How changes in consumer behaviour and retailing affect competence requirements for food

advertisement

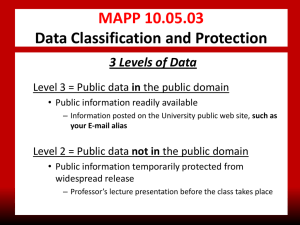

How changes in consumer behaviour and retailing affect competence requirements for food producers and processors Klaus G. Grunert MAPP - Centre for Research on Customer Relations in the Food Sector The Aarhus School of Business Denmark © MAPP Overview 1. Trends in consumer food choice and in food retailing 2. Implications for the attainment of sustainable competitive advantage and for competencies to be developed by food producers and processors 3. Implications for the organisation of the food chain © MAPP Dynamic, complex and heterogeneous consumer demands hedonistic attributes increasing importance of convenience attributes hedonistic + health attributes hedonistic + health + process attributes © MAPP Importance of quality dimensions of food 18 16 14 G-93 G-96 F-94 F-98 GB-94 GB-98 12 10 8 6 4 2 0 Taste Health Organic/naturalnes s © MAPP C onvenience Consumer food quality perception Dominated by experience and, increasingly, credence characteristics Increasingly multidimensional Perceived trade-offs and incompatibilities between dimensions Cultural differences Different consumer segments © MAPP Example of subjective trade-offs happinessand inner harmony quality of life long, healthy life look good enjoyment less healthiness healthiness wholesomeand natural product good quality and taste high fat content © MAPP Example of cultural differences 1,2 1 0,8 0,6 0,4 0,2 0 -0,2 -0,4 -0,6 -0,8 Denmark Finland USA not enriched omega-3 © MAPP oligosaccharides Example of segments 2,0 F.UI D.CO UK.CO UK.UI 1,5 F.CO 1,0 DK.CO D.RA ,5 F.MO UK.RA D.UI F.RA 0,0 UK.CA DK.UI DK.TE -,5 D.CA F.HE -1,0 D.AD DK.EC DK.IM DK.AD UK.AD -1,5 -2,0 -2,5 -2,0 -1,5 -1,0 -,5 0,0 © MAPP ,5 1,0 1,5 2,0 Food retailing: What does the private label trend mean? Finland France Volume Value Spain Netherlands Germany Belgium UK Switzerland 0 10 20 30 40 © MAPP 50 60 70 The private label trend Changes in channel dominance A higher proportion of value creation An increased emphasis on positioning in the mind of the consumer © MAPP Quality of product Fish Relative imp ortance in % 13 Product price 8 Consistency 6 Market information Traceability 6 Sufficient quantities Promotion 16 Wide range 5 Long-term relationships Reputation 17 National/ foreign 10 11 2 6 Average part worths Average -.84 -.10 (vector) Average -.34 No -.34 No -.65 No -.93 Average -.10 Average -.30 No -1.02 Average -.37 Foreign without sales office -.63 Above average .15 Premium .69 Cheese Relative imp ortance in % 12 10 Superior .34 Yes .34 Yes .65 Yes .93 Superior .10 Superior .30 Yes 1.02 Superior .37 Foreign with sales office -.05 6 6 12 17 3 5 18 6 National .58 © MAPP 7 Average part worths Average -.74 -.11 (vector) Average -.34 No -.33 No -.66 No -.95 Average -.16 Average -.30 No -1.02 Average -.35 Foreign without sales office -.44 Above average .13 Superior .34 Yes .33 Yes .66 Yes .95 Superior .16 Superior .30 Yes 1.02 Superior .35 Foreign with sales office .09 Premium .61 National .35 Changing criteria for retailers‘ choice of suppliers More emphasis on own branding function implies responsibility for product development, quality control, market communication Importance of product-specific consumer knowledge © MAPP Implications for the attainment of competitive advantage Complex, difficult to imitate competencies Lower relative costs Competitive advantage Superior customer value © MAPP Implications for the attainment of competitive advantage Dynamic, complex and heterogeneous consumer demands create new opportunities for creating superior customer value... …but also increase the likelihood for failure Retailers‘ urge to have a larger share of overall value creation in the food chain puts producers under pressure… …but opens up possibilities for creating superior customer value in cooperation with retailers © MAPP Market-related competencies Relative costs Perceived value Productionrelated competencies Marketrelated competencies © MAPP Market orientation as a key success factor “ Market orientation is the organisationwide generation of market intelligence, pertaining to current and future customer needs, dissemination of the intelligence across departments, and organisation-wide responsiveness to it” © MAPP Market orientation as a key success factor Market orientation implies the understanding of