Macroeconomics ECON 2301 May 2010 Marilyn Spencer, Ph.D.

advertisement

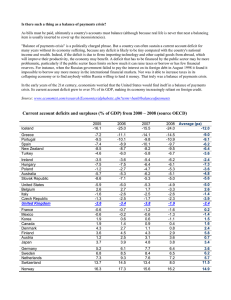

Macroeconomics ECON 2301 May 2010 Marilyn Spencer, Ph.D. Professor of Economics Chapters 6, 7, 8 & 14 Review Exam 2, May 25 Chapters 6, 7, 8 &14 Study PPT slides Study assigned end-of-chapter questions Study with a friend Test format: 25 multiple choice questions (+ 3 extra credit) Questions include definitions, theory & applications Expect graphs and numbers. 1 hour Scantron answer sheet provided Test Resources Used Please check any applicable box concerning "fees" for test resources you plan to use DURING the exam: 3x5 card with notes, 5 test points textbook and notebook, 15 test points information from others, 100 test points Will NOT use additional resources* * Two (2) points will be added to your score if you choose to NOT use any of these test resources. Name (please print):____________________ ID #: ______________________ (some portion of ID#) Signature: ___________________________ Chapter 6 EXAM QUESTION TOPICS Know about the revenue sources of our federal government. Know average tax rates v. marginal tax rates. Know the differences among proportional taxes, progressive taxes & regressive taxes. Be able to explain our federal personal income tax system, in terms of the 3 taxes above. Know the major issues of our social security tax system. Know how the taxes governments levy on purchases of goods and services affect market prices and equilibrium quantities. Chapter 7 EXAM QUESTION TOPICS Know how the unemployment rate is calculated. Know who’s in the labor force and who isn’t. Know what “discouraged worker” means. Know the 4 types of unemployment. Know the major price indexes & how price they’re calculated. Be able to use information from a price index. Understand who loses and who gains from inflation. Understand key parts of a business cycle. Know how to calculate the real interest rate. Chapter 8 EXAM QUESTION TOPICS Understand the circular flow model: Know what is purchased in factor markets v. product markets by whom and from whom. Know that income flows one way and resources/goods the other. Be able to define gross domestic product (GDP). Know the formula for the expenditure approach to GDP. Know why intermediate goods aren’t included. Know why not all production gets counted. Understand the limitations of using GDP as a measure of national welfare. Understand the difference between real & nominal GDP. Chapter 14 Exam Question Topics: Federal budget deficit, surplus or balanced budget Largest spending categories of the federal budget How the federal government finances a budget deficit How a budget deficit can crowd out private spending Public debt: gross v. net burden to future generations: paying for it How to reduce the deficit Assignment to be completed before class May 26: Pre-read Chapter 16 & these end-of-chapter Problems: 14th ed: 16-1, 16-2, 16-4, 16-7, 16-9, 16-12 & 16-15, on pp. 420-421; 15th ed: 16-1, 16-2, 16-4, 16-7, 16-9, 16-10 & 16-13, on pp. 420-421.