The Role of Financial Early-warning System

advertisement

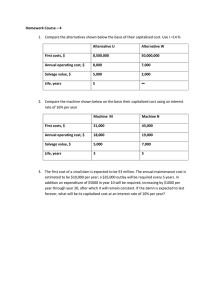

The Role of the Financial Early-warning System Dr. & Professsr Wei-Yi Lin Abstract Ever since financial liberalization became a popular world trend in the 1980s the global financial markets becoming increasingly integrated and efficient financial technology being upgraded and new financial products on financial supervision financial institutions need to consolidate their risk management add emphasis on financial discipline and financial supervision Abstract the impact of financial liberalization and globalization has greatly increased the operational risk borne by financial institutions I would now like to discuss with you all the following four topics The Importance of Establishing a Financial Early-warning System The supervisory authorities need to strengthen financial supervision in the following aspects: (1) Placing added emphasis on financial discipline(Table2). (2) Maintaining financial stability(Table3). (3) Safeguarding the rights and interests of depositors. (4) Handling the problem financial institutions promptly. Table 2 Financial Risk Management Model - for good corporate governance Table 3 The Importance of Establishing a Financial Early-warning System Practices of Early-Warning system in the U.S. system: set up bank appraisal system financial institutions were evaluated on Capital adequacy, Asset quality, Management, Earnings , Liquidity and Sensitivity to market risks :CAMELS. FDIC’s Risk-Related Premium System (RRPS) Supervisory Subgroup Capital Group A B C 1.Well Capitalized 23 26 29 2. Adequately Capitalized 26 29 30 3. Undercapitalized 29 30 31 * Rates are in cents per $100 of insured deposits. The Current Operating Conditions of the Financial Early-warning System in Taiwan The Examination Data Rating System referred to the Federal Financial Institutions Examinations Council of the U.S., that is , the so called CAMELS rating system. CDIC’s Risk-Based Premium System (RBPS) Examination Data Rating Score Capital Adequacy A B C 1.Well Capitalized 5.0 5.0 5.5 2. Adequately Capitalized 5.0 5.5 6.0 3. Undercapitalized 5.5 6.0 6.0 * Rates are in cents per $100 of insured deposits. The Contribution of the Taiwan’s Financial Early-warning System Effectively Utilizing Financial Supervisory Resources and Strengthening the Handling of Problem Financial Institutions To Immediately Implement Effective Response Policies Determining the Risk-base Assessment Rate Criteria for each Financial Institution. The Operational Performance of Deposittaking Financial Institutions in Taiwan Pastdue Loans Ratio Unit:%, multiples Banks in General Credit Cooperative Associations Credit Dep. of Farm’s and Fishermen’s Associations 1996 3.74 6.13 8.5 1997 3.71 6.19 10.8 1998 4.14 7.55 13.2 1999 4.96 10.54 16.18 2000 5.47 12.45 17.9 2001 7.48 11.66 19.3 2002 6.12 10.34 18.62 2003 4.33 6.91 17.57 2004 2.78 3.17 14.46 2005 2.24 2.09 10.92 2006 2.13 1.55 8.13 2007 1.84 1.29 6.25 Category Of Institution Year-end 2008 1.54 1.24 5.16 Note: set up RTC fund to resolve of financial institutions operational crises in the 2001.7 Conclusion and Recommendations The government in regard to the financial earlywarning system and both financial supervision and the deposit insurance mechanism will in the future need to give careful consideration to the following: 1.The financial early-warning system will need to expand and to integrate relating to banking, insurance, securities business and futures trading on the financial services groups to effectively unify the work of financial supervision. Conclusion and Recommendations 2.Financial early-warning system “in order to be able to detect abnormal capital ratios and quickly take corrective measures”. 3.A basis for implementing the deposit insurance risk-based premium system, in order to reflect the operational risk of financial institutions and avoid moral hazard. 4.To avoid the occurrence of delays in handling problem financial institutions. The end