Store Brands and Store Competition

advertisement

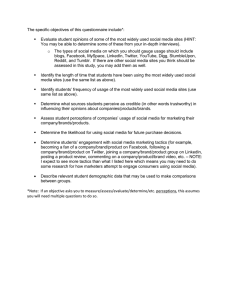

6th Global Conference on Business & Economics ISBN : 0-9742114-6-X Store Brands and Store Competition Dr. Sungchul Choi, School of Business, University of Northern British Columbia, Canada Dr. Karima Fredj, Economics Program, University of Northern British Columbia, Canada ABSTRACT Most past studies of store brands ignored store competition and focused on limited interactions among channel members. This research seeks to extend the literature in this area by considering various channel leadership structures and retail competition in a channel of a single national brand manufacturer and two competing store brand retailers that also sell the national brand. Besides the variety in vertical price leadership between the national brand manufacturer and the store brand retailers, we particularly investigate the role of horizontal price leadership between two store brand retailers. We find that the two competing retailers are better-off when they practice price leadership between them. In addition, consumers are better-off when no leadership exists between the three channel members and worst-off under the manufacturer’s leadership. Total channel profits are also the highest when no leadership is practiced by the channel members and larger when the channel leaders are the store brand retailers rather than the national brand manufacturer. Keywords: Distribution Channels; Store Brands; Price Competition; Game Theory INTRODUCTION Store brands represent more than $40 billion of current retail businesses and are achieving new levels of growth every year (Private Label Manufacturers Association, 2005 Yearbook). According to the United States Department OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X of Agriculture (USDA) 2000's estimates, one out of every five items sold per day in the U.S. supermarkets, drug chains and mass merchandisers is a store brand product. Because of such success of store brands in several product categories over the past two decades, competition between national brands and store brands has been extensively studied. One research stream focuses on the empirical approach that investigates the effects of some variables such as advertising, perceived quality, and industry concentration on competition between national brands and store brands to explain the variation in store brand market share across different product categories (see for example; Cannor and Peterson 1992, Hoch and Banerji 1993, Hoch 1996, Kim and Parker 1999, Cotterill et al. 2000). Another research stream introduces theoretical models that describe price competition between national brands and store brands to study some related issues. For instance, Raju et al. (1995) developed a game-theoretic model in order to examine the conditions under which it is profitable to introduce store brands; Narasimhan and Wilcox (1998) examined the incentives for store brand introduction in the loyal/switcher market structure; and more recently, Sayman et al. (2002), Du et al. (2004), and Choi and Coughlan (2006) investigated the retailer's store brand positioning issue. However, the existing literature of price competition in economics-based modeling between national brands and store brands still has its limitations and our main contribution in this paper is to address some of them. Firstly, in order to provide maximum brand exposure and more consumer convenience, most consumer goods are sold intensively through several independent retailers that offer competing brands. Hence, the importance of inter-store competition between large retailers has been argued as critical for store brand introduction (McMaster 1987). However, most of the previous store brands' studies ignored inter-store competition and accounted only for product competition between national brands and store brands (e.g. Raju et al. 1995, Narasimhan and Wilcox 1998, Sayman et al. 2002). On the other hand, the previous models that considered store differentiation effects in a duopoly common retailers channel did not include store brands in the model (e.g. Choi 1996, Trivedi 1998, Basuroy et al. 2001). Thus, little is known about the role of store brands in price competition at the retail level. Our contribution at this level is to have, in the same model, both store competition and product competition between a national brand and store brands. This is achieved using a model framework where the market structure is OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X composed of one national brand manufacturer and two retailers who sell their own store brand in addition to marketing the manufacturer's national brand. Secondly, previous studies, related to store brands issues, only investigated the Manufacturer Stackelberg (MS) channel leadership structure where manufacturers are modeled as Stackelberg leaders and retailers as followers (see for example; Raju et al. 1995, Narasimhan and Wilcox 1998, Sayman et al. 2002). This excludes some other possible channel leadership structures that have been proven pertinent by the previous literature that did not account for store brand competition; such as a Vertical Nash (VN) where manufacturers and retailers are at the same power level, or Retailer Stackelberg (RS) where, as opposed to the MS, retailers act as price leaders and manufacturers as price followers. Indeed, as argued in this literature, in certain circumstances retailers may be "powerful" enough to lead the channel, leaving manufacturers no other choice but to accordingly adjust their decisions (Lee and Staelin 