On the Rate of Convergence of Binomial Greeks

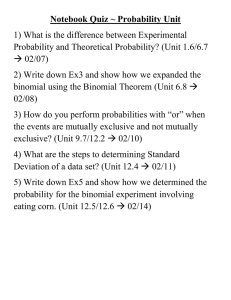

advertisement

On the Rate of Convergence of Binomial Greeks

San-Lin Chung, Weifeng Hung and Pai-Ta Shih***

Abstract

The recent literature indicates that the most efficient binomial models, including

binomial Black-Scholes (BBS) model of Broadie and Detemple (1996), the flexible

binomial model (FB) of Tian (1999), the smoothed payoff (SPF) approach of Heston

and Zhou (2000), and the generalized Cox-Ross-Rubinstein (GCRR) model of Chung

and Shih (2007), generally yield binomial option prices with monotonic and smooth

convergence. However, their efficiency for the calculation of delta and gamma are not

known. To fill the gap of the literature, we investigate the convergence patterns and

the rates of convergence of these binomial models for calculating delta and gamma.

The method proposed by Hull (1993, hereafter Hull method) and extended binomial

tree proposed by Pelsser and Vorst (1994, hereafter extended method) are applied to

these binomial models. The numerical results indicate that by using the Hull method

or the extended method, these binomial models can generate monotonic convergence

with the rate of convergence O(1/ n) for calculating delta and gamma. Moreover, the

GCRR-XPC model with an extended tree is the most efficient model to compute

deltas and gammas for options when a two-point extrapolation formula is used.

Keywords: binomial option pricing model, Greeks, monotonic convergence, rate of

convergence

JEL Classification: G13

Corresponding author, Department of Finance, National Taiwan University, 85, Section 4, Roosevelt

Road, Taipei 106, Taiwan, R.O.C.. Tel: 886-2-3366-1084. Email: chungs@management.ntu.edu.tw.

Department of Finance, Feng-Chia University. 100, Wenhwa Rd., Seatwen, Taichung, Taiwan 40724,

Taiwan, R.O.C.. Tel: 886-04-24517250#4173. Email: wfhung@fcu.edu.tw.

***

Department of Finance, National Taiwan University, 85, Section 4, Roosevelt Road, Taipei 106,

Taiwan, R.O.C.. Tel: 886-2-3366-1093. Email: ptshih@management.ntu.edu.tw.

Introduction

Binomial methods, developed first by Cox, Ross and Rubinstein (1979, CRR

thereafter), are well-known for their flexibility and efficiency in calculating option

price. One stream of the literature modifies the lattice or tree type to improve the

accuracy and computational efficiency of binomial option prices. The pricing errors in

the discrete-time models are mainly due to “distribution error” and “nonlinearity

error” (see Figlewski and Gao (1999) for thorough discussions). Within the literature,

there are many proposed solutions that reduce the distribution error and/or

nonlinearity error. For example, Broadie and Detemple (1996) and Heston and Zhou

(2000) suggested modified binomial models by replacing the binomial prices prior to

the end of the tree by the Black-Scholes values, or by smoothing payoff functions at

maturity, and computing the rest of binomial prices as usual. The advantage of their

approach is that the resulting binomial option prices converge to the Black-Scholes

prices monotonically and smoothly, and thus the standard Richardson extrapolation

can be applied to obtain solutions with high accuracy. The other improved lattice

approaches including Omberg (1988), Leisen and Reimer (1996), Figlewski and Gao

(1999), Widdicks, Andricopoulos, and Newton, and Duck (2002).1

In this paper, we focus on recent binomial models whose binomial option prices

converge to the “true” value monotonically and smoothly. In other words, the pricing

1

Omberg (1988) developed a family of efficient multinomial models by applying the highly efficient

Gauss-Hermite quadrature to the integration problem (e.g. N (d1 ) in the Black-Scholes formula)

presented in the option pricing formulae. Leisen and Reimer (1996) modified the sizes of up- and

down-movements by applying various normal approximations (e.g. the Camp-Paulson inversion

formula) to the binomial distribution derived in the mathematical literature. Figlewski and Gao (1999)

proposed the so-called adaptive mesh method which sharply reduces nonlinearity error by adding one

or more small sections of fine high-resolution lattice onto a tree with coarser time and price steps.

1

errors of these binomial option prices are of the same sign and decrease at a known

rate as the number of time steps increases.2 These models include the binomial

Black-Scholes (BBS) model of Broadie and Detemple (1996), the flexible binomial

model (FB) of Tian (1999), the smoothed payoff (SPF) approach of Heston and Zhou

(2000), and the GCRR-XPC model of Chung and Shih (2007).3

Although the above models have been widely applied to price options, their

convergent patterns and rate of convergence for calculating the hedge ratios are not

well known. To fill this gap, we apply the method proposed by Hull (1993) and

extended method proposed by Pelsser and Vorst (1994) to calculate Greeks under

these models. We find that by using Hull method and extended method, these

binomial models can generate monotonic convergence with O 1n rate for

calculating deltas and gammas.4 Thus one can apply the extrapolation formula to

enhance the computation of the hedge ratios. Among all the binomial models

considered in this paper, the GCRR-XPC model is the most efficient one for the

evaluation of deltas and gammas for European options when a two-point extrapolation

is used.

The rest of the paper is organized as follows. Section 2 briefly reviews the

binomial models considered in this paper. The rates of convergence of applying

2

Binomial models with the smooth and monotonic convergence property are the most accurate ones in

the recent literature because their accuracy can be substantially improved by applying the Richardson

extrapolation technique (Chang, Chung, and Stapleton, 2007).

3

In the GCRR-XPC model, a stretch parameter ( ) is used to adjust the lattice so that the strike price

is located in the center of the final nodes. See Section 2.1 for details of the GCRR-XPC model.

4

Numerical differentiation formulae can also be applied to these binomial models for the calculations

of Greeks. However, by using numerical differentiation formulae, it needs to construct two binomial

trees to calculate delta and to construct three binomial trees to calculate gamma. Thus, it takes more

time to calculate Greeks. Besides, the numerical results show that the convergent patterns of binomial

Greeks using numerical differentiation formulae are not smooth and monotonic. Thus, we do not apply

numerical differentiation formulae in this paper.

2

extended binomial tree to CRR model, SPF model and GCRR-XPC model are proved

and the extrapolation formula is discussed in Section 3. Section 4 presents the

numerical results of various binomial models for the evaluations of deltas and

gammas of options. Section 5 concludes the paper.

2. Reviews of the binomial option pricing models

We assume that the Black-Scholes economy holds and thus options can be

valued as if the investor is risk-neutral. In other words, the options can be priced

under the risk-neutral measure where stock price follows a geometric Brownian

motion given by

dS

(r q ) dt dZ ,

S

(1)

where S is the stock price, r is the risk-free rate, q is the dividend yield, and

is the instantaneous volatility of S .

The binomial option pricing model was first developed by Cox, Ross, and

Rubinstein (1979) and Rendleman and Bartter (1979). Consider the pricing of an

option maturing at time T . In an n-period binomial model, the time to maturity

[0, T ] is partitioned into n equal time steps t T / n . If the stock price is S in this

period, then it is assumed to jump either upward to uS with probability p or downward

to dS with probability 1 p in the next period, where 0 d e( r q ) t u and

0 p 1 . The binomial model is completely determined by the jump sizes u and d

and the risk-neutral probability p.

2.1. The binomial models with monotonic and smooth convergence property

In the traditional CRR model, the following three conditions are utilized to

determine u, d, and p.

