ĞÏ à¡± á ... • ... ˜ ™ š › ...

advertisement

ĞÏ à¡± á

>

şÿ

•

şÿÿÿ

—

˜

™

š

›

œ

ÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿ

ÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿ

ÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿ

ÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿ

ÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿ

ÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿÿì¥Á

€

ğ ¿

ªè

bjbjûwûw

C

Ž

qğ

ÿÿ

™

™

ÿÿ

)=

yÿÿ

·

Ž

Ñ

û

š

P

t

û

5)

k

K

l

¬

×

÷ºp â

×

k'

k'

×

$

@

«'

ÿÿÿÿ

«'

û

«'

û

ó(

.

!)

p

p

p 9

A)

A)

Tp *

A6

p

p

p

p

p

A)

×

A) ¢

×

p

A6

A6

A6

A6

A6

n

p

×

×

p

«'

«'

û

p

xv

ã0 "

~p <

-R

ºp

×

¢

>u :

ó(

«' H

«'

A)

¥Q

ÁT

‡¸Î

œr

ó(

ÍR

ô

xv

«'

1

’

ÿÿÿÿ

xv

@

€üŠÓ

ÁT

ÁT H

×

W

ü

A)

A)

A)

A)

A6

A)

A)

p

A)

p

—

3

ª

A)

A)

A)

ÿ

ÿÿÿÿ

ÿÿÿÿ

ÿÿÿÿ

ÿÿÿÿ

ÿÿÿÿ

ÿÿÿÿ

ÿÿÿÿ

ÿÿÿÿ

A)

A)

A)

A)

A)

Ž

A)

ÿÿÿÿ

ÿÿÿÿ

xv

A)

ÿÿÿÿ

ÿÿÿÿ

A)

A)

ÿÿÿÿ

ÿÿÿÿ

A)

ºp

ÿÿÿÿ

A)

A)

ÿÿÿ

ÿÿÿÿ

A)

—

:

Evidence on the Market Response to Corporate Governance Deficiencies

Carol Ann Frost*

Joshua Racca**

Mary Stanford***

*University of North Texas

**University of Alabama, Birmingham

*** Texas Christian University

April 2013

Abstract

We provide evidence that equity market participants value Nasdaq’s

enforcement of corporate governance listing rules. We document a

significantly negative market response to news that a firm has received a

Nasdaq corporate governance deficiency notice. More specifically, we show

that market participants react negatively to disclosure of noncompliance

with audit committee independence requirements and that the most negative

shareholder reaction is observed for firms failing to review and certify

financial statements in conformance with SOX. This evidence indicates

that market participants learn about these corporate governance failures

through the Nasdaq enforcement process, supporting the current selfregulatory model.

Key Words: Corporate Governance, Listing rule deficiencies, stock

exchange regulation

Acknowledgements: We are grateful helpful comments and suggestions from

workshop participants at Rice University, and for many useful discussions

with Nasdaq Stock Market, Inc. staff. Financial support from Texas

Christian University, the University of Alabama-Birmingham, and the

University of North Texas is gratefully acknowledged.

Evidence on the Market Response to Corporate Governance Deficiencies

Introduction

The effect of corporate governance on firms’ financial and market

performance and accounting irregularities has received much attention in

the past decade.

However, few studies assess how market participants

respond to changes in corporate governance effectiveness. One exception

is Defond, Hann and Hu (2005), which examines the market reaction to an

increase in corporate governance effectiveness: the appointment of an

accounting financial expert to the audit committee. However, Defond et

al., find somewhat mixed results; appointment of a financial expert to

the audit committee leads to a positive market response only for firms

with strong governance, suggesting a complementary relation.

In this study, we document an adverse market response to news of firms’

noncompliance with Nasdaq’s corporate governance requirements. Our study

is motivated by the generally mixed evidence on the association between

corporate governance quality and firm financial and market performance.

Gompers et al. (2003) provide evidence that firms with stronger

shareholder rights exhibit higher firm value, higher profits, and higher

sales growth, using a sample of 1,500 firms during the 1990’s. However,

many later studies using the Gompers Index and other proxies for

corporate governance find contrasting evidence. One concern with this

line of research is that the weak evidence on the effects of corporate

governance may simply reflect researchers’ inability to identify the most

important corporate governance matters.

We use governance standards established by the Nasdaq Stock Market as

proxies for market participants’ minimum expectations. We test the joint

hypothesis that (1) Nasdaq’s corporate governance requirements reflect

shareholder expectations about corporate governance effectiveness, and

that (2) news of a company’s inability to remain above at least one

regulatory minimum is associated with a decrease in firm value. We

document a significantly negative market response to news that a firm has

received a Nasdaq corporate governance deficiency notice indicating noncompliance with listing rules. This decline in share price is consistent

with the view that Nasdaq enforcement of its corporate governance

requirements provides new and significant information to the market that

leads to revised expectations about the integrity of a firm’s financial

statements and about that firm’s future profitability or risk.

Our study is also motivated by the limited evidence available on how

exchanges perform the important investor protection role of stock

exchange self-regulation, which includes developing and enforcing their

own listing requirements. In 2004 the SEC announced a major reassessment

of the self-regulatory system in light of changes in the ownership

structure of stock exchanges and increased competition (SEC 2004a, Cox

2006). Consistent with this, Sirri (2006) notes that increasing

competition for market share by exchanges has increased concerns about

inherent conflicts of interest in the self-regulatory system. Although

several studies provide evidence on certain aspects of regulatory

delisting, delisting, the most severe outcome, is only one part of the

enforcement process. , We find that almost all companies receiving

governance deficiency notices from Nasdaq regain compliance and continue

to trade on Nasdaq. Thus, the self-regulatory process appears to

identify, enforce, and promote the correction of corporate governance

problems, at least at the Nasdaq market.

Further, our stock return

evidence indicates that equity market participants use the information in

deficiency notices to revise their expectations about firm value,

suggesting that stock exchange enforcement of corporate governance

requirements is valued.

Our sample consists of 406 firms that received Nasdaq deficiency notices

between January 1, 2004 and December 31, 2011 regarding a total of 472

corporate governance deficiencies. The deficiencies we examine are

related to Nasdaq requirements for audit committees, board independence,

shareholder approval, Sarbanes-Oxley Act-related reviews and

certifications, and nomination and compensation committees. Our evidence

shows that firms receiving deficiency notices are smaller, less

profitable, more levered, and have lower return on assets and market to

book ratios than their Nasdaq-listed industry counterparts that do not

receive such notices. These findings are consistent with evidence from

several studies showing a positive association between financial and

market strength and the occurrence of accounting restatements and other

irregularities, and internal control weaknesses.

More importantly, we examine short-window cumulative abnormal returns

(CARs) surrounding deficiency notice dates to assess the extent to which

news of Nasdaq enforcement actions conveys information to the market.

We find a negative mean (median) three-day CAR of -1.28% (-1.20%),

significant at the .001 (.01) level (two-sided tests used in all

analyses) on the days surrounding the earliest deficiency notices

received by each firm. Results are similar when we use a five-day return

window.

We also analyze each deficiency type subsample (audit committee, board

independence, review and certification, shareholder approval, and

nomination and compensation). For audit committee deficiencies, we

document a significant negative response, the mean (median) three-day

CARs is –1.79% (-1.42%) significant at the .001 level. This finding is

consistent with investors’ awareness that audit committees’ play a

central role in ensuring the integrity of financial statements. Among

these firms, we identify three reason for a board members departure from

audit committees, resignation, retirement, and death. The market response

is significant for resignations and retirements but not for deaths. In

addition, we also determine whether or not the departing board member is

designated as the financial expert on the audit committee. The mean

(median) market response to the departure of the financial expert is 2.29 (-1.70) with a t-statistic of -2.45 (-1.71) providing support for

the requirement that audit committees have a financial expert.