1997). These retailers are often much larger than most of the manufacturers, and exercise their power on the flow of products (Choi 1996). This is exemplified in the real world by the dominance of large retailers such as Wal-Mart (Choi 1991, Lee and Staelin 1997). Henceforth, we believe that considering all the different leadership structures would particularly reflect the impact of store brands on the strategic role of retailers in the channel (Trivedi 1998). Finally, existing studies in this area ignored horizontal price leadership by assuming that channel members interact in a Bertrand-Nash manner at the horizontal level (two manufacturers or two retailers) (Raju et al. 1995, Narasimhan and Wilcox 1998, Sayman et al. 2002). Thus, one of our main contributions is to introduce a new leadership structure where we allow for a sequential interaction à la Stackelberg at the retail level in addition to considering the Bertrand-Nash interaction. This new assumption of leadership is well justified as most of the empirical studies show inconsistent results with the Bertrand-Nash manner assumption. For instance, Vilcassim et al. (1999) analyzed the dynamic price and advertising competition among firms in a personal-care product category and found evidence rejecting Bertrand-Nash interactions among firms. Dhar and Ray (2004) also found that grocery supermarkets with strong store brands might show more strategic interaction between retailers in fluid milk product category (see also Bresnahan 1989 for more related counter-examples). As pointed out by Kadiyali et al. (2000), “Therefore, a more general model of interactions is needed” and we propose a horizontal Stackelberg pricing game. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X In summary, the primary focus of this paper is to investigate price competition between a manufacturer’s national brand and retailers’ store brands in the presence of store competition. As indicated above, this paper extends the previous literature mainly in three directions: (1) considering both product and store differentiation, (2) applying different vertical price leadership structures (MS, RS and VN), to a store brand model and (3) applying horizontal price leadership at the retail level. This paper is organized as follows. In the next section, we develop a model that examines price competition between a national brand and store brands in a channel structure with one manufacturer and two retailers. In the third section, we derive the analytical equilibrium solutions for the prices, margins, quantities demanded and profits under the different channel leadership structures. In the fourth section, we perform sensitivity analyses, comparisons and discuss the implications of the channel leadership. Finally, we conclude and delineate further research directions. THE MODEL This section describes the demand and profit functions and provides a description of the channel leadership structures. We assume that the manufacturer produces a national brand product that he distributes to two competing retailers. In addition to the national brand, each retailer offers a store brand. 1 The manufacturer chooses the wholesale price that maximizes his profits and each retailer determines the optimal retail margins for the national brand and her store brand that maximize her combined profits from marketing the two products. The Demand Structure Following the established literature, we use linear demand functions that capture the main properties; such as the quantity demanded of a good is decreasing in its price and increasing in the competing product's price and affected by the degree of product and store differentiation. Accordingly, we extend the demand function used in Raju et al. (1995) as follows: OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics q im qi ISBN : 0-9742114-6-X 1 (1 p im ( p jm pim ) ( p i p im ) 2 2 1 ( pi ( pim pi )) , 2 2 (1) (2) where m : the index for the manufacturer, i, j 1,2, i j : indexes for the retailers, qim : the demand of the manufacturer’s national brand at store i, qi : the demand of the store i’s brand, pim : the retail price of the manufacturer’s national brand at store i, pi : the retail price of the store i’s brand, : the cross price sensitivity between the national brand and a store brand at store i, : the cross price sensitivity between the two stores for the national brand, : the store brand’s base level of demand. Smaller values of β indicate less product substitutability (or more product differentiation) between the national brand and a store brand. A small value of the cross-price sensitivity between two products hence implies that a change in the price of one of the products will have small impact on the demand of the other product and viceversa. By considering the same β between the national brand and each of the store brands, we implicitly assume that the national brand is symmetrically positioned with respect to the two store brands. A smaller value of γ, on the other hand, represents less store substitution (or more store differentiation) implying that price differences for the same national brand between the two stores has less impact on the demand they will face. Finally, λ indicates the base level of demand of a store brand. λ=0 represents the case where the store brand has no base level of demand and λ=1 represents the case where the store brand has exactly the same base level as the national brand. In general, λ can take any value between 0 and 1, with higher values of λ implying highly competitive store brands compared to the national brand. Following Raju et al. (1995), we assume that each retailer procures her store brand from a manufacturing source. The store brand producers incur a fixed unit cost for a long-term period (Cook and Schutte 1967, Mcmaster 1987). We also assume that the price at which each retailer procures her store brand is equal to the marginal From now on we shall refer to the manufacturer by “he or him” and to each retailer by “she or her” to avoid the confusion. