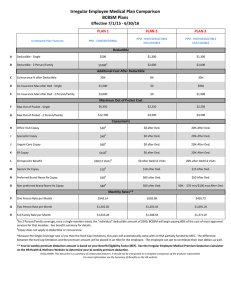

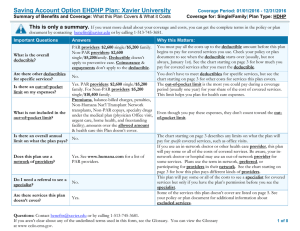

PLAN 1 PLAN 2 PLAN 3

advertisement

MCC Staff Medical Plan Comparison BCBSM Plans Effective 7/1/15 - 6/30/16 In Network Plan Features PLAN 1 PLAN 2 PLAN 3 PPO - CONVENTIONAL PPO - HIGH DEDUCTIBLE HSA ELIGIBLE PPO - HIGH DEDUCTIBLE HSA ELIGIBLE $1,300 $1,300 $2,600 $2,600 20% 0% 20% Deductible A Deductible - Single $500 B Deductible - 2 Person/Family A $1000 Additional Cost After Deductible C Coinsurance % after Deductible D Co-Insurance Max after Ded - Single $1,500 $0 $950 E Co-Insurance Max after Ded - 2 Person/Family $3,000 $0 $1,900 Maximum Out of Pocket Cost F Max Out of Pocket - Single $6,350 $2,250 $2,250 G Max Out of Pocket - 2 Person/Family $12,700 $4,500 $4,500 Copayments H Office Visit Copay $20 B $0 after Ded. 20% After Ded. I Specialist Copay $40B $0 after Ded. 20% After Ded. J Urgent Care Copay $60B $0 after Ded. 20% After Ded. K ER Copay $150 $0 after Ded. 20% After Ded. L Chiropractic Benefit $30/12 VisitsB $0 after Ded/12 Visits 20% after Ded/12 Visits M Generic Rx Copay $10 B $10 after Ded. $15 After Ded. N Preferred Brand Name Rx Copay $40 B $60 after Ded. $50 After Ded. O Non-preferred Brand Name Rx Copay $80B $60 after Ded. 50% - $70 min/$100 max After Ded. B Monthly Rates P One Person Rate per Month $543.14 $502.08 $455.72 Q Two Person Rate per Month $1,302.02 $1,203.45 $1,092.26 R Full Family Rate per Month $1,633.28 $1,508.93 $1,371.07 Employee Bi-Weekly Payroll Deduction Amounts Cost Share - Hard Cap Employer Employee Employer Employee Employer Employee S Cost Share per Pay - One Person $230.47 $20.21 $230.47 $1.26 $230.47 $0.00* T Cost Share per Pay - Two Person $481.99 $118.94 $481.99 $73.45 $481.99 $22.13 U Cost Share per Pay - Full Family $628.56 $125.25 $628.56 $67.87 $628.56 $4.23 A for 2 Person/Family coverage, once a single member meets the "individual" deductible amount of $500, BCBSM will begin paying 80% of the cost of most approved services for that member. See benefit summary for details. B Copay does not apply to deductible or coinsurance. *Because the Single Coverage rate is less than the Hard Cap limitations, this plan will automatically come with an HSA partially funded by MCC. The difference between the hard cap limitation and the premium amount will be placed in an HSA for the employee. The employee can opt to contribute their own dollars as well. DISCLAIMER: This document is a summary of certain plan features. It should not be interpreted as a complete comparison of the products represented. For more information see the Summary of Benefits on the HR website.