The finding of an adverse market response to noncompliance with Nasdaq’s

audit committee requirement is also consistent with Defond et al.’s

(2005) evidence of a positive market reaction to an increase in the

financial expertise of audit committee members, since the departure of an

audit committee member is most common reason for audit committee

noncompliance in our study. Our finding is also consistent with the

Hoitash et al. (2009) result that audit committee characteristics are

linked to internal control weaknesses under section 404 of SarbanesOxley, which requires auditor certification, but not under section 302,

which does not require auditor certification.

The strongest negative market reaction is for the 18 firms that do not

comply with the financial statement review and certification requirements

mandated by SOX. These firms exhibit a mean (median) three-day CAR of -

5.43% (-2.24%), significant at the .001 (.05) level. This finding is

consistent with the view that the SOX certification process is a critical

aspect of ensuring financial statement integrity, and that disclosure of

Nasdaq deficiency notices is a primary means by which market participants

learn of certification failures. However, closer examination of these 18

firms indicates several reasons for management’s decision to not certify

the financial statements. Most of these deficiencies, 16 out of 18, occur

in 2004 and 2005 shortly after SOX was mandated. Not surprisingly, the

most common reason for lack of certification is management’s failure to

assess internal controls or problems identified with internal controls.

Other reasons given for managements refusal to certify the financial

statements include auditor resignations, audit delays and mergers

resulting in no financial statements being issued.

Our review and certification results are in contrast to findings in Chang

et al. (2006). Chang et al. (2006) reports no significant market response

for the 12 firms that did not comply with the SEC’s certification order

(but does document a positive market response to the SEC’s administrative

order requiring top management of large firms to certify financial

statements in 2002).

We do not find a significantly negative market response to news of

noncompliance with Nasdaq’s independent directors requirement. This

result may suggest that market participants do not view board

independence issues as significant as audit committee issues. That is,

while board independence may be desirable, its absence does not directly

impair the integrity of financial statements. However, we are currently

reading the 8-Ks and press releases to determine the reasons for these

departures from the board. Initial findings suggests that some reasons

for departure may be positive, such as becoming CEO of the firm, while

others are negative.

Noncompliance with Nasdaq corporate governance requirements other than

those related to board independence and audit committees is relatively

less common, resulting in relatively small sample sizes. Market reactions

to news of deficiency notices related to nomination or compensation

committees (11 firms) are negative (mean three-day CAR is -1.36%) but not

statistically different from zero at conventional levels. Market

reactions to deficiencies related to failure to seek shareholder approval

(41 firms) are also negative (mean three-day CAR is -1.55%) but not

significantly different from zero at conventional levels. Finally, we

show that equity market participants identify those firms for which the

corporate governance failure is a symptom of deeper problems with the

company’s viability. The subsample of 59 firms that are delisted within

three years of the deficiency notice date have mean (median) negative

three-day CARs of -4.69% (-2.29%), significant at the .001 (.05) level

around the date of the deficiency notice.

We complement our event study analyses with cross sectional regression

estimations to determine whether firm characteristics previously

associated with internal control weaknesses help explain the magnitude of

the market response to the issuance of staff deficiency notices. Our

findings with respect to firm attributes previously linked to poor

internal controls, firm complexity, growth opportunities, and bankruptcy

risk, are insignificant. However, we find that the three-day CAR for an

audit committee deficiency is more negative for firms that delist within

three years but less negative for firms with a restructuring plan in

place in the year of or year before the notice. This suggests that market

participants assess the likelihood of delisting as an additional risk and

react less negatively when they know management has implemented a

restructuring plan.

Our study contributes to the broad literature on the role of corporate

governance in requiring management to act in the shareholders’ best

interest. Compared to prior cross-sectional studies, this study provides

a more powerful test of how the market assesses changes in corporate

governance. Because receipt of a corporate governance deficiency notice

indicates that a company’s corporate governance effectiveness has fallen

below a minimum allowable level, our evidence of a decline in share price

indicates that the market views Nasdaq listing requirements as minimum

corporate governance standards and that the deficiency notices provide

new and valuable information. Further, the strong negative reaction to

declines in the audit committee’s independence complement and extend

prior studies that document a relation between audit committee

independence and future firm performance. Finally, we provide the first

evidence of a negative reaction to departures of the financial expert

from the audit committee, indicating that market participants are aware

of and value financial expertise on the audit committee.

This study is also relevant to those considering the costs and benefits

of U.S. stock exchange requirements and the self-regulation process. The

evidence supports the following inferences. First, the Nasdaq enforcement

process identifies many companies that fall out of compliance with

corporate governance listing rules, most of whom remedy their

deficiencies. Second, Nasdaq enforcement actions convey new information

to the market about corporate governance problems, particularly those

related to audit committee independence and management’s review and

certification of financial statements. Thus, equity market participants

recognize and value stock exchange self-enforcement of these corporate

governance requirements.

The rest of this paper is organized as follows. Section 2 describes the

self-regulatory nature of stock exchanges and then summarizes Nasdaq

listing requirements and the enforcement process. Discussion of sample

and data is in section 3. Empirical results are presented in section 4,

and conclusions appear in section 5.

2. Nasdaq’s Incentives, Listing Requirements, and Enforcement Process

Nasdaq, a Self Regulatory Organization (SRO), was founded in 1971 as a

wholly-owned subsidiary of the National Association of Securities Dealers

(NASD). It became a for-profit company with private ownership on June 28,

2000, and a registered national securities exchange in August 2006.

As

an SRO, Nasdaq establishes and enforces initial and continued listing

requirements for its markets, subject to SEC approval.

The Sarbanes-Oxley Act of 2002 (SOX) (U.S. Congress 2002) expanded the

enforcement responsibilities of U.S. stock exchanges. The Act required

the SEC to draft a rule prohibiting stock exchanges from listing

companies that do not comply with the audit committee requirements in

Title III, Sec. 301 of the Act. Nasdaq also enforces various review and

certification requirements imposed by the Act, including requirements for

officers’ certification of annual and quarterly reports (Sec. 302), and

for the preparation of, and auditor reports on, internal control reports

(Sec. 404).

The 2010 Dodd-Frank financial reform law (U.S. Congress 2010) further

expanded the corporate governance enforcement role of U.S. stock

exchanges. Dodd-Frank requires the SEC to issue rules directing the stock

exchanges to prohibit the listing of issuers not in compliance with the

Act’s compensation committee requirements. (The SEC issued its final rule

in June, 2012 [U.S. SEC 2012].)

A central regulatory issue concerns inherent conflicts of interest

between stock exchanges and their listed companies. As self-regulatory

organizations (SROs), stock exchanges monitor issuers and delist those

that fail to meet minimum requirements. At the same time, exchanges face

increasing pressure to attract and retain listings due to growing

competition among themselves and with alternatives to stock exchanges.

A stock exchange that chooses to be a stringent regulator may obtain a

competitive advantage by increasing its credibility and reputation, and

by avoiding SEC disciplinary actions. On the other hand, stringent

enforcement may reduce the exchange’s listing revenues if it leads to

numerous regulatory delistings and/or deters companies from seeking to

list on the exchange.

2.1 NASDAQ LISTING REQUIREMENTS

Nasdaq’s listing requirements are designed to promote investor protection

and market quality.

Investor protection includes (1) providing

investors material information, (2) monitoring and enforcing market

rules, (3) preventing fraud in the public offering, trading, voting and

tendering of securities, and (4) promoting comparability of information.

Market quality refers to the market characteristics of fairness,

orderliness, efficiency, and freedom from abuse and misconduct.

Nasdaq’s Marketplace Rules (2005) include initial and continued listing

requirements for Nasdaq’s National Market (NM) and SmallCap (SC) Market.

