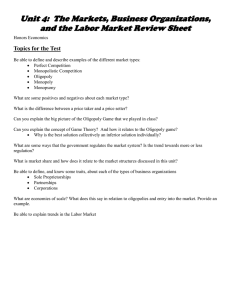

click here for Powerpoint presentation

advertisement

Superstar Firms in

International Trade

J. Peter Neary

University of Oxford and CEPR

12 September 2011

1. Introduction

“Two and a Half Theories of Trade”:

1.0: Perfect Competition: Comparative Advantage

2.0: Monopolistic Competition: Product Differentiation and Increasing Returns

2.5: Oligopoly

Despite growing empirical evidence: large firms matter for trade

• The “2nd Wave” of micro data on firms & trade

• 1st wave (1995-): Exporting firms are exceptional:

• Larger, older, more productive, pay higher wages, do more R&D

• 2nd wave: Even within exporters, large firms dominate:

[Bernard et al. (JEP 2007), Mayer and Ottaviano (2007)]

• Distribution of exporters is bimodal

• The firms that matter (for most questions) are different: larger, multi-product,

multi-destination

• Possible to model this using a Pareto distribution with high dispersion

• “Granularity”: Gabaix (2005), di Giovanni and Levchenko (2009)

• I prefer to try “putting the grains into granularity”

2

Bernard et al. (JEP 2007):

• Data on U.S. exporting firms 2000

• By # of products & export destinations

1 product,

1 destination only:

40.4% of firms

5+ products:

& 5+ dests.:

25.9% of firms

11.9% of firms

0.20% of export value

98.0% of export value

92.2% of export value

7.0% of employment

83.3% of employment

68.8% of employment

3

1. Introduction (cont.)

Why does oligopoly give only half a theory of trade?

In I.O. it gets equal billing: “Two faces”

1. Take-home messages less than overwhelming?

– Cross-hauling of identical goods [Brander JIE 1980] ...

• Empirically important?

Friberg-Ganslandt (JIE 2006)

– Competition effect of trade [Brander] ...

• Also in monopolistic competition if s is variable

Krugman (JIE 1999), Behrens-Murata (JET 2007), Melitz-Ottaviano (REStud 2008)

– Strategic trade policy [Brander-Spencer JIE 1984] ...

• Non-robust to assumptions about factor mobility and firm behaviour

Dixit-Grossman (1986), Eaton-Grossman (1986)

4

1. Introduction (cont.)

2. Not embedded in general equilibrium?

– This can be done: General Oligopolistic Equilibrium [“GOLE”]

Neary (JEEA 2003, REStud 2007), Bastos and Krieckemeier (JIE 2009), Grossman and Rossi-Hansberg (QJE 2010), Bastos and

Straume (2010)

–

–

–

–

Trade with oligopoly interesting because there is less of it, not more

Competition effects and comparative advantage interact: profit share may rise

Suggests an explanation for non-price effects of foreign competition on wages

Allows consideration of effects of trade on market structure itself

Neary (2002, RIE 2002, REStud 2007)

3. Hard to combine with entry and exit?

– Here: Some potential approaches

•

•

•

Based on work in progress with Carsten Eckel and with Kevin Roberts

… combining oligopoly with entry

… and with heterogeneous firms

5

Plan

1.

2.

3.

4.

5.

6.

Introduction

Oligopoly plus Free Entry

Heterogeneous Industries

Natural Oligopoly

Superstar Firms

Conclusion

6

Plan

1.

2.

3.

4.

5.

6.

Introduction

Oligopoly plus Free Entry

Heterogeneous Industries

Natural Oligopoly

Superstar Firms

Conclusion

7

2. Oligopoly plus Free Entry

The “Integer Problem”:

• Ignoring it comes close to assuming monopolistic or perfect competition:

–

–

–

•

•

•

Brander and Krugman (1983): Trade liberalization cannot lower welfare

Markusen and Venables (1988): No role for strategic trade policy

Head, Mayer and Ries (2002): No home-market effect.

Taking account of it is hard

Or is it?

Promising approach: impose restrictions on profit functions:

–

Bergstrom-Varian (REStud 1985): Profits depend on own costs and average of all firms’

e.g., Cournot with identical goods

–

Acemoglu-Jensen (CEPR WP 2009): “Aggregative games”: Profits depend on own costs

and a generalised mean of all firms’:

e.g., Cournot or Bertrand with CES differentiated products

i [ci , (c), n]

Proposition:

• The number of firms in any heterogeneous-firm free-entry equilibrium of

an aggregative game is the same as the integer number of firms in the

corresponding “lean” homogeneous-firm non-integer equilibrium.

