FINA 252- Syllabus Semester 1-Year 2015-16.doc

advertisement

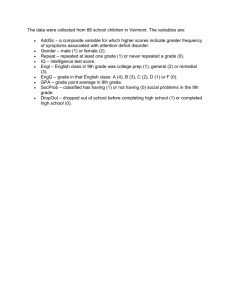

King Abdul Aziz University College of Business Department of Finance Course of Study Outline FINA252 Basics of Financial Management Semester 1, 2015-16 Version date (1 July, 2016) Course of Study Outline Course of study code FINA252 Course of study name Basics of Financial Management Teaching Term/Semester & Year Semester 1, 2015-16 Contact Hours (hrs/wk) or total contact hours Duration: 2 teaching days over 15 weeks Credit Points 3.000 Contact hours: 45 hours Teaching Staff Name Dr. Mazharul Islam Role Lecturer Room No. 7-214 Phone No. 0568543711 Email Address malislam@kau.edu.sa mazharulislam@yahoo.com Consultation Times Section Monday & Wednesday (9.30am to 10.50am) Course Description This is an introductory course in Financial Management. It is designed to elaborate the theory and practice of corporate finance. This course will build your understanding of basic financial theory and practices. You will address current financial management issues faced by business decision-makers and will build the essential analytical skills necessary for dealing with various financial issues. This course involves a careful overview of the finance field and will start by defining finance and the role of financial managers in terms of objectives and goals . Also, it will involve defining and understanding corporate governance and its implication on corporate world. It will then, cover the basic concept of time value of money and it is importance in the finance field in terms of decision making. Lastly, as one of the most important roles of the financial manager is to be able to use financial statements to analyse and project a firm`s financial performance, It will help to identify investment opportunities, thus increase shareholders wealth. Aims and Objectives The overall aim of the course is to provide students with the basic of financial management. Familiarize students to with the concept of finance and the role financial managers. Explain why the role of the financial manager today is so important. Be able to fully understand the concept of corporate world. Understand the concept of time value of money. Comprehend the tradeoff between risk and return and how investors will be tempted to take on extra risk to get greater return. Be able to identify the principals involved in managing a firm’s investment in working capital. Understand the relationship between present value and future value. Calculate both present value and future value. Be able to calculate the present & future value of mixed flows. Understand the difference between simple interest and compound interest. Be able to calculate the value of bonds. Define, calculate and categorize the major financial ratios (according to liquidity, financial leverage, coverage, activity and profitability) and understand what they can tell us about the firm. Understand the limitation of financial ratios. Be able to develop analytical and problem solving skills, skills and attitudes conducive to lifelong learning. Page 2 of 7 Content The following topics will be covered in the financial management course; The Role of Financial Management. Important concepts of Finance. Financial Statements, Taxes, and Cash Flow. The time value of money. Risk and Return. Financial Statement Analysis. Cash-Flow Analysis, and Financial Planning. Learning and Teaching Structure Teaching method: Lectures, Class exercise Students are expected to read lecture slides and complete homework before coming to class. In a Semester, you should normally expect to spend, on average, 6 hours of total time (formal contact time plus independent study time) a week on a 3 credit point unit of study. Resources and Reference Material 1. Ross/Westerfield/Jordan, Fundamentals of Corporate Finance, 9th edition, available at University Book Store or can buy online from amazon.com. Also any Edition can be used. 2. Students will need to have a Calculator 3. PowerPoint slides for each lecture, Test Bank, Solutions, and the Unit Outline will be available in my URL:http://www.kau.edu.sa/DRS-0061123.aspx) Material on the URL is updated several times each week. Students are required to check the site frequently to ensure that they have up-to-date information. Page 3 of 7 Date Week Lecture Topic 1 Contents - Define of financial management 24 & 26 August. 