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 1 6th Global Conference on Business & Economics manufacturing cost. ISBN : 0-9742114-6-X For mathematical tractability and to separate the effects of different channel leadership structures from the effects of cost difference, we assume zero marginal costs without loss of generality. The profit function for a national brand manufacturer can then be written as: m w i 1, 2 m q mi wm q mi (3) i 1, 2 and the profit function for each retailer is Ri mi qmi pi qi , (4) where wm is the national brand manufacturer’s wholesale price, mi pim wm is the store i’s margin on the national brand.2 The Channel Leadership Structure To model variety in price leadership among channel members, we consider both vertical interactions between the manufacturer and the retailers, and horizontal interactions between the two retailers. In addition, at each interaction level, we consider both simultaneous and sequential plays, which translate into the following four pricing games: The Manufacturer Stackelberg (MS): It refers to a Stackelberg price leadership at the vertical level (where the manufacturer is the leader and retailers are followers) and a simultaneous Nash game between the two retailers at the horizontal level. This game is solved backward. Each retailer first chooses her optimal margins for the national brand and her store brand that maximize her profits conditional on the second retailer's choice. Afterwards, the manufacturer using this information (i.e., reaction functions of the retailers) chooses the wholesale price for his national brand that maximizes his own profits. The Vertical Nash (VN): It refers to a simultaneous play à la Bertrand-Nash between the manufacturer and the two retailers. In this game, all channel members maximize their profits conditionally on each other’s reaction function(s) by choosing the wholesale price for the manufacturer and the different margins for the retailers. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X The Retailer Stackelberg (RS): It also refers to a Stackelberg price leadership but as opposed to the MS, the manufacturer is the follower and retailers are the leaders. Solved backward, this means that the manufacturer first solves for the wholesale price of the national brand that maximizes his profits. The obtained reaction function is then used by the retailers while simultaneously maximizing their respective profits. The Retailer Double Stackelberg (RDS): This game is similar to the RS in terms of the vertical interaction between the manufacturer and the retailers. However, it differs at the horizontal level, by considering sequential interaction à la Stackelberg rather than a simultaneous one à la Bertrand-Nash between the two retailers. Thus, one retailer (Retailer 2 in our model) has price leadership over the other (Retailer 1). Solved backward, this means that the manufacturer first chooses his wholesale price. Then the following retailer (Retailer 1) chooses her margins for the national brand and her store brand before the leading retailer (Retailer 2), using the reaction functions of the two other channel members, fixes the margins for the national brand and her store brand that maximize her profits. Figure 1 illustrates these different configurations of the channel leadership structures. As mentioned in the introduction section, the different behavioural assumptions for the vertical pricing game were commonly used in the previous literature (see for example, Choi 1991, Choi 1996, Lee and Staelin 1997, Kadiyali et al. 2000, Tyagi 2005). Our major contributions are to apply them to a model including store brand products and to consider a sequential play between the channel members at the horizontal level, building up the last channel leadership structure (RDS). 2 Since we assume that the price at which retailers procure their store brand is equal to the marginal costs (set equal to zero), the retail prices and the margins for the store brand are equal. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X Figure 1. The Channel Leadership Structure (a) Manufacturer Stackelberg (MS) (b) Retailer Stackelberg (RS) Manufacture r Manufacture r Retailer 1 Retailer 2 Retailer 2 Retailer 1 (c) Vertical Nash (VN) (d) Retailer Double Stackelberg (RDS) Retailer 2 Manufacture r Retailer 1 Retailer 1 Retailer 2 Manufacturer THE EQUILIBRIUM OUTCOMES In this section, we derive the equilibrium results for the different leadership structures. The optimal results are superscripted by MS, RS, VN, and RDS for the four leadership assumptions described above. The MS Leadership Under the MS leadership, the manufacturer knows up-front the reaction functions of the retailers and takes them into account when he chooses the wholesale price for the national brand. These reaction functions are derived as first order conditions of (4) subject to (1) and (2) for each retailer i=1,2: OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X miMS 1 wmMS (2 1) , and 4 2 piMS 2 (2 2) wmMS . 