3

pSu (1 p) Sd Se( r q ) t ,

pu 2 (1 p)d 2 pu (1 p)d 2 t ,

2

(2)

ud 1.

The first two conditions are used to match the mean and variance of the stock price in

the next period, and the third condition is imposed arbitrarily by CRR. With these

three conditions, one can easily determine the binomial parameters as follows:

u e

t

, d e

t

, and p (e( r q ) t d ) /(u d ) .

According to the Central Limit Theorem,5 the discrete distribution of the asset

price under the CRR model will converge to its continuous-time limit (i.e.

Black-Scholes model). In other words, as t 0 , the price distribution of the CRR

model converges to a lognormal distribution,

2

ln ST N ln S0 (r q )T , T .

2

d

(3)

As a result, the option prices calculated by the binomial model will also converge to

the Black-Scholes price.

Although the CRR model is a well known and widely used model for valuing

options, the option prices calculated from it usually converge to the Black-Scholes

price in a wavy erratic fashion. In order to enhance the accuracy of the binomial

option prices, the recent literature has developed several ways to overcome the wavy

erratic problem embedded in the CRR model. Four important articles are discussed

and applied in this paper. These papers developed binomial models with monotonic

and smooth convergence property. Monotonic convergence is desirable because more

time steps do guarantee more accurate prices. Moreover, smooth convergence is also

5

The following condition should be satisfied to apply the Central Limit Theorem:

p u e( r q ) t 1 p d e( r q ) t

3

3

[ p(u e( r q ) t )2 1 p (d e( r q ) t )2 ]1.5 n

0 as t T / n 0 .

4

advantageous because the standard Richardson extrapolation can be used to enhance

the accuracy.

Broadie and Detemple (1996) proposed a binomial model termed Binomial

Black and Scholes (BBS) model to price options. The BBS model is identical to the

CRR model except that at one time step before option maturity the Black-Scholes

formula replaces the usual “continuation value.” Broadie and Detemple (1996)

showed that the option prices obtained from the BBS model converge to the

Black-Scholes formula smoothly and monotonically. Thus, they suggested using the

Richardson extrapolation to enhance the accuracy.

Tian (1999) developed a flexible binomial (FB) model with a “tilt” parameter ( )

that alters the shape and span of the binomial tree. The parameters of the FB binomial

model are as follows:

t 2 t

ue

, d e

t 2 t

e( r q ) t d

.

, p

ud

(4)

With a positive tilt parameter, > 0, the up movement is larger than the

corresponding up move in a standard CRR tree. Consequently, the central nodes

depict an upward sloping line. The resulting tree span is thus shifted upward. The

exact opposite is true for binomial trees with a negative tilt parameter, < 0. Fig. 1

illustrates the effect of the “tilt” parameter on binomial trees.

<Insert Fig. 1. Here>

Tian (1999) first proved that his FB model converges to its continuous-time

counterparts (i.e. the Black-Scholes model) for any value of the tilt parameter.6 Tian

6

However, the tilt parameter must satisfy the following inequality in order to have “nonnegative

probability”:

( r q)

2

1

t

.

5

(1999) then suggested the way to select a particular tilt parameter that enhances the

rate of convergence of binomial prices to their continuous-time limit. This is done by

selecting a tilt parameter such that a node in the tree coincides exactly with the strike

price at the maturity of the option. This idea was inspired by Leisen and Reimer

(1996). 7 As a result, one can derive the formula for the tilt parameter as the

following:

ln( SX0 ) (2 j0 n) t

n 2 t

,

(5)

ln( SX ) n ln(d0 )

0

where j0

, [.] denotes the closest integer to its argument, X is the

ln( ud00 )

strike price, u0 e

t

, and d 0 e

t

. Using the FB model with the above tilt

parameter, Tian (1999) showed that monotonic and smooth convergence is possible

for pricing standard European and American options, and extrapolation methods are

used to enhance the accuracy.

Heston and Zhou (2000) showed that the accuracy or rate of convergence of the

binomial model depend crucially on the smoothness of the payoff function. They have

developed an approach to smooth the payoff function. Intuitively, if the payoff

function at singular points can be smoothed, the binomial recursion might be more

accurate. They defined the smoothed payoff function G x as follows:

G x

1

2 x

x

x

g x y dy ,

(6)

where g x is the payoff function. This is a rectangular smoothing of g x . The

7

Leisen (1996) independently proposed a binomial model that has some similar features as the flexible

binomial model. See his SMO model. However, his choice of u and d is rather ad hoc. A

systematic way of determining u and d is proposed here through the choice λ.

6

smoothed function, G x , can be easily computed analytically for most payoff

functions used in practice. For example, the smoothed payoff function of a European

put option with a strike price X can be derived as follows:

0,

e t e t

,

G ( ST )= X ST

2

t

X t ln ST

X

ST

e

2 t

2 t

ln ST ln X t

ln ST ln X t

t

(7)

X

, t ln ST ln X t

ST

Applying the smoothed payoff function G x , instead of g x , to the binomial

model yields a rather surprising and interesting result. The associated SPF model

converge at the O 1n rate to its continuous-time limit and this convergence is

smooth and monotonic as the number of time steps increases.

Chung and Shih (2007) proposed a generalized CRR (GCRR) model by adding

a stretch parameter into the model specification. In the GCRR model the jump sizes

and probability of going up are as follows:

u e

t

, d e

1

t

, and p

e( r q ) t d

,

ud

(8)

where 0 is a stretch parameter which determines the shape (or spanning) of the

binomial tree. The CRR model is obviously a special case of our GCRR model with

1 . When t 0 , i.e., the number of time steps n grows to infinity, the GCRR

binomial option prices also converge to the Black-Scholes formulae for plain vanilla

European options.

Generally speaking, the rate of convergence of the GCRR model for pricing

7

options is of order O

1

n

when 1 .8 This rate of convergence is inferior to other

binomial models such as the BBS model and the FB model. Thus, to best apply the

GCRR model, Chung and Shih (2007) suggested using the so-called GCRR-XPC

model, where the lattice is set up in a way that the strike price is in the center of the

final nodes, to price options. In particular, the binomial option prices of the

GCRR-XPC model not only converge at a high order (of order O 1n ) but also

converge smoothly and monotonically to the Black-Scholes formulae. Thus in the

numerical analysis of this paper, we adopt the GCRR-XPC model to calculate hedge

ratios.

2.2. Calculating hedge ratios with binomial models

Greeks (or hedge ratios) are the sensitivity of the option price with respect to the

change of the underlying risk factors. For the Hull method, the estimated delta is

calculated at time t T / n and the estimated gamma is calculated at time 2t in

the standard tree where the current underlying asset price and option price are S0,0

and C0,0 , respectively. In Fig. 2, the estimates of delta and gamma can now be

obtained as follows:

C C1,0

ˆ 1,1

,

S1,1 S1,0

C2,2 C2,1 C2,1 C2,0

2

C

S2,2 S2,1 S2,1 S2,0

ˆ 2

.

1

S

S

S

2,2 2,0

2

(9)

(10)

<Insert Fig. 2. Here>

Instead of using the Hull method, we also apply the extended method to

calculate delta and gamma. In the extended binomial tree, we build the binomial tree

8

Please refer to Theorem 2 of Chung and Shih (2007).