buyers, both at the retail and the consumer level Market orientation implies the development of market-related competencies Market orientation allows the development of more value-added products Market orientation establishes customer relationships Market orientation increases increases switching costs for customers and imitation lags for competitors © MAPP Deficit index 1.46 1.37 1.37 1.30 1.30 1.28 1.26 1.20 1.19 1.19 1.17 1.15 1.13 1.11 1.11 1.09 1.07 1.02 1.00 0.98 0.94 0.89 0.83 0.80 0.80 0.78 0.78 0.76 0.66 0.61 0.57 0.57 0.54 0.52 0.39 0.31 0.15 0.02 -.39 Competence elements Following up on marketing activities Benchmarking Training and education of sales force Systematic and continuous surveillance of suppliers CompanyΥs brand image Marketing competence, having a marketing department Fast dissemination of information about competitors or customers Ability to develop products with a high degree of newness Logistics management Ability to develop good product concepts Emphasize communication with selected partners (relationship management) Systematic and continuous surveillance of comp etitors Ability to reduce development time Achieve balance between quality and costs Improve processes and activities (BPR) Ability to achieve cost reductions Ability to exploit economies of scale Use information on customers and competitors in strategic planning Cross-functional co-operation in product development Collecting information on consumers Planning and executing promotional activities with external partners Culture that promotes the achievement of goals Strategic planning Analyses of customer satisfaction with own and competing products Customer knowledge of sales force Cross-functional co-operation on changes in p roducts and services CompanyΥs image Promotional activities Managing the sales force Quality control systems Co-operation with external partners in product development Target marketing to specific customer segments Reacting to changes in customer demands in a satisfactory way Fast response to customer wants concerning changes in p roducts and services Regular meetings to discuss market developments Co-ordination of production processes Ability to commu nicate visions and values by internal marketing © MAPP Management of suppliers Insight into changes in direct customersΤ needs and wants Three market-related key competencies Understanding consumers Development of new products Managing relationships © MAPP Understanding consumers Understanding the formation of consumer preferences Concentration instead of spreading in the selection of markets A core competence: To be developed in-house © MAPP Development of new products High failure rates Comprehensive research on key success factors in new product development provides guidelines for Management and organisatio of NPD Market orientation of NPD Contingent development of physical product and communication © MAPP Managing relationships Downstream: joint value creation with retailers, becoming an indispensable partner Upstream: The higher up in the value chain differentiation and adding value occurs, the higher the need for traceability, segregation and information flow from end users Changing governance structures for food chains © MAPP Matching raw material characteristics and end user demands End- user heteroge neity Low Low High Little need for MOC MOC ma inly downstream Raw-material heterogeneity High Info rmation flow MOC im portant throughout cha in, throughout cha in responsivenes s to end use r needs mainly up stream © MAPP The orange juice example heterogeneity Farm homogeneity FOJC industry heterogeneity bottler © MAPP retailer consumer Major messages Changes in consumer food choice create new possibilities for gaining competitive advantage by differentiated, value-added products Exploiting these possibilities requires marketoriented competencies, especially consumer understanding and new product development These competencies are complex, difficult to imitate, and develop slowly © MAPP Major messages Changes in food retailing create new opportunities for long-term partnerships with food retailers Exploiting these opportunities requires competencies in managing relationships as well as competencies in developing differentiated, value-added products An increased emphasis on differentiated, value-added food products will have to change the governance structure of the food chain © MAPP http://www.mapp.asb.dk © MAPP