A fuzzy real option valuation approach to capital budgeting under uncertainty

advertisement

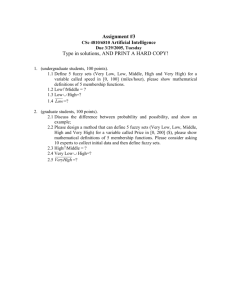

A fuzzy real option valuation approach to capital budgeting under

uncertainty

Shin-Yun Wang

Department of Finance, National Dong Hwa University, 1, Sec.2, Da-Hsueh Rd., Shou-Feng, Hualien 974,

Taiwan

Cheng-Few Lee

Department of Finance and Economics, Rutgers University, New Jersey, USA

Abstract

The information needed for capital budgeting is generally not known with certainty. Therefore,

capital budgeting procedures under conditions of uncertainty should be developed to improve

the precision of assessment of the value of risky investment projects. The sources of

uncertainty may be either the net cash inflow, the life of the project, or the discount rate. We

propose a capital budgeting model under uncertainty in which cash flow information can be

specified as a special type of fuzzy numbers. Then, we can estimate the present worth of each

fuzzy project cash flow. At the same time, to select fuzzy projects under limited capital budget,

we give an example to compare and analyze the results of the capital budgeting problem using

a fuzzy real option model. Hence, the fuzzy numbers and the real option model can be jointly

used in solving capital budgeting under uncertainty.

Keywords: Capital budgeting; Real option; Fuzzy numbers; Uncertainty.

1. Introduction

Large investments are capital projects of strategic importance which have a long economic life cycle.

They often have many unknown that hard to estimate risks and potentials, difficult to be foreseen at their

initial planning stage. Hence these investments may change during their long economic life and the changes

can be fundamental. Such uncertainty and possibility of change in the fundamentals of large investments

which is essential, because of the larger the investments are, the more strategic importance they usually

have. However, the information needed for capital budgeting is generally not known with certainty.

Therefore, capital-budgeting procedures under conditions of uncertainty should be developed to improve

the precision of assessment of the value of risky investment projects. The sources of uncertainty may be

either the net cash inflow, the life of the project, or the discount rate.

In practice precise information concerning future investment projects is rarely obtained. Extensive

study has been undertaken to consider the capital budgeting problems under risk. Hence decision maker

does not have exact knowledge concerning future investment opportunities. Traditional approaches to

capital budgeting are based on the premise that probability theory is necessary and sufficient to deal with

the uncertainty that underlie the estimates of required parameters. It is argued that, in many circumstances,

this premise is invalid since the principal sources of uncertainty are often non-random in nature and relate

to the fuzziness rather than the frequency of data. In order to capture and quantify correctly the underlying

uncertainty present in non-statistical situations, the theory of possibility, an extension of the theory of fuzzy

sets introduced by Zadeh (1965). A possibility distribution can be viewed as the membership function of a

parameter.

In the real world, the data sometimes cannot be recorded or collected precisely. For instance, if

1

considering to ask a group of economists for predicting the rate of economical growth in the next year.

Their statements may be like “approximately 3%,” “should be 3–5%” or “may be below 6%,” etc. All of

those statements can be characterized as fuzzy sets. Suppose that we introduce a selection procedure which

will determine the probability that each economist will be selected. Then for each possible selection, their

statements are fuzzy sets. Therefore, to deal with a capital budgeting model under uncertainty, the cash

flow information can be specified as a special type of fuzzy number-triangular fuzzy numbers. Zadeh

(1965), Dubois and Prade (1988), and Carlsson and Fuller (2002) have investigated the usefulness of the

fuzzy set theory in decision making under uncertainty. The fuzzy capital budgeting approaches allow cash

flow estimates as fuzzy numbers and offer the means to integrate trend data into cash flows. Fuzzy cash

flows can better reflect the uncertainty in the project.

In this paper, fuzzy capital budgeting is to use fuzzy versions of the neo-classical capital budgeting

methods and real option valuation. In Section 2, we will discuss methods for capital budgeting and

investment decision making. Next section derives the fuzzy real option method. Section 4 gives a numerical

example to compare and analyze the results of the capital budgeting problem using a fuzzy real option

model and conclusion in section 5.