8

starting from two time steps back from today. Fig. 3 illustrates the extended binomial

tree, where the current underlying asset price and option price are S0,1 and C0,1 ,

respectively. The estimates of delta and gamma can now be obtained as the following:

C C0,0

ˆ 0,2

,

S0,2 S0,0

(11)

C0,2 C0,1 C0,1 C0,0

2

C

S0,2 S0,1 S0,1 S0,0

.

ˆ 2

1

S

S0,2 S0,0

2

(12)

<Insert Fig. 3. Here>

3. The rate of convergence of the binomial models and the

extrapolation formula

When the convergence pattern of the binomial option prices is monotonic and

smooth, one can apply the extrapolation technique to enhance its accuracy. However,

the extrapolation formula depends on the rate of convergence of the binomial model.

Thus we first discuss the rate of convergence of the binomial models discussed in this

paper.

Leisen and Reimer (1996) proved that the convergence is of order O 1n for

the CRR model. Since the FB model of Tian (1999) is a fine tune of the CRR model,

it is straightforward to verify that its convergence is also of order O 1n . Moreover,

Heston and Zhou (2000) showed that the rate of convergence can be improved by

smoothing the option payoff functions and cannot exceed

1

n

at some nodes of the

tree.9 They showed that the rate of convergence of the binomial model with smoothed

payoff functions (e.g. the BBS model and the SPF model) is also of order O 1n .

Finally, Corollary 1 of Chung and Shih (2007) proved that the rate of convergence of

9

Please see p. 57 of Heston and Zhou (2000).

9

the GCRR-XPC model is of order O 1n . Thus, all the binomial models considered in

this paper have the same rate of convergence, i.e. of order O 1n for calculating option

prices.

Let e(n) be the pricing error of the n-step binomial model, i.e.:

e(n) Cn CBS ,

(13)

where Cn is the n-step binomial price and C BS is the Black-Scholes price. Define

the error ratio as:

(n) e(n / 2) e(n).

(14)

The error ratio is a measure of the improvements in accuracy as the number of time

steps doubles. Given the fact that all the binomial models considered in this paper

have the convergence of order O 1n , we obtain that the error ratio will converge to 2

as the number of time steps increases. Thus the Black-Scholes price can be

approximated as follows:

CBS (n) 2Cn Cn 2 .

(15)

It is not difficult to show that the pricing error after applying the extrapolation can be

written as:

e(n) CBS (n) CBS (2 (n))e(n) .

(16)

Thus the pricing error after applying the extrapolation critically depends on the

difference between 2 and the error ratio. If the error ratio ( n ) is within the range of

(1, 3) , the absolute pricing error with extrapolation is smaller than the absolute

pricing error without extrapolation. Otherwise, applying the extrapolation method to

the binomial prices will increase rather than decrease the pricing errors.

Similarly, to derive the extrapolation formula for hedge ratios, one needs to

10

derive the rate of convergence of the Greeks calculated from the binomial models. In

the following, the theoretical proofs of the convergent rates of applying the extended

method to CRR, SPF, and GCRR-XPC for calculating deltas are offered.10 Similarly,

calculating gamma also has the same rate of convergence and the detailed proofs are

available on request.

Theorem 1. Let ˆ n,CRR be the n-period CRR binomial delta of a standard European

put option with extended tree and BS is the true delta. Therefore,

n ,CRR = BS

d12

2

e

f (n) O 1n ,

n 2

(17)

where f (n) = 2d 2 ( (n) (n) 2 ) , N(.) is the cumulative density function of the

standard

normal

distributions,

d1

ln XS (r 2 / 2)T

T

and (n)

ln SXx

ln du

,

S x Su m d nm , and m is the largest integer which satisfies Su m d n m X .

Proof: It is assumed that Su m d n m X and m is the largest integer. In other words,

m

ln XS

n

n

( n) = z ,

2

2 2 t

(18)

ln X ln Su m d nm

(n) and 0 (n) 1 . Since

where z

(n) , we have

2 t

2 t

ln

X

S

Su m d nm Xe2

t

.

(19)

On the other hand,

10

Generally, BBS and SPF can be classified as the models with the smoothed payoff function. On the

other hand, FB and GCRR-XPC can be classified as the models with the adjusted tree so that the strike

price is allocated at one of the final nodes. Therefore, in addition to the convergent rate of applying

extended binomial tree method to CRR, only the convergent rates of applying extended binomial tree

method to SPF and GCRR-XPC for calculating deltas are offered for simplicity.

11

ert e

p

where a

r

t

e

e

t

t

1

a t O 1n ,

2

(20)

2

2 .

2

In the extended tree, the option value at the node with stock price equal Su 2 at

present time is

m 1

e rT C nj p j (1 p)n j X Su 2u j d n j ,

j 0

(21)

and the option value at the node with stock price equal Sd 2 at present time is

m 1

e rT C nj p j (1 p)n j X Sud 2u j d n j .

j 0

The estimated delta is n,CRR

(22)

(21) (22)

. We denote (21)-(22) =A+B+C, where

S (u 2 d 2 )

n m

n m 1

,

A Xe rT Cmn p m 1 p Cmn 1 p m1 1 p

B=

nm

n m1

e rT Cmn p m 1 p Su 2u md nm Cmn 1 p m1 1 p

Sd 2u m1d nm1 ,

m

C= e rT C nj p j 1 p

j 0

n j

Su

2

(23)

Sd 2 u j d n j .

According to Chung and Shih (2007),

m

C

n j

rT

e

C nj p j 1 p u j d n j

2

2

S (u d )

j 0

0.5 (n)

N d1

O 1n .

np 1 p

Because Cmn 1 Cmn

nm

and Su m d nm Xe2

m 1

12

t

by (19), we have

(24)

A+B

Xe rT Cmn p m 1 p

= Xe rT Cmn p m 1 p

where D = u 2e2

nm

nm

t

t

n m p 2

e

m 1 1 p

t

1

nm p

m 1 1 p

(25)

D,

1 2nz

nm

Since

m 1 1 2( zn1)

2 2

u e

n m p 2

e

m 1 1 p

t

1

nm

nm p

. First, let’s check

.

m 1

m 1 1 p

2

2 z 2( z 1) 4 z 1

1 1

...

, by (18),

n

n

n2

2 ln XS

nm

1

O

m 1

n t

.

e1 ( n )

n

(26)

Besides, we have

u 2e2

t

1 2 t 1 (n) 2 2 t 1 (n) O

2

e2 ( n )

n15

,

(27)

and by (20)

p

1 4a t O 1n .

1 p

(28)

Therefore, D defined in (25) is

2ln XS

D 1

O

n t

e1 ( n )

n

1 4a

× 2 t (n) 2 2 t 2 (n) O

t O 1n

e3 ( n )

n15

+ 2 t 1 (n) 2 2 t 1 (n) O

2

e2 ( n )

n15

4 t 0.5 (n) 2 2 t 2 (n) 8at (n)

4ln XS

2

(n) 2 2 t 1 (n) O

n

e4 ( n )

n1.5

On the other hand, according to Feller’s (1971, P.53~P.54),

13

(29)

n! 2 n

n

1

2 n

e

1 O .

1

n

Therefore,

Cmn

Since

1

1

1 O 1n .

1

1

2 n 1 m nm 2 m m 2

n

n

m 1 z

according to (18),

n 2 n

1 O 1n

1

.

