Exam 3 Review Sheet 14_02_ACC_255_Review_Sheet_Exam_3.doc

advertisement

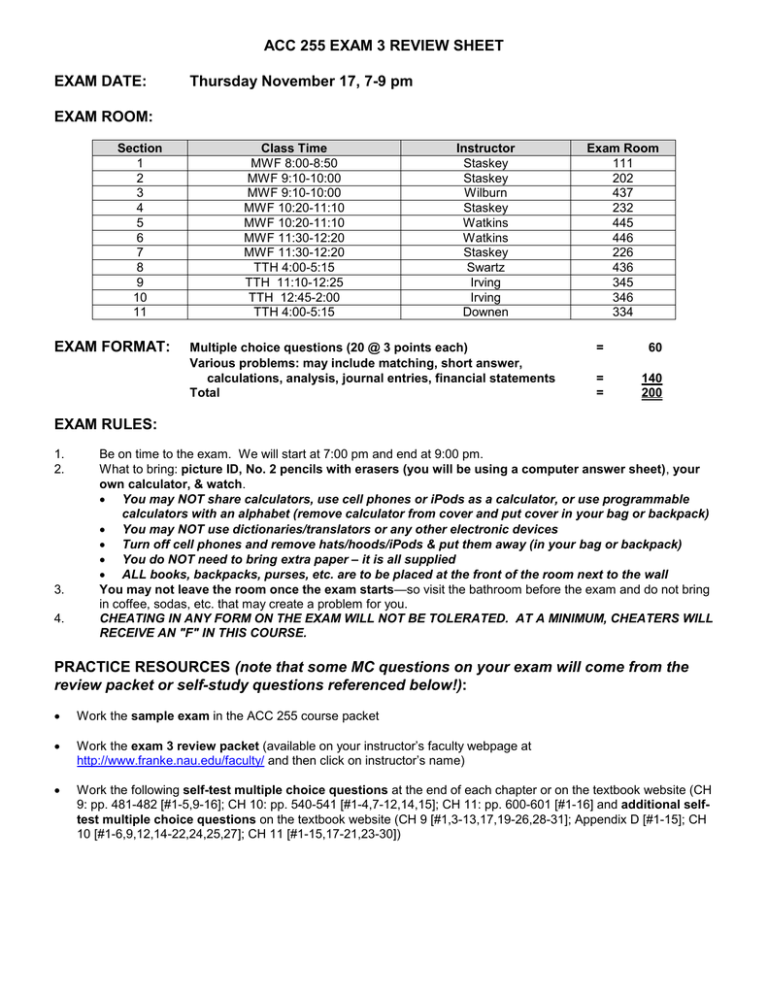

ACC 255 EXAM 3 REVIEW SHEET EXAM DATE: Thursday November 17, 7-9 pm EXAM ROOM: Section 1 2 3 4 5 6 7 8 9 10 11 EXAM FORMAT: Class Time MWF 8:00-8:50 MWF 9:10-10:00 MWF 9:10-10:00 MWF 10:20-11:10 MWF 10:20-11:10 MWF 11:30-12:20 MWF 11:30-12:20 TTH 4:00-5:15 TTH 11:10-12:25 TTH 12:45-2:00 TTH 4:00-5:15 Instructor Staskey Staskey Wilburn Staskey Watkins Watkins Staskey Swartz Irving Irving Downen Multiple choice questions (20 @ 3 points each) Various problems: may include matching, short answer, calculations, analysis, journal entries, financial statements Total Exam Room 111 202 437 232 445 446 226 436 345 346 334 = 60 = = 140 200 EXAM RULES: 1. 2. 3. 4. Be on time to the exam. We will start at 7:00 pm and end at 9:00 pm. What to bring: picture ID, No. 2 pencils with erasers (you will be using a computer answer sheet), your own calculator, & watch. You may NOT share calculators, use cell phones or iPods as a calculator, or use programmable calculators with an alphabet (remove calculator from cover and put cover in your bag or backpack) You may NOT use dictionaries/translators or any other electronic devices Turn off cell phones and remove hats/hoods/iPods & put them away (in your bag or backpack) You do NOT need to bring extra paper – it is all supplied ALL books, backpacks, purses, etc. are to be placed at the front of the room next to the wall You may not leave the room once the exam starts—so visit the bathroom before the exam and do not bring in coffee, sodas, etc. that may create a problem for you. CHEATING IN ANY FORM ON THE EXAM WILL NOT BE TOLERATED. AT A MINIMUM, CHEATERS WILL RECEIVE AN "F" IN THIS COURSE. PRACTICE RESOURCES (note that some MC questions on your exam will come from the review packet or self-study questions referenced below!): Work the sample exam in the ACC 255 course packet Work the exam 3 review packet (available on your instructor’s faculty webpage at http://www.franke.nau.edu/faculty/ and then click on instructor’s name) Work the following self-test multiple choice questions at the end of each chapter or on the textbook website (CH 9: pp. 481-482 [#1-5,9-16]; CH 10: pp. 540-541 [#1-4,7-12,14,15]; CH 11: pp. 600-601 [#1-16] and additional selftest multiple choice questions on the textbook website (CH 9 [#1,3-13,17,19-26,28-31]; Appendix D [#1-15]; CH 10 [#1-6,9,12,14-22,24,25,27]; CH 11 [#1-15,17-21,23-30]) WHAT TO REVIEW AT A MINIMUM! (you are responsible for all study objectives listed in your syllabus/course packet for each chapter!) Important notes: you will be provided with time value of money tables; you will also be provided with formulas for the computation & notation of ratios FOR ALL CHAPTERS: know all the concepts & terminology pertaining to all learning objectives covered in each chapter (at the end of each chapter, there is a list with all important terms defined) AND be able to THINK! (that is, you must be able to apply your knowledge to situations you have not encountered before -- if you simply "memorize" the material, you will be in trouble!) CHAPTER 9 (1) Identify items included in acquisition cost of long-lived assets & prepare JE to record; distinguish between capital and revenue expenditures (2) Explain the concept of depreciation; calculate annual