2. Methods for capital budgeting and investment decision making

Capital budgeting methods based on the discounted cash flow (DCF) have been the ruling instruments

for investment decision making. The most commonly used DCF based method is the net present value

(NPV). Under static circumstances and in truly now or never situations, DCF based methods provide

reliable results, but the real world situations are seldom static. Especially in cases of large investments with

long economic lives the static discounted cash flow based methods fail to present a highly reliable picture

of the profitability and possibilities offered by the investment project at hand. As DCF based methods have

been the best thing available, and it is better to use them than not to use any kind of decision tool for capital

budgeting, they have rooted to management practices during years of use.

However, there are many enhancements to the original formulae, but the underlying unsatisfactory

assumptions still exist. Hence the adjustment models include the risk-adjusted discount-rate methods, and

the certainty-equivalent method. The risk-adjusted discount-rate method simply extends the cash-flow

valuation model under certainty to the uncertainty case. The advantage of this method is that the valuation

model gives us a formula that explicitly considers the uncertainty associated with future cash flows.

Although the model does not specify exactly what constitutes the risk of the cash flows, it can be used to

develop and explore the relationships among the variables of asset-valuation models. On the other hand, the

disadvantages of the risk-adjusted discount-rate model are clear. The value of interest rate is only a

subjective estimate, which could well differ from person to person. Therefore, an objective determination

of the value of a risky investment project will be almost impossible by simply applying this method. While

the risk-adjusted discount-rate method provides a means for adjusting the basic riskless discount rate, an

alternative method, the certainty-equivalent method, adjusts the estimated value of the uncertain cash flows.

The underlying rationale is that, given a risky cash flow, the decision maker will evaluate this risky cash

flow by attaching an expected utility to that cash flow, that utility estimate being hypothesized to be equal

to the utility derived from some certain amount. If the decision maker performs this process for each cash

flow, a series of certainty equivalents for the risky flows can be obtained. Above both methods are used to

evaluate future uncertain cash flows, the two models should yield the same value for a given stream of cash

flows. Moreover, the present value of each period's cash flows should be the same under these two

valuation models. Robichek and Myers (1966) showed that the risk-adjusted rate method tends to lump

together the pure rate of interest, a risk premium, and time (through the compounding process), while the

certainty-equivalent approach keeps risk and the pure rate of interest separate. This separation gives an

advantage to the certainty-equivalent method.

To remedy the problems of the DCF based methods new methods have been introduced. The real

option approach is a methodology that calculates the value of an investment with techniques originally

developed for valuation of financial options. This gives the possibility to take into consideration the

managerial flexibility to take action during the lifetime of an investment. The term real option was coined

in an article about corporate borrowing by Myers (1997). Since then there has been a growing literature

2

describing the different theoretical aspects of real options (Kulatilaka and Marcus, 1998; Dixit and Pindyck,

1994; Trigeorgis, 1995), as well as the managerial and strategic implications and application of real options

(Bowman and Hurry, 1993; Luehrman, 1998; Amram and Kulatilaka, 1999). A number of case based

articles are also available to give further insight into real world application (Kulatilaka, 1993; Nichols,

1994; Micalizzi, 1999). The value of a real option is computed by using the Black and Scholes (1973)

formula extended by Merton (1973).

Some Economic factors, such as competition, consumer preferences, technological development, and

labor market conditions are a few of the factors that make it virtually impossible to foretell the future.

Consequently, the economic life, revenues, and costs of investment projects are less than certain. With the

discuss of risk, a firm is no longer indifferent between two investment proposals having rates of return

equal or net present values. Both net present value and its standard deviation should be estimated in

performing capital-budgeting analyses under uncertainty. There are three related stochastic methods useful

in the making of capital-budgeting decisions which are the probability-distribution, decision-tree, and

simulation methods. The statistical distribution method which Chen and Moore (1982) have generalized this

model by introducing the estimation risk. Hillier (1963) combines the assumption of mutual independence

and perfect correlation in developing a model to deal with mixed situations. This model can be used to

analyze investment proposals in which some of the expected cash flows are closely related, and others are

fairly independent. A decision-tree approach to capital-budgeting decisions can be used to analyze some

investment opportunities involving a sequence of investment decisions over time. It is an analytical

technique used in sequential decisions, where various decision points are studied in relation to subsequent

chance events. This technique enables one to choose among alternatives in an objective and consistent

manner. Simulation is another approach to confronting the problems of capital budgeting under uncertainty.