The three types of requirement for continued listing are: (1)

quantitative; (2) qualitative (corporate governance); and (3) timely

filing/procedural. This study focuses exclusively on qualitative

(corporate governance) deficiencies.

Qualitative (Corporate Governance) Requirements

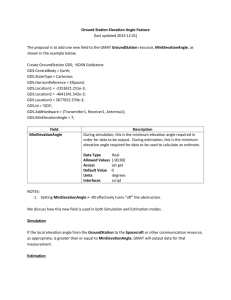

Marketplace Rules §4350, summarized in Exhibit 1, presents the

qualitative listing requirements for Nasdaq issuers. These rules are the

same for all issuers on Nasdaq exchanges, and are categorized as follows:

(1) distribution of annual and interim reports; (2) board requirements

(related to audit committees, independent directors, and compensation and

nominating committees); (3) shareholder meetings; (4) conflicts of

interest (in connection with related party transactions); (5) shareholder

approval; (6) code of conduct; and (7) voting rights. Nasdaq also

requires issuers to comply with the review and certification requirements

contained in §§ 302, 404, and 906 of the Sarbanes-Oxley Act of 2002.

Nasdaq includes deficiencies related to public interest concerns in the

qualitative category. Specifically, Marketplace Rules §4330(a) states

that “Nasdaq may … deny inclusion or apply additional or more stringent

criteria if … Nasdaq deems it necessary to prevent fraudulent and

manipulative acts and practices, to promote just and equitable principles

of trade, or to protect investors and the public interest.” We focus on

corporate governance deficiencies and hence, do not include public

interest-related deficiencies in our analysis.

2.2 THE NASDAQ ENFORCEMENT PROCESS

Nasdaq’s Marketplace Rules [2006, §4800] describe Nasdaq’s listed company

enforcement process. When Listing Department staff determines that a

company does not comply with at least one listing standard and the

applicable grace period has expired, the staff immediately informs the

company through a written Staff Deficiency Notice that limits or

prohibits the continued listing of an issuer’s securities on Nasdaq.

Information about companies’ noncompliance with Nasdaq listing

requirements is promptly made public. Each trading day, Nasdaq publishes

a list of companies that are not in compliance with its continued listing

requirements. Further, Nasdaq requires issuers to publicly announce the

receipt of deficiency notices within four business days of the notice.

The SEC requires that a Form 8-K be filed disclosing receipt of the

notice (SEC 2004b).

The deficiency notice describes the specific listing requirements that

the company is not in compliance with and states that the issuer may

appeal the determination using Nasdaq’s hearing process. It also states

that within 15 calendar days the company must submit a plan to regain

compliance with the listing standards. After receiving the company’s

plan, Listing Department staff members evaluate the likelihood that the

plan will result in compliance. Additional deficiency notices are issued

if the Listing Department identifies further deficiencies during the

review process.

Companies have seven calendar days from the date of the staff notice to

respond by requesting either a written or oral hearing. The hearing

request stays the delisting until the panel issues a decision on the

appeal. All hearings are held before a Listing Qualifications Panel

consisting of two independent panelists. To the extent practicable,

hearings are held within 45 days of the hearing request. Companies may

appeal adverse Listing Qualification Panel decisions to the Nasdaq

Listing and Hearing Review Council (LHRC), which also consists of

independent members. The LHRC reviews every Listing Panel Hearing, and

sometimes reverses Listing Panel decisions. Companies may also appeal to

Nasdaq’s Board of Governors and the SEC. Refer to Exhibit 2 for a more

detailed summary of Nasdaq’s hearings and appeals procedures.

3. Sample Selection and Economic Characteristics

3.1 SAMPLE SELECTION

We identify firms receiving Nasdaq corporate governance deficiency

notices using two data sources. One source is a dataset provided by

Nasdaq’s Listing Department to the authors that lists each Nasdaq

deficiency notice issued during January 1, 2004 - December 31, 2005. This

dataset includes the identity of the firm, the date of the notification,

the deficiencies cited, the resolution of the enforcement action, bases

for delisting (if applicable), and the resolution date. Our second source

is Forms 8-K. We search the Edgar database to obtain all Forms 8-K filed

during January 1, 2006 through December 31, 2011 that contained any of

the following terms: Delist, “notice of delisting,” and “continued

listing.” We then inspected each Form 8-K to determine whether it

disclosed receipt of a Nasdaq notice related to at least one corporate

governance deficiency. We coded the Form 8-K filing date (available on

the Edgar “cover page” for each Form 8-K), and the date of any related

press release included as an attachment to the Form 8-K.

Our empirical proxy for the initial disclosure date of a Nasdaq

deficiency notice (referred to as the “deficiency date”) is the earlier

of the Form 8-K filing date or any associated press release. For the 2004

and 2005 deficiency observations provided by Nasdaq, we used the “Nasdaq

notification date” to proxy for the initial disclosure date. Many 2004

deficiencies occurred before the August 23, 2004 effective date for the

SEC requirement that stock exchange deficiencies be disclosed in Form 8K. As a result, in 2004 many companies did not publicly disclose receipt

of Nasdaq deficiencies notices.

The initial sample includes all Nasdaq companies we identified as

receiving at least one corporate governance deficiency notice during the

period January 1, 2004 through December 31, 2011. To ensure that our

market response tests focus exclusively on corporate governance

deficiencies, we include only companies whose first deficiency notice

during the sample period refers only to corporate governance

deficiencies. The number of “mixed” deficiency notices (those that cite

both one or more corporate governance deficiency and one or more noncorporate governance deficiency) is low. This is because most corporate

governance deficiencies are triggered by events, such as the departure of

a board member, that are generally unrelated to events that trigger

quantitative deficiencies, such as expiration of bid price deficiency

grace periods and publication of financial results.

Our initial sample is 463 Nasdaq-listed companies which received Nasdaq

notices citing a total of 535 corporate governance deficiencies during

the sample period. CRSP and Compustat data availability requirements

reduce the sample to 406 companies with a total of 472 deficiencies, as

shown in Table 1, Panel A. Untabulated analysis indicates that 85.0% of

the notices cite a single corporate governance deficiency, and much

smaller numbers of notices cite two or three deficiencies (13.8% and

1.2%, respectively). All five notices citing three deficiencies discuss

deficiencies related to board independence, audit committee, and

nomination/compensation requirements. Forty-one of the 56 notices citing

two deficiencies cite both board independence and audit committee issues.

This is an expected result, since the departure of an independent board

member often involves the loss of an audit committee member as well.

Insert Table 1 about here.

Table 1, Panel B shows that the frequency of corporate governance

deficiencies declined during the sample period, with annual frequencies

ranging from a mean of 78 during 2004-2005, to 48 in 2007 and only 20 in

2011. This evidence suggests that Nasdaq-listed companies have been

learning how to stay in compliance with the corporate governance rules.

Consistent with the Form 8-K disclosure requirement becoming effective on

August 23, 2004, Table 1, Panel B shows that less than one-half of 72

companies receiving deficiency notices disclosed the noncompliance in

Forms 8-K during 2004. We located 81 Forms 8-K for calendar 2005, only

three less than the 84 deficiency notices reported in the Nasdaq dataset.

During 2006-2011, all deficiency notices in the sample are disclosed in

Forms 8-K, since Forms 8-K were the data source we used to identify the

deficiencies.

Our tabulation of press releases included in sample companies’ Forms 8-K

indicates that less than one-half of the companies appear to have made

press release disclosure of the receipt of a Nasdaq deficiency notice,

even though Nasdaq’s Marketplace Rules (Nasdaq 2006; section 4800)

requires such disclosure. Table 2, Panel B shows that 123 (71.1%) of the

173 press releases were published on the same day that the Forms 8-K were

filed, and 50 (28.9%) were published between one and six days earlier.