C

n 1

1

1

2 n 1

2 z nm 2

2 z m 2

1 n

1 n

2

n

m

(30)

On the other hand, by (20),

p

m

1 p

nm

n

m

n m

1

1 x 1 x ,

2

(31)

where x 2a t O 1n . Therefore, by (30) and (31),

C p 1 p

n

m

m

nm

1

1 1 x

2 n 1 1 2nz

2

nm

1 x

2z

1 n

n

m

1

1

2z 2

n

1

2z 2

n

1 1

m

1 x 1 x 1 2nz

1 O 1n

2z

2z

n 1 n 1 x 1 n

2

4

1

.

(32)

y 2 y3

According to the Taylor’s series of ln(1 y ) y

... and the

2

3

definitions of z and x in (18) and (31),

n

m

1 x 1 x 1 2nz

nx 2

2z 2

ln 2 z

2z

2 xz

O

2

n

1 n 1 x 1 n

2

1

n

z

= 2 a t n

O

n

14

.

1

n

(33)

2

r

2

ln XS

2 (n)

z

( n) 1

d2

Since a t n

T

,

2

n

2

n

2 T

n

d

(33)

2

2 (nn )

2

2

O

1

n

d22 2d2 (n)

O

2

n

.

1

n

Therefore,

d 22 2 d 2 ( n )

2

n

Xe rT Cmn p m 1 p

nm

e

Xe rT

n

2

4

1

S

1 O

2

n

4

e

d12

2

e

2 d 2 ( n )

n

1 O

1

n

1

n

.

1 O

1 O

1

n

.

1 O

1 O

1

n

1

n

(34)

By (29) and (34), A+B in (25) is

( A B) S

1

2

n

4

e

d12

2

e

2 d 2 ( n )

n

1

n

4 t 0.5 (n) 2 2 t 2 (n) 8at (n)

4ln XS

n

(n) 2 2 t 1 (n) O

2

e4 ( n )

n1.5

(35)

Therefore, after tedious calculations, we have

n,CRR

(21) (22) A B C

(35)

(24) .

2

2

2

2

S (u d ) S (u d ) S (u 2 d 2 )

N d1

d12

2

e

f (n) O 1n ,

n 2

where f (n) = 2d 2 (n) 2 (n) .

(36)

Q.E.D.

According to Theorem 1, although using CRR with an extended tree to calculate

delta has the rate of convergence O 1n , the convergent pattern is oscillatory due to the

15

relative allocation of the strike price between two most adjacent nodes. However, SPF

and GCRR-XPC models demonstrated that the CRR’s binomial prices monotonically

converge to the Black-Scholes formula at the rate of O( 1n ). The rates of convergence

of applying extended tree to SPF and GCRR-XPC models in calculating delta are

proved in the following theorems.

Theorem 2. Let ˆ n, SPF be the n-period SPF binomial delta of a standard European

put option with extended tree and BS is the true delta,

n , SPF = BS O 1n .

(37)

Proof: For simplicity, it is assumed that (n) 0.5 . The proofs for the other values of

(n) are quite similar, and they are available on request. In the extended tree, the

option value at the node with stock price equal Su 2 at present time is

m 1

e t e

e rT C nj p j (1 p) n j X Su 2u j d n j

2 t

j 0

t

rT n m

n m

e Cm p (1 p )

X t ln( Su m1d nm1 )

X

e t

X

m 1 n m 1

×

Su d

,

2 t

2 t

2 t

(38)

and the option value at the node with stock price equal Sd 2 at present time is

m 1

e rT C nj p j (1 p ) n j ( X Sd 2u j d n j

j 0

e

rT

n

m 2

C

p

m 2

(1 p)

n m2

e

e

2 t

t

t

)

X t ln Su m1d nm1

X

2 t

e t

X

Su m 1d n m 1

.

2 t

2 t

The estimated delta is denoted by n, SPF

(39)

(38) (39)

. For the convenience of proof,

S (u 2 d 2 )

16

We define

t ln Su m1d nm1

t

X

Su m1d nm1

1

e

A=

.

X

2

t

2

t

2

t

Xe rT A[Cmn p m (1 p)nm Cmn 2 p m 2 (1 p)n m2 ]

(38) (39)

Let’s first calculate

in

.

2

2

S (u 2 d 2 )

S (u d )

Because ln

Su m1d nm1

2 t 1 (n) ,

X

t (1 2 ( n ))

1]

2

1

[e

A= (1 (n))

t 0.5 (n) O

2 t

2

E1 ( n )

n

.

(40)

In addition,

Xe rT [Cmn p m (1 p) n m Cmn 2 p m 2 (1 p) n m 2 ]

(n m 1)(n m) p 2

Xe rT Cmn p m (1 p)nm 1

.

(m 1)(m 2) (1 p) 2

Since p

a

r

(41)

[1 2( zn1) ][1 2nz ]

1

(n m 1)(n m)

a t O 1n and

where

2

(m 1)(m 2)

[1 2( zn1) ][1 2( zn 2) ]

2

2

2

and z

ln

X

S

2 t

( n) ,

(n m 1)(n m) p 2

4ln XS

(r 2 )

1

4

t O

(m 1)(m 2) (1 p) 2 n t

2

4d 2

O

n

E1 ( n )

n

E2 ( n )

n

.

(42)

By (34) and (42), we have

(41)= S

1

2

n

4

e

d12

2

e

2 d 2 ( n )

n

(1 O

) 1 O 4nd

1

n

1

n

Therefore, by (40) and (43),

17

2

O

E2 ( n )

n

.

(43)

Xe rT A[Cmn p m (1 p)n m Cmn 2 p m 2 (1 p )n m 2 ]

S (u 2 d 2 )

1 2

e

n 2

d12

2

(d 2 ) 0.5 (n) O

2

E3 ( n )

n1.5

.

2

1 2 d21

e (d 2 ) (n) 2 (n) O 1n

n 2

(44)

From the above theorem, we know

d12

2

U D

2e

N d1

d 2 (n) 2 (n) O 1n ,

2

2

Su Sd

n 2

(45)

where

m 1

e t e

U = e rT C nj p j (1 p )n j X Su 2u j d n j

2 t

j 0

t

,

m 1

e t e

D = e rT C nj p j (1 p )n j X Sd 2u j d n j

2 t

j 0

t

.

Therefore by (44) and (45), the estimated delta

n, SPF

(40) (41)

= (44)+(45) = N (d1 ) O 1n .

2

2

S (u d )

Q.E.D.

Theorem 3. Let ˆ n,GCRR XPC be the n-period GCRR-XPC binomial delta of a

standard European put option with extended tree and BS is the true delta,

n ,GCRR XPC = BS O 1n .

(46)

Proof: Please refer to Appendix 1.

To sum up, in this section, we discuss the rate of convergence of the binomial

models and offer the theoretical proofs of the rates of convergence of applying

extended method to CRR, SPF and GCRR-XPC to calculate deltas. It is found that

applying extended tree to SPF and GCRR-XPC can generate monotonic convergence

with O 1n rate for calculating Greeks.

18

4. Numerical results and analysis

In the following numerical analysis, we will extensively illustrate the

convergent patterns, rate of convergence and numerical efficiency of various binomial

models of calculating delta and gamma. First, to show the error ratios of various

binomial models defined in (14), the following parameters are chosen: stock price=40,

strike price = 45, volatility = 0.2, time to maturity= 6 months, riskless interest

rate=6% and dividend yield= 0 so that we can make sure if the extrapolation

technique can be applied to enhance the accuracy.

