Chapter 3 Comparative International Financial Accounting I

advertisement

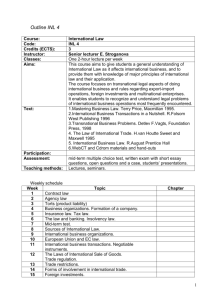

Chapter 3 Comparative International Financial Accounting I Founding Members of the IASC and IASB Exhibit 3.1 Economic Data for Developed Countries GDP PPP (in billions) GDP Per Capita Populatio n (in millions) Unemplo yment Inflation Area per sq km (in thousands) Imports (in billions) Exports (in billions) U.S $10,990.0 $37,800 293.0 6.0% 2.3% 9,631.4 $,1260.0 $714.5 U.K. $1,666.0 $27,700 60.3 5.0% 1.4% 244.8 $363.6 $304.5 Australia $571.4 $29,000 19.9 6.0% 2.8% 7,686.9 $82.9 $68.7 Netherlands $461.4 $28,600 16.3 5.3% 2.1% 41.5 $217.7 $253.2 Sweden $238.3 $26,800 9.0 4.9% 1.9% 450.0 $83.3 $102.8 Germany $2,271.0 $27,600 82.4 10.5% 1.1% 357.0 $585.0 $696.9 $239.3 $32,700 7.4 3.7% 0.6% 41.3 $102.2 $110.0 France $1,661.0 $27,600 60.4 9.7% 2.1% 547.0 $339.9 $346.5 Italy $1,550.0 $26,700 58.1 8.6% 2.7% 301.2 $271.1 $278.1 Spain $885.5 $22,000 40.3 11.3% 3.0% 504.8 $197.1 $159.4 Japan $3,582.0 $28,200 127.3 5.3% -0.3% 337.8 $346.6 $447.1 Switzerland International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black Anglo-American Accounting Less conservative and more transparent Pre-Sarbanes Oxley – what about post? United States Focused on large corporations and interests of investors Securities markets are the dominant influence on accounting regulation SEC has authority to formulate and enforce accounting standards Delegated to the FASB Only listed corporations are required by law to comply with GAAP Very public standards-setting process – solicit input before rules go into place – Example, SFAS 96 v. 109. International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black Anglo-American Accounting United Kingdom Focus on information needs of investors Securities markets dominate the process of acctg. Regulation. Commercial/Company law has a much wider remit Accounting requirements are for all LLCs and corporations Why LLCs too? Accounts present a “true and fair view” of company results Accounting Standards Board (ASB) recently incorporated International Financial Reporting Standards (IFRS) International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black Anglo-American Accounting Australia English influence Focus on investors rather than tax needs Australian Securities & Investments Commission Regulate and enforce company law Australian Accounting Standards Board – creates standards Urgent Issues Group (UIG) Financial Reporting Council oversees AASB Provides guidance for public and private sector International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black The Netherlands Though Nordic, more similar in approach to U.S. and U.K. Business economics approach to accounting – focus on investors and other uses access and disclosure - voluntarily Tradition of Public ownership of shares International business outlook “Generally Acceptable Accounting Principles” – mandating true and fair concept in financial reporting. Provided by Council for Annual Reporting Members from the accounting profession (NIVRA) and others Not mandated by law, but followed by most companies Influence of Commercial law supplemented by case law is increasingly present in setting accounting standards. IFRS required for listed companies in 2005 International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black Nordic Accounting Nordic Countries: Denmark, Finland, Iceland, Norway, and Sweden Sweden Focus on creditors, government, and tax authorities Also heavily involves accounting profession in standard setting. Capital Markets important to accounting and disclosure req’ts Two-tier approach The law provides a framework rather than detailed requirements Individual accounts – traditional basis Consolidated accounts of major groups – international capital market needs Accounting Standards Board and Accounting Council provide guidance in the context of company law IFRS required for listed companies in 2005 International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black Germanic Accounting Germany / Austria Focus on needs of creditors and tax authorities MNEs are becoming more investor-oriented Commercial law is predominant influence Accounting rules amend the Commercial Code Annual accounts are the basis for tax accounts Tax rules dominate legal accounting issues Limited impact of accounting profession German Accounting Standards Board Fair and true standard = transparent and reliable for in German viewpoint. IFRS required for listed companies in 2005 International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black Germanic Accounting Switzerland Favors needs of creditors and authorities More companies are making further voluntary disclosures – as Swiss Securities Markets grow./ Swiss companies face competition Very secretive and conservative system Dominated by commercial law and tax regulations New law – 1992 Improved disclosure and protection for investors Secret reserves are still allowed Accounting profession consists of – still relatively small Foundation for Accounting and Reporting Recommendations – supervises the Accounting Standards Board Recommendations elaborate and supplement company law International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black Latin Accounting France Focus on needs of creditors and tax authorities Consolidated groups can report in U.S. GAAP or IAS Commercial law/tax law are the predominant influences Small accounting profession established by law OECCA and CNCC for public accounting and auditing Small stock market Focus on national economic planning Tax laws tend to override accounting rules Most capital contributed by banks, government, or family French equivalent of the SEC – Commission des Opérations de Bourse (COB) IFRS required for listed companies in 2005 International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black Latin Accounting Italy Focus on interests of government and tax authorities Focus is shifting because of globalization Accounts are used as the basis for taxation Tradition of conservatism to minimize taxes Italian equivalent of the SEC – CONSOB Slow to adopt EU directives because External investor interests are seen as less important than family and state interests Tendency to protect the right of companies to keep business secrets Professional accounting bodies are advisory IFRS required for listed companies in 2005 International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black Asian Accounting Many countries have a colonial accounting history or foreign influence Japan Focus on needs of creditors and tax authorities Commercial Code (similar to Germany) Corporate tax law is very influential Leads to conservative accounting Government institutions are directly involved in standardsetting Ministry of Finance – responsible for securities and exchange law Ministry of Justice – responsible for application of Commercial Code International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black Asian Accounting Japan continued Accounting for business combinations is a source of concern Keiretsu – system of interlocking directorates of related businesses formed to work together Small accounting profession Makes recommendations on the practical application of legal accounting rules Tendency for secrecy and a lack of disclosure Increased international focus ASBJ in Japan is similar to the FASB in the U.S. Approximately 30 Japanese companies listed in the U.S. prepare financial statements in accordance with U.S. GAAP. International Accounting & Multinational Enterprises - Chapter 3 - Radebaugh, Gray, Black