Deindustrialitation and financing in Mexico Alicia Puyana Mutis

advertisement

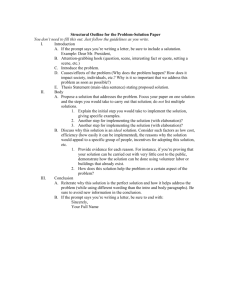

Deindustrialitation and financing in Mexico Alicia Puyana Mutis • Debt crsis, international, context and deregulation • The debt crisis and the opening of LA economies: Rising international inflation, and interest rates, decreasing commodity prices. Insolvency or illiquidity? • The embedding o f the Washington Consensus credo: “deregulation, privatization and stabilization”. • Key features: Labour market liberalization plus: Fiscal discipline: low taxation and cero deficit. Structural reforms not enough structural • Mexican reforms: • Trade liberalization path Joinnig the GATT in 1986, signing “Pacto de Solidaridad Económica” in 1987 and NAFTA in 1994. • Trade and fiscal surplus to pay public and private. Public or private external debt; FDI or portfolio investment; placements in foreign securities markets; repatriation of capital; or increase in the volume of exports • Capital liberalization Changes on FDI law in early 80´s, gradual elimination of credit controls and restrictions on the financial sector, deregulation of the market, openness to foreign investment and banking privatization in 1991-92. Effects of trade liberalization in Mexico: the external coefficient has grown, but… Faster growth of imports than exporsts. All countries reinforcing a ricardian trade model: Commodity and maquila exports. Country differences. Deterioration of the terms of trade, price instability and real exchange rate appretition. High increase in import propensity : Mexico 4.5% Fall of real return on investment s in tradable goods and feeble private sector interest in investing. Limited diversification productive estructure, deagriculturization and de-industrialitation . ECONOMIC INSTABILITY AND WEAK GROWTH IN THE LONG TERM Own elaboration based on WDI (2015). América Latina: Tasa de Crecimiento Anual del PIB y de las Exportaciones de Bienes y Servicios de y el Caribe. 1961-2011 Effects of liberalization of capital markets in Mexico Privatization or extranjeriation and extreme concentration? Capital inflows lead to an overvaluation of the real exchange rate. Financial sector Changing preferences: Credit flows to housing and consumer sector. Short term speculative gains around international differentials in interest rates. No financing to productive sectors. Exchange rate and interest rates volatility tends to prioritize the 'rentier' to 'productive activities ECONOMIC INSTABILITY AND WEAK GROWTH IN THE LONG TERM Own elaboration based on WDI (2015). LUCAS PARADOX (1990): contrary to what annunced, capital flows South-North Confirming the Lucas paradox… • And when it flows to developing countries it does not goes to the fastest growing sectors (Puyana and Romero, 2010). • From 1980 to 2013, capital flows, FDI, expanded but mainly to developed countries (63%) • China and USA were the main receivers of FDI in 2013, 13.8% and 12.9%, respectively, while Mexico capture only 2.6% (UNCTAD). Own elaboration based on UNCTAD (2014). Banking sistem and development financing The main function of Central Bank: controlling prices. Own elaboration based on Banxico (2015). Commercial banks: lending rates by loan portfolio type. Source: Levy (2014) Own elaboration based on Banxico (2015). Own elaboration based on Presidencia de la República (2014). Fiscal policy: fiscal discipline Private investmenthas not fully compensated public expenditure reduction replaced public investment. Own elaboration based on WDI (2015). Own elaboration based on Centro de Estudios de las Finanzas Públicas, Cámara de Diputados (2015). Source: Romero (2014). • Fall in total Investment/Worker. • Fall in public investment per worker. • Labour productivity stagnated Mexican labour productivity as % of USA productivity. 1950-2013 Mexico: Index of minimum and medium real wages. 1980-2013 Year 2000 = 0 1980 1990 2000 2010 2013 Minimum Real wage Medium Real wages 312 114 145 89 100 100 97 113 99 114 Conclusions • Mexico and other Latin American economies are in a premature deindustrialization process, constraining growth. • Investment does not flow to the productive sector because there are not profitability conditions. Finance capital rentier and its prominence on the real economy have consolidated. • Mexican economy performance has been poor because of this separation between financial sector and real sector CONCLUSIONS • It is not possible to conclude that Mexico has fully and sustainable recovered from 2007-08• Neither has it recover the rates fo growth registered in 1945-1982. • Other Latin American countries have done better but not very much better • Instability is a constant menace, low empoyment and low labor incomes