English translation page in Word

advertisement

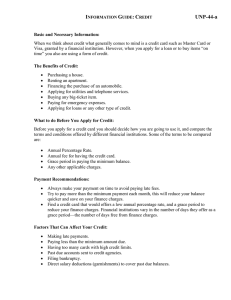

INFORMATION GUIDE: BANKING SERVICES UNP-46-a Basic Information on Banking Services: Money in the bank is one of the safest ways to keep and protect your possessions. Once cash is lost, it cannot be replaced. Commercial banks and other financial institutions offer a wide variety of services to the public. Advantages of Having a Bank Account: Protection and security for your money. Options to save or invest. Easy bill payment through a checking account. Direct Deposit/Electronic Fund Transfer. 24-hour access to ATM machines for withdrawals and/or payments using a debit card. Applying for loans. Tax payment and inheritance planning. Considerations Before Opening a Bank Account: Before you open a bank account, first decide what your priorities are based on your finances. For instance, do you want to save or just want to keep your money safe for monthly bill payments? Make sure the bank is federally insured, look for the logo FDIC (Federal Deposit Insurance Corporation). Do not forget to compare the different terms that various banks or financial institutions have to offer. As you shop for a bank account, consider the following: Personal Priority: A checking or savings account or both. Requirements: Minimum amount to open and maintain a checking/savings account. Interest: Earned on your account balance. Account Charges: Fees for written checks, debit card use, service charge (monthly fee for having the account), and any other services or problems that may arise. Other services: Direct deposit, automatic bill payment, link-up with a savings account, credit card, and services in Spanish. Convenience: Easy access and service hours to the public Personal Relations: Courtesy and special services for the physically challenged. How To Open a Bank Account: Two pieces of identification (ID) are required. One must be a picture ID. You will usually need a Social Security number to open a bank account (check with your bank). The minimum amount to open an account varies. You may open an account with $5, $10, $50, $100 or $500. You may use cash or a check to open an account (this depends on the bank). UNP-46-a Considerations Before Opening a Savings Account: Minimum amount you must keep in your account. Interest to be earned. What is the maximum amount of money you may withdraw and how often can you make withdrawals? Bear in mind that some financial institutions may charge a fee if you withdraw too frequently from your savings account. Any fees pertaining to the account. Fees for maintaining less that the minimum balance. Considerations of Lesser Importance Before Opening a Bank Account: Contrary to the past, today most people in this country are encouraged to open at least one bank account. However, it is important to keep in mind that there is certain information that is unnecessary when choosing the type of account and the bank. Do not pay attention to the following: Prestige: The bank’s “image” is unimportant, but the services that they offer are important. Advertisement: Commercials and promotional offers such as special gifts and other freebies are unimportant when you open an account. Interest Rate Calculation: The method of calculating the interest rate earned on your account is irrelevant. Juana I. Macias, Spanish Programming, Urban Affairs and New Nontraditional Programs, Alabama A&M University; Bernice B. Wilson, Extension Urban Specialist—Resource Management, Urban Affairs and New Nontraditional Programs, Alabama A&M University Reference to a company or product name does not imply approval or recommendation of the product by the Alabama Cooperative Extension System or the United States Department of Agriculture to the exclusion of others that may also be suitable. Issued in furtherance of Cooperative Extension work in agriculture and home economics, Acts of May 8 and June 30, 1914, and other related acts, in cooperation with the U.S. Department of Agriculture. The Alabama Cooperative Extension System (Alabama A&M University and Auburn University) offers educational programs, materials, and equal opportunity employment to all people without regard to race, color, national origin, religion, sex, age, veteran status, or disability. New, May 2002