2015 - Financial management The Role of decisions Financial Management - Goal of financial management - Agency problems 2 Financial 31st August Statements, & 2nd Sept. Taxes, and 2015 Cash flow 3 - The balance sheet - The income statement - Taxes - Cash flow - Cash flow and financial statements 7&9 (Sept. 2015) Financial Statements and Longterm Financial Planning - Standardized financial statements - Ratio Analysis - The Du Pont Identity - Using financial statement information 4 - Define financial planning 14 & 16 (Sept. 2015) Financial Statements and Longterm Financial Planning 5 5&7 (October 2015) The Time Value of Money (October 2015) - Present value and discounting - More about present and future vales - Future and present values of multiple cash flows Discounted cash flow valuation - Annuities and perpetuities - Effective interest rate and Nominal interest rate. Assessment Chapter 1 (Ross/Westerfiel/Jordan -Fundamentals of corporate finance, 9th edition) Class attendance and participation Lecture note 1 Chapter 2 (Ross/Westerfiel/Jordan -Fundamentals of corporate finance, 9th edition) Class attendance and participation Lecture note 2 Chapter 3 (Ross/Westerfiel/Jordan -Fundamentals of corporate finance, 9th edition) Quiz-1 Lecture note 3 Chapter 4 (Ross/Westerfiel/Jordan -Fundamentals of - The percentage of sales corporate finance, 9th approach edition) - External financing and Lecture note 4 growth - Future value and compounding 6 12 & 14 - Financial planning models Reading Class attendance and participation Chapter 5 (Ross/Westerfiel/Jordan -Fundamentals of corporate finance, 9th edition) Class attendance and participation Lecture note 5 Chapter 6 (Ross/Westerfiel/Jordan -Fundamentals of corporate finance, 9th edition) Class attendance and participation Lecture note 6 Page 4 of 7 7 Chapter 7 19 & 21 (October 2015) - Bond and bond valuation Bond Valuation - Bond features - Bond rating (Ross/Westerfiel/Jorda n-Fundamentals of corporate finance, 9th edition) Mid-Term Exam Lecture note 7 8 26 & 28 (October 2015) Bond Valuation - Types of bond Chapter 7 - Bond Markets (Ross/Westerfiel/Jorda n-Fundamentals of corporate finance, 9th edition) - Inflation and interest rates - Determinants of bond yields 9 Class attendance and participation Lecture note 7 Chapter 8 2&4 Stock (Nov. 2015) Valuation - Common stock valuation - Features of common stock (Ross/Westerfiel/Jorda n-Fundamentals of corporate finance, 9th edition) Class attendance and participation Lecture note 8 10 Chapter 8 9 & 11 Stock (Nov. 2015) Valuation - Features of preferred stock - Stock markets - Review class (Ross/Westerfiel/Jorda n-Fundamentals of corporate finance, 9th edition) Class attendance and participation Lecture note 8 11 Chapter 16 Financial - Capital Structure leverage and - Capital Structure and (Nov. 2015) Capital cost of equity Structure 16 & 18 (Ross/Westerfiel/Jorda n-Fundamentals of corporate finance, 9th edition) Class attendance and participation Lecture note 9 12 Chapter 16 Financial - Optimal capital structure leverage and - Observed capital (Nov. 2015) Capital structure Structure 23 & 25 (Ross/Westerfiel/Jorda n-Fundamentals of corporate finance, 9th edition) Class attendance and participation Lecture note 9 13 30th Nov. & 2nd Dec. (2015) Practical exercise on financial statement analysis 14 7 & 9 (Dec. 2015) 15 14 & 16 Revision (Dec. 2015) Class Report writing on financial statement analysis All relevant chapters that will cover in the final exam Homework Submission Final Exam (date will be informed later) Page 5 of 7 Assessment a. Assessment Task Details: Assessment Task Individual/ Weighting Group Task Class participation Individual 10% Quizzes Individual 15% 2nd exam Individual 25% Homework Group 10% Final exam Individual 40% In order to successfully complete this unit, students must achieve at least 60% of the marks allocated to the all assessment tasks. Course Requirements & Policies You are expected to fulfil the following requirements of the course to obtain a grade: Participation/Attendance Attendance for face-to-face class is compulsory. Any student not attending a class should provide a medical certificate or a written justification (signed by a parent or guardian in the case of a full-time student). Students are required to participate actively in class discussion, exercises and other class activities. Students are expected to read the topics before coming to class to facilitate their understanding of the subjects and in the discussion. Class Assignments/Homework Each student is required to submit written assignment/homework of selected cases. These assignments must be done as a group. Assignments must be submitted on the specified date. If you perform poorly on an assignment, I will give you the opportunity to redo the work for a better grade (with a lower maximum). For any assignments/homework given, the format of the paper should be as follows: A cover page with your details – Name, Student ID and Sections Font Arial, size 11 with 1.5 spacing Include a reference page (if needed) for every assignment/homework that you submitted. Quizzes must be taken on the specified date. If you encounter any problem to take the quizzes on the specific date, you are required to sit for quiz within the next five days. Page 6 of 7 Final Result Categories Symbol % A+ 95-100 A B+ B C+ C D+ D 90-94 85-89 80-84 75-79 70-74 65-69 60-64 Page 7 of 7