II A. Basic concepts: functions and duality.

advertisement

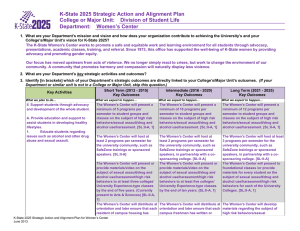

II-A

II. General equilibrium

approaches—theory

A. Analytical tools: producers, consumers, markets and trade

B. Geo metric models of trade and env ironment

- What are we measuring? Environmental and welfare outcomes

C. Comparative static result s and standa rd theo rems

D. Sim ple models of trade and env ir onmental poli cy

- Environmental and welfare costs of trade poli cies.

Sour ces:

* OEE Chap ter 2, sections 2.3-2.5

* Buffi e 2001 , Ch. 2 (or equivalent cove rage of ana lytical tools )

Ulph 1999

1

II-A

A. Analytical tools

•

•

•

•

•

Producer’s problem

Consumer’s problem

Aggregate income and expenditure

Markets and trade

Distortions and non-traded goods

2

II-A

Producer’s problem

Maximiz e profits subject to resource endow ments v and techno logy.

Factor supplies are ‘fixed’ at the agg rega te leve l,

but can be all ocated across sectors producing the n goods.

Revenue ma ximi zation:

r(p, v) = maxy{py | (v,y feasible) }

= py*(p, v)

= Find revenue -maximi zing ou tput bund le, on su rface of PPF,

tangen tial t o price ratio.

3

II-A

Properties of r(p,v):

•

•

•

•

Inc reasing in p

Inc reasing in v

Homogeneous of degree 1 in p

Convex in p.

• If r() is twice differentiable then by enve lope theor em:

Žr/Žp = rp(p, v) = y(p, v)

(output vec tor)

Žr/Žv = rv(p, v) = w(p, v)

(shadow factor price vec tor).

and

4

II-A

Consumer’s problem

Maximiz e utilit y subject to a budg et constraint.

Can represent the consu mer's decision by a cost (expend it ure)

mi nimization p roblem

e(p, u) = mi nc{pc | u(c) •u}

= pc(p, u),

whe re c(p, u) is a vec tor of Hicksian (i.e. compensa ted) demand func tions .

Consumer will minimi ze exp. associated wit h a chieving target utilit y,

given initi al i nco me based on endo wments.

5

II-A

Properties of e(p,u): • Inc reasing in p

• Homogeneous of degree 1 in p

• Concave in p.

• If e() is twice differentiable then by enve lope theor em:

Že/Žp = ep(p, u) = c(p, u)

(cond iti ona l demand s for good s)

and

Že/Žu = money cost of an additional un it of utilit y, i.e. reciprocal

of marginal utilit y o f income.

NB Conditional expend it ure func tion: when some quan titi es (such as

poll ution) are pub li c goods (or bads), i. e. their quan titi es are exogenous

to consu mers.

6

II-A

Aggregate budget constraint

Consumer's budge t constraint is same pric e li ne faced by produce rs.

Ther efore, total income of produce rs equa ls total expend it ure by

consumers.

In equ ili brium,

r(p, v) = e(p, u)

Total inco me from produc tion is equa l to total expend it ure by consumers.

7

II-A

Equilibrium: Walras’ law

When agg rega te inco me and expend it ure are equa l, trade is also in ba lance

-- Define excess demand for each good as cj – yj = mj (ne t im ports)

-- Notice that mj > (<) 0 deno tes im port (expor t)).

-- Then if consumers on budge t cons traint, the sum o f all exce ss dds is

equa l t o zero, including exce ss dd for foreign cu rrency to buy im ports.

Setting e(p, u) = r(p, v), and subs tit uting:

j

pjcj j pjyj

p j j c j yj j p j mj 0

So in equili brium, wit h consu mers on budge t cons traints and firm s

maximi zing p rofits (i.e. on PPF), trade is also in balanc e, by Walr as' Law.

8

II-A

Equilibrium of a two-sector

economy

y2

p = p2/p1

y = (y1, y2)

m2

c = (c1, c2)

u

m1

y1

9

II-A

Trade expendi ture function

For the mod el just described, the agg rega te budge t cons traint,

e(p, u) = r(p, v)

contains all the information nece ssary to describe an equ ili brium.

We can a lso use it for comparative static ana lysis of the effects

of price, endow ment and techno logy shocks .

10

II-A

Trade policy distortions

•

E.g. trade policy.

•

•

•

Define tariff-distorted prices p* = p(1 + t).

TEF is now:

e(p*, u) = r(p*, v) + t•m

11

II-A

Externalities

•

E.g. env. externality in production

•

•

•

•

TEF is now:

e(p, u) = r(p, v) - z'y

where z is qty of pollution per unit of y

produced.

Env. externality in consumption:

u = u(c, z) ==> e(p, z, u)

•

NB assumption of separability.

12

II-A

Non-traded goods

•

Goods may be non-traded (or effectively so) for

intrinsic and policy reasons.

If one good is non-traded, for this, mn = 0.

•

•

•

•

•

•

Equilibrium now requires additional equation:

e(p, u) = r(p, v)

en(p, u) = rn(p, v)

and solves for pn as well as agg. welfare.

With endog. prices, preferences play a role.

13

II-A

Salter-Swann diagram

T

RER = pN/pT

(yT, yN) = (cT, cN)

N

14

II-A

Effects of growth

T

N

15

II-A

Equilibrium: macro view

(A) Base model

Y = C + I + G + (X - M)

let C + I + G = E be agg. dom. spending; so

Y - E = X - M in equilibrium. Internal balance <==>

external balance

(B) With taxes and int’l capital flows

Y + R - T = C + I + G - T + (X + R - M)

let Y + R - T - C = S be agg. dom. savings; so

X + R - M = (S - I) + (T - G) in eq’m. Curr. acc.

surplus is equal to excess of savings over

investment plus gov’t budget surplus.

16

II-A

Summary

• Basic tools reflect our assumptions about

technology, preferences and behavior

• Representative agent models

• Focus of trade as determinant of price

formation

• Aggregate budget constraints impose

internal consistency

• Many forms of complication are possible.

17

II-A

Q & A: basic tools

18