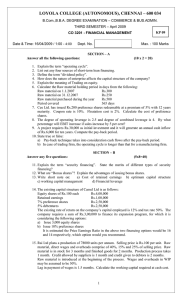

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

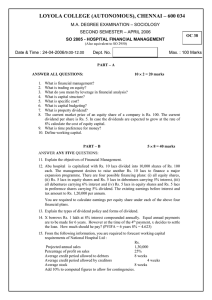

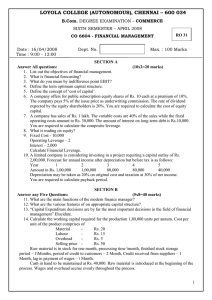

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.B.A. DEGREE EXAMINATION – BUSINESS ADMINISTRATION SUPPLEMENTARY EXAMINATION – JUNE 2008 BU 3201 - FINANCIAL MANAGEMENT Date : 28-06-08 Time : 9.00 – 12.00 Dept. No. Max. : 100 Marks PART A Answer all questions 10 x 2 = 20 marks Explain the following: 1. Operating Leverage 2. Trading on Equity 3. Wealth maximisation 4. Earnings per share 5. Pay back period 6. Operating cycle 7. Working capital 8. Risk and Return 9. Time value of money 10. Internal Rate of return PART B Answer any FIVE questions 5 x 8 = 40 marks 11. Briefly explain the factors that determine the working capital required by a company.. 12. What is Capital Budgeting? Critically evaluate the pay back technique of Capital Budgeting. 13. Evaluate ‘Equity Capital’, ‘Debentures’ as a source of funds from the point of view of a company. 14. Explain the functions performed by a Finance Manager in a large manufacturing concern. 15. Sales 10,000 units, Selling Price Rs.20 per unit; Variable Cost Rs.12 per unit; Fixed Cost Rs.6 per unit; 10% Debentures Rs.1,00,000; Tax Rate 50%. Calculate Operating Leverage, Financial Leverage and Combined Leverage. 16. a) Market price of an Equity share is Rs.25. The dividend expected next year is Re.2. Growth rate of dividend is 8%. Calculate the cost of Equity. b) If the cost of equity is 8%, Dividend is Re,1 and growth rate 5% calculate the market price of the share. c) A Ltd issued 1000 12 % preference shares of Rs.100 each at a discount of 5%, redeemable at the end of 5 years at a premium of 10%. If the tax rate is 50%, calculate the cost of preference shares. d) A Ltd issued 10% debenture of Rs.100 at 4% discount, redeemable at par, at the end of 10 years. If the tax rate is 50% calculate the cost of the debenture. 17. S Ltd is considering the purchase of a new machine, which would carry out some operations at present performed by manual labor. The two alternative models under consideration are X and Y. The following information regarding the machines is available. Machine X (Rs.) Machine Y (Rs.) Cost of machine 1,50,000 2,50 000 Savings per annum In scrap 10,000 15,000 In wages 90,000 1,20,000 Additional cost per annum For supervision 12,000 16,000 For maintenance 7,000 11,000 For indirect material 6,000 8,000 The estimated life of each machine is 10 years and tax rate is 50%. Recommend the machine to be purchase using ‘pay back’ method. 1 18. From the following data estimate the working capital requirement of the firm at cash cost.. Projected annual sales 26,000 units Selling price per unit Rs.60 Material cost per unit Rs.24; Labour cost per unit Rs.18 and Overheads per unit Rs.12 Raw material will be in stock for 3 weeks and finished goods for 2 weeks. Processing time for work in progress takes 4 weeks. Credit allowed to debtors 5 weeks and received from suppliers 3 weeks. Lag in payment of wages and overheads - 2weeks Cash in hand is to be maintained Rs.40,000 PART C Answer any TWO questions 2 x 20 = 40 marks 19. X Ltd requires Rs 5 lakhs for investment in a new project. It has identified the following four financing options: a. Issue 50,000 equity shares of Rs.10 each. b. Issue 25,000 equity shares of Rs.10 each and 2,500, 8% debentures of Rs.100 each. c. Issue 25,000 equity shares of Rs.10 each and 2,500, 10% preference shares of Rs.100 each. d. Issue 20,000 equity shares of Rs.10 each, 2,000 10% preference share of Rs.100 each and 1,000 8% debentures of Rs.100 each. Assuming the tax rate is 50% and EBIT after construction of the plant would be Rs.1,50,000, which financing option would you recommend? 20. A Ltd has the following Capital Structure as on 31/12/2005: Rs. Equity capital Rs.100 each 5,00,000 9% Preference shares 3,00,000 10% Debentures 200,000 10,00,000 Equity shares are quoted at Rs.105 and the company is expected to declare a dividend of Rs.8 per share. The growth rate of dividend is 6%. Tax rate is 50%. a) Calculate the weighted average cost of capital. b) Assuming that the company plans to raise an additional loan of Rs.4 lakhs at 14% in 2006, what would be the revised weighted average cost of capital, given that dividend per share will increase to Rs.10 but the business risk associated with the new financing would bring down the market value of the equity share to Rs.98 21. A company plans to buy a machine. The machine requires an investment of Rs10 lakhs, has a life of five years and the scrap value of Rs 2 lakhs and end of the its life. The machine is expected to earn the following profits before depreciation and tax: Year Machine A PV of Re.1 at 10% PBDT (Rs.) 1. 2,00,000 0.909 2. 5,00,000 0.826 3. 6,00,000 0.751 4. 4,00,000 0.653 5. 3,00,000 0.621 If the tax rate is 50% and the cost of capital is 10%, determine which machine should be purchased using (a) payback method (b) net present value (c) profitability index. @@@@ 2