Chapter 7 The Master Budget 7 - 1

advertisement

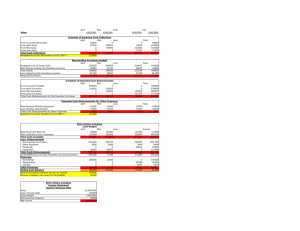

Chapter 7 The Master Budget 7-1 Objective 1 Explain the major features and advantages of a master budget. 7-2 Advantages of Budgets Budgets Goals and Objectives 7-3 Advantages of Budgets Compels managers to think ahead Aids managers in coordinating their efforts Provides definite expectations that are the best framework to evaluate performance 7-4 Types of Budgets Strategic Plan Long-Range Plan Capital Budget Master Budget Continuous Budget 7-5 Strategic Plan The most forward-looking budget is the strategic plan, which sets the overall goals and objectives of the organization. 7-6 Long-Range Plan The strategic plan leads to long-range planning, which produces forecasted financial statements for five- to ten-year periods. 7-7 Capital Budget Long-range plans… are coordinated with capital budgets, which detail the planned expenditures for facilities, equipment, new products, and other long-term investments. 7-8 Master Budget… Sales summarizes the planned activities of all subunits of an organization. Production Distribution Finance 7-9 Master Budget Operating Budget Financial Budget 7 - 10 Objective 2 Follow the principal steps in preparing a master budget. 7 - 11 Master Budget Sales Budget Master Budget Purchases Schedules Costs 7 - 12 Components of Master Budget Inventory Budget ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ Sales Budget ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ Purchases Budget ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ Cost of Goods Sold Budget ____ ____ ____ ____ ____ ____ ____ ____ Operating Expenses Budget ____ ____ ____ ____ ____ ____ ____ ____ Budgeted Income Statement ____ ____ ____ ____ ____ ____ ____ ____ Operating Budget 7 - 13 Components of Master Budget Cash Budget Capital Budget _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ Budgeted Balance Sheet _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ Financial Budget 7 - 14 Objective 3 Prepare the operating budget and the supporting schedules. 7 - 15 Operating Budget Sales Budget Cash collections from customers Purchases Budget Disbursements for purchases Operating Expenses Budget Disbursements for operating expenses 7 - 16 Cash Collections It is easiest to prepare budgeted cash collections at the same time as the sales budget. Cash collections include the current month’s cash sales plus the previous month’s credit sales. 7 - 17 Purchases Budget Budgeted purchases = Desired ending inventory + Cost of goods sold – Beginning inventory 7 - 18 Disbursements for Purchases For example, 50% of the current month’s purchases and 50% of the previous month’s purchases may be included. The total disbursements are then used in preparing the cash budget. 7 - 19 Operating Expense Budget The budgeting of operating expenses depends on several factors. Month-to-month changes in sales volume and other cost-driver activities directly influence many operating expenses. 7 - 20 Operating Expense Budget Expenses driven by sales volume include sales commissions and many delivery expenses. 7 - 21 Operating Expense Budget Other expenses are not influenced by sales or other cost-driver activity and are regarded as fixed, within appropriate relevant ranges. Rent Depreciation Insurance Salaries 7 - 22 Operating Expense Disbursements Disbursements for operating expenses are based on the operating expense budget. 7 - 23 Operating Expense Disbursements For example, 50% of last month’s and this month’s wages and commissions plus miscellaneous and rent expenses may be included. The total of these disbursements is then used in preparing the cash budget. 7 - 24 Budgeted Income Statement The income statement will be complete after addition of the interest expense, which is computed after the cash budget has been prepared. 7 - 25 Budgeted Income Statement Budgeted income from operations is often a benchmark for judging management performance. 7 - 26 Objective 4 Prepare the financial budget. 7 - 27 Cash Budget The cash budget has the following major sections: – total cash available before financing – cash disbursements – minimum cash balance desired – financing requirements – ending cash balance 7 - 28 Cash Budget Total cash available before financing = Begining cash balance + Cash receipts Cash receipts depend on collections from customers’ accounts receivable and cash sales and on other operating income sources. 7 - 29 Cash Budget Cash disbursements for purchases depend on the credit terms extended by suppliers and the bill-paying habits of the buyer. Payroll depends on wages, salaries, commission terms, and payroll dates. 7 - 30 Cash Budget Disbursements for some costs and expenses depend on contractual terms for installment payments, mortgage payments, rents, leases, and miscellaneous items. Other disbursements include outlays for fixed assets, long-term investments, dividends, and the like. 7 - 31 Cash Budget Management determines the minimum cash balance desired depending on the nature of the business and credit arrangements. 7 - 32 Cash Budget Financing requirements depend on how the total cash available compares with the total cash needed. Needs include the disbursements plus the desired ending cash balance. 7 - 33 Cash Budget Ending cash balance = Total cash available before financing – Total disbursements + Cash from financing The cash from financing can be either positive (borrowing) or negative (repayment). 7 - 34 Budgeted Balance Sheet The final step in preparing the master budget is to construct the budgeted balance sheet that projects each balance sheet item in accordance with the business plan as expressed in the previous schedules. 7 - 35 Objective 5 Understand the difficulties of sales forecasting. 7 - 36 Sales Forecast A sales forecast is a prediction of sales under a given set of conditions. 7 - 37 Factors to Consider When Forecasting Sales 1 2 3 4 Past patterns of sales Estimates made by the sales force General economic conditions Competitors’ actions 7 - 38 Factors to Consider When Forecasting Sales 5 6 7 8 Changes in the firm’s prices Changes in product mix Market research studies Advertising and sales promotion plans 7 - 39 Objective 6 Anticipate possible human relations problems caused by budgets. 7 - 40 Acceptance of the Budget To fully benefit from budgets, an organization needs the support of all the firm’s employees. To avoid negative attitudes toward budgets, accountants and top management must demonstrate how budgets can help each manager and employee achieve better results. 7 - 41 Acceptance of the Budget Another problem that can negate the benefits of budgeting arises if budgets stress one set of performance goals, but employees and managers are rewarded for different performance measures. 7 - 42 Participative Budgeting Budgets created with the active participation of all affected employees are generally more effective than budgets imposed on subordinates. This involvement is usually called participative budgeting. 7 - 43 Objective 7 Use a spreadsheet to develop a budget. 7 - 44 Software Spreadsheet software for personal computers is a powerful and flexible tool for budgeting. Sensitivity analysis is the systematic varying of budget data input to determine the effects of each change on the budget. 7 - 45 Objective 8 Understand the importance of budgeting to managers. 7 - 46 Importance of Budgets to Managers The budgetary process compels managers to think and to prepare for changing conditions. 7 - 47 Importance of Budgets to Managers Budgets are aids in planning, communicating, setting standards of performance, motivating personnel toward goals, measuring results, and directing attention to problem areas that need investigation. 7 - 48 End of Chapter 7 7 - 49