As reported in Table 1, Panel C, the most common types of corporate

governance deficiencies relate to the audit committee and board

independence (52% and 28% of the sample, respectively). Audit committee

deficiencies are triggered by the departure of an audit committee member,

reducing the number of audit committee members to less than three.

Further analysis indicates that the reason for these departures are

resignation, 125 firms, retirements, 22 firms, and death, 26 firms. In

almost all cases, the company’s Form 8-K states that no disagreements

existed between the departing audit committee member and the company.

Similarly, almost all board independence deficiencies are triggered by

the departure of an independent board member, with the result that a

majority of the board members are independent. Generally, the company

states that no disagreements were involved. We are currently coding the

reasons for deficiencies related to board independence. The other types

of governance deficiencies include noncompliance with Nasdaq rules

related to: (1) review and certification such as required by SOX sections

302, 404, and 906 (5%), (2) shareholder approval (9%), and (3) nomination

or compensation committees (5%).

Panel D of Table 1 presents an industry classification of deficiency

firms based on two-digit SIC codes. The table shows that 134 (32.9 %) of

the firms are concentrated in three high-technology industries: (1)

electrical and electronics (51 firms, 12.5%), (2) business services

including computer software (45 firms, 11.1%), and (3) chemical,

biotech, and pharmaceutical (38 firms, 9.3%).Table 1, Panel D also shows

that in each of the three industry groups, the proportion of deficiency

firms is more than three times as large as the proportion of Nasdaq

companies at 2011 year-end. Thus, our sample is clustered in hightechnology industries. Diagnostic analysis indicates that the financial

and market characteristics of sample companies in the high-technology

industries does not differ significantly from those of sample companies

in other industries.

Untabulated analyses show that deficiency notice dates are evenly spaced

throughout the calendar year, consistent with the lack of association

between most corporate governance deficiencies and fiscal period ends. We

also determine whether or not sample firms’ delist or merge in the years

following the deficiency dates using delist data available on CRSP.

Untabulated analyses show that 59 companies, 14% of the sample, delisted

within three calendar years of the deficiency notice date. CRSP

identifies violation of listing rules as the reason for delisting for 43

companies, 73% of those that delist. Only three companies were labeled by

CRSP as delisting for reasons related to corporate governance. Nine

delistings were made at the company’s request, and the reason for seven

of the delistings is “unknown.”

This evidence shows that almost all

firms remedy their corporate governance deficiencies.

3.2 ECONOMIC CHARACTERISTICS OF DEFICIENCY FIRMS

The mixed evidence from prior studies on corporate governance quality

and financial performance, and the high percentage of companies that

remedy their corporate governance deficiencies suggest that corporate

governance deficiencies might not be associated with impaired financial

condition and performance. However, noncompliance with Nasdaq listing

rules imposes significant costs for most affected firms (hearing fees,

attorney fees and senior management time). As a result, large and

financially strong companies might be expected to incur reasonable costs

to remain compliant with the rules. We therefore conjecture that

corporate governance deficiency companies are smaller and financially

weaker than their Nasdaq industry peers.

Table 2 presents descriptive evidence on the economic characteristics of

deficiency firms as compared to those of a control sample comprised of

Nasdaq firms matched on two-digit SIC code. Units of analysis are firm-

years with fiscal year t-1data used when the deficiency notice is

received in year t.

Insert table 2 about here.

We compare the following financial attributes of interest to investors:

firm size (total assets), profitability (net income, return on assets),

growth opportunities (market to book ratio), leverage (debt to assets

ratio ), liquidity (current assets / current liabilities and cash flows

from operations). We also examine equity market performance (cumulative

abnormal returns during the month before receipt of deficiency).

Table 2 shows that deficiency firms are significantly weaker than other

Nasdaq-listed firms in the same industries with respect to all attributes

(two-sided tests throughout). P-values range from <.0001 (five

comparisons) to 0.002 and 0.032 (one comparison each). Thus, the

corporate governance deficiency firms are significantly smaller, less

profitable, less liquid, more highly levered, and exhibit lower growth

opportunities and weaker operating cash flows than other firms in the

same industry.

Panels B through H of table 2 present evidence on financial and market

characteristics for each of the five types of corporate governance

deficiencies and for the subsamples of firms that were delisted (59

firms) and not delisted (347 firms) within three calendar years of the

deficiency notice date.

In Panels B, C and F, firms disclosing audit

committee, board independence, and/or shareholder approval deficiencies

(respectively) exhibit significantly weaker financial performance in

paired comparisons with industry control groups. Firms with the other

deficiency types are generally not different from their industry although

this may be due to the small sample size.

Table 2 Panel G shows that financial and market weakness are most

pronounced for the delist subsample, consistent with a generally weak

financial profile observed for companies that are delisted from stock

exchanges. However, as shown in Table 2 Panel H, the not-delisted

subsample also exhibits weakness in all categories other than debt to

assets and current assets/current liabilities (the two categories that

exhibit the least significant differences in the full sample). Results in

Panels G and H suggests that both firms that eventually delist and those

that remedy their deficiency are weaker than the average firms in their

industry.

Table 2 Panel A also provides descriptive statistics for five additional

variables used in our cross-sectional analysis of the factors associated

with the magnitude of the market response to news of initial receipt of

Nasdaq deficiency notices. We analyze firm attributes previously shown to

explain the market reaction to internal control weaknesses including risk

associated with organizational complexity, proxied by foreign sales, and

two proxies for risks associated with organizational change, sales growth

and restructuring charges (Ashbaugh et al (2007), Doyle et al. (2007) and

Leone (2007)). We also include an indicator variable for firms that

delist within three years, the probability of bankruptcy, and prior month

CAR as proxies for poor financial strength and performance. Only 12% of

the sample companies have foreign sales, defined as an indicator variable

that equals 1 if pretax income from foreign operations is positive in the

fiscal year of the deficiency notice date and/or the year prior to the

deficiency notice date, and 0 otherwise. This is consistent with Nasdaq

firms being relatively small, relatively less complex, and relatively

less likely to have international operations. Restructuring charge is

measured as the sum of restructuring charges in the year of and year

prior to the deficiency notice. Although the mean is negative $2.82

million, the median restructuring charge is zero indicating the majority

of firms receiving a deficiency notice do not have a restructuring plan.

High sales growth is measured with an indicator variable that equals 1 if

sales during year of or prior to the year of the deficiency is in the top

10% of sales growth in their industry, and 0 otherwise. The mean is 22%,

indicating that the nearly 80% of sample firms are not high growth firms.

Thus, the majority of firms are not engaged in organizational change

prior to the deficiency notice as indicated by low sales growth and lack

of restructuring plans.

We calculate a bankruptcy risk probability score using Hillegeist et

al.’s (2004) updated version of the Altman Z score formula (Altman 1968)

transformed into a probability score computed as exp

(score)/(1+exp(score)). The score is increasing in bankruptcy risk with a

mean (median) of 7.16% (7.83%). Similarly, sample companies exhibit poor

market performance averaging a -2.54% CARs during the month preceding the

deficiency notice date. Also, as mentioned above, 14% of sample firms

delist within three years of the deficiency notice date. These statistics

suggest that Nasdaq companies receiving corporate governance deficiencies

are smaller, less complex, not engaged in organizational change, have a

non-zero probability of bankruptcy, and have weak stock return

performance immediately before the notice.

4. Empirical Results

4.1. INFORMATION CONVEYED BY DEFICIENCY NOTICES

4.1.1.

Univariate Analysis

Table 3 presents evidence on market participants’ response to the

news that a firm has received a corporate governance deficiency notice

from Nasdaq. The table presents mean and median three-day and five-day

CARs calculated around the date of the first deficiency notice.

The

sample consists of 406 firm observations. The following discussion

focuses on mean three-day CARs; results for median CARs and five-day CARs

are qualitatively similar.

