Long-run Roots of Generic Financial Crises

advertisement

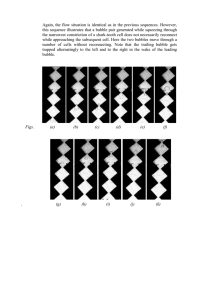

Long-run Roots of Generic Financial Crises Erik S. Reinert The Other Canon Foundation & Tallinn University of Technology Chennai, January 24, 2012. The impact of financial crises on the publication of economics books. Hayek’s ’overshooting’ mechanism. ’Never will man penetrate deeper into error than when he is continuing on a road which has led him to great success’ Friedrich von Hayek, Austrian economist. i.e. economic success leads to theoretical oversimplification which leads to crisis. Compare Hyman Minsky’s ’destabilizing stability’ as a mechanism behind financial crises. Three Times Rise and Fall of ’Physics-based’ Economics School Physiocracy Starting point Quesnay 1758 Peak 1760s Death 1789 1840s 1848 1990s NOW (’Rule of Nature’) Classical Economics Ricardo 1817 Neoclassical Samuelson 1948 synthesis Financial Crises: A theoretical axis independent of right and left Financial crises a natural part of capitalism: • Marx • Lenin • Hilferding • Hitler’s men • Schumpeter • Keynes • Minsky Fails to see financial crises: • Quesnay • Ricardo & followers • Neo-classical economics + neoliberalism The Circular Flow of Economics The real economy “Güterwelt” ”Black Box” Production of goods and services Financial economy “Rechenpfennige” Money/capital WHEN THE ’ACCOUNTING UNITS’ ATTACK ’THE REAL ECONOMY’ “In the years preceding the first world war there were in common use among economists a number of metaphors ... ‘Money is a wrapper in which goods come’; ‘Money is the garment draped round the body of economic life’; etc. During the 1920s and 1930s ... money, the passive veil, took on the appearance of an evil genius; the garment became a Nessus shirt; the wrapper a thing liable to explode. Money, in short, after being little or nothing, was now everything... Then with the Second World War, the tune changed again. Manpower, equipment and organization once more came into their own. The role of money dwindled to insignificance..” C. Pigou, The Veil of Money, 1949, pp.18-19. Three basic and complementary mechanisms behind the conflicts between the real economy and the financial economy (financial crises): THE HAMMURABI EFFECT (Babylonia ca. 1795 – 1750 BC) The Effect of Compound Interest. THE PEREZ EFFECT(Carlota Perez, Venezuelan economist) Technological Revolutions Create Financial Bubbles. THE MINSKY/KREGEL EFFECT (Hyman Minsky, 1919-1996) Destabilizing stability and Ponzi schemes. THE HAMMURABI EFFECT ‘A shilling put out at 6% compound interest at our Saviour’s birth would . . . have increased to a greater sum than the whole solar system could hold, supposing it a sphere equal in diameter to the diameter of Saturn’s orbit.’ Richard Price, English Economist, 1769. THE PEREZ EFFECT. 1. Financial markets – with some logic – have a love affair with a new breakthrough technology (US Steel, Microsoft). 2. Role of financial innovation: 1720 stocks, 1990s hedge funds, that create illusion of ’gravity lost’. 3. Illogically the market wants to bid up all shares as if they were hi-tech (US Leather). 4. Enters fraud: Parmalat & ENRON. 5. Gravity rediscovered: collapse. Types of bubbles (Perez): • Technology bubbles that in the end are useful (1990s technology boom) • Useless bubbles based on easy credit (NOW!) DUBIOUS PROJECTS IN 1720 BUBBLE THE MINSKY EFFECT Types of financing: Hedge financing, low risk. Speculative financing involves future renegotiating of the debt (rollover). A typical speculative position consists of financing long term assets with short term liabilities. Ponzi financing is when expected revenues can not afford even interest payments, and agents are submitted to increasing debt. Ponzi schemes (such as subprime loans) cause financial institutions to redefine the game – in this case not only causing a financial crisis but also a permanent (?) shift in profitmaking from the real economy to the financial economy in the West. 1990s NASDAQ Bubble = 2000s easy-liquidity bubble ICT finance and finance IPOs as percent total IPOs in stock in m arkets 1970-2007 ICT and as ofpercent ofUStotal US stock markets 1993-2007 Common financial Bubble Major Technology Bubble 60% 50% Percent of total IPOs Percent of total initial public offerings 70% Finance IPOS 40% 30% Information and communications technology IPOs 20% 10% ICT as % of total IPOs 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 0% Finance as % of total IPOs Major technology bubbles are part of CREATIVE DESTRUCTION in market economies Credit-pumped bubbles leave destruction and recession in their wake The major technology bubbles change the trends in income distribution strongly in favor of the few at the top Percentage of income earned by the top 1% in the USA 1913-2007 Turning Point 4th Share of total income 30% Recession Deployment 4th 25% Installation 4th 20% The 1920s bubble Installation 5th The Post WWII boom The 1990s bubble The 2000s bubble 15% 10% 5% 2003 1998 1993 1988 1983 1978 1973 1968 1963 1958 1953 1948 1943 1938 1933 1928 1923 1918 1913 0% …and in this surge the trends have changed on a global scale Source: Piketty and Saez Fragilities + Retrogression. • • • • • • Financial fragility (Hyman Minsky) Wage fragility Pension fragilities Livelihood fragility Technological fragility and so on, including ’reduced marriage fragility’ (number of US divorces down by 25 % in the 1930s). Increased social tensions, increased migration (’Grapes of Wrath’), neo-Medievalism, ’madmen in authority’ (Keynes 1936) Latvian Ministry of the Economy 1994: Forces set in motion: • De-industrialization • De-agriculturalization • De-population Examples; Southern Mexico, Moldova, Caribbean states Destruction of real wages: • In small Latin American countries from the mid 1970s. • Stagnating wages in the US from about the same time. • De-industrialization of The Second World starting in 1990 (from Latvia to Mongolia). • Argentina late 1990s (real wages down by 40 per cent from peak) + Asian crisis. • Western Europe is being hit now.