2(4 2) It is interesting to notice from these expressions that as the wholesale price of the national brand goes up, each retailer decreases her margin on the national brand and increases the price of her store brand. This means that a high wholesale price of the national brand results in a lower retail margin on the product, for which the retailers can compensate by choosing higher retail margin on their own store brand. Substituting these reaction functions into the manufacturer profit function (equation 3) and maximizing it with respect to the wholesale price gives the following optimal value: wmMS 2(2 1 (1 )) . 2( (4 2 2) 2( 1)(2 1)) Finally, replacing this value of wmMS in the retailers’ reaction functions yields the optimal control variables’ values for each retailer i=1,2: miMS 2(1 ) 6 2 (2 )(1 ) 2 3 (4 )(1 ) (4 3 )(2 ) 2( 3 (4 ) 2 2(2 3 2 ) 2 (32 28 5 2 ) (20 24 6 2 )) and piMS 4(2 3 2 ) 4 3 (4 )(1 ) 2 ( 2 (2 3 ) 8(3 5 ) 4 (5 7 ) 2 (4 16 2 (1 4 ) (5 18 )) . 4( 3 (4 ) 2 2(2 3 2 ) 2 (32 28 5 2 ) (20 24 6 2 )) By replacing the above margins and wholesale price in the demand and profit functions, we can easily get the equilibrium quantities and profits for each channel member. The full results are available in the appendix. No Channel Leadership (VN) Under this scenario, all players optimize their profit functions simultaneously which results in the following reaction functions: miVN 1 wVN m ( 2 1) ; 4 2 OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA i 1,2 , 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X piVN 2 (2 2) wmVN ; 2(4 2) wmVN 2 ( p1VN p 2VN ) ( 1)(m1VN m2VN ) . 4( 1) i 1,2 and The optimal solutions are then obtained from solving the above system: miVN (4 3 2 2) 3( 1) ; 6( 1)(2 1) ( 2)(3 2) piVN (3 3) ( 1)(3 2 3) ; 6( 1)(2 1) ( 2)(3 2) wVN m 2(2 1) (2 2) . 6( 1)(2 1) ( 2)(3 2) i 1,2 , i 1,2 and The equilibrium quantities and profits for each channel member can be easily derived by substituting these values in the right expressions (see the appendix). The RS Leadership We first solve for the manufacturer optimization problem to get his reaction function wmRS 2 ( p1RS p2RS ) ( 1)(m1RS m2RS ) . 4( 1) It is obvious from this reaction function that the wholesale price of the national brand increases as the retail price of a store brand increases ( wm w 0 and m 0 ), which is consistent with the complementarity property of p1 p2 the two products. Furthermore, the wholesale price of the national brand decreases as the retail margin of the national brand increases ( wm wm 0 and 0 ) as one can expect, for the national brand to keep competitive RS m1 m2RS prices relative to the store brands. The retailers maximize their profits given the reaction function of the manufacturer and conditionally on each other’s reaction functions, yielding the following optimal margins OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X miRS (8 5 2 4) 5( 1) , i 1,2 and 10( 1)( 2 1) (16 5 2 8) piRS (5 2 5) ( 1)( 4 5( 1)) , i 1,2 . 10( 1)( 2 1) (16 5 2 8) Substituting these values into the manufacturer reaction function gives the optimal wholesale price wmRS 6( 1)( 2 1) (16 7 2 8) 4( 1) . 2( 1)(10( 1)( 2 1) (16 5 2 8) ) It is then straightforward to derive the equilibrium values for the quantities demanded and profits for each channel members (see the appendix). The RDS Leadership Under this channel leadership structure, the two retailers are acting as price leaders and the manufacturer acts as a price follower in terms of vertical interaction. In addition, Retailer 2 has horizontal price leadership over Retailer 1. The first maximization problem for the manufacturer gives the same reaction function as in the RS leadership case. Retailer 1 (follower at the retail level), will then use this information to maximize her profits which yield the following reaction functions: m1RDS (4 3 2 2) 3( 1) (3 4 8 2 2 3 2 1)m2RDS (2 1) p2RDS , 2(9 4 8 6 2 3 2 3) p1RDS (3 2 3) (3 4 3)( 1) 2 p2RDS 2( 1) m2RDS . 2(9 4 8 6 2 3 2 3) Finally, Retailer 2 uses the information on the two followers’ reaction functions to maximize her own profits and obtains the optimal margins for the national brand and her store brand. By substituting these values in the right expressions, we get the equilibrium retail margin and wholesale price of the national brand, and the retail price of the store brand. Then, from these values we can derive the equilibrium solutions for the quantities demanded of each brand and the profits for each channel member. The analytical results for the four channel leadership structures are summarized in the appendix. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X DISCUSSION In this section, we conduct sensitivity analyses within each of the channel leadership scenarios to see how the main variables such as prices, quantities demanded, and profits react to a change in some of the parameters. We then perform some comparisons within each scenario as well as between the different scenarios with respect to the equilibrium values of the main variables.3 Sensitivity Analyses We first conduct sensitivity analyses for each of the four channel leadership scenarios to examine the effects of product differentiation, store differentiation, and the base level of store brand demand on the equilibrium outcomes. The results are presented in the three following propositions. PROPOSITION 1. Every thing else remaining the same, the cross-price sensitivity between the national brand and store brand i (β) has a positive impact on the level of store brand demand regardless of the channel leadership structure. This proposition simply states that the demand for a store brand increases as the degree of product substitutability between the store brand and the national brand increases. The interpretation is straightforward as higher cross-price sensitivity means that the two brands are closer substitute. Consequently, small changes in the price of the national brand will have high impact on the demand of the store brand. The next proposition highlights the effects of cross price sensitivity between stores. PROPOSITION 2. Every thing else remaining the same, higher cross-price sensitivity between the stores (γ) results in a higher wholesale price but lower margins for the retailers. Its impact on the demand of both products is positive. It results in higher profits for the manufacturer and lower profits for the retailers. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X A straightforward interpretation of this proposition would be that a higher store substitution (γ) implies more competition between the two stores and consequently lower margins on both the national brand and store brands resulting in an increase in the demand level of both brands. On the other hand, this competition seems to favor the manufacturer vis-à-vis the retailers allowing him to raise his wholesale price. This results in more profits for the manufacturer as both the wholesale price and the quantity demanded of the national brand increase. The negative impact on the retailers’ profits, however, indicates that the increase in the quantities demand of both the national brand and store brand are not high enough to compensate for the decrease in the retail margins of these products. To resume, higher cross-price sensitivity between stores is good for the manufacturer but not for the retailers. These results are consistent with the findings of Sayman et al. (2002) as well as Choi (1996) in a duopoly common retailers channel even if there were no store brand products in the latter models, meaning that the introduction of store brand does not qualitatively change the results at this level. PROPOSITION 3. Every thing else remaining the same, a retailer’s base level of demand for her store brand (λ) has a positive impact on both the wholesale price and the retail margins. It also has a positive effect on demand for the store brand, but a negative impact on demand for the national brand. Its impact on the profits is negative in the case of the manufacturer and undetermined in the retailers’ cases. On one hand, we can explain the effect on prices by the fact that an increase in the market share of the retailer’s store brand encourages her to increase the retail prices and margins for the two brands. Accordingly, the manufacturer charges a higher wholesale price for the national brand. On the other hand, the positive impacts on demand for the national and store brands are intuitive as higher values of λ mean stronger demand for the store brand relative to that for the national brand. The negative impact of λ on the manufacturer profits indicates that the decrease in the demand of the national brand overweighs the increase of the wholesale price and his profits decrease. For the retailer, the total impact cannot be determined, though it is expected to be positive. These results are 3 Detailed proofs of all propositions in this section are available upon request from the authors. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X consistent with Raju et al. (1995) findings indicating that a retailer is better-off introducing a store brand for which the base level of demand is high. The three above propositions resume the effects of store competition, brand competition, and the store brand’s level of demand. We now move to the effects of the channel leadership structures. The Channel Leadership Structure Effects Given the symmetric demand structure in the model, the optimal margins, quantities demanded and profits are the same for the two retailers except for the RDS case. Hence, we only need to make the distinction between the two retailers’ behaviour under the RDS scenario. PROPOSITION 4. The optimal prices of the national brand and store brand compare as follows for the different scenarios x= VN, MS, RS, and RDS: i. pim pi and pim wm ; ii. pi x wmx pim x if xp , x x x x pi wm pim if p , w x p x p x if x , i im p m x x x x where the critical values xp are functions of cross-price sensitivities β and γ and compare as follows: VN RS RDS RDS 1 MS p p p p1 p 2 0 . iii. p2 RDS p1 RDS , m2 RDS m1 RDS and p2m RDS p1m RDS . The first part of the proposition above indicates that the retail price of the national brand at each store is always higher than the store brand’s price and the wholesale price of the national brand. This result holds for all OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X channel leadership structures and regardless of the values that the different cross-price sensitivities and base level demand parameters can take; confirming face validity of the model. The second part of the proposition shows that the relationship between the national brand's wholesale price and the store brand i’s retail price, however, depends on the parameters of the demand function and how they relate to each other. The way we present the results generates critical values of the base level demand of the store brand as a function of the cross-price sensitivities between stores as well as between products. When λ is greater than the critical value under each channel leadership structure, the price of a retailer’s store brand is higher than the wholesale price of the national brand and vise-versa. These findings reinforce the sensitivity analysis results with respect to λ. Furthermore, by comparing the different critical values obtained under the different leadership structures, we find that the highest