Insert Table 3 about here.

Table 3, Panel A shows that the mean three-day CAR is -1.28%, significant

at the .001 level (two-sided tests throughout), indicating that market

participants react negatively to news that a firm is no longer in

compliance with a Nasdaq corporate governance requirement.

This

reaction is concentrated in the 345 firms that report a single deficiency

in the first notice. The average CAR for these single-deficiency firms is

-1.37% (significant at the .001 level). The mean CAR for the 61 firms

whose first deficiency notice includes two or three deficiency types is

-0.76% (not significantly different from zero at conventional levels).

This result is unexpected, since noncompliance with the audit committee

requirement affects all but ten of the 61 multiple-deficiency companies,

and, as discussed below, the market response to audit committee

deficiencies is significantly negative.

For the 59 firms that delist within three years of receiving a deficiency

notice, the mean (median) CAR around the date of the notice is -4.69% (2.29), significant at the 0.001 level. Untabulated analysis indicates

that the mean three-day CAR associated with firms that do not delisted is

also significantly negative with a mean (median) of -0.70 (-1.06) with Zvalues of -1.849 (-2.093) significant at less than 0.05 level.

Untabulated test also indicate that the market response to the delist

firms is significantly more negative than the response to firms that do

not delist within three years. Thus, market participants appear to assess

the likelihood that the firm’s underlying problems will lead to delisting

and respond significantly more negatively to governance violations for

these firms. Overall, these findings indicate that Nasdaq enforcement

actions convey new and valuable information to the market about changes

in corporate governance that are significant enough to cause

noncompliance with listing requirements.

Table 3 also presents evidence for each of the five deficiency type

subsamples: audit committee, board independence, nomination and

compensation committee, review and certification, and shareholder

approval. Statistically and economically significant negative three-day

abnormal returns are observed for audit committee and review and

certification deficiencies. Specifically, the mean three-day CAR

associated with news of audit committee deficiency notices is -1.79%

(significant at the .001 level). When we examine the reasons for the

board members departure from the audit committee we find significant

negative responses to resignations, -2.33%, and retirements -2.09%, and

an insignificant response to deaths, -087%. In addition, the market

response to departure of the financial expert on the audit committee is

significantly negative, -2.29%. These negative returns indicate that

shareholders are aware of the role of the audit committee and respond

negatively when audit committee independence is compromised. Further, the

adverse market response to departures of the financial expert is

consistent with the market valuing financial experience on the audit

committee and an increased awareness of the importance of the audit

committee following the passage of SOX .

Firms becoming noncompliant with review and certification

requirements (related to SOX sections 302, 404, and 906) experience the

largest negative returns with a mean three-day CAR of -5.43% (significant

at the .001 level). This adverse market response indicates that

shareholders are sensitive to the SOX certification process and

disclosure of noncompliance with SOX-related requirements. This supports

the notion that Nasdaq’s enforcement of SOX-mandated review and

certification requirements is valuable to market participants. Closer

examination of these 18 firms indicates several reasons for management’s

decision to not certify the financial statements. Most of these

deficiencies, 16 out of 18, occur in 2004 and 2005 shortly after SOX was

mandated. Not surprisingly, the most common reason for lack of

certification is management’s failure to assess internal controls or

problems identified with internal controls. Other reasons given for

managements refusal to certify the financial statements include auditor

resignations, audit delays, and mergers resulting in no financial

statements being issued. This evidence complements evidence in Chang et

al. (2006) that the market responded positively when CEOs and CFOs

certified financial statements under the SEC’s administrative order in

2002.

Negative CARs are also observed for deficiencies related to

Nasdaq’s nomination/compensation committee and shareholder approval

rules. The magnitudes of the mean CARs are relatively large, ranging from

-1.36% to -2.71%, depending on return window and type of deficiency.

(Only three of the four median CARs are negative, however.) Subsample

sizes are relatively small (11 and 41 observations for the

nomination/compensation committee and shareholder approval subsamples,

respectively), limiting the extent to which statistical tests show

significant differences from zero. Finally, the mean three-day CAR

associated with board independence deficiencies is positive, 0.62%, but

not significantly different from zero indicating that deficiency notices

regarding board independence do not convey news to the market.

The evidence in Table 3 is consistent with the view that Nasdaq’s

corporate governance enforcement actions convey relevant information

about listed firms, particularly as related to the integrity of these

firms’ financial statements. However, we cannot rule out the alternative

explanation that the enforcement process imposes costs on non-compliant

firms, leading to a reduction in firm value. Further, the market response

varies depending on type of deficiency and whether the affected company

is delisted within three years of the deficiency notice date.

The negative market response to news of Nasdaq deficiencies might

reflect the market’s response to: (1) information about the corporate

governance deficiency, (2) news that the firm is under close regulatory

scrutiny due to noncompliance with a listing rule, and/or (3) negative

information about the firm that is related to, but distinct from

corporate governance deficiencies (such as financial weakness or

organizational change). In the next section we perform cross-sectional

analyses in an attempt to distinguish between these underlying causes for

the market reaction.

4.1.2.

CROSS-SECTIONAL ANALYSES

In this section, we complement our event study with cross-sectional

analyses to determine the extent to which factors previously associated

with internal control weaknesses help explain the market response to

violations of Nasdaq corporate governance listing requirements. Doyle et

al. (2007) and Ashbaugh-Skaife (2007) provide evidence on the

determinants of internal control weaknesses. These studies develop

proxies for financial strength, risk associated with organization

complexity, and risk associated with organizational change. We include

similar proxies in our regression model. We also include prior month

return and delisting to help us determine when market participants learn

about the deficiency and whether they assess delisting risk separate from

the deficiency as well as firm size. Thus, we estimate the following

cross-sectional model with the five-day CAR centered on the deficiency

notice date as the dependent variable.

² 1

² 3

F o r e i g n S a l e s

H i g h G r o w t h

+

R i s k

w h e r e

C A R

r e t

m o d

notice

+

C A R

( - 2 , + 2 )

=

² 0

+

+

² 2

R e s t r u c t u r i n g

+

² 4

B a n k r u p t c y

² 5

A s s e t s

+

² 6

D e l i s t

+

² 7

P r i o r C A R

+

e ;

f o r

f i r m

i :

( - 2 , + 2 )

=

c u m u l a t i

u r n

c o m p u t e d

a s

t h

e l residuals for days -2 through

date, using a value-weighted market

v e

a b n o r m a l

e

s u m

o f

m a r k e t

+2 relative to the deficiency

portfolio.

ForeignSales = an indicator variable that equals 1 if pretax income from

foreign operations is positive in the fiscal year of the deficiency

notice date and/or the year prior to the deficiency notice date, and 0

otherwise.

Restructuring = the sum of restructuring charges in the fiscal year of

the deficiency notice date and the fiscal year prior to the year of the

deficiency notice date in US$ millions.

HighGrowth =

an indicator variable that equals 1 if sales during

year prior to the year of the deficiency notice date is in the top 10% of

sales growth in the industry, and 0 otherwise.

Bankruptcy Risk = an updated version of the Altman Z score formula

(Altman 1968), transformed into a probability score computed as exp

(score)/(1+exp(score)). The score is increasing in bankruptcy risk. See

Hillegeist et al. (2004).

Assets = total assets as of the end of the fiscal year preceding the year

of the deficiency notice date, in $US millions.

Delist = an indicator variable that equals 1 if firm is delisted within

three calendar years of the deficiency notice date and 0 otherwise.

PriorCAR = the value weighted cumulative abnormal return during the month

prior to the date the deficiency notice is made public.

Table 4 presents results from estimating an OLS regression model.

