LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

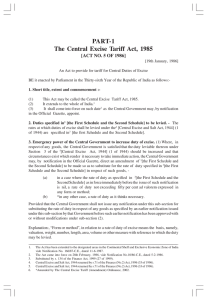

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.Com. DEGREE EXAMINATION – COMMERCE FOURTH SEMESTER – APRIL 2007 TH 10 CO 4501 - BUSINESS LAW - II Date & Time: 24/04/2007 / 9:00 - 12:00 Dept. No. Section – A Answer All Questions Max. : 100 Marks (10 X 2 = 20) 1) A Customer gives his tailor a length of suiting and requires him to make a suit for him, the lining materials and the buttons to be supplied by the tailor. State the nature of the transaction 2) Define “Turnover” as per the Central Sales Tax Act 1956 3) Who is a “Casual Trader” under the T.N.G.S.T Act 1959 4) A of Delhi comes to Mumbai and purchases goods from B in Mumbai. After purchasing, A transports these goods to Delhi in his own name. Is this sale chargeable to Central Sales tax? 5) What do you mean by Insurable Interest 6) Define ‘Whole Sale dealer’ under the central Excise Act 1944 7) When is a sale or purchase of goods said to take place in the course of import or export. 8) Write a note on endowment Policy 9) Define the concept of “Charter party” under the carriage of goods Act. 10) Bring out the meaning of ‘Subrogation’ under the insurance contract Section – B Answer Any Five Questions (5 X 8 = 40) 11) Sate the doctrine of caveat emptor and the exceptions to it. 12) Enumerate and explain the rights and the liabilities of a common carrier 13) What is a contract of insurance? Explain the basic principles of the law of Insurance. 1 14) State and explain in detail the provisions for the levy and the collection of excise duty under the Central Excise Act 1944 15) State the implied conditions in a contract for the sale of goods. 16) Define the following terms as per the T.N.G.S.T Act 1959 with suitable illustrations a. Turnover b. Total Turnover c. Taxable Turnover 17) Distinguish between sale and an Agreement to Sell 18) What is auction sale? What are the rules relating to auction sale? Section – C Answer Any two Questions (2 X 20 = 40) 19) When is a seller of goods deemed to be a unpaid seller? What are the rights against a. the goods b. the buyer personally? 20) Discuss in detail the provisions regarding the following as per the CST act 1956 a. Sale or purchase of goods in the course of inter-state trade b. Sale or purchase of goods outside a state c. Registration of dealers 21) “Delivery does not amount to acceptance of goods” Discuss, when a buyer can be said to have accepted the goods and the rules as to delivery of goods with proper illustrations ****** 2