II C: Comp statics and theorems

advertisement

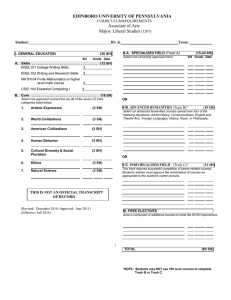

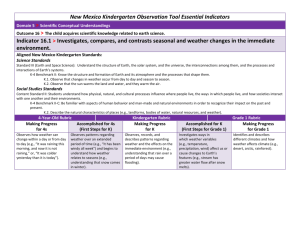

II-C Clean good UW UT A pT C B pW YT YW Dirt y good zA zC z=2()x Composition zB Scale zS Techn ique z=1()x Poll ution Sour ce: Adapted from Antweil er et al. 2001 1 II-C Welf are R – value of output C- utilit y from env ir onmental qua lit y Tariff 2 II-C Spot test! Q. In the previous example, what is the optimal tariff, and how is it calculated? A. Where absolute values of slopes of R and C are equal (marginal environmental benefit=marginal cost in terms of consumption) B. Q. What is the optimal tariff on imports of a dirty good? C. A. t = 0. 3 II-C II. General equilibrium approaches—theory A. Ana lytical tools : produce rs, consumers, markets and trade B. Geo metric models of trade and env ironment - What are we measuring? Environmental and welfare outcomes C. Compara tive static results and standard theorems D. Sim ple models of trade and env ir onmental poli cy - Environmental and welfare costs of trade poli cies. 4 II-C Trade expendi ture function For the mod el just described, the agg rega te budge t cons traint, e(p, u) = r(p, v) contains all the information nece ssary to describe an equ ili brium. We can a lso use it for comparative static ana lysis of the effects of price, endow ment and techno logy shocks . 5 II-C Comp. statics with TEF Method: take total differential of TEF. e(p, u) = r(p, v) eudu + epdp = rpdp + rvdv Rearrange, noting that ep – rp = net imports: eudu = –(ep – rp)dp + rvdv -- LHS is a money-metric of welfare -- RHS captures effects of price and endowment changes 6 II-C Details • Welfare measure: eu = ∂e/∂u is the reciprocal of ∂u/∂y, the marginal utility of income. So eudu = dy, a money-metric of welfare change. • Welfare effects of terms-of-trade shocks: • Sign depends on whether goods are net imports or exports. • Welfare effects of endowment growth: • Recall that ∂r/∂v = w, the shadow factor price. 7 II-C Extensions • Policies, e.g. trade policy • Externalities • Non-traded goods 8 II-C Trade policy distortion (tariff) • • • Suppose 2 goods, exports (x) and imports (m). Let px = 1 and q = pm + t (= tariff) Adding tariff revenues to income: • • e(1, q, u) = r(1,q) + t(em – rm) Then by differentiation (using dq = dt), dy = t(emm - rmm)dt < 0 • where = (1- tem) > 0. A tariff increase reduces welfare. • • 9 II-C Spot test! In this model, a tariff clearly reduces welfare. What effect does it have on the sectoral structure of production? How do we know? The tariff raises output in the protected sector, and reduces it in the other sector. Check 2nd derivatives of revenue function, using homogeneity property. 10 II-C Externalities • E.g. env. externality in production • • • TEF is now: • e(p, u) = r(p, v) - z'y where z is qty of pollution per unit of y produced. Env. externality in consumption: • • u = u(c, z) ==> e(p, z, u) NB assumption of separability. 11 II-C Non-traded goods • • • Goods may be non-traded (or effectively so) for intrinsic and policy reasons. If one good is non-traded, for this, mn = 0. Equilibrium now requires additional equation: e(p, u) = r(p, v) en(p, u) = rn(p, v) and solves for pn as well as agg. welfare. With endogenous prices, preferences play a role in economic structure. 