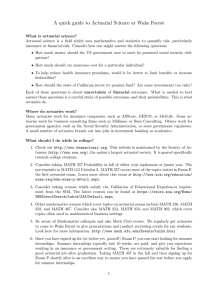

Vabilo SAD november 2013.doc

advertisement

S lo v e n s k o a k tu a r s k o d r u š tv o Železna c. 14, 1000 Ljubljana, Slovenija Davčna številka: 17081068 Številka računa: 02038-0055144937 Spoštovani! Vljudno vas vabimo, da se udeležite strokovnega seminarja Slovenskega aktuarskega društva z naslovom Aktualne teme s področja obvladovanja tveganj , ki bo potekal 6. in 7. novembra 2013 v M- hotelu, Derčeva ul. 4, Ljubljana. Na seminarju bodo predavali priznani tuji in domači gosti: Maximilian Strasser, Andrew Smith, Daniel Matić, Antoine Esquieu, Vincent Dupriez, Andrej Blejec in Aleš Tomažin. Predavanja bodo v angleščini. Obravnavali bomo modeliranje naravnih katastrof, težavnost modeliranja tveganj in ocenjevanje napak v modelih, življenjska zavarovanja v spremenjenem ekonomskozakonodajnem okolju, seveda pa tudi aktualne vsebine iz Solventnosti 2 in novosti s področja računovodskih standardov (IFRS 4 faza 2). Že prvi dan je predvidena tudi praktična delavnica, kjer bomo imeli priložnost teorijo utrditi skozi praktične primere, zato udeležence prosimo, da imajo prvi dan s sabo prenosne računalnike z Excelom. Kotizacija za udeležbo na seminarju je za člane Slovenskega aktuarskega društva 350 EUR (za ostale 400 EUR) in vključuje kosilo ter pogostitev v odmorih. Vljudno vas vabimo, da se seminarja udeležite v čim večjem številu. Udeležba na seminarju šteje za 50 točk formalnega PSI. Prosim, da udeležbo potrdite na elektronskem naslovu društva: info@actuaries.si s pripisom: »za orga-team Seminar« najpozneje do 30. 10. 2013. Prosim, da ob prijavi navedete tudi, kdo bo plačnik, in v primeru, da je plačnik podjetje, navedete tudi davčno številko podjetja. Po izvedbi seminarja Vam bomo poslali račun. Ljubljana, 14. oktober 2013 Upravni odbor SAD S lo v e n s k o a k tu a r s k o d r u š tv o Železna c. 14, 1000 Ljubljana, Slovenija Davčna številka: 17081068 URNIK: Sreda 06.11.2013 Čas Naslov predavanja 8.30 – 9.00 Prijava, čaj / kava 9.00 – 11.00 Predavatelj Uvod v tehnično ozadje modeliranja katastrof (z odmorom) 11.00 – 11.15 Odmor 11.15 – 12.45 Težavnost modeliranja tveganj - 1. del Maximilian Strasser Andrew Smith 12.45 – 13.45 Kosilo 13.45 – 14.45 Težavnost modeliranja tveganj - 2. del 14.45 – 15.00 Odmor Spremembe v okolju življenjskih zavarovanj - izzivi in 15.00 – 17.00 reakcije (z odmorom) Andrew Smith Daniel Matić Četrtek 07.11.2013 Čas Naslov predavanja Predavatelj 8.30 – 9.00 Čaj / kava 9.00 – 10.30 IFRS 4 faza 2: poudarki zadnjega osnutka standarda Antoine Esquieu 10.30 – 10.50 Odmor 10.50 – 12.20 Tržna optimizacija Solventnosti 2: Kako izkoristiti Solventnost 2 pri razvoju novih produktov Vincent Dupriez 12.20 – 13.50 Kosilo 13.50 – 14.50 Statistika (je) za vsakogar Andrej Blejec 14.50 – 15.10 Odmor 15.10 – 16.10 Pet faz človeškega razvoja Aleš Tomažin 16.10 – 16.30 Razprava in zaključek 2 S lo v e n s k o a k tu a r s k o d r u š tv o Železna c. 14, 1000 Ljubljana, Slovenija Davčna številka: 17081068 ABSTRACTS: Technical introduction to the development of cat models – Maximilian Strasser Using Slovenian model developments as case studies the session aims at providing an in depth understanding of probabilistic cat models. Addressing the need for cat models, requirements on the input data side and discussing typical cat model output, the talk will provide a good overview on why and how we use cat models today. Probabilistic models will also shortly be reviewed in the light of Solvency II. The main part of the lecture will lead the audience through critical components of a probabilistic cat model development combined with Q&A. Difficult to model Risks – Andrew Smith The presentation includes work with practical examples. More about the talk is available on http://www.actuaries.org.uk/events/one-day/sessional-research-event-extreme-events-workingparty-paper-0. Errors in Proxy Models The talk will present modelling issues: the construction of the proxy model of bonds, annuities, term assurance and investment guarantees, model fitting, methods available to help deciding for the appropriate model, simulation issues and analysis of the results. Model and Parameter Errors The second part will cover introduction to several model and data