(All variables are winsorized at the 99% and 1% levels.) As expected in a

regression with abnormal returns as the dependent variable, and closely

consistent with results reported in DeFond et al. (2005, Table 5), the

adjusted R2s are relatively low. For the audit committee subsample the

positive coefficient on restructuring is 0.0006 (t=2.03, significant at

the .05 level, two-sided tests throughout this section), indicating that

abnormal returns are significantly less negative for firms that have

incurred restructuring charges in the current or prior year. This

suggests that market participants view a management team that is already

engaged in remedial action as better able to remedy corporate governance

noncompliance associated with audit committee independence. Consistent

with the univariate results, firms with audit committee violations that

delist within three years have more negative abnormal returns.

Insert Table 4 about here.

For the board independence subsample, the delisting indicator is

the only variable that is significantly different from zero. The

coefficient on the delist indicator is -0.046 (t = -1.75, significant at

the .10 level) Thus, market participants response to news of board

independence-related deficiency notices is more negative for firms that

delist within three years of the deficiency notice date.

The “other violations” subsample consists of the review and

certification, nomination and compensation, and shareholder approval

subsamples. Estimation using this subsample yields only one significant

variable: the foreign sales indicator. The foreign sales indicator

estimated coefficient is 0.088 (t = 2.51, significant at the .01 level).

This suggests that a more complex organization with foreign operations is

viewed as more likely to be able to recover from a corporate governance

deficiency. It may be that the management teams for these firms are

viewed as somewhat more capable or sophisticated.

The strongest evidence in Table 4 is that the market response to news of

deficiency notices is generally more adverse for firms that are delisted

within three years, relative to those that are not. Table 4 results also

indicate that firm characteristics shown to be associated with

internal

control weaknesses in cross-sectional tests do little to explain the

market reaction to declines in corporate governance that result in

noncompliance with Nasdaq listing rules.

4.3 Diagnostics and extensions

As discussed above, our sample covers the period January 2004 to December

2011, using data from two sources. When we replicate our event study

using only the Nasdaq-provided dataset for the period January 2004 to

December 2005, or using only the January 2006 to December 2011 dataset,

all results and inferences remain the same. We also found that results

for the 2004-2005 subsample did not change when we used Form 8-K filing

dates as the “deficiency notice dates” instead of the Nasdaq-supplied

“notification dates.”

For our cross-sectional analyses of five-day CARs associated with

deficiency notices we also examined many different financial variables

and measurement periods, i.e., the deficiency year and years following

the deficiency notice year. None of the estimated coefficients associated

with these additional variables were different from zero at conventional

significance levels.

5. Summary and Conclusions

This study presents empirical evidence on Nasdaq’s enforcement of its

corporate governance listing requirements. We find that companies that

fall into non-compliance with Nasdaq listing requirements are smaller,

less profitable, more levered, and have lower return on asset and market

to book ratios than their industry counterparts that remain in

compliance. More importantly, we document a significant decline in share

price in response to receipt of a Nasdaq corporate governance deficiency

notice. This indicates that deficiency notices conveys new and valuable

information about the quality of firms’ corporate governance, particulary

as related to the integrity of their financial statements. Further, the

fact that the majority of sample firms regain compliance and continue to

trade, and the decrease in frequency in deficiencies during the sample

period suggest that the self-regulatory process identifies and promotes

the correction of corporate governance problems, at least in the Nasdaq

market. Overall, our evidence indicates that Nasdaq plays an important

monitoring and enforcement role and that equity market participants value

its enforcement of corporate governance requirements.

Analysis by deficiency type indicates that shareholders are aware of the

role of the audit committee and respond negatively when audit committee

independence is compromised and when the financial expert departs. No

prior studies have shown a market response to the departure of a

financial expert from the board. This is consistent with SOX raising

awareness of the audit committee’s importance. In addition, disclosure of

firms’ noncompliance with review and certification requirements related

to SOX Sections 302, 404, and 906) have the largest negative abnormal

stock returns. This strong reaction indicates that the market is

sensitive to the SOX certification process and the underlying

requirements for internal control. Finally, this evidence indicates that

the primary means by which market participants learn about certification

failures is the Form 8-K and/or press release disclosing receipt of a

Nasdaq deficiency notice. This supports the notion that market

participants value Nasdaq’s enforcement of SOX review and certification

requirements through its listing requirements.

Evidence in this study should be relevant to those considering the costs

and benefits of U.S. stock exchange listing requirements and the selfregulation process. First, the Nasdaq enforcement process identifies many

instances of noncompliance with its corporate governance rules , most of

which are remedied (perhaps in response to the threat of delisting).

Second, SEC and Nasdaq disclosure requirements result in wide

dissemination of news of that a firm has a corporate governance

deficiency, and this disclosure is the primary means of revealing SOX

review and certification failures to the market.

References

Altman, E.I. “Financial Ratios, Discriminant Analysis and the Prediction

of Corporate Bankruptcy.” The Journal of Finance. XXIII. 1968: 589-609.

Ashbaugh-Skaife, H., D.W. Collins, and W.R. Kinney, Jr. “The Discovery

and Reporting of Internal Control Deficiencies Prior to SOX-Mandated

Audits.” Journal of Accounitng and Economics 44 (2007): 166-192.

Ajinkya, B., S. Bhojraj, and P. Sengupta. “The Association between

Outside Directors, Institutional Investors and the Properties of

Management Earnings Forecasts. Journal of Accounting Research. 43:3

(2005): 343-376.

Beasley, M.S. “An Emirical Analysis of the Relation Between the Board of

Director Composition and Financial Statement Fraud.” The Accounting

Review. 71 (October, 1996): 443-465.

Bhagat, S. and B. Black. “The Non-Correlation Between Board Independence

and Long-Term Firm Performance.” Journal of Corporation Law. 27(2002):

231-274.

Battacharya, U., P. Groznik, and B. Haslem. “Is CEO Certification

Credible?” Regulation 26 (2003): 8-10.

Brown, L. D. and M. L. Caylor. “Corporate Governance and Firm Operating

Performance.” Review of Quantitative Finance and Accounting. 32(2009):

129-244.

Bushee, B.J. and C. Leuz. “Economic Consequences of SEC Disclosure

Regulation: Evidence from the OTC Bulletin Board.” Journal of

Accounting and Economics 39 (2005): 233-264.

Bushman R., Q. Chen, E. Engel, and A. Smith. “Financial Accounting

Information, Organizaitonal Complexity and Corporate Governance.”

Journal of Accounting and Economics 37 (2004): 167-201.

Chang, H., J. Chen, W. Liao, B. Mishra. “CEOs’/CFOs’ Swearing by the

Numbers: Does it Impact Share Price of the Firm? The Accounting Review

81(2006): 1-27.

Cox, C. Speech by SEC Chairman: More Efficient and Effective Regulation

on the Era of Global Consolidation of Market. U.S. Securities and

Exchange Commission. November 10, 2006.

Dechow, P.M.., R.G. Sloan, and A.P. Sweeney. “Causes and Consequences of

Earnings Manipulation: An Analysis of Firms Subject to Enforcement

Actions by the SEC.” Contemporary Accounting Research 13(Spring, 1996):

1-36.

Defond, M.L., R.N. Hann, and X. Hu. “Does the Market Value Financial

Expertise on Audit Committees of Boards of Directors?” Journal of

Accounting Research. 23(May, 2005): 153-193.

Doyle, J., W. Ge, and S. McVay. “Determinants of Weaknesses in Internal

Control Over Financial Reporting.”

44 (2007): 193-223.

Journal of Accounting and Economics

Emen, M.S. Corporate Governance: The View From NASDAQ. The Nasdaq Stock

Market Inc. New York: 2004.

Engel, E. R.M. Hayes, and X. Wang. “The Sarbanes-Oxley Act and Firms’

Going-Private Decisions.” Journal of Accounting and Economics 44(2007):

116-145.

