Document 15497922

advertisement

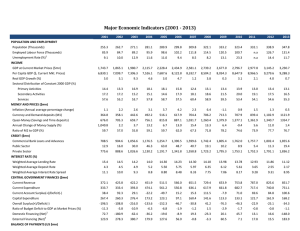

Wiener Institut für Internationale Wirtschaftsvergleiche The Vienna Institute for International Economic Studies www.wiiw.ac.at Session on: Economic integration and its impact Current state and crisis of Europe’s model of integration Michael A Landesmann IDEAS Conference, Delhi 29 January 2012 2 Main Issues What is at the root of the crisis in Europe? Is the Euro-zone going to pull through? In which shape? What is the predicament of Europe’s ‘periphery’? Pitfalls in the ‘European integration model of growth and convergence’? More generally: growth and catching-up in an era of financial market integration wiiw 3 What is at the root of the crisis in Europe? Why is EU more hit than other advanced economies? No-bail-out clause plus constitution of the ECB makes the Euro-zone very vulnerable in times of very nervous financial markets; but the additional important ingredient is: Pronounced developments of external imbalances within the Euro-zone, driven by financial market integration and – mostly – fast private sector debt accumulation Policy-mechanisms to deal with these imbalances non-existent or in-effective: no established crisis management mechanism at EU/Euro level (ECB mandate, no pooling of debt responsibility; no fiscal stabilisation function); financial markets insufficiently (and nationally) regulated; real exchange rates diverge persistently driven by capital inflows (interest rate convergence before the crisis); relative price adjustment very slow – hence, during the crisis, rebalancing through incomes; wiiw 4 Current state of the crisis in Europe Banks very weak; no effective re-capitalisation; implicit liability of states – sovereign debt problem and feed-back processes; national segmentation of responsibility and differentiated vulnerability of countries persists – very slow move towards some ‘mutualisation of debt’ Austerity in fiscal policies, deleveraging processes (corporate, households, banks) generate stagnation; sustainability of debt of both private and public sectors judged (by markets) as unresolved; banking and sovereign debt crisis could further escalate Any resolution in sight? wiiw 5 Policy master-plan? Exclusive focus on fiscal consolidation: Germany sees this as a precondition for any move towards joint action/mutualisation on the debt problem and widening ECB’s mandate – focus to bring long-term public debt ratios down (constitutional amendments; tightening of fiscal control) Recapitalisation of banks asked for, but happens through shrinkage of balance sheets – credit crunch Some moves towards EU-wide regulatory and supervisory bodies; but lacking teeth so far; in the short-run more national segmentation of banking Measures to monitor development of competitiveness in the future; details to be worked out; unlikely to be very effective No growth strategy, except lip-service to change revenue and expenditure structures in ‘growth enhancing’ manner; plus liberalisation wiiw 8 Economic Integration and Emerging Economies: general issues emerging from the crisis International financial markets integration can strongly accentuate the possibility of external and internal imbalances Exchange rate regimes are very important in this context Catching-up processes can be seriously derailed due to the build-up of imbalances Impact on distorting economic structures (domestic savings behaviour, capital allocations across tradable/non-tradable sectors, asset prices, competitiveness – real exchange rates, etc.) The setting for catching-up economies in (EU)rope is