Scholarship Notes

You got accepted, so now what?

Have you celebrated like this?

Or have your parents done this?

"University of North Texas," "UNT," "Discover the power of ideas"

Work life Earnings

Education

Professional Degree

Doctorate

Master's Degree

Bachelor's Degree

Associate Degree

High School Diploma

Less than High School Diploma

Earnings (in millions of dollars)

$4.4

$3.4

$2.5

$2.1

$1.6

$1.2

$1.0

Earnings for full-time, year-round workers by educational attainment for work life of approximately 40 years. Source: U.S. Census Bureau.

•

College can be a financial burden for both parents and students.

•

However there are several options and opportunities to either get financial help or scholarships for college.

•

More than $132 billion in grants, work-study funds, and lowinterest loans were awarded by the federal government last year to help students afford college.

•

Nearly half of four-year students attend a college with a sticker price that is less than $9,936 a year — and thanks to financial aid, most of them pay even less than that.

•

The average student received little over $12,400 last year to help pay for college. More than

6 out of 10 college students receive some sort of financial aid.

Type of College

Public Two-Year College (in-state students)

Public Four-Year College (in-state students)

Public Four-Year College (out-of-state students)

Private Four-Year College

Average

Published

Yearly

Tuition and Fees

$2,690

$8,240

$20,770

$28,500

•

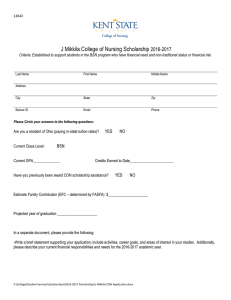

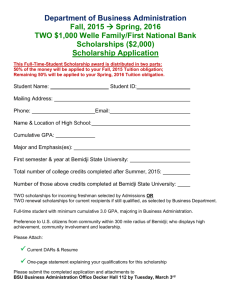

Scholarships given by colleges are the most common.

•

Check out your college(s) website to see what scholarships you may apply for.

•

Scholarships have requirements that students must achieve or upheld to obtain the scholarship.

•

Scholarships can also come from local sources:

•

Employer

•

Church

•

Clubs

•

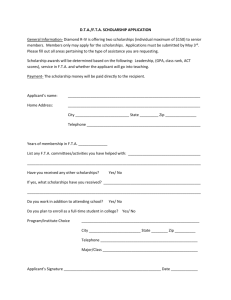

National Scholarships

(just a few of many)

•

National Merit Scholarship

Corporation

•

Gates Millennium Scholars

•

Intel Science Talent Search

•

Coca-Cola Scholars

Foundation

• https://bigfuture.collegeboard.

org/scholarship-search

•

This website is from College

Board online and allows you to see what scholarships fit you and your college dreams.

•

Most scholarships have deadlines so make sure you start the search a soon as possible.

•

In addition most scholarships need transcripts, essays, recommendations, etc.

–

Get organized and start you search today!

•

Financial aid is funding that is intended to help students pay for college.

–

Most financial aid is based not on your grades but on your families finances.

•

Family income

•

How may people live in your home

•

Medical expenses

•

Even if you believe you do not qualify for financial aid it does not hurt to fill out the form.

•

The financial aid form is called FAFSA and must be completed starting January

1

–

This form can help you get money from

•

federal and state student grants, work-study, and federal loans

•

Palmetto Fellows

•

Life Scholarships

•

Hope Scholarship

•

Lottery Tuition

Assistance

•

Requirements (you must meet all 3)

•

1200 SAT score or 27 ACT score

•

3.5 GPA

•

Top 6% of Sophomore,

Junior, or Senior class.

•

Money Received

•

$6,700/year

•

Must attend a 4 yr college in

South Carolina

•

Requirements (you need

2)

•

1100 SAT score or 24 ACT score

•

3.0 GPA

•

Top 30% of graduating class

•

Money Received

•

$5,000/year

•

Must attend a 4 yr college in

South Carolina

•

Requirements

•

3.0 GPA

•

Must attend a 4 yr college in South Carolina

•

Money Received

•

$2,800 for one year

•

Requirements

•

SC resident for at least one year

•

Be enrolled in a 2 year institution in South

Carolina.

•

Money Received

•

Money is based on enrollment status

•

Many students may feel that they are the only one struggling to pay for college.

•

Many students and their families have the financial burden placed on them when going to college.

•

Year in college: Junior

•

Major: Business economics

•

Family income: $20,000–$40,000

•

College: Public four-year university

•

Published yearly in-state tuition and fees: $8,690

•

Financial aid received: State academic scholarship, Federal

Pell Grant

•

Current job: Guest ambassador at the World of Coca-Cola

•

Remain positive and don’t let the financial obstacle stop you from going to college.

•

Treat the application process like a class project, break it down into small pieces.

•

The biggest challenge for Jonard was filling out the FAFSA (Free

Application for Federal Student

Aid). You had to find a lot of

[financial] information about your family and yourself. But it all paid off in the end.

•

Jonard landed a scholarship and a grant that, together, pay for his tuition and books. To save on housing costs, he lives off campus with his grandparents who have a house near the university.

•

Year in college: Junior

•

Major: Finance

•

Current job: Owns a construction business

•

College path: Transferred from a two-year college to a four-year university

•

Published yearly in-state tuition and fees: $8,690

•

Financial aid received: State academic scholarship,

Federal Pell Grant

•

High school GPA: 2.3

•

Year in college:

Sophomore

•

Major: Accounting

•

Family income: $10,000–

$20,000

•

College: Public two-year college

•

Published yearly in-state tuition and fees: $4,642

•

Dream job: Motivational speaker and civil rights leader

•

Jonard, Cesar, and

Annaesia all received financial assistance to achieve a better education.

•

Financial help is out there you just need to look for it.

•

When you receive your acceptance letter please bring it to the guidance office so we may make a copy.

•

After we have a copy look for your name on the college wall.