Title: The Sub-Prime Lending Debacle: Competitive Private Markets are the Solution, not the Problem

advertisement

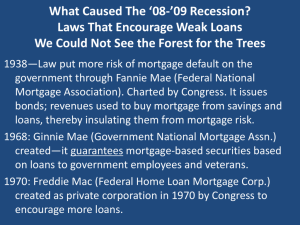

How US Politicians Brought Down the Global Financial System Patric H. Hendershott and Kevin Villani PBFEAM, July 9, 2011 Taipei, Taiwan What Brought Down Global System? • Large global holdings of Fannie and Freddie MBSs and private label securities (PLBs) held by governments, banks and retirement systems • Both the MBSs and PLSs were highly-rated securities backed by sub-prime mortgages (and sub-prime was REALLY sub-prime) • The avalanche of sub-prime loans came on top of a normal boom, funding an abnormal rise in US house prices from mid2004 through 2006 The Crash • Some of the mortgage loans were so bad that they would fail (default) even if house prices didn’t fall – a fifth were delinquent in six months • House prices were due to fall because they has been artificially run up • Defaulting loans and falling house prices reinforced each other, leading to a total collapse of the US housing market and many financial institutions • And thus the expression sub-prime debacle Brief Overview on US Mortgage System US has developed a housing finance system that differs from most developed economies - Most mortgages are securitized and most securities are tranched - The leading securitizers are federally-sponsored agencies, Fannie Mae and Freddie Mac (F&F) System was developed in part to get around branching restrictions – regional capital shortages would develop providing an impetus for securitization So What Caused the Sub-Prime Debacle? Two competing narratives: • The politically correct narrative pushed by the Financial Crisis Inquiry Commission established by the US Congress (2009) and embodied in the Dodd-Frank Act of 2011 • An alternative factually correct narrative pushed by conservative US think tanks Politically Correct Narrative Causes that made sub-prime debacle systemic • Deregulation and inadequate regulation • Wall Street greed led to massive PLSs that, when defaulted, dragged down Fannie Mae and Freddie Mac (F&F) • Home buyers, lenders, etc behaved irrationally Solution is more comprehensive regulation (Dodd-Frank Act) Some Truth (Regulation Was Awful) But Three Myths First myth: deregulation was a cause of debacle • Removal of deposit rate ceilings (1980) • Elimination of branching restrictions (1994) • repeal of Glass-Steagall (1999), which had required separation of commercial and investment banking All of these steps strengthened the financial system; they were not a cause of debacle Myth 2: Private Sector Dragged Down Fannie Mae and Freddie Mac • F&F were mandated to make percentage of loans to those with below median income (30, 42, 56) – also below 60% of median – were mandated to make bad loans • F&F required to fund half of sub-prime loans in 2005 • F&F bought 40% of subprime private label securities (PLS) during the boom Myth 3: Behavior Was Irrational • Borrowers didn’t need to expect house price appreciation to make owning a wise economic decision (nothing to lose – no money down, live rent free) • F&F executives made hundreds of millions • Loan originators – securitizers of PLSs - made billions making/selling crap loans • NRSROs (Nationally Registered Statistical Rating Organizations) made billions ratings MBSs How Did Everyone Make Money? Leverage • Homeowners borrowed up to 100% • F&F borrowed 99% at just above the government rate – federally sponsored • PLS leverage was only 95% (sometimes 98%) Even if things eventually went bad, what was made before that more than compensated Factually Correct Narrative • Regulation was near complete by 2001 (and enforcement was almost totally inept) • F&F had largely replaced the private market in the conforming loan segment • Prudential regulation controlled PLSs Moral hazard created by politicians/regulators was the sole cause of the debacle Error 1: Fannie Mae and Freddie Mac • Privatization created public risk for private profit model: incredible moral hazard problem • Regulator put in HUD where attempts to regulate were overruled: conflict of prudential and mission regulation • Extreme leverage • 30/42/56 and 50% of sub-prime market in 2005 Error 2: Recognized Security Raters • Establishment of NRSRO by the SEC: removed potential competition of other raters • Raters determined how much of the issue could be put into investment grade tranch and thus pay a low coupon • Risk assessors then relied on ratings rather than evaluating the risk of the investment • With little competition, ratings (especially of second mortgages) were far too generous Error 3: Basil I Capital Requirements (response to previous S&L debacle) • Risk weightings: commercial loans and mortgages 100%, MBSs 50%, AAA/AA rated securities 20%, governments 0% • Huge impetus to securitize – to originate mortgages to sell, producing major moral hazard in loan originations • Relied on NRSRO ratings; gave them (undeserved) credibility • Generally eroded market discipline Error 4: Commercial Banks • TBTF banks were allowed to develop as banking system consolidated • Off-balance sheet funding was allowed (SIVs) • Banks were permitted to issue preferred stock (AAA rated, of course) and count it as equity capital • Erroneous Basil I requirements; in 2001 20% weighting given to PLS AAA/AA segments Error 5: SEC and Investment Banks • Bail out of LTCM (1998) illustrated that investment banks, too, could be TBTF (Geitner) • Still, capital requirements were far less than those of commercial banks • SEC declared five largest to be “consolidated supervised entities” and lowered capital requirements in 2004, but provided little supervision Why Was Regulation So Bad? Politicians • They believed that their judgment (or that of their appointees) could substitute for market discipline • They believed that off budget subsidies through finance could be given (Housing Lending Goals) • They received millions in political contributions and payoffs • They created crony capitalism and called it a new hybrid public/private partnership Some Errors of Politicians • Put F&F regulator in HUD and prevented him from stopping bad loan purchases • Voted against raising far too low F&F capital requirements • They didn’t oversee behavior of SEC, FDIC, etc. Repeal Dodd-Frank • Doesn’t fix money market regulation – invest in government securities (not Greek debt) • Retains F&F, contending that government sponsorship can be limited with moral hazard • Extends investment market regulation to derivatives/hedge funds Creates a committee of politicians, bureaucrats and professors to prevent the next crisis – and housed in the Treasury Department! Restoring Investment Market Discipline • Eliminate F&F – no government sponsorship • Repeal NRSRO designations • Alter risk-based rules for mortgages to reduce the incentive to originate to sell • Encourage a market determined allocation of risks (covered bonds, ABSs)