For calculating deltas, from Tables 1 and 2, it shows that applying Hull method

or applying the extended method to these binomial models result in quite stable error

ratios around 2. It means that they converge to the true delta monotonically with

O(1/n) rate. Therefore, the extrapolation technique can be applied to enhance the

accuracy. We first choose a large set of options (243 options). The 243 parameter sets

are drawn from the combinations of X {35, 40, 45}, T {1/12,4/12,7/12}, r {3%,

5%, 7%}, q {2%, 5%, 8%}, {0.2, 0.3, 0.4}, and S 40 . We report the results

for different numbers of time steps n {20, 40, 60, 80, 100, 500, 1000} in order to

examine the convergence property. The accuracy measure used in this paper is the

root mean squared (RMS) absolute error. RMS absolute error is defined as

1 m 2

RMS

ei ,

m i 1

(47)

where ei cˆi ci is the absolute error, ci is the “true” value (estimated from the

Black-Scholes formula), cˆi is the estimated value from the binomial model.

<Insert Tables 1 and 2 Here>

19

To clarify the role played by Richardson extrapolation, we first compare the

numerical efficiency of each model on a raw basis without any extrapolation

procedure. From Table 3, the extended method on average underperforms Hull

method without extrapolation.11 Overall, the SPF with Hull method is the best.

However, when Richardson extrapolation is applied, Table 4 shows that the extended

method on average outperforms the Hull method in calculating Greeks. 12 The

improvement of using Richardson extrapolation for the extended method is because

the error ratios of the extended method are more like to be 2 for these four binomial

models compared to the Hull method as shown in Table 1 and Table 2. Overall,

applying extended method to GCRR-XPC is the best.

For calculating gammas, from Table 5 and Table 6, applying Hull method or

extended method to these binomial models result in quite stable error ratios around 2,

so the extrapolation technique can be applied to enhance the accuracy. Again, to

clarify the role played by Richardson extrapolation, we first compare the numerical

efficiency of each model on a raw basis without any extrapolation procedure. In Table

7, it shows that the extended method is on average superior to the Hull method.13

Overall, the performance of FB with the extended tree is the best. However, when

Richardson extrapolation is used in Table 8, FB performs worst and this is consistent

with Table 5 and Table 6 in which the error ratios of using FB are most unstable

11

This is true for all these four binomial models except for GCRR-XPC model.

12

The numerical results of using extended method are better than those of using Hull method for

GCRR-XPC model and FB model. Besides, the numerical result of using extended method is almost as

good as those of using Hull method for BBS model.

13

The numerical results of using extended method are better than those of using Hull method for CRR

model, GCRR-XPC model, and FB model. However, the numerical result of using Hull method is

better than those of using extended method only for BBS model and SPF model.

20

around 2. Overall, applying extended tree to GCRR-XPC is the best. To sum up,

applying extended tree to GCRR-XPC with extrapolation results in the most efficient

estimates of deltas and gammas.

<Insert Tables 3 to 8 Here>

5. Conclusion

This paper uses various binomial models to calculate Greeks and discuss the

convergent pattern, convergent rate, and the numerical efficiency among these models.

We contribute to the literature at least three aspects. First, although BBS model of

Brodie and Detemple (1996) , SPF of Heston and Zhou (2000), FB of Tian (1999),

and GCRR-XPC of Chung and Shih (2007) have been widely applied to price options,

their convergent patterns and rate of convergence for calculating the hedge ratios are

not well known. To fill this gap, we apply the Hull method and the extended method

to these models in order to compute deltas and gammas.

Second, we apply the Hull method and extended method to these models and

compare numerical efficiency of calculating Greeks. It is found that applying the

extended method to GCRR-XPC is the most efficient binomial model in calculating

Greeks when a two-point extrapolation formula is used.

Finally, we derive the convergence rate of the binomial model in calculating

Greeks. We prove that applying the extended method to GCRR-XPC model and SPF

model converge to the true delta monotonically with the rate of convergence O(1/n).

21

Appendix 1 (Proof of Theorem 3)

At the node with stock price equal to Su1u2 , the option price is

n

1

2

e rT C nj p j (1 p)n j ( X Su1u2 u1j d1n j ) ,

(A1)

j 0

and at the node with stock price equal to Sd1d 2 , the option price is

n

1

2

e rT C nj p j (1 p)n j ( X Sd1d 2 u1j d1n j ) ,

(A2)

j 0

where u1 e

( n ) t

, u2 e

t

(n)

, d1 e

t

(n)

and d 2 e ( n )

t

. The estimated delta is

(A1) (A2)

defined as ˆ n ,GCRR XPC

and

S (u1u2 d1d 2 )

n

1

n2 1

2

n j

n j

n j

n j

(A1) (A2) X C j p (1 p) C j p (1 p)

j 0

j 0

n

1

n2 1

2

j n j n j

n j

j n j n j

n j rT

+ Su1u2 u1 d1 C j p (1 p) Sd1d 2 u1 d1 C j p (1 p )

e

j 0

j 0

Because C(nn / 2) 1

n!

n

n/2

n

C(nn / 2)

,

n2

n n n n n 1

1 ! 1 ! ! ! 2

2 2 2 2

n

1

n2 1

2

n j

n j

n j

n j rT

X C j p (1 p) C j p (1 p)

e

j 0

j 0

n

n

n

n

1

1

X Cnn/2 p 2 (1 p) 2 C(nn /2) 1 p 2 (1 p) 2 e rT

n

p rT

XC(nn /2) p n /2 (1 p)n /2 1

e .

n 2 1 p

22

(A3)

1

a t O 1n ,where

2

According Chung and Shih (2007), p

2

ln r

T

2

1 r ln XS 1

1

1

.

a

d2

2 T 2 2

T

2

T

X

S

(A4)

Therefore,

n

1

1

2

p (1 p) a t O 1n a t O 1n

2

2

n

2

n

2

n

1 2

1 4a 2 t O

4

.

n

2

1

n

3

(A5)

2

On the other hand,

n

1

n2 1

2

Sd d u j d n j C n p j (1 p ) n j Su u u j d n j C n p j (1 p )n j e rT

1 2

1 1

j

1 2

1 1

j

j 0

j 0

n

2

( Sd1d 2 Su1u2 ) C nj p j (1 p) n j u1j d1n j e rT

j 0

n

n

1

1

2

2

1 2 1

1

Sd d u

d

n

( n /2) 1

C

n n

2 2

1 1

p

n

1

2

Since Su d X , u1 e

(1 p )

( n ) t

n

1

rT

2

e

, u2 e

n

2

1 2 1

n

2

1

Su u u d C

t

(n)

, d1 e

n

n /2

t

(n)

n

2

n

2

p (1 p ) e rT .

and d 2 e ( n )

t

(A6)

,

n

n

n

n

n n

n

n

1

1

1

1

rT

n

2

2

2

2

2 2 n

2

2

Sd

d

u

d

C

p

(1

p

)

Su

u

u

d

C

p

(1

p

)

1 2 1 1 ( n /2) 1

e

1 2 1 1

n /2

n

n

n n

ddu

n

p rT

Cnn/2 p 2 (1 p ) 2 Su12 d12 u1u2 1 2 1

e

d1

n 2 1 p

C

n

n /2

p

n rT

p (1 p) X u1u2

e

1 p n 2

n

2

n

2

By (A3), (A6) and (A7),

23

(A7)

n

2

n

2

XC p (1 p) [u1u2 1] rT

(A1) (A2)

C nj p j (1 p)n j u1j d1n j e rT

e .