critical value occurs under the MS leadership case followed consecutively by VN, RS, and RDS cases. These results seem intuitive and consistent with the rest of our findings as they simply show that as the retailer gets more power in the channel she needs relatively less base level of store brand demand in order to start charging higher prices for her store brand compared to the manufacturer’s wholesale price. Finally, it is of interest to note that the critical value is lower under the RDS compared to the RS structure even for the following retailer. This implies that both retailers benefit of more strategic power under the RDS scenario regardless of the roles they play. However, as shown in the third part of this proposition the leading retailer still has an advantage over her following competitor as prices and margins under the RDS leadership structure are always higher for the leading retailer (Retailer 2) than for the follower (Retailer 1). In sum, the last proposition aiming at comparing the prices within each leadership scenario showed that in some cases this can be impossible to accomplish without referring to the channel leadership structure effects. We therefore compare the equilibrium solutions obtained in the four channel leadership structures to have a better idea of their impact on each channel member’s outcomes. We summarize the results in propositions (5) to (7) stated and discussed below. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X PROPOSITION 5. Every thing else remaining the same, Stackelberg channel leaders get higher unit margins on the national brand compared to the VN game. The two competing retailers get even higher unit margins on the national brand playing a sequential Stackelberg rather than interacting simultaneously à la Bertrand-Nash. The wholesale price of the national brand is the highest in the MS leadership, consecutively followed by the VN, RS, and RDS cases ( wm MS wm VN wm RS wm RDS ). In contrast, the retail margin of the national brand at each store is the highest in the RDS case followed consecutively by the RS, VN, and MS cases ( m2 RDS m1 RDS mi RS mi VN mi MS i 1,2 ). These results imply that a channel leader can obtain a higher , mark-up on the national brand, which provides a direct incentive for each channel member to become the leader. In addition, even the Stackelberg price follower among the two retailers (Retailer 1) shows higher retail margin for the national brand under the RDS compared to the RS leadership. This supports the statement in the previous proposition that the two retailers benefit by playing a Stackelberg game between them regardless of their roles. PROPOSITION 6. Every thing else remaining the same, Stackelberg leadership results in higher retail prices for the national brand compared to the VN game. Due to store competition, both the RS and RDS games result in lower retail prices for the national brand and the store brand compared to the MS game. The retail prices of the national brand resulting from the three different Stackelberg leadership are always higher than those of the VN case ( pm2 MS pm2 RDS pm2 RS pm2 VN , pm1 MS pm1 DRS , and pm1 RS pm1 VN ). This indicates that consumers are better-off in the absence of channel leadership, which is consistent with previous studies' findings (Shugan and Jeuland 1988, Choi 1991 and 1996). In addition, the two retailer Stackelberg cases (RS and RDS) lead to lower retail prices for the national brand compared to the MS case. This result also corroborates with the previous conclusion that a manufacturer’s leadership results into higher retail prices than a retailer’s leadership when accounting for store competition (Choi 1996). With respect to two retailer’s Stackelberg scenarios, the Stackelberg price leader (Retailer 2) benefit from a higher retail price for the national brand under the OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X RDS compared to the RS case. The equivalent relationship is, however, undetermined for the Stackelberg follower (Retailer 1). The retail prices of the two store brands are also higher under the MS case compared to the VN and under the RDS compared to the RS case ( pi MS pi VN and pi RDS pi RS , i 1,2 ). The intuition behind this result is that each retailer sets a relatively high price for her own store brand under the MS structure because the competing national brand price is also higher in this case and chooses a high price under the RDS as she has more power under this scenario compared to the RS. It is not clear though, from these price comparisons, that the store brand provides the retailers with a concrete mark-up incentive to become leaders. However, we can reach this conclusion by com paring the profits, which lead us to the last proposition. PROPOSITION 7. Every thing else remaining the same, each channel member obtains higher profits by being the Stackelberg leader rather than playing a VN game. Two competing retailers also benefit from a Stackelberg leadership at the horizontal level. In contrast, consumers are better-off when there is no channel leadership and worse-off when the national brand manufacturer leads the channel. The manufacturer profits are the highest under the MS case followed in order by the VN, RS, and RDS cases VN RS RDS ( MS ), M M M M whereas the retailers profits present the reverse order VN MS ( RDS RS Ri Ri Ri Ri , i 1,2 ). These results are expected, as the leader has informational advantage (knows the followers' reaction functions) and exploits it in his/her pricing strategy. In addition, it is confirmed once again that the two competing retailers are better-off when there is price leadership between them as they benefit from higher retail margins for the national brand and store brands compared to the RS case. Thus, horizontal price leadership at the retail level would be the best pricing strategy not only for the price leader but also for the price follower when they dominate the national brand manufacturer. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X Globally, and as expected, the total channel profits ( x mx Rx1 Rx 2 ) are maximized when there is no channel leadership. In addition, the two retailer Stackelberg cases (RS and RDS) produce larger channel profits than the MS case ( VN RS RDS MS ). CONCLUSION This paper presents a general analytical framework that helps better understand the nature of price competition between national and store brands in presence of store competition. In fact, we consider both intra-store competition between national brand and store brands and inter-store competition between two stores. In addition, we consider various price leadership structures among the channel members, namely simultaneous interactions à la BertrandNash and sequential à la Stackelberg both at the vertical and horizontal levels of the channel. Some of the results are intuitively appealing: A channel member benefits by playing the Stackelberg leader at the expense of the other channel member(s) who become follower(s) as opposed to consumers who benefit of lower retail prices when there is no Stackelberg price leader in the market. Demand levels for store brands increase as the cross price sensitivity between the national brand and store brands increases. More competition between retailers’ stores results in lower retail margins for national and store brands, increasing the demand levels of both products despite a higher wholesale price for national brands. Accordingly, only the national brand manufacturer benefits from more store competition by increasing his profits. The retailers' base level of store brand demand has a positive impact on both the wholesale price and the retail margins. Its impacts on the quantities demanded of the store brand at the equilibrium are positive. On the national brand, demand impacts are negative, resulting in lower profits for the manufacturer. Some other results provide new insights: OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X The two competing retailers benefit from price leadership at the retail level regardless of their roles (leader or follower). The retail prices of the national brand and store brands under the MS case are always higher than those of the two retailer Stackelberg cases. The total channel profits increase as the retailers have more price leadership than the national brand manufacturer. They are also higher under the RS compared to the RDS leadership. These findings are insightful for practitioners in many perspectives. First, powerful store brand retailers need to seek price leadership between them as it would increase their profits in presence of store competition. As such, a store brand retailer should not fear her competitor (second retailer) as long they dominate over the manufacturer. Second, each store should develop a unique positioning strategy to differentiate from the competitors as it helps in increasing the retailer’s profits. Finally, the retailers should offer a store brand that is a close substitute to the national brand in order to guarantee a high level of demand. This result was also compatible with Sayman et al. (1995) who found, in a different channel structure, that closer positioning of a store brand to the leading national brand is the optimal strategy in a different channel structure. Combined, the last two managerial implications suggest that to be more successful, each retailer needs to differentiate her store more from that of her competitor and less her store brand from the national brand by providing relatively homogeneous brands in the store. To conclude, this study can be extended in many directions. For instance, one can consider more than one manufacturer in the channel; introduce more asymmetry between the retailers (for example, different base levels of demand); allow for different positioning of the retailers vis-à-vis the manufacturer by using different product differentiation parameters between the national brands and store brands; consider nonlinear demand functions; and/or consider more strategic variables other than the price such as advertising, quality and promotions. REFERENCES Basuroy, S., M. K. Mantrala, R. G. Walters. 2001. The impact of category management on retailer prices and performance: Theory and evidence. J. Marketing. 65 16-32. Bresnahan, T. F. 1989. Industries and market power. Handbook of Industrial Organization, North-Holland, Amsterdam, The Netherlands. Choi, S. 1996. Price competition in a duopoly common retailer channel. J .Retailing. 72(2) 117-134. Choi, S., A. T. Coughlan. 2006. Private label positioning: Quality versus feature differentiation from the national brand. J. Retailing. 82(2) 79-93. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X Connor, J., E. Peterson. 1992. Market structure determinants of national brand-private label price difference of manufactured food products. J. Industrial Econom. 40 157-171 Cotterill R., B. Putsis, R. Dhar. 2000. Assessing the competitive interaction between private labels and national brands. J. Bus. 73(1) 109-137. Dhar, T. P., S. Ray. 2004. Understanding dynamic retail competition through the analysis of strategic price response using time series techniques. Working paper, University of British Columbia, Vancouver, Canada. Du, R., E. Lee, R. Staelin. 