“GLOBAL IMBALANCES AFTER THE ECONOMIC CRISIS” Dimitri B. Papadimitriou Levy Economics Institute

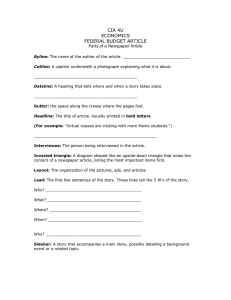

advertisement

“GLOBAL IMBALANCES AFTER THE

ECONOMIC CRISIS”

Dimitri B. Papadimitriou

Levy Economics Institute

International Development Economics Associates (IDEAs) Conference

“Reforming the Financial System: Proposals, Constraints and New

Directions”

January 25-27, 2010, Muttukadu, Chennai, India

Outline

•

•

•

•

•

Global imbalances and the crisis

Origins of the U.S. external deficit

The role of China and oil exporters

Plausible future scenarios

Measures to address global imbalances

The “savings glut” hypothesis

“I will argue that over the past decade a combination of

diverse forces has created a significant increase in the

global supply of saving - a global saving glut - which

helps to explain both the increase in the U.S. current

account deficit and the relatively low level of long-term

real interest rates in the world today.

(…) the developing and emerging-market countries that

brought their current accounts into surplus did so to

reduce their foreign debts, stabilize their currencies, and

reduce the risk of financial crisis

(..) Because investment by businesses in equipment and

structures has been relatively low in recent years (…)

much of the recent capital inflow into the developed

world has shown up in higher rates of home construction

and in higher home prices. Higher home prices in turn

have encouraged households to increase their

consumption” Bernanke (2005)

Chinese External Sector

Chinese International Reserves

Current Account Behavior for Oil

Exporters

Key Global Current Account Balances

U.S. Net Foreign Assets and Current

Account Balance

Foreigners’ Role in Financing U.S.

Government Deficit

Foreign Holdings of U.S. Treasury

Securities

Japan

China

Germany

Oil

exporters

U.K.

Financial

centers

Dec. 2000

31.3%

5.9%

4.8%

4.7%

4.9%

8.2%

Dec. 2006

29.6%

18.9%

2.2%

5.2%

4.4%

7.9%

Aug. 2009

21.2%

23.1%

1.6%

5.5%

6.5%

9.9%

Source: Dep. of the Treasury

Financial centers: Caribbean Banking Centers, Luxembourg, Switzerland

The Conceptual Framework

Accounting Identity of Financial Balances

Internal

Financial Balance

=

Current

Account

Balance

{

+

Government

Balance

{

Private

Sector

Balance

External

Financial Balance

In 2008 the identity was roughly like this:

1.1% of GDP -6.0% of GDP = -4.9% of GDP

Third quarter 2009 the identity was roughly like this:

7.9% of GDP –10.9% of GDP = -3.0% of GDP

U.S. Main Sector Balances and Real GDP

Growth

Private Sector Borrowing: Historical Data

and Baseline Assumptions

Congressional Budget Office Projections

for the Federal Budget

Main Sector Balances in Baseline

Scenario

U.S. Exports by Country of Destination

Main Sector Balances in Scenario 1,

Postponed Deficit Reduction

U.S. Dollar Exchange Rate (Broad

Index) Actual and Projected

Main Sector and Trade Balances in

Scenario 2, U.S. Dollar Devaluation and

Some Deficit Reduction

Global Rebalancing is Necessary

Private Consumption as a Share of GDP

Policies to correct imbalances

• Revaluation of the currencies of surplus

countries will be effective in reducing both

global and U.S. domestic imbalances

• Such revaluation will require concerted

actions of Central banks, particularly in East

Asia

• Energy policies can reduce the impact of oil

price changes on the U.S. trade balance, and

the U.S. oil trade deficit

If these fail then . . .

“Unpopular” Policies may become

necessary

Under WTO rules (Article 12), external imbalances

can be addressed through “protectionist-type”

measures

- non-selective import tariffs

- import certificates (Buffet proposal)

- import certificates (Levy Institute version)

The more effective resolution can probably be

achieved only via an international agreement that

would change the international pattern of

aggregate demand, combined with a change in

relative prices. Together, these measures would

ensure that trade is generally balanced at full

employment.

Thank You