depreciation, accumulated depreciation, and book value using different methods: (a) straight-line, (b) units-of-activity, and (c) double-declining balance; prepare AJE to record annual depreciation; prepare balance sheet presentation of PP&E (3) Account for disposal of long-lived assets, including calculation of gain or loss and preparation of disposal JE (4) Account for intangible assets: prepare JE to record acquisition; distinguish which intangibles are amortized versus not; prepare JE to record amortization if appropriate (and compute amount); compute book value and prepare balance sheet presentation for intangibles (5) Compute and interpret ratios to analyze a company’s profitability (return on assets, asset turnover, and profit margin); describe the relationship of profit margin and asset turnover to determine ROA. APPENDIX D (1) Compute future value of single sum or annuity. (2) Compute present value of single sum or annuity. (3) Apply concepts to solve various time value of money problems, including calculation of an annuity amount, interest rate, number of periods (must understand use of FV & PV tables & formulas). (4) Compute present value (i.e., selling price) of bonds. CHAPTER 10 (1) Define current liability and identify major types of current liabilities. (2) Prepare JEs for notes payable to record (a) issuance of note, (b) accrual of interest (be able to calculate interest), and (c) payment of note. (1) For bonds payable, (a) identify types of bonds, (b) know how selling prices of bonds are quoted and whether results in a premium or discount based on the relationship between the contractual interest rate and market interest rate; (c) prepare JEs to record issuance of bond at face, premium, or discount; periodic interest payments for bond issued at face; and redemption of bond at maturity date; (d) prepare balance sheet presentation of bonds. (4) Compute and interpret ratios to analyze a company’s liquidity and solvency (current ratio, debt to total assets ratio, and times interest earned ratio). (5) Define contingent liability and identify when it should be recorded. CHAPTER 11 (1) Identify (a) major characteristics of a corporation and its advantages & disadvantages, (b) rights and characteristics of preferred & common stock, and (c) authorized, issued, and outstanding shares of stock-be able to calculate the number of shares issued and outstanding. (2) Prepare JEs to record stock issuance for cash when stock is a par value, stated value, or no-par stock. (3) Prepare JEs for the repurchase of stock (i.e., treasury stock). (4) Prepare stockholders' equity section of balance sheet, including disclosure of retained earnings restrictions; (identify which accounts represent paid-in capital). (5) Account for cash dividends, including calculation of dividend amount for preferred stock and for common stock, and preparation of JEs at (a) declaration date, (b) record date, and (c) payment date. (6) Compute the effect of stock dividends on stockholders’ equity accounts. (7) Account for stock splits: calculate new number of shares & new par value per share; know effect on stockholders' equity and balance sheet. (8) Compute and interpret ratios to analyze a company’s dividends and earnings performance (payout ratio, return on common stockholders’ equity); describe factors in a company’s debt versus equity decision.