2004. Focus, fill the gap, attack, or stimulate: Retail category management strategies with a store brand. Working paper, Duke University, Durham, NC. Hoch, S. 1996. How should national brands think about private labels? Sloan Management Rev. 37(2). 89-102. Hoch, S., S. Banerjee. 1993. When do private labels succeed? Sloan Management Rev. 34(4) 57-67. Kim, N., P. M Parker. 1999. Collusive conduct in private label markets. Internat. J. Research Marketing. 16 143-155. Lee, E, R. Staelin. 1997. Vertical strategic interaction: Implications for channel pricing strategy. Marketing Sci. 16(3) 185-207. McMaster, Derek. 1987. Own brands and the cookware market. Eur. J. Marketing. 1(21) 83-94. Narasimhan, C., R. Wilcox. 1998. Private labels and the channel relationship: A cross-category analysis. J. Bus. 71(4) 573-600. Raju, J., S. Dhar, R. Sethuraman. 1995. The introduction and performance of store brands. Management Sci. 41(6) 957-978. Sayman, S., S. J. Hoch, J. S. Raju. 2002. Positioning of store brands. Marketing Sci. 21(4) 378-397. Shugan, S. M., A. P. Jeuland. 1988. Competitive pricing behavior in distribution systems. Issues in Pricing: Theory and Research. Heath Lexington Books, Lexington, MA; 219-237. Trivedi, Minakshi. 1998. Distribution channels: An extension of exclusive relationship. Management Sci. 44(7) 896-909. Twining, D. W. 2005. PLMA's 2005 Private Label Yearbook. New York, NY. Tyagi, R. K. 2005. Do strategic conclusions depend on how price is defined in models of distribution channels? J. Marketing Res. 42(2) 228-232. Vilcassim, N. J., V. Kadiyali, P. K. Chintagunta. 1999. Investigating dynamic multifirm market interactions in price and advertising. Management Sci. 45(4) 499-518. OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X APPENDIX Table 1 Equilibrium Outcomes (a) The MS case wm mi 2 1 4 2 2 2 1 3 4 2 4 2 2 4 2 32 1 2 3 4 4 5 2 28 2 2 2 2 3 4 3 4 3 4 2 1 4 8 2 2 2 4 2 2 2 2 2 4 7 4 2 3 3 2 2 2 1 8 3 2 3 6 2 24 2 5 32 4 5 9 4 7 5 2 28 2 5 6 2 4 20 24 2 16 6 2 1 1 6 2 8 2 1 M wm q1 m q2 m Ri mi qim pi qi ... i 2 4 4 6 4 8 4 2 3 1 2 1 8 3 4 1, 2 OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 2 2 2 3 2 4 2 32 28 2 5 2 2 20 24 4 4 6 24 4 2 4 4 1 2 1 3 20 2 1 wm mi 4 2 qi 2 3 4 3 pi qim 4 1 2 2 2 3 p im 6 6 2 2 2 1 2 2 6 2 1 1 4 5 18 5 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X (b) The VN case wm mi p im pi qim 2 1 6 9 4 3 2 9 6 1 2 1 4 4 3 2 4 2 2 6 M wm q1 m q2 m Ri mi qim pi qi ... i 6 6 1 2 9 4 2 4 2 9 4 1 2 3 2 4 3 2 9 2 2 4 8 3 2 2 4 3 2 4 4 3 2 4 4 4 3 2 1 2 2 3 2 1 2 2 6 3 qi 3 2 4 4 6 2 3 2 1 wm mi 3 2 3 2 4 4 2 6 4 1 2 9 1 2 1 4 3 2 4 1, 2 OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 4 9 4 4 2 1 2 9 4 2 2 1 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X (c) The RS case wm mi p im pi qim 6 8 2 1 10 8 2 15 5 5 2 4 8 2 9 4 10 8 5 2 4 4 2 2 2 4 1 M wm q1 m q2 m Ri mi qim pi qi ... i 2 1 15 8 2 10 4 1 10 1, 2 OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 15 20 7 4 8 4 8 5 2 4 8 2 38 1 3 9 2 4 5 2 4 7 8 8 2 2 6 2 5 8 12 15 10 8 21 10 2 6 8 8 4 1 4 15 2 1 8 4 2 10 3 1 8 7 5 5 2 1 10 12 5 2 4 8 14 2 4 5 2 4 8 4 6 2 5 2 1 wm mi 5 9 10 4 2 5 qi 2 2 4 5 2 4 20 3 2 2 2 2 2 6 6 15 12 15 8 7 8 1 2 4 2 1 25 4 11 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X (d) The RDS case wm 2 121 656 2 504 2 2 5 3993 128 8712 8 51 6 8 1 2 2 256 3 3 29 2325 16 1683 2 5 4 3 304 24 2 10 4853 128 3 12 1089 2 3233 2112 3 2 4072 312 13039 2 998 2 51 188 3 912 16 2 287 2 532 11863 3213 4032 4 3 64 8062 3 2 3424 2 208 3 13 5 16 15972 3672 2 5800 7623 3 77 32 3 193 71 2 3389 3 4 22 2 87 1936 288 6680 1088 6 76 20 937 39638 3 424 6732 2 8 439 144 2 10893 2 3800 918 14506 32 3008 2 8831 2 287 166 2411 888 722 29437 2912 3 76 6400 768 3 3 1364 m1 80 2 4 41 120 3 2 5 3728 3760 6 4 51 16 1938 pim 28 4 3264 2 24 2 2 2 1683 m2 51 6 16 10 2 2 34 wm mi ... i 776 463 3 3 188 912 3 1 2 32 2 80 96 2 5 328 51 4 2 3622 4 2550 210 3 2 4 2 1076 357 37 749 572 12 2 99 40 6191 4572 5546 4918 2 51 4072 2 4853 4 7310 4103 1692 1519 17 4 4 48 5 2 1 20 17 4 8 208 2 64 3 5 2 3 3213 8062 70 3389 2 3672 6680 5800 2 1088 3 4 17 4 24 7 2 2 129 2 4 51 100 32 2 4 51 1 8 8 424 3 918 6732 14506 68 2 8831 2 73 2 2 221 2912 2 3008 1364 3 3 42 88 2 354 768 3 214 3 408 170 524 200 163 96 2 1, 2 p1 208 2 4 51 188 2 2 102 7 4 26 204 25 4 3 4 3 41 2 2 64 3 51 6 16 20 80 2 19 74 3 416 996 9 8 5 2 1 16 3 16 2 34 80 OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 77 7 2 5052 8311 32 2 17 288 4 8 5 1057 4916 8 32 3 1 8703 2 4 82 3 1 2 51 10 3 100 28 2 6 816 4 102 19 44 32 2 2 8 2 8 2 19 156 47 2 5 3 45 221 354 1911 2558 2 142 88 2 5238 6578 2846 7040 3 408 524 4623 10675 96 2 6th Global Conference on Business & Economics ISBN : 0-9742114-6-X p2 2 17 40 2 16 2 34 4 9 17 4 4 3 2 4 1 8 23 2 8 2 1 6 17 85 204 451 2 34 80 2 2 32 3 17 80 17 4 14 2 1 2 2 8 8 4 34 5 7 51 100 2 32 187 262 2 2 88 2 221 354 3 408 524 96 2 q1 m 82 240 4 160 2 4 328 8 7 q2 m 123 8 2 20 3 2 55 14 12 16 3 21 2 129 88 4 16 34 80 2 6 3 2 2 4 4 3 246 5 150 7 14 9 2 32 11 8 4 17 2 2 72 35 81 14 2 8 8 4 2 2 533 16 2 29 9 51 100 32 2 2 2 221 354 2 88 2 535 56 3 408 524 96 2 1 4 1 q1 16 2 8 17 40 4 2 8 81 272 16 1 q2 5 4 3 41 2 1 2 8 27 68 208 498 4 34 80 32 2 17 4 8 8 4 3 10 24 226 675 2 7 1 16 1 M wm q1 m q2 m Ri mi qim pi qi ... i 6 8 1 2 1 4 3 2 4 OCTOBER 15-17, 2006 GUTMAN CONFERENCE CENTER, USA 2 27 476 5 32 32 2 51 100 2 3 1, 2 4 2 3 351 1700 30 71 48 4 8 2 2 2 9 4 2 1 10 68 960 2 2 221 354 3 2 2 4 2 4 2 45 142 1 1 6 9 8 2 1 88 2 15 60 4 4 3 2 151 622 81 646 96 2 408 524 2 8 23 4 2 16 77 1 170 1111