English translation page in Word

advertisement

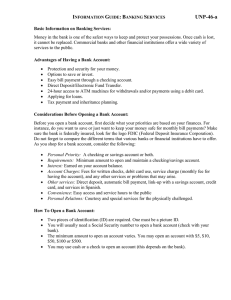

INFORMATION GUIDE: CREDIT UNP-44-a Basic and Necessary Information: When we think about credit what generally comes to mind is a credit card such as Master Card or Visa, granted by a financial institution. However, when you apply for a loan or to buy items “on time” you also are using a form of credit. The Benefits of Credit: Purchasing a house. Renting an apartment. Financing the purchase of an automobile. Applying for utilities and telephone services. Buying any big-ticket item. Paying for emergency expenses. Applying for loans or any other type of credit. What to do Before You Apply for Credit: Before you apply for a credit card you should decide how you are going to use it, and compare the terms and conditions offered by different financial institutions. Some of the terms to be compared are: Annual Percentage Rate. Annual fee for having the credit card. Grace period in paying the minimum balance. Any other applicable charges. Payment Recommendations: Always make your payment on time to avoid paying late fees. Try to pay more than the minimum payment each month, this will reduce your balance quicker and save on your finance charges. Find a credit card that would offers a low annual percentage rate, and a grace period to reduce your finance charges. Financial institutions vary in the number of days they offer as a grace period—the number of days free from finance charges. Factors That Can Affect Your Credit: Making late payments. Paying less than the minimum amount due. Having too many cards with high credit limits. Past due accounts sent to credit agencies. Filing bankruptcy. Direct salary deductions (garnishments) to cover past due balances. UNP-44-a Protecting Your Finances: Never lend your credit card to anyone. Do not leave your card unattended. Do not give your credit card number over the phone or Internet, unless you are certain they are a trustworthy company or business. Keep a copy of your credit card number, expiration date, and the telephone number and address of the financial institution that granted you the card in a safe place. Do not sign any blank receipts. Verify the right total amount of charges on the receipt to avoid additional charges to your card. Maintaining Good Credit: You may think that you will never need credit. However, nowadays having good credit is basic money management. Start by applying for a small loan at your local bank. This loan can be guaranteed by savings or having someone to co-sign for you. Apply for a credit card that will accommodate your needs. Open up credit with your favorite store or business. Use your credit card sparingly. Make payments on time. Maintain a perfect credit history and take advantage of the many benefits of having a credit card. Juana I. Macias, Spanish Programming, Urban Affairs and New Nontraditional Programs, Alabama A&M University; Bernice B. Wilson, Extension Urban Specialist—Resource Management, Urban Affairs and New Nontraditional Programs, Alabama A&M University Reference to a company or product name does not imply approval or recommendation of the product by the Alabama Cooperative Extension System or the United States Department of Agriculture to the exclusion of others that may also be suitable. Issued in furtherance of Cooperative Extension work in agriculture and home economics, Acts of May 8 and June 30, 1914, and other related acts, in cooperation with the U.S. Department of Agriculture. The Alabama Cooperative Extension System (Alabama A&M INFORMATION GUIDE: CREDIT UNP-44-a University and Auburn University) offers educational programs, materials, and equal opportunity employment to all people without regard to race, color, national origin, religion, sex, age, veteran status, or disability. New, May 2002