Metropolitan Community College Personal Finance (FINA 1200) Quiz 3 Study Guide Chapter 9:

advertisement

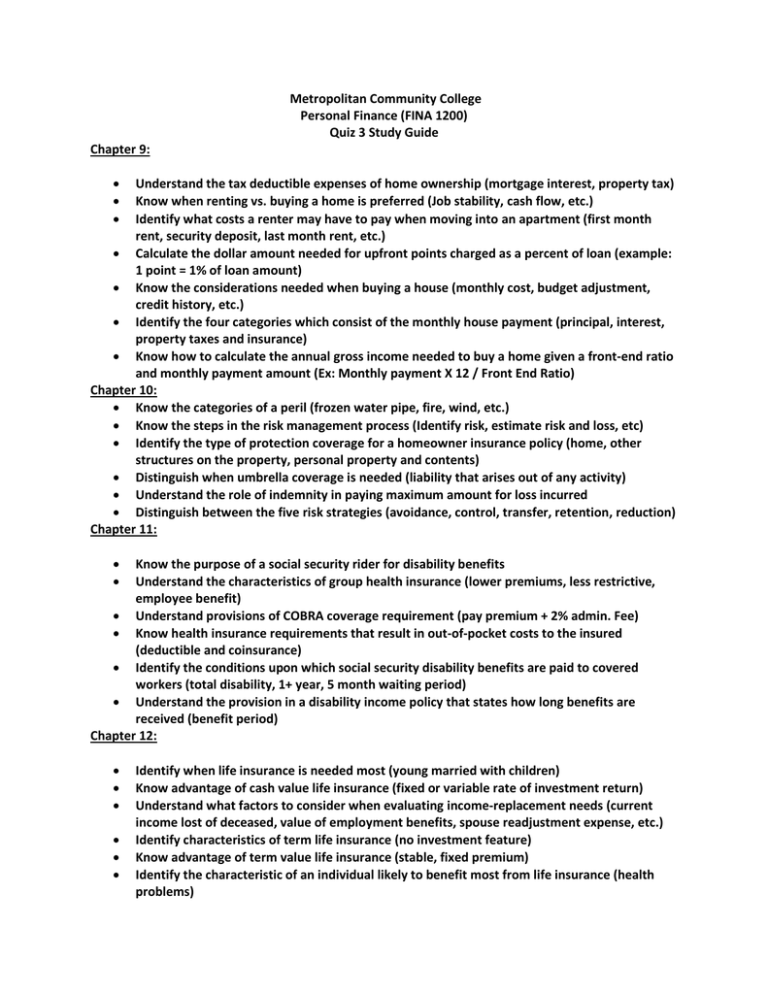

Metropolitan Community College Personal Finance (FINA 1200) Quiz 3 Study Guide Chapter 9: Understand the tax deductible expenses of home ownership (mortgage interest, property tax) Know when renting vs. buying a home is preferred (Job stability, cash flow, etc.) Identify what costs a renter may have to pay when moving into an apartment (first month rent, security deposit, last month rent, etc.) Calculate the dollar amount needed for upfront points charged as a percent of loan (example: 1 point = 1% of loan amount) Know the considerations needed when buying a house (monthly cost, budget adjustment, credit history, etc.) Identify the four categories which consist of the monthly house payment (principal, interest, property taxes and insurance) Know how to calculate the annual gross income needed to buy a home given a front-end ratio and monthly payment amount (Ex: Monthly payment X 12 / Front End Ratio) Chapter 10: Know the categories of a peril (frozen water pipe, fire, wind, etc.) Know the steps in the risk management process (Identify risk, estimate risk and loss, etc) Identify the type of protection coverage for a homeowner insurance policy (home, other structures on the property, personal property and contents) Distinguish when umbrella coverage is needed (liability that arises out of any activity) Understand the role of indemnity in paying maximum amount for loss incurred Distinguish between the five risk strategies (avoidance, control, transfer, retention, reduction) Chapter 11: Know the purpose of a social security rider for disability benefits Understand the characteristics of group health insurance (lower premiums, less restrictive, employee benefit) Understand provisions of COBRA coverage requirement (pay premium + 2% admin. Fee) Know health insurance requirements that result in out-of-pocket costs to the insured (deductible and coinsurance) Identify the conditions upon which social security disability benefits are paid to covered workers (total disability, 1+ year, 5 month waiting period) Understand the provision in a disability income policy that states how long benefits are received (benefit period) Chapter 12: Identify when life insurance is needed most (young married with children) Know advantage of cash value life insurance (fixed or variable rate of investment return) Understand what factors to consider when evaluating income-replacement needs (current income lost of deceased, value of employment benefits, spouse readjustment expense, etc.) Identify characteristics of term life insurance (no investment feature) Know advantage of term value life insurance (stable, fixed premium) Identify the characteristic of an individual likely to benefit most from life insurance (health problems)