Because uncertainty associated with capital budgeting is not restricted to one or two variables, every

variable relevant in the capital-budgeting decision can be viewed as a random variable. Facing so many

random variables, it may be impossible to obtain tractable results from an economic model. Simulation is a

useful tool designed to deal with this problem, and is the closest we can get to modeling in cases of

uncertainty.

Generally speaking, the probability-distribution, decision-tree, and simulation methods are three

alternative approaches that are available to deal with the problem of capital budgeting under uncertainty.

These methods have explicitly utilized the concepts of probability distributions and statistical distributions

to carry out the analysis. If there is only a single accept-reject decision at the outset of the project, then the

decision maker can use either statistical-distribution methods or simulation methods. If investment

opportunities involve a sequence of decisions over time, then a decision-tree method can be used to

perform the analysis. In addition, if want to reduce risk of the investment, the real option is a better choice.

The real option approach also supports the determination of the timing for the investment, and offers a

comprehensive way of presenting value of possibilities opened by the project, which is further enhanced

with frequently updated fuzzy cash flows.

3. The fuzzy real option valuation (FROV) approach

3.1. Fuzzy numbers

From Zadeh (1965), A is a convex fuzzy set if and only if its -level set A {x : A ( x) } is a

convex set for all any . Therefore, if is a fuzzy number, then the -level set is a compact (closed and

bounded in R) and convex set; that is, is a closed interval. The -level set of is then denoted

by [ L , U ] . A fuzzy number is said to be nonnegative if ( x) 0 for x<0. It is easy to see

that if is a nonnegative fuzzy numbers then L and U are all nonnegative real numbers for

all [0,1] .

3.2 Triangular Fuzzy Number, TFN

The concept of triangular fuzzy number attempts to deal with real problems by possibility. The

membership of a triangular fuzzy number is defined as follows:

3

( x L) /( M L) M x U

A ( x) (U x) /(U M ) L x M

0 otherwise

A ( x)

1

0

L

M

R

x

Figure 1 The membership function of the triangular fuzzy number

According to the characteristics of triangular fuzzy numbers and the extension principle put forward by

Zadeh (1965), the operational laws of triangular fuzzy numbers, A (l1 , m1 , r1 ) and B (l2 , m2 , r2 ) are as

follows:

(1) Addition of two fuzzy numbers

(l1 , m1 , r1 ) (l2 , m2 , r2 ) (l1 l2 , m1 m2 , r1 r2 )

(2) Subtraction of two fuzzy numbers

(l1 , m1 , r1) (l2 ,m2 ,r

l(1 r2 ,m1 m2, r1 l2 )

2 )

(3) Multiplication of two fuzzy numbers

(l1 , m1 , r1

) (l2 ,m2 ,

r2 ) l(1 l2 ,m1 m2 , r1 r2 )

(4) Multiplication of any real number k and a fuzzy number

k (l1 , m1 , r1 ) (kl1 , km1 , kr1 )

(5) Division of two fuzzy numbers

(l1 , m1 , r1 )(l2 , m2 , r2 ) (l1 / r2 , m1 / m2 , r1 / l2 )

3.2. A real option valuation

A real option means that the possibility for a certain period to either choose for or against making an

investment decision, without binding oneself up front. The real option rule is that one should invest today

only if the net present value is high enough to compensate for giving up the value of the option to wait.

Because the option to invest loses its value when the investment is irreversibly made, this loss is an

opportunity cost of investing. While ongoing evaluation effort is structured around key decision points, or

triggered by changes in the business environment, it is a process in which the valuation, even the

computing process, is not intended to provide a definite answer, but rather to provide decision makers an

ongoing dialogue about the project (Dahiberg and Porter, 2000). So a process view of the real option

approach is a relevant task in analyzing the decision support needs.