Frankel, R., S. McVay, M. Soliman, “Non-GAAP earnings and board

independence.” Review of Accounting Studies, 16(2011): 719-744.

Gompers, P., J. Ishii and A. Metrick. “Corporate Governance and Equity

Prices.” The Quarterly Journal of Economics, February 2003: 107-155.

Hansen, B., G. Pownall and W. Wang. “The Robustness of the Sarbanes Oxley

Effect on the U.S. Capital Market.” Review of Accounting Studies. 14:2-3

(2009): 401-439.

Harris, J.H., V. Panchapagesa n, and I.M. Werner. “Off but Not Gone: A

Study of Nasdaq Delistings.” The Ohio State University Charles A. Dice

Center for Research in Financial Economics working paper 2008-06. March

4, 2008.

Hillegeist, S.A., E.K. Keating, D.P. Cram and K.G. Lundstedt. “Assesing

the Probability of Bankruptcy.” Review of Accounting Studies (9) 2004: 534.

Hoitash, U., R. Hoitash, and J.C. Bedard. “Corporate Governance and

Internal Control over Financial Reporting: A Comparison of Regulatory

Regimes.” The Accounting Review. 84:3 (2009): 839-867.

Karamanou, I. and N. Vafeas. “The Association between Corporate Boards,

Audit Committees, and Management Earnings Forecasts: An Empirical

Analysis. Journal of Accounting Research. 43:3 (2005): 453-486.

Klein, A. “Audit Committee, Board of Director Characteristics, and

Earnings Management. Journal of Accounting and Economics. 33:3 (August,

2002): 375-400.

Larcker, D.F., S.A. Richardson, and I. Tuna. “Corporate Governance,

Accounting Outcomes, and Organizational Performance.” The Accounting

Review 82 (2007): 963-1008.

Leone, A.J. 2007. Factors related to internal control disclosure: A

discussion of Ashbaught, Collins, and Kinney (2007) and Doyle, Ge, and

McVay (2007). Journal of Accounting and Economics 44: 224-237.

Leuz, C. “Was the Sarbanes-Oxley Act of 2002 Really This Costly? A

Discussion of Evidence From Event Returns and Going-Private Decisions.”

Journal of Accounting and Economics 44 (2007): 146-165.

Leuz, C., A. Triantis, and T. Wang. “Why Do Firms Go Dark?

Causes and

Economic Consequences of Voluntary SEC Deregistrations.”

Accounting and Economics. 45(2008): 181-208.

Journal of

Kinney, W.R., Jr. and L.S. McDaniel. “Characteristics of Firms Correcting

Previously Reported Quarterly Earnings.” Journal of Accounting and

Economics 11(February, 1989): 71-93.

Macey, J., M. O’Hara, and D. Pompilio. “Down and Out in the Stock Market:

The Law and Economics of the Delisting Process.” Journal of Law and

Economics. 51:4 (November 2008): 683-713.

Mulherin, J.H. “Measuring the Costs and Benefits fo Regulation:

Conceptual Issues in Securities Markets.” Journal of Corporate Finance

13(2-3) 2007: 421-437.

Nasdaq Stock Market, Inc., The. Marketplace Rules. Nasdaq Manual Online

(http://www.complinet.com/nasdaq/ on October 20, 2005)

________________________. Form 10-K Annual Report for the Fiscal Year

Ended December 31, 2006. New York.

________________________. Form 10-K Annual Report for the Fiscal Year

Ended December 31, 2005. New York.

Sanger, G.C. and J.D. Peterson. “An Empirical Analysis of Common Stock

Delistings.” Journal of Financial and Quantitative Analysis. 23:2 (June,

1990): 261-272.

Sirri, E.R. Testimony Concerning Consolidation of NASD with the Member

Firm Regulatory Functions of the NYSE: Working Towards Improved

Regulation. U.S. Securities & Exchange Commission. May 17, 2007.

United States Congress (111th). Dodd-Frank Wall Street Rform and Consumer

Protection Act. Pub.L. 111-203. 124 Stat. 1376-2223. July 16, 2012.

United States Congress (107th). Sarbanes-Oxley Act of 2002. H.R. 3763.

Jan. 23, 2002.

United States Securities and Exchange Commission. Listing Standards for

Compensation Committeess; Final Rule. Release Nos. 33-9330; 34-67220;

File No. S7-13-11. Washington D.C.: June 20, 2012.

_________________________________________. Concept Release Concerning

Self-Regulation; Proposed Rule. Release No. 34-50700; File No. S7-40-04.

Washington, D.C.: December 8, 2004a.

_________________________________________. Additional Form 8-K Disclosure

Requirements and Acceleration of Filing Date. Release Nos. 33-8400; 3449424; File No. 27-22-02. Washington, D.C.: March 16, 2004b.

_________________________________________. 1994 Annual Report.

Washington, D.C.

_________________________________________. Internationalization of the

Securities Markets: Report of the Staff of the U.S. Securities and

Exchange Commission to the Senate Committee on Banking, Housing and Urban

Affairs and the House Committee on Energy and Commerce (July 17, 1987).

Washington, D.C: SEC.

Vafeas, N. “Board structure and the in formativeness of earnings.”

Journal of Accounting and Public Policy 19 (2000): 139-160.

Exhibit 1

Summary of Nasdaq Qualitative (Corporate Governance) Continued Listing

Requirements and Nasdaq’s Discretionary Authority

Source: Nasdaq Marketplace Rules [2006]

1.Corporate Governance Requirements (Marketplace Rules Sect. 4350.)

Distribution of Annual and Interim Reports

Each company must make available to its share holders an annual report

containing audited financial statements of the company and its

subsidiaries either by: (i) by mailing the report to shareholders, or

(ii) posting the report on or through the company’s website.

Each company must make interim reports available to shareholders upon

request.

Board Requirements

Independent Directors

Each company’s board of directors is required to have a majority of

independent directors. [Rule 4350(c)(1)] Rule 4200(a)(15) describes

certain relationships that preclude a person from being an independent

director. In addition, the company’s board must make a determination that

there is no other relationship that would interfere with the exercise of

independent judgment in implementing the responsibilities of a director.

Executive Sessions

Independent directors must have regularly scheduled meetings at which

only independent directors are present. [Rule 4350(c)(2)] It is

contemplated that executive sessions will occur at least twice a year and

perhaps more frequently, in conjunction with regularly scheduled board

meetings.

Compensation and Nominating Committees

Independent directors must determine the compensation of the chief

executive officer and other executive officers. Independent directors

must select nominees for directors.

[Rule 4350(c)(3) and Rule 4350(c)(4)].

Audit Committees

Each company is required to have an audit committee consisting solely of

independent directors who have the requisite financial experience and

expertise. The audit committee must have at least three members. [Rule

4350(d) and SEC Rule 10A-3]

Controlled Company Exception

A Controlled Company is not required to have a majority of independent

directors and is not required to have the nominating and compensation

functions performed by independent directors. A Controlled Company is one

of which more than 50% of the voting power is held by an individual, a

group, or another company. [Rule 4350(c)(5)]

Exception for “Exceptional and Limited” Circumstances

One director who is not independent under Nasdaq’s definition may be

appointed to the nominating, compensation and audit committees, provided

the board determines, under exceptional and limited circumstances, that

the individual’s membership on the committee is required by the best

interests of the company and its shareholders.

Phase-ins for Initial Public Offerings

A company listing in connection with an initial public offering has

twelve months from the date of listing to comply with the majority

independent board requirement.