8

3. Oligopoly plus Free Entry (cont.)

Heterogeneous-firm equilibrium in an aggregative game:

(i) Firms’ costs a random draw:

ci drawn from g(ci) with positive support over [c,)

(ii) Incumbents do not make losses:

[ci , {c ( n ) }, n] 0 i 1, ... n

(iii) A new “lean” entrant would make a loss: [c, {c( n) , c}, n 1] 0

Symmetric equilibrium:

s (c, n) [c, (c), n]

i.e., assume own effect dominates cross effect

Lean symmetric equilibrium:

s (c, n) 0 and s (c, n 1) 0

Non-integer lean symmetric equilibrium:

s (c, n) 0

Proposition:

• The number of firms in any free-entry equilibrium of an aggregative game

is the same as the integer number of firms in the non-integer lean

symmetric equilibrium

9

Example: The Linear Cournot Model

i ( p ci ) xi f

p a s 1 X

•

Solution in symmetric (homogeneous-firm) case:

ac

x

s

n 1

ac

1 2

s x f

s f

n 1

2

10

Cournot Competition: Equilibrium n as a Function of Market Size

10.00

Real

9.00

8.00

7.00

6.00

n

5.00

4.00

3.00

2.00

1.00

0.00

0.0

1.0

2.0

3.0

4.0

5.0

6.0

s

11

Cournot Competition: Equilibrium n as a Function of Market Size

10.00

Real

9.00

Integer

8.00

7.00

6.00

n

5.00

4.00

3.00

2.00

1.00

0.00

0.0

1.0

2.0

3.0

4.0

5.0

6.0

s

12

Plan

1.

2.

3.

4.

5.

6.

Introduction

Oligopoly plus Free Entry

Heterogeneous Industries

Natural Oligopoly

Superstar Firms

Conclusion

13

3. Heterogeneous Industries

Firm heterogeneity in monopolistic competition:

[Melitz (Em 2003)]

• Firms pay a sunk cost to reveal their unit cost

Draw c from g(c) with positive support over [c , )

• Given c, they calculate their expected profits and choose to produce or exit

Exit if c < ce where (ce) = 0

or r(ce) = f .

• If exporting requires an additional fixed cost, only low-cost firms will

engage in it

Extend to a continuum of industries/sectors:

• Firms draw a unit cost and a sector: {c, z}

• Sectors differ in their fixed costs: f(z), f ´ > 0

• In equilibrium, sectors have different expected firm numbers

14

Monopolistic Competition

n

16

8

Oligopoly

4

2

Monopoly

1

0

z

1

Equilibrium Expected Market Structure

(Vertical scale is ln2n)

15

Plan

1.

2.

3.

4.

5.

6.

Introduction

Oligopoly plus Free Entry

Heterogeneous Industries

Natural Oligopoly

Superstar Firms

Conclusion

16

4. Natural Oligopoly

So far: Fixed costs exogenous

Now, allow them to be chosen endogenously

Dasgupta-Stiglitz (EJ 1980), Gabszewicz-Thisse (JET 1980), Shaked-Sutton (Em 1983), Sutton (1991, 1998)

Free entry condition:

[Equilibrium operating profits a reduced-form function of firm numbers and market size]

(n,s) = 0

Define: Market-Size Elasticity of Market Structure:

E

s

s dn

s

n ds

n n

• Stability requires n < 0 for given s

• Presumption (?) that s > 0

So, E presumptively positive?

•

•

•

Clearly so in simple entry games: Cournot, Bertrand

Not necessarily positive in multi-stage games

“Natural Oligopoly” the case where E 0

17

Example: The Linear-Quadratic R&D+Cournot Case

i ( p ci ) xi 12 ki2 f

p a s 1 X

•

•

•

ci ci 0 ki

Investments are unfriendly

Hence, E can be very small or negative.

Solution in symmetric non-strategic case:

a c0

x

s and

n 1 s

2

k x

[“Relative efficiency of R&D” for a unit market size]

1

1

2

2 s

1

s x 2 k f

(

a

c

)

s f

0

2

( n 1 s )

1 2

2

18

Equilibrium Real n as a Function of Market Size

10.00

0.0

9.00

0.2

8.00

0.4

7.00

0.6

0.8

6.00

1.0

5.00

n

1.2

1.4

4.00

1.6

3.00

1.8

2.00

2.0

1.00

0.00

0.0

1.0

2.0

3.0

4.0

5.0

6.0

s

19

Equilibrium Integer n as a Function of Market Size

10

0.0

9

0.2

8

0.4

7

0.6

0.8

6

1.0

5

n

1.2

1.4

4

1.6

3

1.8

2

2.0

1

0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

s

20

Plan

1.

2.

3.

4.

5.

6.

