Chapter 8

Budgetary Planning

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

McGraw-Hill/Irwin

Copyright © 2014 by The McGraw-Hill Companies, Inc. All rights reserved.

Role of Budgets in the Planning and

Control Cycles

A budget is a comprehensive financial

plan for achieving the financial and

operational goals of an organization.

Planning

Developing

objectives for

acquisition

and use of

resources.

Control

Steps taken by

management to

ensure that

objectives are

attained.

8- 3

Planning and Control Cycle

8- 4

Planning Process

Strategic

Plan

Long-term

Objectives

Short-term

Objectives

Tactics

8- 5

Benefits of Budgeting

Thinking Ahead

Communication

Motivation

Forcing managers to

look ahead and state

their goals for the future

Communicating

management's

expectations

and priorities

Providing motivation for

employees to work

toward organizational

objectives

Providing lead time to

solve potential problems

Promoting cooperation

and coordination

between functional

areas of the organization

Providing a benchmark

for evaluating

performance

8- 6

Behavioral Effects of Budgets

Budget Problems

Solution

• Perceived unfair or

unrealistic goals.

• Reasonable and

attainable budgets.

• Poor managementemployee

communications.

• Employee participation in

budgeting process.

8- 7

Behavioral Effects of Budgets

Budget Problems

• Building budget slack

into budgets.

• A “use-it-or-lose-it”

mentality.

Solution

• Different budgets for

planning and for

performance evaluation.

• Continuous, or rolling

budgets.

• Zero-based budgeting.

8- 8

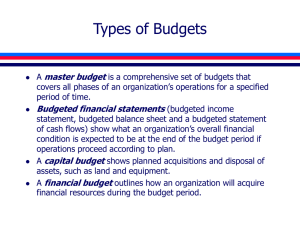

Components of the Master Budget

8- 9

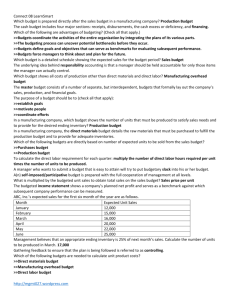

Sales Budget

Sales

Budget

Estimated

Unit Sales

Estimated

Unit Price

Analysis of economic and market conditions

+

Forecasts of customer needs from marketing personnel

8- 10

Production Budget

The production budget is directly related to the sales budget

and to the quantity of inventory the company wants to have on

hand at the beginning and end of each period. The

relationship between budgeted production, sales, and

inventory is summarized in the following formula:

8- 11

Raw Materials Purchases Budget

Next, we must determine what quantity of raw materials to

purchase to use for the production budget. Budgeted material

purchases will depend on budgeted production needs, as well

as on the planned levels for beginning and ending raw

materials inventory. The relationship between budgeted raw

material purchases, budgeted production, and raw materials

inventory is summarized in the following formula:

8- 12

Cash Budget

Our focus is on cash flows that arise from operating

activities and are directly related to the operating budgets

for Cold Stone Creamery. The relationship between

budgeted cash collections and budgeted cash payments

from operating activities and cash balances is summarized

in the following formula:

8- 13

Budgeting in Non-Manufacturing

Firms

The primary operating budget for a merchandiser is a

merchandise purchases budget, which is similar in form

to a raw materials purchases budget for a manufacturer.

Since a merchandising company does not manufacture, it does not

have raw material, direct labor, and manufacturing overhead budgets.

8- 14

End of Chapter 8

8- 15