S (u1u2 d1d2 )

S (u1u2 d1d 2 )

j 0

n

n /2

n /2

(A8)

Because

2

1

p(1 p) a t O 1n

2

2

1

[1 x ]

4

where x 4a 2 t O

n

(A9)

,

1

n1.5

n

X Cnn/2 p 2 (1 p) 2 [u1u2 1] rT X n 1

e Cn /2

S

u1u2 d1d 2

S

4

Since (1 x)

e

d22

2

e

n /2

e

( d1 a T )2

2

ln(1 x )

e

n

2

d12

2

e

( x

x2

n

...)

2

2

n /2

e2 a tn e

2

O

1 x

n /2

u1u2 1

e rT

u1u2 d1d 2

(A10)

, by (A4) and

1

n

S rT

e ,we have

X

(1 x)

n /2

e

d22

2

S e d2 erT eO .

e

O

2

1

1

n

1

n

X

and

n

d

X

1 2 S rT 21 rT O 1n (u1u2 1)

e e e e

(A10) Cnn/2

S

u1u2 d1d 2

4 X

n

2

d

1 2 1 O 1 (u1u2 1)

Cnn/2 e 2 e n

.

u1u2 d1d 2

4

2

(A11)

According to Feller’s (1971, p.53 ~ p.54),

n! 2 n

n

1

2 n

e

If we set n 2k ,we have

24

1 O .

1

n

C

n

n /2

n

2

(2k )! 1

1

k !k ! 2

4

2k

2k

1

2

e 2 k 1 O 21k 1

2k

2

2

2 k 2 k 1e2 k 1 O 1k

2 (2k )

1

1 O 1k .

k

Therefore,

n

n

n /2

C

1

1

1 2

1 O 1n

1 O 1n ,

k

n / 2

4

(A12)

and

(A11) e

e

d12

2

O 1

u u 1

1

1 O 1n e n 1 2

u1u2 d1d 2

2 (n / 4)

d12

2

1 d21

e

2

1

1 O 1n 1 O

2 (n / 4)

12 O

1

n

1

O 1n .

2 (n / 4)

1

n

(A13)

In (A8), according to Chung and Shih (2007),

n /2

n /2

J 0

J 0

C nj p j (1 p) n j u1j d1n j e rt C nj p* j (1 p* )n j

0.5

O 1n .

N d1

*

*

np (1 p )

where p*

(A14)

pu1

.

e r t

0.5

(A14) N (d1 ) N (d 1 )

O 1n

np* (1 p* )

1 d1

N (d1 ) e 2

2

1

O 1n .

2 (n / 4)

25

(A15)

Finally, we have

(A1) (A2)

ˆ n ,GCRR XPC

(A13) (A15) N ( d1 ) O 1n .

Su1u2 Sd1d 2

(A16)

Q.E.D.

26

References

Broadie, M., Detemple, J., 1996. American option valuation: New bounds,

approximations, and a comparison of existing methods. Review of Financial

Studies 9, 1211-1250.

Chang, C.C., Chung, S.L., Stapleton, R., 2007. Richardson extrapolation techniques

for the pricing of American-style options. Journal of Futures Markets 27,

791-817.

Chung, S.L., Shih, P.T., 2007. Generalized Cox-Ross-Rubinstein binomial model.

Management Science, 53, 508-520.

Cox, J.C., Ross, A., Rubinstein, M., 1979. Option pricing: A simplified approach.

Journal of Financial Economics 7, 229-263.

Feller, W., 1971. An introduction to probability theory and its applications. NY: John

Wiley&Sons, Inc.

Figlewski, S., Gao, B., 1999. The adaptive mesh model: A new approach to efficient

option pricing. Journal of Financial Economics 53, 313-351.

Heston, S., Zhou, G., 2000. On the rate of convergence of discrete-time contingent

claims. Mathematical Finance 10, 53-75.

Hull, J.C., 1993. Options, futures and other derivatives. NJ: Prentice-Hall

International, Inc.

Leisen, D., Reimer, M., 1996. Binomial models for option valuation-examining and

improving convergence. Applied Mathematical Finance 3, 319-346.

Omberg, E., 1988. Efficient discrete time jump process models in option pricing.

Journal of Financial and Quantitative Analysis 23, 161-174.

Pelsser, A., Vorst, T., 1994. The binomial model and the Greeks. Journal of

Derivatives 1, 45-49.

27

Rendleman, R., Batter, B., 1979. Two-state option pricing. Journal of Finance 34,

1093-1110.

Tian, Y.S., 1999. A flexible binomial option pricing model. The Journal of Futures

Markets 19, 817-843.

Widdicks, M., Andricopoulos, A.D., Newton, D.P., Duck, P.W., 2002. On the

enhanced convergence of standard lattice methods for option pricing. Journal of

Futures Markets 22, 315-338.

28

0

0

0

Fig. 1. The flexible binomial tree for different λ values

S 2,2

S1,1

C2,2

C1,1

S 0,0

S 2,1

S1,0

C0,0

S 2,0

C 2,1

C1,0

C2,0

Fig. 2. The Hull method

C0,2

S 0,2

S 1,1

C 1,1

S 2,0

S 0,1

C 0,1

C2,0

S 1,0

C1,0

S 0,0

C0,0

-2 t

- t

0

-2 t

- t

Fig. 3. The extended binomial tree

29

0

TABLE 1

Delta and error ratios for European put options by using Hull method

GCRR-XPC

FB

Delta

Error

Error ratio

Delta

Error

Error ratio

20

-0.719297

-0.010454

—

-0.716577

-0.007734

—

40

-0.714714

-0.005871

1.780563

-0.712432

-0.003589

2.154864

80

-0.712009

-0.003166

1.854442

-0.710782

-0.001939

1.850665

160

-0.710508

-0.001665

1.901807

-0.709920

-0.001077

1.800574

320

-0.709704

-0.000861

1.932918

-0.709386

-0.000543

1.983631

640

-0.709284

-0.000441

1.953739

-0.709094

-0.000251

2.165007

1280

-0.709067

-0.000224

1.967875

-0.708973

-0.000130

1.936146

2560

-0.708956

-0.000113

1.977577

-0.708908

-0.000065

1.983873

5120

-0.708900

-0.000057

1.984291

-0.708875

-0.000032

2.016248

Time steps n

BBS

SPF

Delta

Error

Error ratio

Delta

Error

Error ratio

20

-0.713379

-0.004536

—

-0.711156

-0.002313

—

40

-0.711087

-0.002244

2.021622

-0.709940

-0.001097

2.107662

80

-0.709950

-0.001107

2.026989

-0.709392

-0.000549

2.000170

160

-0.709394

-0.000551

2.007205

-0.709103

-0.000260

2.109401

320

-0.709119

-0.000276

1.999329

-0.708974

-0.000131

1.977799

640

-0.708981

-0.000138

2.003059

-0.708909

-0.000066

1.977977

1280

-0.708911

-0.000068

2.015835

-0.708876

-0.000033

1.996055

2560

-0.708877

-0.000034

2.000920

-0.708860

-0.000017

2.012228

5120

-0.708860

-0.000017

1.995844

-0.708851

-0.000008

1.990182

Black-Scholes

-0.708843

Time steps n

The number of time steps starts at 20 and doubles each time subsequently. The left side of the

table reports delta, delta errors, and error ratios.