issues that are important for the analysis of model and parameter error and resulting implications for capital charges for these risks. It will conclude explaining the appropriate communication of statistical test results. Change in insurance climate – challenges and reactions – Daniel Matić In the presentation the following topics will be covered: Markets in “traditional run-off” Recent developments in product Innovation Capital Management in volatile times FLAOR IFRS 4 phase 2 : main features of the new exposure draft – Antoine Esquieu 10 years after the « Draft Statement Of Principles » of the IFRS standard applicable to insurance reserves, the IASB has published the “Exposure Draft” of the standard at summer 2013. This project of standard follows the previous version that had been published in 2010, and withdrawn following the reactions of the market. If the main principles remain unchanged, some significant evolutions have been introduced. This presentation addresses the key points of the Exposure Draft, the main evolutions compared to the previous version and a comparison to latest Solvency II principles. Solvency II Commercial Optimisation : How to benefit from Solvency II Maximasing returns and minimising volatility – Vincent Dupriez Solvency II is likely to come into force the 1rst of January 2016. There are some key commercial consideration that companies should deal with. Current product design and pricing methodology is unlikely to be appropriate going forward. There is a danger that metrics will slip during the transition and whilst products are developed. The overall capital employed by the business will change and could be volatile. It is possible, without mitigating action that this will reduce returns below stated targets. Some portfolios or entities could have onerous requirements under SII or hybrid capital may 3 S lo v e n s k o a k tu a r s k o d r u š tv o Železna c. 14, 1000 Ljubljana, Slovenija Davčna številka: 17081068 need replacing. It will be important to mitigate these needs, and avoid capital raising at a time when others may be, or that would surprise the market. There is uncertainty around the volatility of the balance sheet in different scenarios, where this can be predicted, action should be taken to reduce. Also, optimising diversification can improve the competitive position. There may be short term opportunities as a result of transition rules which can be used to reduce capital requirements. Etc. What should I do now? What are my competitors doing? When will there be sufficient certainty to take particular actions? The presentation will explore some considerations around choice of return metrics, group structuring, ALM/investment strategy, external risk transfer and sale/purchase of business units, capital review and product design. Statistics (is) for Everybody – Andrej Blejec Statistics (or better said, statistical reasoning) is part of everyday life, and yet it is not among the popular experiences for those who encounter statistics in formal education. In this lecture we will show that there is a place for statistical reasoning. Some important statistical concepts and methods, used to describe phenomena around us, will be put into everyday perspective. Five phases of human enterprise – Aleš Tomažin The story of Human Enterprise, over centuries, is the story of instinctive desire to survive and prevail. The evolution of human enterprise went through four phases and as we analyse this evolutionary process, we shall see the early signs of emergence of the new phase - Phase Five. SHORT CVs: Maximillian Strasser 2001: Graduation with Diploma in Geophysics 2001-2002: Scientific assistant at the seismological observatory on ICE, Tilaran Costa Rica 2002-2006: Risk Analyst at GE Frankona Re, Munich, Germany 2006 – today: Senior Vice President at Guy Carpenter GC Analytics. Member of the in the Global model Development Team, located in Munich Germany Tasks: Project manager for developments of probabilistic catastrophe models, scenario and underwriting tool development, assessment of commercial models (RMS, AIR, EQE) Recent project activities: Italy Flood model development (2013), pan European hail model development (2014) Andrew Smith is a partner at