12 II-C Salter-Swann diagram T RER = pN/pT (yT, yN) = (cT, cN) N 13 II-C Effects of growth with nontraded good T Income exp. path N 14 II-C Two fundamental GE results • Distributional effects of a price change: the Stolper-Samuelson theorem • Production effects of a factor endowment change: the Rybczinski theorem • Assume: – Two factors of production, two products, so yj = yj(x1, x2), for j = 1,2 – Complete and competitive markets, CRTS. – Prices are ‘given’ in world markets. 15 II-C A useful tool: ‘hat’ calculus Rules. For all variables x, a and b, Leve ls x = ab Proportiona l change s xˆ aˆ bˆ x=a +b xˆ x=a –b xˆ aˆ bˆ x = kab xˆ aˆ bˆ a b ˆa bˆ x x 16 II-C Effects of a price change By CRTS, pjyj = w1x1j + w2x2j fo r all j = 1,2 Divide both sides by yj to obtain pj = w1a1j + w2a2j, whe re aij = xij/yj is unit i nput requireme nt. Totally differentiate this expre ssion to obtain dpj = a1j dw1 + a2jdw2 for all j = 1,2 Convert to proportiona l change s: pˆ 1 11wˆ 1 21wˆ 2 pˆ 2 12 wˆ1 22 wˆ 2 whe re ij wi xij / pj y j , 1 j 2 j 1. 17 II-C Choose p2 as numeraire price, so pˆ 2 0 . Now solve as a system o f equa tions to obtain: 21 ˆw1 22 ˆp1 ˆ and w2 pˆ1 whe re = 1122 - 1221 = 22 – 21. If comm odit y 1 is intensive in factor 1, then : ˆ 1 ˆp1 22 0 w Moreove r, since 1j + 2j = 1, we have Thus : and ˆ 2 ˆp1 0 w ˆ 1 ˆp1 1 . w ˆ 1 pˆ1 ˆp2 0 w ˆ2 w 18 II-C Stolper-Samuelson theorem A rise in one commodity price raises the real return to the factor used intensively in producing that commodity, and reduces the real return to the other factor. 19 II-C Applications of S-S • Effects of trade shocks or trade policy reforms on the returns to factors – For environmental analysis: changes in factor returns indicate incentives for exploitation or investment • Ex.1: If forests are open-access, a ‘shock’ that raises returns to timber may increase harvests • Ex. 2: raising returns to agriculture may promote soil-conserving investments 20 II-C Effects of endowment growth Each factor endow ment vi is full y e mployed in the two sectors, so: vi y1ai1 y2ai 2, where aij x ij / yj Find the effect of a change in vi on yj. - Define proportiona l changes in va riables: vˆi = dvi/vi, etc. - Then for each input vi: whe re ij are employment shares. vˆi i1 ˆy1 i 2 yˆ2 Equi li brium sectoral ou tput changes a re given by solution to: 11 12ˆy1 vˆ1 yˆ ˆv 21 22 2 2 21 II-C For sim pli cit y le t vˆ2 0. Then : 22 ˆy1 vˆ1 and 21 ˆy2 ˆv1 whe re = 1122 2112. If > 0 (sector 1 is intensive in use of v1) then ˆy1 vˆ1 1 , and ˆy1 ˆv1 ˆv2 ˆy2 22 II-C Rybczinski Theorem At constant prices, expansion of one factor endowment raises output of the good that uses that factor intensively, and reduces that of the other good. If 2 factors expand, one good's output grows more slowly than the rate of growth of either factor. 23 II-C Implications of Ryb. result • Unequal rates of factor accumulation alter structure of production – Capital deepening causes labor-intensive or NR-intensive sectors to decline, other things equal • Thus investment in non-agricultural sectors may diminish pressures exerted on the natural resource base by primary industries. 24 II-C Discussion of fundamental results • The S-S and R theorems provide ‘core’ insights for any GE analysis. • They hold for 2X2 models; similar, but weaker predictions apply for higher-dimension models. • Both theorems break down in presence of externalities. • In practice, however, can use these predictions to check the credibility of predictions obtained from larger models. 25