LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

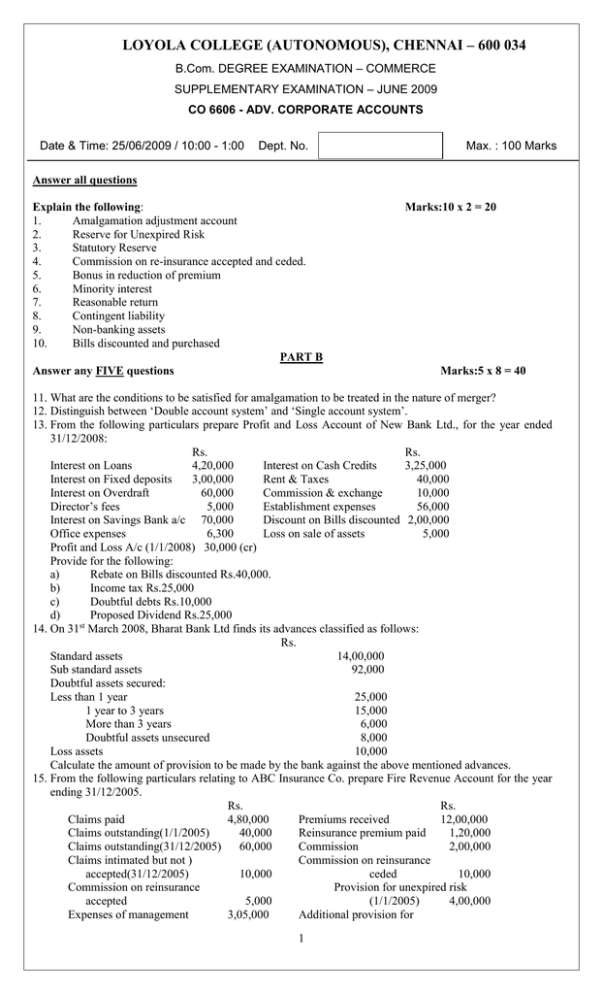

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.Com. DEGREE EXAMINATION – COMMERCE SUPPLEMENTARY EXAMINATION – JUNE 2009 CO 6606 - ADV. CORPORATE ACCOUNTS Date & Time: 25/06/2009 / 10:00 - 1:00 Dept. No. Max. : 100 Marks Answer all questions Explain the following: 1. Amalgamation adjustment account 2. Reserve for Unexpired Risk 3. Statutory Reserve 4. Commission on re-insurance accepted and ceded. 5. Bonus in reduction of premium 6. Minority interest 7. Reasonable return 8. Contingent liability 9. Non-banking assets 10. Bills discounted and purchased PART B Answer any FIVE questions Marks:10 x 2 = 20 Marks:5 x 8 = 40 11. What are the conditions to be satisfied for amalgamation to be treated in the nature of merger? 12. Distinguish between ‘Double account system’ and ‘Single account system’. 13. From the following particulars prepare Profit and Loss Account of New Bank Ltd., for the year ended 31/12/2008: Rs. Rs. Interest on Loans 4,20,000 Interest on Cash Credits 3,25,000 Interest on Fixed deposits 3,00,000 Rent & Taxes 40,000 Interest on Overdraft 60,000 Commission & exchange 10,000 Director’s fees 5,000 Establishment expenses 56,000 Interest on Savings Bank a/c 70,000 Discount on Bills discounted 2,00,000 Office expenses 6,300 Loss on sale of assets 5,000 Profit and Loss A/c (1/1/2008) 30,000 (cr) Provide for the following: a) Rebate on Bills discounted Rs.40,000. b) Income tax Rs.25,000 c) Doubtful debts Rs.10,000 d) Proposed Dividend Rs.25,000 st 14. On 31 March 2008, Bharat Bank Ltd finds its advances classified as follows: Rs. Standard assets 14,00,000 Sub standard assets 92,000 Doubtful assets secured: Less than 1 year 25,000 1 year to 3 years 15,000 More than 3 years 6,000 Doubtful assets unsecured 8,000 Loss assets 10,000 Calculate the amount of provision to be made by the bank against the above mentioned advances. 15. From the following particulars relating to ABC Insurance Co. prepare Fire Revenue Account for the year ending 31/12/2005. Rs. Rs. Claims paid 4,80,000 Premiums received 12,00,000 Claims outstanding(1/1/2005) 40,000 Reinsurance premium paid 1,20,000 Claims outstanding(31/12/2005) 60,000 Commission 2,00,000 Claims intimated but not ) Commission on reinsurance accepted(31/12/2005) 10,000 ceded 10,000 Commission on reinsurance Provision for unexpired risk accepted 5,000 (1/1/2005) 4,00,000 Expenses of management 3,05,000 Additional provision for 1 Bonus in reduction of premium 12,000 unexpired risk (1/1/2005) 20,000 You are required to provide for additional reserve for unexpired risk at 1% of the net premium in addition to the opening balance. 16. From the following Balance Sheets relating consolidated Balance sheet: H Ltd S Ltd Rs. Rs. Share capital (Rs.10) 10,00,000 2,00,000 Profit & Loss A/c 4,00,000 1,20,000 Reserves 1,00,000 60,000 Creditors 2,00,000 1,20,000 17,00,000 5,00,000 to H Ltd and S Ltd, as on 31/12/2005, prepare the H Ltd. S. Ltd. Rs. Rs. Fixed Assets 8,00,000 Stock 6,10,000 1,20,000 Debtors 1,40,000 15000 shares in S 1,50,000 2,40,000 Ltd. 17,00,000 1,40,000 5,00,000 a) H Ltd acquired the shares on 1/1/2005 on which date the General Reserve and Profit and Loss A/c of H Ltd. stood in its book as Rs.40,000 and Rs.50,000 respectively. b) Stock of H Ltd includes Rs.50,000 purchased from S Ltd., which company had made a profit of 25%on cost. c) Creditors of H Ltd include Rs.20,000 payable to S Ltd 17. An electricity company replaced its mains in the year 2009 at a cost of Rs.15 lakhs. The original mains had cost Rs.5 lakhs in 1972, comprising of material and labor in the ratio of 3:2. Since its construction, material prices have doubled and labor rates increased by 50%. Old materials worth Rs.20,000 were sold, and those costing Rs.40,000 were used in the new construction and included in the cost given above. Show the apportionment of cost into capital and revenue and pass necessary journal entries. 