special: affects not only EU members but also economies in the neighbourhood (e.g. Balkans) wiiw 9 The European integration model of catching-up targeted at ‘deep integration’ with the EU/Euro area associated with very far-reaching internal and external liberalization (trade, capital transactions, financial market integration, labour mobility) benefits: ‘downhill’ capital inflows, trade integration, ‘technology’ transfer; institutional convergence the model worked - ‘convergence process’ – but emergence of severe structural imbalances in important groups of European EMEs; heterogeneity of pre- and post-crisis experience of European EMEs wiiw 10 Growth – GDP at constant prices Average annual growth rates, 2002-2008, in % wiiw 11 European periphery and comparisons with other emerging economies CE-5: Czech Republic, Hungary, Poland, Slovakia and Slovenia EU-Coh: Greece, Portugal, Spain Asia-6: Indonesia, Korea, Malaysia, Philippines, Taiwan and Thailand Latam-8: Argentina, Brazil, Chile, Columbia, Ecuador, Mexico, Peru and Uruguay BB-5: Bulgaria, Romania (SE-2); Estonia, Latvia, Lithuania (B-3) WB-6: Albania, Bosnia and Herzegovina, Croatia, Former Yugoslav Republic of Macedonia, Montenegro and Serbia; 11 wiiw 12 Composition of the current account of the balance of payments, 1995-2009 Goods&Services Income Transfers Current account 15.0 10.0 5.0 0.0 -5.0 -10.0 -15.0 -20.0 LATAM-8 ASIA-6 MENA-6 EU-COH CE-5 SEE-2 B-3 WB-6 TR -25.0 Note: ASIA-6 excl. Taiwan. Source: IMF International Financial Statistics and IMF WEO October 2010. wiiw 13 Net private financial flows in % of GDP, 1993-2009 LATAM-8 ASIA-6 MENA-6 EU-COH CE-5 Source: IMF Balance of Payments Statistics. ASIA-6 excl. Taiwan. SEE-2 B-3 WB-6 TR wiiw 14 Credit to the private sector (%GDP, 1995-2009) wiiw 15 Financial integration - Changes in: (i) assets plus liabilities; (ii) credit to private sector in % of GDP (percentage point change), 2001-2007 LATAM-8 200.0 ASIA-6 MENA-6 300.0 EU-COH SEE-2 B-3 WB-6 TR 60.0 250.0 50.0 200.0 40.0 100.0 150.0 30.0 50.0 100.0 20.0 150.0 0.0 CE-5 10.0 50.0 0.0 0.0 -50.0 Exports plus Imports Assets and liabilities -10.0 Assets and liablities Credit to private sector Note: Assets and liabilities: EU-COH: 265.82%; WB-6: 212.14%. Source: IMF International Financial Statistics. ASIA-6 excl. Taiwan, MENA-6 excl. Lebanon. wiiw 16 External debt: public and private (% of GDP), 2008 Intercompany lending Other Sectors Banks Monetary Authorities General Government 120.00 100.00 80.00 60.00 40.00 20.00 0.00 LATAM-8 ASIA-4 MENA-4 CE-5 SEE-2 B-3 WB-3 Note: ASIA-4 excl. PH, TW. MENA-4 excl. LB, SY. B-3 excl. FYROM, BA, RS. Source: World Bank, World Databank. wiiw 17 External debt: public and private (% of GDP), 2008 Intercompany lending Other Sectors Monetary Authorities General Government Banks 250.00 200.00 150.00 100.00 50.00 0.00 LATAM-8 ASIA-4 MENA-4 EU-COH CE-5 SEE-2 B-3 WB-3 Note: ASIA-4 excl. PH, TW. MENA-4 excl. LB, SY. B-3 excl. FYROM, BA, RS. Source: World Bank, World Databank. wiiw 18 CESEE: GDP growth was well above the interest rate before the crisis Nominal interest rate on government debt and nominal GDP growth (%), 2000-2010 CESEE 20.0 15.0 15.0 10.0 10.0 5.0 5.0 Nominal GDP growth 0.0 OECD (non-CESEE) 20.0 0.0 Nominal GDP growth Nominal interest rate Nominal interest rate -5.0 Note: Interest rate = government interest expenditures / previous year gross debt. 2010 2008 2006 2004 2002 2000 2010 2008 2006 2004 2002 2000 -5.0 wiiw 20 Debt in % of GDP Gross external debt Public debt Bulgaria 180 160 140 120 100 80 60 40 20 0 Private debt Romania 90 80 70 60 50 40 30 20 10 