Introduction

Oligopoly plus Free Entry

Heterogeneous Industries

Natural Oligopoly

Superstar Firms

Conclusion

21

5. Superstar Firms

Distribution of ex ante identical firms:

Stage 1: Pay a fixed cost f to discover their unit cost c

Stage 2: Choose to either:

• Remain as a “small” firm ; or:

• Pay a further cost fL to invest (in capacity/R&D/technology adoption/

product range) and become a “large” firm

Stage 3: Competition in quantities or prices:

• Strategic competition between large firms

•

…… facing a (monopolistically) competitive fringe

22

G(c): Cumulative distribution of unit costs

G(c)

Crucial assumption:

G '( c ) 0

G(c)

c

(fL )

Threshold for acquisition of

(f )

c

Threshold for entry

“superstar” technology

Entry condition for “superstar” firms? Same as Section 2 only!

23

5. Superstar Firms (cont.)

So far: Advantage of “large firms” unspecified

One important case: Large firms produce a continuum of products

–

–

Consistent with earlier empirical evidence

Solves a technical problem: large firms are of finite, small ones of zero measure

Different approaches to modelling multi-product firms:

(1) I.O.: Products few and/or fixed; product line / quality competition.

(2) Symmetric demands and costs

Allanson and Montagna (IJIO 2005), Feenstra and Ma (2009), Nocke and Yeaple (2006)

(3) Stochastic market-specific costs

Bernard, Redding and Schott (AER 2009)

(4) “Flexible manufacturing”

Eckel and Neary (REStud 2010)

Empirical evidence favours (4):

Arkolakis-Muendler (2010)

•

(2) predicts equal sales of all varieties - rejected

•

(3) predicts sales ranks uncorrelated across markets - rejected

But (2) is more tractable!

–

Work in progress: Extend model of oligopoly with multi-product firms to allow for

entry by “small” firms

24

ci

Product Range

“Core Competence”

i

Flexible Manufacturing

25

x 0

x i

p0

pi

ci t

c0 t

“Core Competence”

i

Output, Price, and Cost Profiles

26

Intra-Firm Effects of Globalization

“Leaner and Meaner”:

•More Competition: Scope falls

•Larger Market: Scale rises

xi

i

Outputs rise

27

Outputs fall

Plan

1.

2.

3.

4.

5.

6.

Introduction

Oligopoly plus Free Entry

Heterogeneous Industries

Natural Oligopoly

Superstar Firms

Conclusion

28

6. Conclusion

A road-map, not a model; hopefully with implications for:

1. Theory:

•

•

Reconcile the “Two faces of IO”

Large firms matter for more than just reciprocal dumping

2. Policy:

•

•

•

•

Hosting superstar firms, or not, may matter?

Fostering entrepreneurship / entry?

Competition policy in general equilibrium

Trade liberalization in oligopoly

3. Empirics:

•

•

•

Firm level data: Good news and bad

Errors at the top more costly

Ideally, think of the industry at the world level

29

6. Conclusion (cont.)

Summary:

• Time for Trade Theory 3.0 ...

• Payoff to looking at the grains in granularity

30

Thank you!

31

1. Introduction

Inspiration: The Krugman Oral Tradition!

1.0: Perfect Competition: Comparative Advantage

2.0: Monopolistic Competition: Product Differentiation and

Increasing Returns

2.5: Oligopoly

32

2. How Many Theories of Trade?

Perfect versus Monopolistic Competition?

Perfect and/or Monopolistic Competition?

• Similar assumptions

• Similar implications with constant s : e.g., gravity equations

• Both imply production efficiency, so can be represented by a GDP function:

Dixit-Norman (1980)

– Dixit and Stiglitz (1977), Helpman (1984), Feenstra and Kee (JIE 2008)

Anyway: 2 full-fledged theories

So, why not trade with oligopoly too?

In I.O. it gets equal billing: “Two faces”

33

2. How Many Theories of Trade? (cont.)

Why does oligopoly give only half a theory of trade?

• Take-home messages less than overwhelming?

– Cross-hauling of identical goods ...

• Empirically important?

Friberg-Ganslandt (JIE 2006)

– Competition effect of trade ...

• Also in monopolistic competition if s is variable

Krugman (JIE 1999), Behrens-Murata (JET 2007), Melitz-Ottaviano (REStud 2008)

– Strategic trade policy ...

• Non-robust to assumptions about factor mobility and firm behaviour

Dixit-Grossman (1986), Eaton-Grossman (1986)

• Not embedded in general equilibrium?

– This can be done: General Oligopolistic Equilibrium [“GOLE”]

Neary (JEEA 2003)

–

–

–

–

Trade with oligopoly interesting because there is less of it, not more

Competition effects and comparative advantage interact: profit share may rise

Suggests an explanation for non-price effects of foreign competition on wages

Allows consideration of effects of trade on market structure itself

34

Neary (2002, RIE 2002, REStud 2007)

How Many Theories of Trade? (cont.)