Real options in option thinking are based on the Black-Scholes model as financial options. The option

pricing theory is that you should invest today only if the net present value is high enough to compensate for

giving up the value of the option to wait. Because the option to invest loses its value when the investment is

irreversibly made, this loss is an opportunity cost of investing. Following Leslie and Michaels (1997), we

will compute the value of a real option as

ROV S0 e T N (d1 ) Xe rT N (d 2 ),

where

ln( S0 / X ) (r 2 / 2)T

d1

, d 2 d1 T

T

and where ROV denotes the current real option value, S0 is the present value of expected cash flows, X is

4

the (nominal) value of fixed costs, σ quantifies the uncertainty of expected cash flows, and denotes the

value lost over the duration of the option.

In real options, the options involve real assets. To have a real option means to have the possibility for

a certain period to either choose for or against making an investment decision. Real options can be valued

using the analogue option theories that have been developed for financial options, but do not mean that they

are the same. Real options are concerned about strategic decisions of a company, where degrees of freedom

are limited to the capabilities of the company. In these strategic decisions different stakeholders play a role,

especially if the resources needed for an investment are significant and thereby the continuity of the

company is at stake. In addition, it is quite different from traditional discounted cash flow investment

approaches. The traditional methods are very hard to make a decision when there is uncertainty about the

exact outcome of the investment. And since these methods ignore the value of flexibility and discount

heavily for external uncertainty involved, many interesting and innovative activities and projects are

cancelled because of the uncertainties.

If the result of NPV is negative, the company would obviously pass up the opportunity. But if we use

the real option valuation the result may be different of the same case. Such a valuation would recognize the

importance of uncertainty, which the NPV analysis effectively assumes away. The main question that a

company must answer for a deferrable investment opportunity is how long we postpone the investment up

to T time periods. To answer this question, Benaroch and Kauffman (2000) suggested the following

decision rule for optimal investment strategy: Where the maximum deferral time is T, make the investment

(exercise the option) at time t is positive and attends its maximum value. Of course, this decision rule has to

be reapplied every time new information arrives during the deferral period to see how the optimal

investment strategy might change in light of the new information.

3.3. A fuzzy real option valuation

We shall introduce a real option rule in a fuzzy setting, where the present values of expected cash

flows and expected costs are estimated by triangular fuzzy numbers, and determine the optimal exercise

time by using the fuzzy real option model. Usually, the present value of expected cash flows can not be

characterized by a single number. But managers are able to estimate the present value of expected cash

flows by using triangular possibility distribution of the form

F [ f l , f m , f r ],

i.e. the most possible values of the present value of expected cash flows lie in the f m (which is the core of

the triangular fuzzy number F ), f r is the greatest value and f l is the smallest value for the present value of

expected cash flows.

In a similar manner one can estimate the expected costs by using a triangular possibility distribution of the

form

X [ xl , xm , xr ],

i.e. the most possible values of expected costs lie in the interval xm (which is the core of the triangular fuzzy

number X ), xr is the greatest value and xl is the smallest value for expected costs.

In addition, the values also influence by the financial market, such as riskless interest rate (discount

rate) and the volatility of cash inflow. We use historic data to estimate them by using a triangular

possibility distribution of the form

R [rl , rm , rr ], [ l , m , r ], [ l , m , r ].

i.e. the most possible values of discount rate, risk-adjusted discount-rate and the volatility of cash inflow lie

in the interval rm , m and m (which is the core of the triangular fuzzy number R, and ), rr is the

greatest value and rl is the smallest value for discount rate, r is the greatest value and l is the smallest

value for the risk-adjusted discount-rate, r is the greatest value and l is the smallest value for volatility of

5

cash inflow.

The information needed for capital budgeting is generally not known with certainty. The sources of

uncertainty may be the net cash inflow, the discount rate, or the life of the project, etc. Hence in addition to

consider the fuzzy volatility and investing cost X , we also consider the fuzzy cash inflow F , fuzzy

interest rate and R . In these circumstances we suggest the use of the following formula for computing

fuzzy real option values

ROV ( F , X , , R, , T ) F e T N (d1 )X e RT N (d2 ).

where

ln( F X ) ( R 2 / 2) T

d1

, d 2 d1 T

T

and where, F denotes the possibilistic mean value of the present value of expected cash flows, X stands

for the possibilistic mean value of expected costs and ( F ) is the variance of the present value expected

cash flows, stands for the risk-adjusted discount-rate, R stands for the discount rate, T stands for the

interval, Using above formula for arithmetic operations on triangular fuzzy numbers we find

FROV ( fl , f m , f r ) e T N (d1 )( xl , xm , xr ) e RT N (d 2 )

( fl N (d1 ) e T xr N (d 2 ) e R T , f m N (d1 ) e T xm N (d 2 ) e R T , f r N (d1 ) e T xl N (d 2 ) e RT ],

Where

d1 [(ln fl / xr rT

r T l l T / 2) / r T , (ln f m / xm rmT mT m mT / 2) / m T ,

l

(ln f r / xl rr T l T r r T / 2) / l T ],

d 2 d1 T .