Deloitte. He is well known internationally for his portfolio of groundbreaking client assignments and extensive published research in the actuarial field. He graduated from Cambridge University in 1990, with a first class degree in mathematics. Since joining Deloitte, Andrew has consulted with many clients in diverse areas. For many years Andrew has been at the forefront of developing stochastic investment models for use in asset-liability modelling and pricing. Andrew has published many papers in insurance, pensions and financial matters. In 1996 he won the Institute of Actuaries' prize for his paper "How Actuaries can use Financial Economics", another prize in 2002 for his joint paper “Corporate Bond Models”, and a further prize for his joint 2004 paper “The Cost of Capital for Financial Firms”. His 2001 methodology for constructing risk-free yield curves has been adopted for the published yield curves under Solvency II. His joint paper “Why financial firms can charge for diversifiable risk” won a Casualty Actuarial Society prize in 2003 and underpins much of current thinking on risk margins. In 2008, the Institute of Actuaries awarded Andrew a Finlaison 4 S lo v e n s k o a k tu a r s k o d r u š tv o Železna c. 14, 1000 Ljubljana, Slovenija Davčna številka: 17081068 Medal, in recognition of Andrew’s contribution to actuarial science, also awarding a prize for his joint paper “The Modelling of Extreme Market Events”. He is a spirited critic of actuarial mumbo jumbo, and is well-known for his ruthless debunking of financial myths. He is frequently quoted in the press, and is widely respected as an entertaining and informative conference speaker. Daniel Matić joined Towers Watson in 2008. He covers a broad range of actuarial areas including evaluation of life insurance companies, Solvency II and capital management. Before joining Towers Watson, Daniel has worked 6 years for Allianz SE in Group Actuarial and L&H reinsurance where he gained deep understanding of Reinsurance and actuarial controlling with strong focus on the CEE. Daniel received a Master's degree in mathematics (Diplom-Wirtschaftsmathematiker) from the University of Bielefeld in 2002 and is a qualified German Actuary (Aktuar DAV) and a member of the German Actuarial Association (DGVM). Antoine Esquieu is partner within Mazars. He is responsible for the Paris audit insurance audit department. He has more than fifteen year experience in the insurance business as legal auditor and actuary. He is the engagement partner of several insurance and reinsurance clients, in Life and NonLife, among which Scor and Axa Assistance. Vincent Dupriez is a partner at EY Actuarial Services practice and has over 14 years of experience in Insurance. He joined EY in July 2010 and is based in the Paris Office. He is a Qualified fellow of the French Institute of Actuaries, a graduate of Ecole Normale Supérieure of Lyon and of Centre d’Etudes Actuarielles. He is deputy chairman of the Internal models working group of the European Consultative Actuarial Group. He works with a large number of insurance companies on various issues such as MCEV, Solvency 2 (pillar 1, ORSA, ...), Actuarial function restructuring, IFRS 4 phase 2. Andrej Blejec is a full professor of statistics at University of Ljubljana (BF, Department of Biology) and senior researcher at National Institute of Biology, where he works as a researcher and consultant for application of statistics in biology. With several decades of experiences in teaching statistics and use of statistical development platform R, he is known as an expert for data visualizations and computer animations for understanding of statistical methods. For actuaries, he teached several introducing courses of R. He is elected member of International Statistical Institute, president elect of International Association for Statistics Education and president of Statistical Society of Slovenia. Aleš Tomažin holds a Master in actuarial science and Master in information management science both from Faculty of Economics from Ljubljana. From 2009 he is Chief Actuary at Maribor insurance company. He is a member of Slovenian actuarial association; from 2007 to 2010 and from 2013 he led the Technical board of association. 5