One more reason why oligopoly matters for trade:

• Empirics: The “2nd Wave” of micro data on firms & trade

• 1st wave (1995-): Exporting firms are exceptional:

• Larger, more productive

• 2nd wave: Bernard et al. (JEP 2007): Even within exporters, big firms

dominate:

[Similar results for France: Mayer and Ottaviano (2007)]

• Distribution of exporters is bimodal:

–

–

–

40.4% of U.S. exporting firms in 2000 exported one product only; accounted for only 0.20% of export value

25.9% of U.S. exporting firms in 2000 exported 5 or more products; accounted for 98.0% of export value

11.9% of U.S. exporting firms in 2000 exported 5 + products to 5+ destinations; accounted for 92.2% of export value

• The firms that matter (for most questions) are different: larger, multiproduct, multi-destination

• Possible to model this using a Pareto distribution with high dispersion

• “Granularity”: Gabaix (2005), di Giovanni and Levchenko (2009)

• I prefer to try “putting the grains into granularity”

35

How Many Theories of Trade? (cont.)

One more theoretical hurdle to be crossed:

• How to combine oligopoly with entry and exit?

• Here: Some potential approaches

– Based on work in progress with Carsten Eckel and with Kevin Roberts

–

… combining oligopoly with entry

–

… and with heterogeneous firms

36

3. Oligopoly plus Free Entry (cont.)

For given market size s, assume profits of firm i depend on own costs ci, on the

average of rivals’ costs c–i, and on n:

[Bergstrom-Varian REStud 1985]

i = (ci , c–i , n)

–

+

–

In symmetric equilibrium:

s(c,n) (c, c, n)

– –

i.e., assume own effect dominates cross effect

Start with symmetric case:

• We can characterise the admissible range of c and n:

(1) s(c,n) 0

[Incumbents do not make losses]

(2) s(c,n1) < 0

[A new entrant would make a loss]

37

(1) s(c,n) 0

n

(2) s(c,n1) < 0

[Incumbents do not make losses]

[A new entrant would make a loss]

n* is the maximum equilibrium number of firms;

BUT: A real number, not necessarily an integer

n*

ne

n*–1

s(c,n) = 0

s(c,n1) = 0

c

c

So: “Lean” symmetric equilibrium has:

ne = int (n*–1, n*]

38

So far: Only “lean” symmetric equilibria;

Now, consider symmetric equilibria with less efficient firms:

n

(c, c, n 1) 0

[A new lean entrant would make a loss]

(c, c, n 1) 0

n*

ne

n*–1

s(c,n) = 0

s(c,n+1) =0

c

c

c

So: Shaded area is the admissible region for equilibrium n in symmetric equilibria

Actual equilibrum values are on the horizontal line corresponding to the integer value:

ne = int (n*–1, n*]

c [c, c ]

39

Finally: Consider asymmetric equilibria:

•

Start with simplest case: monopoly vs. duopoly

•

•

Assume there is a monopoly equilibrium:

“Lean outsider” condition:

•

Consider a candidate duopoly equilibrium with:

cm [c, c ]

(c, cm ,2) 0

c1 c2 c

(c1, c2 ,2) (c2 , c2 ,2)

(c, c,2)

(c, cm ,2) 0

Proof can be extended to oligopoly and generalised mean [n] case:

•

Assume an equilibrium with n–1 firms

•

Replace “2” by n, c2 by n, and cm by n–1 in above

•

Conclusion: There cannot be an equilibrium with n firms

So: Equilibrium integer n is a monotonic function of (e.g.) industry size

… and, if we know the population distribution of c, we can calculate the

distribution of c in free-entry oligopoly equilibrium

40

Possible Cost Configurations in Duopoly

[c 0]

(ii) Medium s

(i) Low s

(iii) High s

c2

c2

c1

c2

c1

(i) Only insider constraints bind

c1

(iii) Only lean outsider

constraint binds

(ii) Lean outsider constraint

binds in symmetric equilibria;

insider constraint in asymmetric ones

41

5. Natural Oligopoly (cont.)

With multi-stage competition:

(n, s) ˆ i (k i , K i ; n, s ) when: k j arg max k ˆ j j

j

dk

s ˆ (n 1)ˆ

ds

i

s

i

K

1 i

dk

i

i

ˆ kk (n 1)ˆ kK ˆ ks

ds

+?

Presumption that dk/ds is positive:

•

•

Seade stability condition

Increase in market size raises investment (?)

Hence, for natural oligopoly:

ˆ Ki 0

•

Necessary condition: investments are “unfriendly”:

•

•

More likely the more investment responds to market size

… which is more likely if investments are strategic complements:

i

ˆ kK

0

42

r i , r i

r i

r i

*

i

Sales Revenue Profiles in Home and (Larger) Foreign Market

43