30

TABLE 2

Delta and error ratios for European put options by using extended method

GCRR-XPC

Time steps n

FB

Delta

Error

Error ratio

Delta

Error

Error ratio

20

-0.701162

0.007682

—

-0.700546

0.008297

—

40

-0.704986

0.003857

1.991408

-0.704675

0.004169

1.990367

80

-0.706911

0.001933

1.995742

-0.706751

0.002093

1.992035

160

-0.707876

0.000967

1.997881

-0.707804

0.001039

2.013715

320

-0.708359

0.000484

1.998943

-0.708324

0.000519

2.000775

640

-0.708601

0.000242

1.999472

-0.708581

0.000262

1.981833

1280

-0.708722

0.000121

1.999736

-0.708713

0.000131

2.003349

2560

-0.708783

0.000061

1.999868

-0.708778

0.000065

2.001280

5120

-0.708813

0.000030

1.999934

-0.708810

0.000033

1.998430

BBS

Time steps n

SPF

Delta

Error

Error ratio

Delta

Error

Error ratio

20

-0.697113

0.011731

—

-0.695143

0.013701

—

40

-0.702848

0.005996

1.956450

-0.701771

0.007073

1.937062

80

-0.705803

0.003040

1.972039

-0.705262

0.003582

1.974643

160

-0.707314

0.001529

1.987975

-0.707027

0.001817

1.971769

320

-0.708077

0.000766

1.995427

-0.707934

0.000910

1.996845

640

-0.708460

0.000384

1.996501

-0.708389

0.000455

2.000010

1280

-0.708651

0.000193

1.993193

-0.708616

0.000228

1.998972

2560

-0.708747

0.000096

1.999067

-0.708730

0.000114

1.997423

5120

-0.708795

0.000048

2.001171

-0.708786

0.000057

2.001033

Black-Scholes

-0.708843

The number of time steps starts at 20 and doubles each time subsequently. The left side of the

table reports delta, delta errors, and error ratios.

31

TABLE 3

RMS errors of delta estimates (without extrapolation)

Time steps n

20

40

60

80

100

500

1000

Hull method

CRR

GCRR-XPC

FB

BBS

SPF

1.97E-03

7.49E-04

9.90E-04

5.24E-04

4.30E-04

6.82E-05

4.04E-05

(0.08)

(0.14)

(0.20)

(0.28)

(0.35)

(4.13)

(15.34)

6.23E-03

3.40E-03

2.35E-03

1.80E-03

1.47E-03

3.17E-04

1.62E-04

(0.13)

(0.20)

(0.29)

(0.38)

(0.50)

(5.70)

(21.16)

4.05E-03

2.07E-03

1.48E-03

1.07E-03

8.43E-04

1.70E-04

8.68E-05

(0.08)

(0.12)

(0.16)

(0.21)

(0.28)

(4.20)

(16.15)

1.77E-03

8.66E-04

5.71E-04

4.28E-04

3.41E-04

6.79E-05

3.38E-05

(3.88)

(7.64)

(11.40)

(15.16)

(18.93)

(97.36)

(203.27)

8.78E-04

4.41E-04

2.91E-04

2.20E-04

1.74E-04

3.50E-05

1.75E-05

(0.13)

(0.19)

(0.27)

(0.36)

(0.47)

(5.27)

(18.56)

Extended method

CRR

GCRR-XPC

FB

BBS

SPF

7.47E-03

3.94E-03

2.29E-03

1.93E-03

1.49E-03

3.24E-04

1.45E-04

(0.10)

(0.15)

(0.21)

(0.29)

(0.36)

(4.16)

(15.40)

5.09E-03

2.55E-03

1.70E-03

1.28E-03

1.02E-03

2.05E-04

1.02E-04

(0.15)

(0.22)

(0.31)

(0.40)

(0.52)

(5.75)

(21.24)

4.95E-03

2.50E-03

1.66E-03

1.24E-03

1.01E-03

2.02E-04

1.00E-04

(0.10)

(0.13)

(0.17)

(0.22)

(0.29)

(4.23)

(16.21)

7.31E-03

3.73E-03

2.51E-03

1.89E-03

1.51E-03

3.05E-04

1.53E-04

(4.27)

(8.02)

(11.78)

(15.54)

(19.31)

(97.75)

(203.68)

8.71E-03

4.45E-03

2.99E-03

2.25E-03

1.80E-03

3.63E-04

1.82E-04

(0.15)

(0.21)

(0.29)

(0.38)

(0.49)

(5.31)

(18.63)

The CPU time (in seconds) required to value 243 deltas is given in parentheses.

32

TABLE 4

RMS errors of delta estimates (with extrapolation)

Time steps n

20

40

60

80

100

500

1000

Hull method

GCRR-XPC

FB

BBS

SPF

2.48E-04

6.74E-05

3.08E-05

1.76E-05

1.14E-05

4.68E-07

1.18E-07

(0.16)

(0.26)

(0.38)

(0.51)

(0.66)

(7.38)

(26.75)

2.89E-03

1.25E-03

6.36E-04

3.49E-04

2.18E-04

2.85E-05

9.44E-06

(0.10)

(0.16)

(0.21)

(0.28)

(0.37)

(5.43)

(20.42)

6.13E-04

1.70E-04

8.17E-05

4.53E-05

3.05E-05

1.01E-06

7.68E-07

(5.93)

(11.56)

(17.22)

(22.88)

(29.26)

(145.38)

(300.24)

4.01E-04

1.27E-04

6.41E-05

3.75E-05

2.26E-05

2.04E-06

6.96E-07

(0.16)

(0.25)

(0.36)

(0.49)

(0.62)

(6.82)

(23.46)

Extended method

GCRR-XPC

FB

BBS

SPF

1.55E-04

4.29E-05

1.98E-05

1.14E-05

7.38E-06

3.08E-07

7.73E-08

(0.19)

(0.29)

(0.41)

(0.54)

(0.69)

(7.44)

(26.85)

9.31E-04

4.36E-04

2.43E-04

1.40E-04

9.08E-05

9.56E-06

2.94E-06

(0.13)

(0.17)

(0.22)

(0.30)

(0.38)

(5.47)

(20.49)

6.17E-04

1.71E-04

8.20E-05

4.56E-05

3.06E-05

1.01E-06

7.68E-07

(6.53)

(12.14)

(17.79)

(23.45)

(29.85)

(145.96)

(300.85)

9.22E-04

2.41E-04

1.06E-04

6.70E-05

4.05E-05

2.19E-06

9.22E-07

(0.19)

(0.28)

(0.39)

(0.52)

(0.66)

(6.93)

(23.82)

Note: The CPU time (in seconds) required to value 243 deltas is given in parentheses.

33

TABLE 5

Gamma and error ratios for European put options by using Hull method

GCRR-XPC

Time steps n

FB

Gamma

Error

Error ratio

Gamma

Error

Error ratio

20

-0.001827

-0.001827

—

0.001526

0.001526

—

40

-0.000883

-0.000883

2.068289

0.000841

0.000841

1.814899

80

-0.000425

-0.000425

2.080183

0.000383

0.000383

2.197365

160

-0.000205

-0.000205

2.076239

0.000149

0.000149

2.562954

320

-0.000099

-0.000099

2.065368

0.000073

0.000073

2.044971

640

-0.000048

-0.000048

2.052693

0.000046

0.000046

1.600160

1280

-0.000024

-0.000024

2.040803

0.000021

0.000021

2.147565

2560

-0.000012

-0.000012

2.030747

0.000010

0.000010

2.041972

5120

-0.000006

-0.000006

2.022736

0.000005

0.000005

1.959054

BBS

Time steps n

SPF

Gamma

Error

Error ratio

Gamma

Error

Error ratio

20

0.061341

0.000717

—

0.061022

0.000398

—

40

0.060984

0.000360

1.993806

0.060824

0.000200

1.991723

80

0.060803

0.000179

2.003719

0.060727

0.000103

1.935925

160

0.060713

0.000089

2.016477

0.060684

0.000060

1.732304

320

0.060669

0.000045

1.987626

0.060653

0.000029

2.078587

640

0.060646

0.000022

1.997408

0.060638

0.000014

2.054581

1280

0.060635

0.000011

2.012954

0.060631

0.000007

2.000481

2560

0.060630

0.000006

2.002770

0.060628

0.000004

1.969727

5120

0.060627

0.000003

1.993477

0.060626

0.000002

2.028263

Black-Scholes

0.060624

The number of time steps starts at 20 and doubles each time subsequently. The left side of the

table reports gamma, gamma errors, and error ratios.