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Slovenia 140 Croatia 160 140 120 100 80 60 40 20 0 120 100 80 60 40 20 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Source: wiiw Annual Database incorporating Eurostat statistics. wiiw 21 Foreign bank ownership, 1998-2005 (assets owned by foreign banks as % of banking system assets) LATAM-8 ASIA-6 MENA-6 CE-5 SEE-2 B-3 WB-6 TR B-3 WB-6 CE-2 SEE-2 90.0 80.0 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 LATAM-8 ASIA-6 MENA-6 Turkey 1999 2000 2001 Note: ASIA-6 excl. Taiwan, MENA-6 excl. Syria. Source: from Claessens et al (2008). 2002 2003 2004 2005 wiiw 27 Summary: Specific features of European EMEs Opening of the capital account: a rule of the game in the EU; deep financial integration Reliance on massive imports of capital; only 4 CESEE-countries could avoid skyrocketing external (private) debt Bank credit: the overwhelming source of external funding Financial integration: major channel for transmitting shocks (EUCoh, B-SEE regions hit hardest by the crisis) So far no meltdown of financial systems in CESEE - advantage of the presence of foreign banks? Differentiation across CESEE economies linked to extent of buildup of industrial production and export capacity wiiw 28 Principal policy lessons: In national and EU policy frameworks: neglect of private sector debt build-up relative to public sector Financial market regulation severely underdeveloped; specific issue in CESEE region: high level of cross-border banking Fixed exchange rate regimes bear high risks; but what are the options of highly euroized EU members and candidates? Current situation characterised by very fragile banking system; protracted deleveraging processes; strong financial market pressure prevents use of fiscal space; Consequence: ‘European integration model of growth’ requires severe re-shaping wiiw 30 Relationship between pre-crisis credit growth and current account balances 20.0 average CA/GDP 2004-2007 15.0 MYS 10.0 TWN 5.0 CHL EGY PHL ARG ECU KOR IDN PER THA MEX URY COL TUN SYR POLCZE 0.0 SVN -5.0 LBN IRL MKD TUR HRV ALB PRT GRC LTU ROU JOR SRB BIH EST HUN SVK -10.0 BRA MAR -15.0 ESP BGR LVA MNE -20.0 -60.0 -40.0 -20.0 0.0 20.0 40.0 60.0 80.0 Change in credit/GDP 2004-2007 Source: IMF World Economic Outlook. wiiw 31 Structural features: European and other EMEs LATAM-8 ASIA-6 MENA-6 CE-5 EU-COH B-SEE Credit/GDP, change from 2004 to 2008 (percentage points) 15.85 -8.97 7.02 6.68 56.88 39.21 Real interest rate average, 2005-2007 4.33 3.17 -0.09 1.10 -3.10 -0.26 Current account balance/GDP, 2007 (%) 0.14 3.35 -1.42 -4.88 -10.09 -15.21 Gross external debt, 2009 (% of GDP) 20.8 34.8 20.9 62.7 229.6 80.4 GDP growth, 2008-2010 3.82 3.47 5.38 0.50 -1.67 -1.55 Source: wiiw calculations. wiiw 32 Structural features: the role of exchange rate regimes ‘Fixers’ and ‘floaters’ amongst the CESEEs CESEE float CESEE fix 20.5 32.8 1.6 -1.6 Current account balance/GDP, 2007 (%) -6.6 -11.8 Gross external debt, 2009 (% of GDP) 78.8 95.6 GDP-growth, 2008-2010 1.18 -1.78 FDI to finance and real estate sectors, 2007 (per cent of total FDI stock) 26.5 40.2 1.5 3.9 Credit/GDP, change from 2004 to 2008 (percentage points) Real interest rate average, 2005-2007 Change in unemployment rate from 2007 to 2010 (percentage points) Source: wiiw calculations. wiiw 33 GDP development, 2005-2012 2008=100 LATAM-8 ASIA-6 EU-COH CE-5 SEE-2 B-3 WB-6 120.0 TR ASIA-6 LATAM-8 TR WB-6 CE-5 115.0 110.0 105.0 100.0 SEE-2 EU-COH B-3 95.0 90.0 85.0 80.0 2005 2006 2007 2008 2009 Source: wiiw forecast and IMF World Economic Outlook, October 2010. 2010 2011 2012 wiiw