In the following we shall generalize the probabilistic decision rule for optimal investment strategy to a

fuzzy setting: Where the maximum deferral time is T, make the investment (exercise the option) at time t ;

0 t T , for which the option, Ct , attends its maximum value,

Ct max Ct F e T N (d1 )X e R T N (d 2 )

t 0,1,...,T

Where

Ft PV (cf0 , cf1 ,..., cfT , ) PV (cf0 , cf1 ,..., cft , ) PV (cft 1 , cf1 ,..., cfT , ),

that is,

T

t

T

cf j

cf j

cf j

Ft cf 0

cf

,

0

j

j

j

j 1 (1 )

j 1 (1 )

j t 1 (1 )

where cf j denotes the expected (fuzzy) cash flow at time j, is the risk-adjusted discount rate (or

required rate of return on the project). However, to find a maximizing element from the set

{C0 , C1 ,..., CT } is not an easy task because it involves ranking of triangular fuzzy numbers.

In our computerized implementation we have employed the following function to determine the expected

fuzzy real option values {Cl , Cm , Cr }, of triangular form:

E (Ct ) [(Cr Cl ) (Cm Cl )]/ 3 Cl

where, Cr, Cm and Cl are the largest, middle, and smallest values of the fuzzy real option values.

4. Computational method and example

We give an example to compare and analyze the results of the capital budgeting problem using a fuzzy

real option model, where the present values of expected cash flows, expected costs, the discount rate, the

risk-adjusted discount rate and volatility of cash inflows are estimated by triangular fuzzy numbers.

6

Table 1 Illustration of conditional-probability distribution approach

Initial

Initial

Net

Conditional

Net Cash

Conditional

Outlay

Probability Cash

Probability

Flow

Probability

Period 0 P(1)

Flow

P(2|1)

P(3|2,1)

10,000

0.3

0.5

0.2

2000

4000

6000

0.25

2000

0.5

3000

0.25

4000

0.3

3000

0.4

5000

0.3

7000

0.25

5000

0.5

7000

0.25

8000

0.2

0.5

0.3

0.2

0.5

0.3

0.2

0.5

0.3

0.3

0.4

0.3

0.3

0.4

0.3

0.3

0.4

0.3

0.25

0.5

0.25

0.25

0.5

0.25

0.25

0.5

0.25

Cash

Flow

Joint

Probability

1000

2000

3000

2000

3000

4000

3000

4000

5000

2000

4000

6000

4000

5000

6000

5000

7000

9000

4000

6000

8000

5000

7000

9000

7000

9000

11000

0.015

0.0375

0.0225

0.03

0.075

0.045

0.015

0.0375

0.0225

0.045

0.06

0.045

0.06

0.08

0.06

0.045

0.06

0.045

0.0125

0.025

0.0125

0.025

0.05

0.025

0.0125

0.025

0.0125

Firstly, let we refer to Table 1 by Bonini (1975), where we consider a project requiring an initial outlay

of $10,000 (Column 1). In each of the following time periods (Columns 3, 5, and 7), the cash flow to be

received is not known with perfect certainty, but the probabilities associated with each cash flow in each

period are assumed to be known (Columns 2, 4, and 6), so that we are dealing with a case of risk, and not

strict uncertainty. We note that Columns (4) and (6) are conditional-probability figures, where the later

periods' expected cash flows depend highly on what occurs in earlier time periods. Given our cash flow and

simple probability estimates for the periods 1, 2, and 3, we find 27 possible joint probabilities (Column 8),

each of which corresponds to a cash-flow series. Thus in the uppermost path we find the joint probability

0.015 being associated with a cash flow of $2000 in Period 1, followed by cash flows of $2000 and $1000

in Periods 2 and 3, respectively. This particular path is the worst possible result; in non-discounted dollar

terms there is a 50 percent loss on the investment. At the other end of the spectrum, we find the best

possible outcome offers a return $12,945 with a joint probability of 0.0125. The returns and joint

probabilities can be calculated similarly for the other 25 possible patterns.

