdf (pages 3-4) • What to do in the event of a disaster or emergency • How to support community resilience EFFAK Checklists and Forms • Emergency Financial First Aid Kit (EFFAK) Checklists and Forms (21 pages) http://www.fema.gov/media-library-data/144131366000638b0760a58131b871d494ddacbf52b6e/EFFAK_2015_F orms_508_enabled.pdf • Checklists of important documents, personal & family info – Also very helpful in death of family member Financial & Legal Documentation • • • • • • Mortgage/rent/utility payments Credit/debit card accounts Insurance policies & agent info Sources of income Tax records Others? Critical Financial Information • Identify financial records & obligations – need proof of income to apply for FEMA disaster assistance • Re-establish your financial accounts if checks are destroyed or online access methods are disrupted • Maintain payments and credit • Provide contact information for your insurance company to discuss damage and repairs • Contact utilities regarding outages & restoration • Apply for FEMA disaster assistance benefits Financial Obligations • In an emergency or disaster, you are still responsible to pay mortgage regardless of the condition of your house or its habitability! • You are responsible for paying credit card bills. – Failing to remain current with payments could negatively affect credit when you need credit the most. • If you lose income and can’t pay bills, call lender/card issuers ASAP to explain situation. – Most lenders/card issuers will work with you to accommodate your situation in an emergency. Vehicle & Other Loans • Loan payment info – Amount, when due, where to send • Vehicle destroyed? Still must pay loan/lease • Insurance documentation • Credit cards • Student loans Housing: Rental or Mortgage Documents • Proof of rental/mortgage contracts required to receive Federal disaster assistance. • More than one mortgage or HELOC? Need documents for all • Utility bills (electric, water, gas) Medical Information • • • • Physician info Copies of health insurance cards Immunization records Provide doctors with health info if medical care is needed • Ensure existing care continues Personal Action Plan: commit & set date to start Other Ideas & Suggestions? Share the news about FPW • New attendee? • Did you bring someone new? • Program repeated tonight at USU Family Life Center, 493 N 700 E, Logan (Tudor style house at bottom of old main hill; free parking) Upcoming Programs • April 13: Life and Health Insurance with guest expert Eric Hatfield • May 11: Protecting your Home with Insurance – HO insurance, flood & earthquake coverage • June 8: Mutual Funds for IRAs and other goals • July 13: Great Ways to Save for College Got financial questions? http://fpwusu.blogspot.com/ • Check out blog for answers to questions or to learn more about financial topics. • FPW website: http://www.usu.edu/fpw – Past presentations available • http://www.facebook.com/FinancialPlanningforWomen • Sign in! Each FPW attendance January – March earns one entry in drawing for a financial consultation