18. A Life Insurance Company got its valuation made once in every two years. The Life Assurance Fund in 31/3/2009 amounted to Rs.41,92,000 before providing Rs.50,000 for Income tax and Rs.32,000 for Shareholders’ dividends. Its actuarial valuation on 31/3/2009 disclosed a net liability of Rs.40,40,000 under its assurance and annuity contracts. An interim bonus of Rs.40,000 was paid to the policy holders during the period ending 31/3/09. Prepare a statement showing the amount now available as bonus to Policy holders PART C Answer any TWO questions. Marks:2 x 20 = 40 19. Balance Sheet of Y Ltd. on 31/12/2005 Rs. Equity share capital (Rs.10 3,00,000 each) Profit & Loss A/c 80,000 Creditors 40,000 8% debentures Rs.100 each 60,000 Export profit reserve 20,000 (statutory) 5,00,000 Goodwill Land & Building Machinery Stock Debtors Cash Rs. 60,000 1,20,000 2,00,000 80,000 30,000 10,000 5,00,000 X Ltd acquired Y Ltd on the following terms: a) a cash payment of Rs.4 for every share in Y Ltd. b) issue of one share of Rs.10 each at a market price of Rs.12 in X Ltd. for every share in Y Ltd. c) expenses of realization amounted to Rs.4,000 which was paid by X Ltd. d) 8% debentures are to be discharged at a premium of 5% by cash payment Show Realisation Account, X Ltd. account, Shareholder’s account and the Share Capital account in the books of Y Ltd. Also pass Journal entries for the acquisition in the books of X Ltd. 20. An electricity company earned a profit of Rs.8,45,000 during the year ended 31st March 2009,after providing for debenture interest at 7 ½ percent on Rs.2,50,000. From the details given below show the disposal of profit: Original cost of Fixed Assets Rs.1,00,00,000 Preliminary expenses Rs. 5,00,000 2 Monthly average of current assets 4% Reserve Fund investment 6% Contingency Reserve investments Loan from Electricity Board Total depreciation written off Fixed Assets Fixed assets acquired through consumer contribution Tariff and Dividend control reserve Security deposits received from customers Assume bank rate to be 6% 21. The trial balance of XYZ Bank Ltd. on 31/03/09 Rs. Balance with banks 46,000 Govt. bonds 1,94,720 Gold 1,70,000 Interest accrued 26,000 Building 65,000 Furniture 5,000 Money at call 26,760 Loans 1,60,000 Cash credits 20,000 Bills discounted 32,500 Interest on deposits 33,950 Salaries 22,450 Loss on sale of investment 10,000 Administration expenses 12,620 Cash in hand and with RBI 75,000 Branch adjustment account 20,000 ----------9,20,000 Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. 25,00,000 10,00,000 2,50,000 15,00,000 18,00,000 2,00,000 50,000 2,00,000 Rs. Share capital 3,00,000 Savings deposits 90,000 Current deposits 29,420 fixed deposits 1,13,000 Statutory reserve 1,40,050 Short loans 40,000 P&L (1/04/08) 13,730 Interest received 1,22,000 Commission 25,300 Discounts 42,000 Transfer fees 600 Profit on sale of investment 3,900 ---------9,20,000 You are required to prepare the Profit and Loss a/c and Balance Sheet as on 31/3/08, after taking into consideration the following: 1. Provide Rs.10,000 for doubtful debts and Rs.25,000 for Income Tax 2. Provide Rs.3,000 rebate on bills discounted 3. The bank held Rs.20,000 bills for collection. 4. Acceptances on behalf of customers amounted to Rs.30,000 5. Provide 10% depreciation on building 6. Directors recommend 10% dividend. @@@@@ 3