34

TABLE 6

Gamma and error ratios for European put options by using extended method

GCRR-XPC

Time steps n

FB

Gamma

Error

Error ratio

20

0.059092

-0.001532

—

40

0.059851

-0.000773

80

0.060236

160

Gamma

Error

Error ratio

—

0.060874

0.000249

1.981377

0.060814

0.000190

1.315248

-0.000388

1.990661

0.060690

0.000066

2.876399

0.060429

-0.000195

1.995324

0.060631

0.000007

10.114306

320

0.060527

-0.000097

1.997660

0.060627

0.000002

2.762609

640

0.060575

-0.000049

1.998830

0.060631

0.000007

0.351503

1280

0.060600

-0.000024

1.999415

0.060627

0.000002

2.857169

2560

0.060612

-0.000012

1.999707

0.060625

0.000001

2.256359

5120

0.060618

-0.000006

1.999854

0.060625

0.000001

1.770236

BBS

Time steps n

Gamma

Error

20

0.060102

-0.000522

40

0.060373

-0.000251

80

0.060501

160

SPF

Error ratio

Gamma

Error

Error ratio

0.059794

-0.000830

—

2.076224

0.060215

-0.000409

2.028231

-0.000124

2.033228

0.060425

-0.000200

2.051288

0.060562

-0.000062

1.998139

0.060533

-0.000091

2.181807

320

0.060594

-0.000030

2.028958

0.060578

-0.000047

1.960983

640

0.060609

-0.000015

2.009468

0.060601

-0.000024

1.972058

1280

0.060617

-0.000008

1.983999

0.060612

-0.000012

2.001634

2560

0.060620

-0.000004

1.997418

0.060618

-0.000006

2.019246

5120

0.060622

-0.000002

2.010265

0.060621

-0.000003

1.983790

Black-Scholes

0.060624

The number of time steps starts at 20 and doubles each time subsequently. The left side of the

table reports gamma, gamma errors, and error ratios.

35

TABLE 7

RMS errors of gamma estimates (without extrapolation)

Time steps n

20

40

60

80

100

500

1000

Hull method

CRR

GCRR-XPC

FB

BBS

SPF

2.18E-03

1.05E-03

7.25E-04

5.29E-04

4.16E-04

8.27E-05

4.13E-5

(0.08)

(0.14)

(0.20)

(0.28)

(0.35)

(4.13)

(15.34)

2.25E-03

1.11E-03

7.41E-04

5.56E-04

4.45E-04

8.98E-05

4.50E-05

(0.13)

(0.20)

(0.29)

(0.38)

(0.50)

(5.70)

(21.16)

2.34E-03

1.13E-03

7.58E-04

5.62E-04

4.51E-04

8.96E-05

4.46E-05

(0.08)

(0.12)

(0.16)

(0.21)

(0.28)

(4.20)

(16.15)

1.39E-03

6.72E-04

4.43E-04

3.30E-04

2.64E-04

5.23E-05

2.61E-05

(3.88)

(7.64)

(11.40)

(15.16)

(18.93)

(97.36)

(203.27)

9.23E-04

4.48E-04

2.94E-04

2.20E-04

1.75E-04

3.46E-05

1.74E-05

(0.13)

(0.19)

(0.27)

(0.36)

(0.47)

(5.27)

(18.56)

Extended method

CRR

GCRR-XPC

FB

BBS

SPF

9.90E-04

5.14E-04

2.99E-04

2.30E-04

1.96E-04

3.91E-05

2.02E-05

(0.10)

(0.15)

(0.21)

(0.29)

(0.36)

(4.16)

(15.40)

1.11E-03

5.66E-04

3.80E-04

2.86E-04

2.29E-04

4.62E-05

2.31E-05

(0.15)

(0.22)

(0.31)

(0.40)

(0.52)

(5.75)

(21.24)

7.38E-04

3.69E-04

2.42E-04

1.86E-04

1.48E-04

2.93E-05

1.47E-05

(0.10)

(0.13)

(0.17)

(0.22)

(0.29)

(4.23)

(16.21)

1.56E-03

8.03E-04

5.41E-04

4.08E-04

3.27E-04

6.61E-05

3.31E-05

(4.27)

(8.02)

(11.78)

(15.54)

(19.31)

(97.75)

(203.68)

1.98E-03

1.02E-03

6.90E-04

5.20E-04

4.17E-04

8.44E-05

4.23E-05

(0.15)

(0.21)

(0.29)

(0.38)

(0.49)

(5.31)

(18.63)

The CPU time (in seconds) required to value 243 gammas is given in parentheses.

36

TABLE 8

RMS errors of gamma estimates (with extrapolation)

Time steps n

20

40

60

80

100

500

1000

Hull method

GCRR-XPC

FB

BBS

SPF

3.51E-04

1.27E-04

7.48E-05

5.19E-05

3.91E-05

4.66E-06

1.77E-06

(0.16)

(0.26)

(0.38)

(0.51)

(0.66)

(7.38)

(26.75)

6.83E-04

2.30E-04

9.97E-05

9.15E-05

4.78E-05

4.87E-06

1.76E-06

(0.10)

(0.16)

(0.21)

(0.28)

(0.37)

(5.43)

(20.42)

1.99E-04

4.63E-05

2.03E-05

1.16E-05

6.97E-06

2.79E-07

9.94E-08

(5.93)

(11.56)

(17.22)

(22.88)

(29.26)

(145.38)

(300.24)

2.23E-04

5.15E-05

2.39E-05

1.70E-05

9.63E-06

9.33E-07

2.95E-07

(0.16)

(0.25)

(0.36)

(0.49)

(0.62)

(6.82)

(23.46)

Extended method

GCRR-XPC

FB

BBS

SPF

1.30E-04

3.67E-05

1.70E-05

9.76E-06

6.32E-06

2.63E-07

6.62E-08

(0.19)

(0.29)

(0.41)

(0.54)

(0.69)

(7.44)

(26.85)

5.38E-04

1.63E-04

6.49E-05

5.89E-05

3.43E-05

3.31E-05

1.26E-06

(0.13)

(0.17)

(0.22)

(0.30)

(0.38)

(5.47)

(20.49)

1.80E-04

5.12E-05

2.35E-05

1.40E-05

8.92E-06

3.99E-07

1.17E-07

(6.53)

(12.14)

(17.79)

(23.45)

(29.85)

(145.96)

(300.85)

2.93E-04

8.07E-05

3.94E-05

2.28E-05

1.48E-05

9.93E-07

3.32E-07

(0.19)

(0.28)

(0.39)

(0.52)

(0.66)

(6.93)

(23.82)

The CPU time (in seconds) required to value 243 gammas is given in parentheses.

37