7

Table 2 NPV and joint probability

t

PVA

NPV

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

4,661.2

5,550.2

6,439.2

6,474.76

7,363.76

8,252.76

8,288.32

9,177.32

10,066.32

8,297.84

10,175.84

11,953.84

12,024.96

12,913.96

13,802.96

14,763.08

16,541.08

18,319.08

13,948.04

15,726.04

17,504.04

16,686.16

18,464.16

20242.16

19,388.72

21,166.72

22,944.72

-5,338.8

-4,449.8

-3,560.8

-3,525.24

-2,636.24

-1,747.24

-1,711.68

-822.68

66.32

-1,602.16

175.84

1,953.84

2,024.96

2,913.96

3,802.96

4,763.08

6,541.08

8,319.08

3,948.04

5,726.04

7,504.04

6,686.16

8,464.16

10,242.16

9,388.72

11,166.72

12,944.72

Probability

0.015

0.0375

0.0225

0.03

0.075

0.045

0.015

0.0375

0.0225

0.045

0.06

0.045

0.06

0.08

0.06

0.045

0.06

0.045

0.0125

0.025

0.0125

0.025

0.05

0.025

0.0125

0.025

0.0125

Standard

Deviation

1021.913

1443.632

984.8824

1131.085

1544.94

1008.12

577.6831

741.2431

440.8144

998.557

693.0202

223.0023

240.0801

25.77347

195.4392

372.9275

866.1388

1127.269

105.4258

430.2211

502.9987

582.0294

1220.687

1144.282

713.7123

1290.468

1111.285

While the primary hurdle in this process is in estimating the cash flows and the probabilities, we

recognize that it is the NPV figures we are ultimately interested in. Table 2 gives the present value of the

cash flows and the net present value of the project for each cash-flow series (PVA), where a constant 4

percent discount rate was employed. When we multiply each joint probability by the expected net present

value associated with that probability, we obtain the expected net present value for the project as a whole,

there shown to be $2,517.18.

If the cash flows probabilities do not know, then the cash flows become an uncertainty case. In

X 0 [9000,10000,11000], R [0.03,0.04,0.05], [0.0 2,0.03,0.04], we can use fuzzy real option to

approach the capital budgeting under uncertainty. We use above example and fuzzy real option model to

compute the expected fuzzy real option values. From above data, we transform them into the triangular

fuzzy number, and then we substitute into following function.

FROV ( fl , f m , f r ) e T N (d1 )( xl , xm , xr ) e RT N (d 2 )

( fl N (d1 ) e T xr N (d 2 ) e R T , f m N (d1 ) e T xm N (d 2 ) e R T , f r N (d1 ) e T xl N (d 2 ) e RT ],

Where

d1 [(ln f l / xr rT

r T l l T / 2) / r T ,

l

(ln f m / xm rmT mT m mT / 2) / m T , (ln f r / xl rr T l T r r T / 2) / l T ],

d 2 d1 T .

8

Table 3 Expected fuzzy real option value

t

F

(F )

FROV

E (Ct )

1

F1 [2617,4661,6705]

1 [960,1022,1084]

C1 [-3765,-2532,-1097]

-2465

2

F2 [2663,5550,8437]

2 [1182,1444,1705]

C2 [-5856,-1899,2721]

-1678

3

F3 [4469,6439,8409]

3 [920,985,1050]

C3 [-3387,-1480,809]

-1353

4

F4 [4213,6475,8737]

4 [1005,1131,1257]

C4 [-4545,-1352,2483]

-1138

5

F5 [4274,7364,10454]

5 [1119,1545,1970]

C5 [-6851,-744,7922]

109

6

F6 [6237,8253,10269]

6 [906,1008,1110]

C6 [-3896,-473,3729]

-213

7

F7 [7133,8288,9444]

7 [531,578,624]

C7 [-3198,-408,2833]

-258

8

F8 [7695,9177,10660]

8 [731,741,752]

C8 [-1163,-25,1368]

60

9

F9 [9185,10066,10948]

