Policy Priorities the Global Economic Crisis in the face of

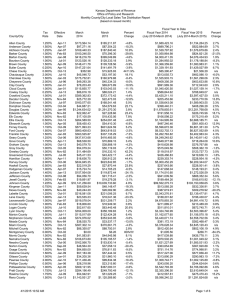

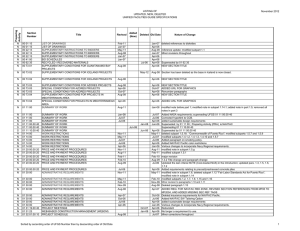

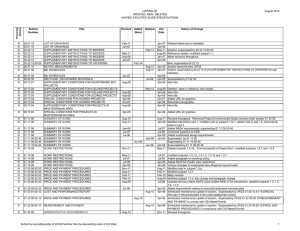

advertisement

Policy Priorities in the face of the Global Economic Crisis IDEAs conference on Re-regulating Global Finance in the light of the Global Crisis Tsinghua University Beijing 9 April 2009 Contagion: crisis spreads Financial sector contagion (incl. vicious circles): Sub-prime crisis financial crisis asset price deflation liquidity/credit crunch Financial crisis Economic recession (including feedback loops) Real economy contagion (incl. vicious circles): Less investment, especially abroad (FDI) Less consumption Reduced demand for imports, i.e. for exports of others Prices, output declines globally Growth, employment declines globally 2 Deflationary spiral • Asset (stock, property) markets deflating negative wealth effect more bank insolvency generalized credit squeeze • Lower external demand, world trade excess capacity investment slowdown • Depressed domestic demand lower prices, output lower employment, incomes Disorderly unwinding of global imbalances Billions of dollars 600 400 200 0 -200 -400 -600 -800 2005 US Japan 2006 EU 2007 2008 Developing, excl China 2009 4 China Globalization: Parallel fates 8 Developing countries 6 World 4 2 Developed countries 0 -2 Preliminary, revised forecast -4 5 2003 2004 2005 2006 2007 2008 2009 (P) 7 Recession in most developed economies 6.5 6.0 6 4.8 5 4.9 4 3 2.9 2.8 2.9 2.4 2.0 2 1.9 2.1 2.7 1.8 1.2 1.1 1 0.4 0.4 0 -1 -0.6 -2 -1.6 -1.9 United States 2005 Japan 2006 2007 EU-15 2008 New EU members 6 2009 orig. forecast Slowing growth in all developing countries 9 8 7 6 5 4 3 2 1 0 -1 8.5 7.2 6.9 6.0 5.9 5.5 5.1 4.74.9 4.5 4.3 2.7 1.6 0.1 Developing Africa East and Western Asia South Asia -0.2 Latin America 7 2005 2006 2007 2008 2009 forecast Annual percentage growth World trade collapsing 15 11.2 9.3 10 7.4 4.4 5 5.6 6.4 2.0 0 -0.8 -5 -10 -15 Preliminary, revised UN forecast -10.0 15 2001 2002 2003 2004 2005 2006 2007 2008 2009 Trade impacts summary • Exports decline all developing countries • Terms of trade primary exporters • Trade surpluses, reserves may run down quickly • But lower energy, food prices help net food and oil-importers 16 Export Implosion in E. Asia Dec. 2008 exports y-o-y (%) % Japan China S Korea Thailand Singapore Taiwan Malaysia -35.0 -2.8 -17.4 -15.7 -20.0 -41.9 -4.9 (Nov.) China: Exports, Imports Drop Sharply US $ billions 160 140 120 EXPORTS (total, fob) 100 80 60 IMPORTS (total, cif) 40 20 0 Jan- Apr06 06 Jul06 Oct- Jan- Apr06 07 07 Jul07 Oct- Jan- Apr07 08 08 Jul08 Oct- Jan08 09 China: Accumulation of Forex Reserves US$ billions, end-month 2500 2000 Other foreign exchange reserves 1500 US treasury securities 1000 500 0 Dec-03 Jun-04 Dec-04 Jun-05 Dec-05 Jun-06 Dec-06 Jun-07 Dec-07 Jun-08 DecSources: State Administration of Foreign Exchange, China; United States Department of the Treasury / Federal Reserve Board China: Industrial Output Slows Down Rapidly % change, year-on-year 25 Industrial Production 20 15 10 5 0 Jan-06 Apr-06 Jul-06 Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 China: Inflation declines in 2008, after 2007 % change, year-on-year 10 9 8 Consumer Price Index 7 6 5 4 3 2 1 0 Jan-06 Apr-06 Jul-06 Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Financial impacts on developing countries • Despite non-involvement in sub-prime debacle: Emerging stock markets collapse greater Reversal of capital flows, FDI also down Spreads rise, much higher borrowing costs • But financial positions stronger than during Asian + LA crises (more foreign reserves, better fiscal balances) But reserves rapidly evaporating with export collapse; fiscal space also disappearing 22 Social, political impacts • >200 m. more working poor • ILO: Unemployment to rise by 51m • Government social spending at risk • Rising social unrest • US intelligence report: crisis -- greatest security risk Responses to crisis • UN, BIS forecasts more accurate than others; IMF, WB upbeat till late 2008 • But IMF, WB also marginalized by G7, etc • IMF discouraging strong fiscal stimulus by developing countries without surplus • G7 G20: more inclusive? legitimate? crisis-, but not developmental or equitable • PGA (Stiglitz) Commission of Experts • Doha Declaration: June 09 summit on impact of crisis on developing countries Thank you Please visit UN-DESA www.un.org , G24 www.g24.org and PGA www.un.org/ga/president/63/ websites • Research papers • Policy briefs • Other documents 31