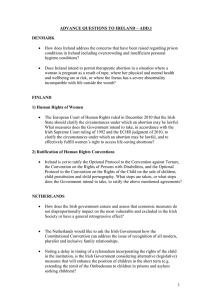

View the presentation delivered by David McNair

advertisement

Tax Justice: The impact of global tax policy on developing countries and the role Ireland can play. David McNair Sheila Killian, Maria Collison, Fintan Bradshaw and Mark Cumming “An effective, efficient, transparent and accountable system for mobilizing public resources and managing their use by Governments is essential.” 2 “We will step up efforts to enhance tax revenues through modernized tax systems, more efficient tax collection, broadening the tax base and effectively combating tax evasion...While each country is responsible for its tax system, it is important to support national efforts in these areas by strengthening technical assistance and enhancing international cooperation and participation in addressing international tax matters...” 3 1)Tax competition and the downward pressure on states to reduce the tax burden. 1)How mechanisms set up to facilitate international capital mobility and foster investment can be abused. 1)Estimates of the impact on developing countries. 1)What can we in Ireland do? 4 “It is a contradiction to support increased development assistance yet turn a blind eye to actions by multinationals and others that undermine the tax base of a developing country.” Trevor Manuel, Former South African Finance Minister 5 Total capital flow from nonEU countries into the EU and US: €850.1 billion Lost Revenue: billion €279 Revenue lost by worlds 49 poorest countries: 2.6 billion 6 Total capital flow non-EU countries into Ireland: €5.8 billion Capital flow from world's 49 poorest countries into Ireland: €268 million Irish Aid budget 2008: €899 million 7 1) Irish Aid could support its programme countries in raising revenue through training and technical assistance for tax authorities. 1)The Irish Government could support international calls for including developing countries in any new agreements on tax cooperation. 1)Irish NGOs could work to build a global movement of civil society organisations demanding that developing countries raise their own revenue in an accountable and transparent way. 8