9 [343,441,539]

C9 [-5432,295,7906]

923

10

F10 [6301,8298,10295]

10 [901,999,1096]

C10 [-3972,-266,4316]

26

11

F11 [8790,10176,11562]

11 [656,693,730]

C11 [-2140,433,3541]

611

12

F12 [11508,11954,12400]

12 [-8,223,454]

C12 [842,2152,3717]

2237

13

F13 [11545,12025,12505]

13 [-19,240,499]

C13 [770,2196,3899]

2289

14

F14 [12862,12914,12966]

14 [-394,26,446]

C14 [6765,2773,9496]

6345

15

F15 [13412,13803,14194]

15 [-85,195,476]

C15 [1619,3313,6015]

3649

16

F16 [14017,14763,15509]

16 [205,373,541]

C16 [-5411,337,11259]

2062

17

F17 [14809,16541,18273]

17 [818,866,914]

C17 [-1135,2400,7003]

2756

18

F18 [16065,18319,20574]

18 [975,1127,1280]

C18 [-3213,2656,11864]

3769

19

F19 [13737,13948,14159]

19 [-43,105,254]

C19 [1334,3211,5723]

3423

20

F20 [14866,15726,16586]

20 [323,430,537]

C20 [-4289,1435,11019]

2722

21

F21 [16498,17504,18510]

21 [444,503,562]

C21 [-2794,2333,9709]

3083

22

F22 [15522,16686,17850]

22 [523,582,641]

C22 [-2547,2122,8664]

2747

23

F23 [16023,18464,20906]

23 [1018,1221,1423]

C23 [-3453,2263,12298]

3702

24

F24 [17954,20242,22531]

24 [1025,1144,1263]

C24 [-2345,2840,10969]

3821

25

F25 [17961,19389,20816]

25 [702,714,726]

C25 [493,2736,5643]

2957

26

F26 [18586,21167,23748]

26 [1125,1290,1456]

C26 [-2703,2802,12303]

4134

27

F27 [20722,22945,25167]

27 [1035,1111,1188]

C27 [29493,74345,165301]

4070

where, t: time(in years), F :cash flow, ( F ) : variance of the present value expected cash flows, FROV

:

fuzzy real option value, E (Ct ) : expected fuzzy real option value.

When the environment is uncertainty, with uncertain cash flows, the investor will face a distribution of

future cash flows rather than a single-point estimate of future cash flow in each period. The method utilized

to deal with these uncertain cash flows is that of the fuzzy real option model. What would option valuation

make of the same case? To begin with, such a valuation would recognize the importance of uncertainty,

which the NPV analysis effectively assumes away. We use the fuzzy real option model to evaluate the

project in the same case, which holding the option also obliges one to incur the annual fixed costs of

keeping the reserve active—let us say $300, This represents a dividend-like payout of three percent (i.e.

300/1000) of the value of the assets, in the discount rate is around 4%, cost is around $10,000 and dividend

rate is around 3%, then we obtain the expected fuzzy real option values for the project as a whole,

9

Ct max Ct , where the maximum deferral time is T=27, make the investment (exercise the option) at

t 0,1,...,T

time t ; 0 t T , for which the option, Ct , there shown to be $6,345 at t=14, which is positive and

attends its maximum value.

5. Conclusions

The FROV will increase with the current value of increasing expected cash flows estimates. A

proactive management can Influence this by developing market strategies to enhance the sale and save the

cost. If volatility of cash flow will increase, then the FROV will increase. The corporate management can

be proactive and find the ways to expand to new markets, product innovations and innovation product

combinations as end results of their strategic decisions. The longer the time to maturity, the greater will be

the FROV. A proactive management can make sure of this development by maintaining protective barriers,

communicating implementation possibilities and maintaining a technological lead. On the other hand, if the

expected value of fixed costs goes up, the FROV will decrease as opportunities of operating with less cost

are lost. This can be countered by using the postponement period to explore and implement production

scalability benefits. An increase in risk-less returns will increase the FROV, and this can be further

enhanced by closely monitoring changes in the interest rates. The FROV will decrease if value is lost

during the postponement of the investment, but this can be countered by either creating business barriers

for competitors or by better managing key resources.

