محاضرة 3 جزء1

advertisement

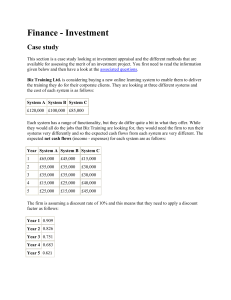

principles of corporate finance Chapter 3 Lecturer Sihem Smida Making investment decisions 1- 2 Chapter Objectives Discuss the various investment evaluation techniques, including their advantages and disadvantages. Apply these techniques to the evaluation of projects. Interpret the results of the application of these techniques in accordance with their respective decision rules. Understand the importance of net present value. 7-2 1- 3 Payback Period The amount of time required for an investment to generate cash flows to recover its initial cost. Estimate the cash flows. Accumulate the future cash flows until they equal the initial investment. The length of time for this to happen is the payback period. An investment is acceptable if its calculated payback is less than some prescribed number of years. 7-3 1- 4 Payback Period Illustrated Initial investment = –$1000 Year 1 2 3 Year 1 2 3 Cash flow $200 400 600 Accumulated Cash flow $200 600 1200 Payback period = 2 2/3 years 7-4 1- 5 Advantages of Payback Period Easy to understand. Adjusts for uncertainty of later cash flows. Biased towards liquidity. 7-5 1- 6 Disadvantages of Payback Period Time value of money and risk ignored. Arbitrary determination of acceptable payback period. Ignores cash flows beyond the cut-off date. Biased against long-term and new projects. 7-6 1- 7 Discounted Payback Period The length of time required for an investment’s discounted cash flows to equal its initial cost. Takes into account the time value of money. More difficult to calculate. An investment is acceptable if its discounted payback is less than some prescribed number of years. 7-7 1- 8 Example—Discounted Payback Year 1 Initial investment = —$1000 R = 10% PV of Cash flow Cash flow $200 $182 2 400 331 3 700 526 4 300 205 7-8 1- 9 Example—Discounted Payback (continued) Year 1 2 3 4 Accumulated discounted cash flow $182 513 1039 1244 Discounted payback period is just under three years 7-9 1- 10 Ordinary and Discounted Payback Initial investment = –$300 R = 12.5% Cash Flow Accumulated Cash Flow Year Undiscounted Discounted Undiscounted Discounted 1 2 3 4 5 $ 100 100 100 100 100 $ 89 79 70 62 55 $ 100 200 300 400 500 $89 168 238 300 355 • Ordinary payback? • Discounted payback? 7-10 Advantages and Disadvantages of Discounted Payback Advantages Disadvantages - Includes time value of money - Easy to understand - Does not accept negative estimated NPV investments - May reject positive NPV investments Arbitrary determination of acceptable payback period Ignores cash flows beyond the cutoff date 7-11 1- 11 1- 12 Accounting Rate of Return (ARR) Measure of an investment’s profitability. average net profit ARR average book value A project is accepted if ARR > target average accounting return. 7-12 1- 13 Example—ARR Year 1 2 3 $440 $240 $160 Expenses 220 120 80 Gross profit 220 120 80 Depreciation 80 80 80 140 40 0 35 10 0 $105 $30 $0 Sales Taxable income Taxes (25%) Net profit Assume initial investment = $240 7-13 1- 14 Example—ARR (continued) $105 $30 $0 Average net profit 3 $45 Initial investment Salvage value 2 $240 $0 2 $120 Average book value 7-14 1- 15 Example—ARR (continued) Average net profit Average book value $45 $120 37.5% ARR 7-15 1- 16 Disadvantages of ARR The measure is not a ‘true’ reflection of return. Time value is ignored. Arbitrary determination of target average return. Uses profit and book value instead of cash flow and market value. 7-16 1- 17 Advantages of ARR Easy to calculate and understand. Accounting information almost always available. 7-17