Shareholder Meetings

Annual Meeting

Each company is required to hold an annual meeting of shareholders no

later than one year after the end of its fiscal year. [Rule 4350(e)]

Quorum

Each company must provide for a quorum of not less than 33 1/3% of the

outstanding shares of its voting stock for any meeting of the holders of

its common stock. [Rule 4350(f)]

Solicitation of Proxies

Each company is required to solicit proxies and provide proxy statements

for all meetings of shareholders consistent with the applicable

requirements of the SEC including the “e-proxy” provisions. [Rule

4350(g)]

Conflicts of Interest

Each company shall conduct appropriate review and oversight of all

related party transactions for potential conflict of interest situations.

The review must be conducted by the audit committee or another

independent body of the board of directors. [Rule 4350(h)]

Shareholder Approval

Companies are required to obtain shareholder approval of certain

issuances of securities including:

Equity compensation [Rule 4350(i)(1)(A)]

Issuances resulting in a change of control [Rule 4350(i)(1)(B)]

Acquisitions where the issuance equals 20% or more of the pre-transaction

outstanding shares, or 5% or more of the pre-transactions outstanding

shares when a related party has a 5% or greater interest in the

acquisition target [Rule 4350(i)(1)(C)]

Private placements where the issuance (together with sales by officers,

directors, or substantial shareholders, if any), equals 20% or more of

the pre-transaction outstanding shares at a price less than the greater

of book or market value. [Rule 4350(i)(1)(D)]

Code of Conduct

Each company must adopt a code of conduct applicable to all directors,

officers and employees. The code must satisfy the definition of a “code

of ethics” set out in the Sarbanes-Oxley Act of 2002, and it must be

publicly available. [Rule 4350(n)]

Voting Rights

The voting rights of existing shareholders cannot be disparately reduced

or restricted through any corporate action or issuance. [Rule 4351]

Public Interest

Nasdaq may deny inclusion or apply additional or more stringent criteria

for the initial or continued inclusion of particular securities or

suspend or terminate the inclusion of an otherwise qualified security if

… Nasdaq deems it necessary to prevent fraudulent and manipulative acts

and practices, to promote just and equitable principles of trade, or to

protect investors and the public interest (Marketplace Rules Sec.

4330(a)).

2.Discretionary Authority (Marketplace Rules Sec. 4300.)

Nasdaq will exercise broad discretionary authority over the initial and

continued inclusion of securities in Nasdaq in order to maintain the

quality of and public confidence in The NASDAQ Stock Market, to prevent

fraudulent and manipulative acts and practices, to promote just and

equitable principles of trade or to protect investors and the public

interest. Accordingly, Nasdaq may deny initial inclusion or apply

additional or more stringent criteria for the initial or continued

inclusion of particular securities or suspend or terminate the inclusion

of particular securities in Nasdaq as inadvisable or unwarranted in the

opinion of Nasdaq, even though the securities meet all enumerated

criteria for initial or continued inclusion.

Exhibit 2

Summary of Hearings and Appeals Procedures at Nasdaq

(Excerpted from Nasdaq’a Regulatory Requirements [August 2006])

A company that is denied initial listing, that is being delisted for

failure to satisfy the continued listing requirements or that has been

issued a public reprimand letter may request a hearing.

• In case of delisting proceedings, a timely request for a hearing will

stay the delisting pending a written determination by the Nasdaq Listing

Qualifications Panel.

• Hearings are generally scheduled to take place within 30-45 days of

the date of the request. Companies are provided an opportunity to submit

written materials and a plan of compliance before the hearing, and may

elect to make an oral presentation or to have their case decided solely

on the basis of the written submission.

• A Panel, comprised of two independent professionals appointed by the

Nasdaq Board of Directors, will review the cases and render a decision.

Written decisions are generally issued within 30 days of the date of the

hearing. The Panel may grant an exception, deny initial or continued

listing or transfer listing from The Nasdaq Global Select Marketsm or the

Nasdaq Global Marketsm to the Nasdaq Capital Market® . The Panel has

discretion to grant an exception to a listing standard for a period not

to exceed 90 days from the date of the decision or 180 days from the date

of the initial staff determination of deficiency. Denial of continued

listing will result in the suspension of the company’s securities within

two business days of the date of the written decision.

• Determinations by the Panel may be appealed to the Nasdaq Listing and

Hearing Review Council (Review Council) within 15 calendar days of the

Panel’s decision. An appeal to the Review Council does not stay the

decision of the Panel or suspension of the company’s securities.

• Determinations by the Panel may be called for review at the discretion

of the Review Council within 45 calendar days of the Panel’s decision. A

call for review does not stay the decision of the Panel or the suspension

of the company’s securities.

• The Review Council may affirm, modify, reverse or remand the Panel’s

decision.

• Any determination of the Review Council may be reviewed by the Nasdaq

Borad at the discretion of any Board member.

• Any final decision of Nasdaq may be appealed to the U.S. Securities

and Exchange Commission.

• A determination to delist a company’s securities becomes final upon

exhaustion of the company’s appeal rights and the Review Council’s and

Nasdaq Board’s review rights. When a delisting determination becomes

final, Nasdaq will file a Form 25 and Notification of Delisting

Determination with the SEC and provide a copy to the company. Nasdaq will

also issue a press release announcing the final delisting determination

and post a notice on its website. Removal of the securities from listing

on The Nasdaq Stock Market will be effective no sooner than ten calendar

days after the filing of the notification with the SEC.

• A company that is delisted by Nasdaq may be eligible for quotation on

the NASD’s Over-the-Counter Bulletin Board (OTCBB) if a market maker

files an application to register and quote the security in accordance

with SEC.

Exhibit 3

Variable Definitions and Data Sources

Data source is Compustat, unless otherwise noted.

CAR (-1,+1)

Cumulative abnormal return computed as the sum of market model residuals

for days -1 through +1 relative to the deficiency notice date, using a

value-weighted market portfolio. Data source: CRSP.

CAR (-2,+2)

Cumulative abnormal return computed as the sum of market model residuals

for days -2 through +2 relative to the deficiency notice date, using a

value-weighted market portfolio. Data source: CRSP.

Deficiency Notice Date

The earlier of: (1) the filing date of the Form 8-K in which the firm

discloses receipt of the Nasdaq deficiency notice, and (2) the date of

any press release included as an attachment to the Form 8-K that

discloses receipt of the deficiency. For deficiency notices occurring in

2004 and 2005, the deficiency notice date is the “notification date”

included in the dataset provided by Nasdaq to the authors.

Total Assets

Total assets as of the end of the fiscal year preceding the year of the

deficiency notice date, in $US millions.

Net Income

Net income for the fiscal year preceding the year of the deficiency notic

date, in $US millions.

Market to Book

Ratio of market value of common stock to book value as of the fiscal year

end preceding the year of the deficiency notice date.

Debt to Assets

Ratio of total debt to total assets as of the fiscal year end preceding

the year of the deficiency notice date.

Current Assets/Current Liabilities

Ratio of current assets to current liabilities as of the fiscal year end

preceding the year of the deficiency notice date.

Cash from Operations

Cash flow from operations from the statement of cash flows for the fiscal

year preceding the year of the deficiency notice date.

Return on Assets

Income before exgtraordinary items divided by average total assets for

the fiscal year preceding the year of the deficiency notice date.

Foreign Sales Indicator

Indicator variable that equals 1 if pretax income from foreign operations

is positive in the fiscal year of the deficiency notice date and/or the

year prior to the deficiency notice date, and 0 otherwise.

Restructuring Charge

Sum of restructuring charges in the fiscal year of the deficiency notice

date and the year prior to the year of the deficiency notice date in US$

millions.

High Sales Growth Indicator

Indicator variable that equals 1 if sales during year prior to the

deficiency year is in the top 10% of sales growth in the industry, and 0

otherwise.

Delist Indicator

Indicator variable that equals 1 if firm is delisted within three

calendar years of the deficiency notice date and 0 otherwise. Data

source: CRSP.

Bankruptcy Risk