The fuzzy capital budgeting approaches allow cash flows estimate as fuzzy numbers and offer the

means to integrate trend data into cash flows. Fuzzy cash flows can better reflect the uncertainty in the

project. The integration of qualitative information into the process gives better support. The real option

approach also supports the determination of the timing for the investment, and offers a comprehensive way

of presenting value of possibilities opened by the project, which is further enhanced with frequently

updated fuzzy cash flows. Finally, we would like to stress that advanced decision methods such as real

options and fuzzy capital budgeting open the chance to explore the value of flexibility inside and outside a

project, and give further insight into the real uncertainty of large investments. The uncertainty is genuine,

i.e. we simply do not know the exact levels of future cash flows. Without introducing fuzzy real option

model it would not be possible to formulate this genuine uncertainty. The proposed model that incorporates

subjective judgments and statistical uncertainties may give investors a better understanding of the problem

when making investment decisions.

References

Amram, M. and Kulatilaka, N.(1999), “Real options managing strategic investments in an uncertain

world,” Harvard Business School Press, Boston, MA.

Bonivi, C. P.(1975), “Comment on formulating correlated cash-flow streams,” Engineering Economist, 20:

269-314.

Bowman, E.H. and Hurry, D. (1993), “Strategy through the option lens: an integrated view of resource

investments and incremental-choice process,” Academy of Management Review, 18:760-842.

Black, F.and Scholes, M. (1973), “The pricing of options and corporate liabilities,” Journal of Political

Economy, 81:637–59.

Carlsson, C. and Fuller, R. (2002), “Fuzzy reasoning in decision making and optimization,” Physica Verlag,

Heidelberg.

Chen, S. N. and Moore, W. T. (1982), “Investment decision under uncertainty: application of estimation

risk in the hillier approach,” Journal of Financial and Quantitative Analysis, 17: 425-440.

Dahlberg, K. and Porter, R.S. (2000), “Get real,” Anderson Consulting Outlook Journal, 2:33-40.

Dixit, A.K. and Pindyck, R.S. (1994), “Investment under uncertainty,” Princeton University Press,

Princeton, NJ.

Dubois, D. and Prade H.(1988), “Possibility theory,” New York: Plenum Press.

Myers, S. C., and Turnbull, S. M.(1977), “Capital budgeting and the capital-asset pricing model: Good

news and bad news,” Journal of Finance, 32: 321-333.

Hillier, F. (1963), “The derivation of probabilistic information for the evaluation of risky investments,”

10

Management Science, 9: 443-457.

Leslie, K.J. and Michaels, M.P.(1997), “The real power of real options,” The McKinsey Quart, 3:5–22.

Kulatilaka, N. and Marcus, A.J. (1988), “General formulation of corporate real options,” Research in

Finance, 7:183-282.

Kulatilaka, N.(1993), “ The value of flexibility: the case of a dual-fuel industrial steam boiler,” Financial

Management, 22(3): 271.

Lee, Financial Analysis and Planning(1985): Theory and Application, Addison-Wesley Publishing

Company.

Luehrman, T. (1998), “Strategy as a portfolio of real options,” Harvard Business Review, 76: 89-99.

Benaroch, M. and KauFman, R.J.(2000), “Justifying electronic banking network expansion using real

options analysis,” MIS Quart, 24:197–225.

Micalizzi, A.(1999), “ Timing to invest and value of managerial flexibility. Schering Plough case study,”

paper presented at the 3rd Annual International Conference on Real Options, Wassenaar/Leiden.

Myers, S. C. and Turnbull, S. M.(1977), “Capital budgeting and the capital-asset pricing model: Good news

and bad news,” Journal of Finance, 32: 321-333.

Nichols, N.A.(1994), “ Scientific management at Merck,”Harvard Business Review, 72:88-99.

Merton, R.(1973), “Theory of rational option pricing,” Bell J. Econom. Manage. Sci., 4 :141–183.

Robichek, A. A. N.and Myers, S. C.(1966), “Conceptual problems in the use of risk-adjusted discount

rates,” Journal of Finance,12: 727-730.

Trigeorgis, L. (Ed.)(1995), “Real options in capital investment: models, strategies and applications,”

Praeger, Westport, CT.

Zadeh, LA.(1965), “Fuzzy sets,” Information and Control, 8:338–53.

11