University of Alaska

Healthcare Reform

L

O

C

K

T

O

N

D

U

N

N

I

N

G

B

E

N

E

F

I

T

S

Healthcare Reform

2012

Regulation

2013

Regulation

Plans required to produce 4 page plan summaries

starting with 9/23/2012 – Open Enrollment April

2013

Limit Health FSAs to $2,500 (current is $5,000, will

change at 7/1/2013)

W – 2 reporting of health plan values

(Requires 2012 reporting received Jan 2013)

.9% additional Medicare tax and 3.8% passive

income tax on individuals earning +$200,000

($250,000 for families)

New appeals process with external review (most

claim payers are in compliant with rule)

Health Insurance Taxes and Fees

-Annual Excise Tax Pharmaceutical tax - $2.8B

annually

- Comparative Effective Research assessment

increases to $2 per enrolled employee

Health Insurance Taxes and Fees

- Annual Excise Tax Pharmaceutical tax -$2.8B

annually

-Comparative Effective Research assessment of $1

per enrolled employee (What healthcare

treatments are appropriate in given circumstances)

1

Healthcare Reform

2014

Regulation

Free Rider Surcharge – Must offer qualifying

coverage (60%) at an affordable cost (no more

than 9.5% of household income) - $2,000 nondeductible penalty per FTE for not offering a plan

($3,000 for offering non-qualifying/non-affordable

coverage)

Automatic enrollment (deferred until regulations

issued)

Cover Clinical Trials - Insurers will be prohibited

from dropping or limiting coverage because an

individual chooses to participate in a clinical trial.

This applies to all clinical trials that treat cancer or

other life-threatening diseases

All employees working more than 30hrs per week

are eligible for coverage

Transitional Reinsurance Program Fees – Estimated

at $150 PEPY

2018

Regulation

Cadillac Tax – 40% excise tax on health benefits for

“high value” plans.

THE “EFFICIENT FRONTIER”

Optimizing Plan Design and

Contribution Strategies by modeling

over 800 alternative plan design

and contribution strategies to assist

in finding an optimal strategy that

minimizes cost to the employer –

mostly by taking advantage of

Exchange subsidies - and maximizes

value for employees.

2

Pay or Play – Average Additional Costs (Losers) or Savings

(Winners) under the Pay option

PAY or PLAY - Average Additional Costs (Losers) or Savings (Winners)

under the PAY option

$20,000

800

700

$15,000

600

$10,000

$5,000

400

Employee Count

$ Costs / Savings

500

300

$200

$(5,000)

100

$(10,000)

< $10,000

$10,000 $20,000

$20,000 $30,000

$30,000 $40,000

$40,000 $50,000

$50,000 $60,000

$60,000 $70,000

$70,000 $80,000

$80,000 $90,000

$90,000 - $100,000 +

$100,000

Income Band

Winners

Losers

Winner Count

Loser Count

3

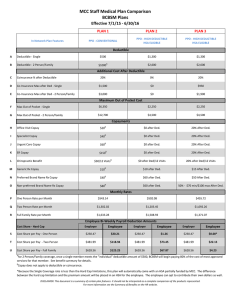

University of Alaska Health Reform Projections 2014

No Reform

PLAY

Current UNDER

Reform

Current BEFORE

Value – 76%

Reform - 2014

Employees covered in Plan

Employees covered in Exchanges

Employees covered in Plan or Exchange

Expected Net Employer Plan Cost

Employer additional taxes paid

Surcharge

Total Expected Net University Cost (Plan

Cost, Taxes, & Surcharge)

Play – Efficient

Frontier

Winners - 60%

Terminate Plan

Value – 80%

(Household Income)

4,155

0

4,155

0

4,794

4,794

0

4,794

4,794

4,083

119

4,202

$60,557,000

$65,214,000

-----------

-----$1,343,000

$9,528,000

-----$1,343,000

$9,528,000

$63,720,000

($282,000)

$357,000

$60,557,000

$65,214,000

$10,871,000

$10,871,000

$63,795,000

$4,657,000

($54,343,000)

($54,343,000)

($1,419,000)

$40,902,000

$68,784,000

$94,471,000

$39,112,000

$2,972,000

$27,882,000

$53,569,000

($1,790,000)

$106,116,000

$79,655,000

$105,342,000

$102,907,000

$37,930,000

$ Change

University plus Employee Total Costs

Terminate Plan

(Salary)

PAY – Public

Exchanges

3,942

0

3,942

$ Change

Total Expected Employee Cost

(EE Contributions, OOP & Taxes

PAY – Public

Exchanges

$98,487,000

4

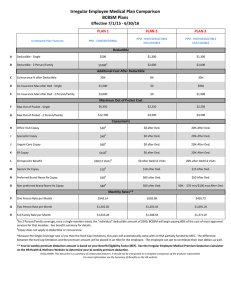

Illustrated 2014 Exchange Plan Design

UA Plans – 76%

Actuarial Value

90%

85%

80%

75%

70%

65%

60%

Exchange Metal

Platinum

High Gold

Low Gold

High Silver

Low Silver

High Bronze

Low Bronze

Deductible

$250

$500

$750

$1,000

$1,250

$1,700

$2,500

Family Deductible

$500

$1,000

$1,500

$2,000

$2,500

$3,400

$5,000

Embedded

Embedded

Embedded

Embedded

Aggregated

Aggregated

Aggregated

OOP Max (Includes Deductible)

$1,250

$2,000

$2,500

$4,000

$3,500

$6,000

$6,000

Family OOP

$2,500

$4,000

$5,000

$8,000

$7,000

$12,000

$12,000

$0

$0

$0

$0

$0

$0

$0

PCP Copay

$15

$15

$25

$25

20% After Ded.

20% After Ded.

20% After Ded.

Specialist Copay

$15

$25

$45

$50

20% After Ded.

20% After Ded.

20% After Ded.

ER Copay

$50

$100

$100

$200

20% After Ded.

20% After Ded.

20% After Ded.

Rx Deductible

N/A

N/A

N/A

$50/$100

20% After Ded.

20% After Ded.

20% After Ded.

Generic Copay

$5

$5

$10

$10

20% After Ded.

20% After Ded.

20% After Ded.

Preferred Brand Copay

$20

$25

$35

20% After Ded.

20% After Ded.

20% After Ded.

Non-Preferred Copay

$35

$40

$50

20% After Ded.

20% After Ded.

20% After Ded.

Family Deductible Type

Employee Coinsurance

30%, min $35,

max $75

40%, min $50,

max $100

5

Healthcare Reform Options

Cost Before Reform - 2014

Estimated Employees in Plan of 3,942

Estimated University cost of $60,557,000

Estimated Employee cost of $37,930,000

Option 1 – Play and offer qualifying coverage

Estimated Employees in Plan of 4,155

Estimated University Cost of $65,214,000

Estimated Employee Cost of $40,902,000

Option 2 – Pay $2,000 per employee (+30 hours) Penalty

Estimated Employees in Exchange 4,794

Estimated University Cost of $10,871,000

Estimated Employee Cost of $68,784,000

Option 3 – Non-Qualifying Plan

Estimated Employees in Exchange of 119 and 4,083 in the plan (4,202)

Estimated University Cost of $63,795,000

Estimated Employee Cost of $39,112,000

6

Our Mission

To be the worldwide value and service leader in insurance brokerage, employee benefits, and risk management

Our Goal

To be the best place to do business and to work

www.lockton.com

© 2011 Lockton, Inc. All rights reserved.

Images © 2011 Thinkstock. All rights reserved.

7