MSc (formerly MA) International Entrepreneurship MSc International Finance

advertisement

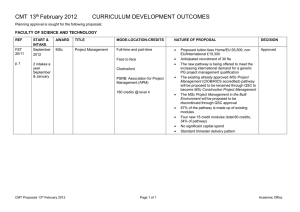

THE SENATE PATHWAY APPROVAL REPORT (Core and/or Franchised Provision) A confirmed report of the event held on 13th October 2008 to consider the approval of the following pathways: MA International Entrepreneurship MSc International Finance Ashcroft International Business School Delivery of Pathways at Anglia Ruskin University, Cambridge campus Quality Assurance Division SECTION A – OUTCOME SUMMARY 1. INTRODUCTION 1.1 The purpose of the event was to consider the approval of the MA International Entrepreneurship and MSc International Finance. 1.2 The pathways will be located in the On-campus Cambridge Programme in the Ashcroft International Business School. 2. CONCLUSIONS 2.1 The Panel recommends to the Senate the approval of the following pathways: MA International Entrepreneurship; MSc International Finance. Approval, once confirmed, will be for an indefinite period, subject to Anglia Ruskin’s continuing quality assurance procedures. Both pathways are approved for delivery in full- and part-time modes with a minimum cohort size of ten students and a maximum of fifty students on each pathway. 2.2 The Panel recommends to the Senate the approval of eight new modules for delivery. The full titles of all new modules are provided in Section D of this report. 2.3 Conditions Approval is subject to the following conditions which were set by the Panel. A copy of the response must be lodged with the Executive Officer by the date(s) detailed below: 2.3.1 2.3.2 2.3.3 2.3.4 Details of Condition Deadline Response to be considered by Submit a Change of Details Form to the Academic Standards, Quality & Regulations Committee to seek approval to amend the award for the International Entrepreneurship pathway from an MA to an MSc (paragraph 4.1 and Appendix 1); Revisit the Pathway Specification Form (PSF) for the MA International Entrepreneurship to review the Pathway Learning Outcomes (PLOs) and assessment strategies (paragraphs 4.2, 5.1 and Appendix 1); The Panel commends the Proposal Team’s integration of practitioners in the delivery of the MA International Entrepreneurship. However, such a practice has an implied risk upon curriculum management. The Proposal Team must submit a statement outlining the management processes for modules to be led by individuals who are not regular members of Faculty staff (paragraph 6.1); Revisit the Module Definition Forms (MDFs) to ensure clarity for students (paragraph 6.2 and 31st October 2008 All Panel members 30th November 2008 All Panel members 30th November 2008 All Panel members 30th November All Panel members Quality Assurance Division 2 Confirmed 2.3.5 2.3.6 2.3.7 2.4 Appendix 2); Revisit the Student Handbook for the MA International Entrepreneurship to develop the philosophy of the pathway, the practitioner base of the teaching team, the role of Postgraduate Major Project within the pathway and how the Major Project will be delivered (paragraph 8.1); Clarify the role of the Chartered Financial Analyst Institute (CFA) within the MSc International Finance, in particular within the curriculum design and its embodiment within the PSF and MDFs. Evidence of the CFA’s credibility should also be provided to students, although with clear guidance that the pathway carries no accreditation from the CFA. The Panel recommends that the Proposal Team removes reference to the CFA within the PSF and retain reference within the MDFs’ Module Description (paragraphs 4.6 and 8.2); Revisit the Student Handbook for the MSc International Finance, in particular ensuring absolute clarity on the relationship (or not) between the pathway and the CFA (paragraph 8.2). 2008 30th November 2008 All Panel members 30th November 2008 All Panel members 30th November 2008 All Panel members Recommendations The following recommendations for quality enhancement were made by the Panel. A copy of the responses to the recommendations listed below must be lodged with the Executive Officer. The Faculty Board for the Ashcroft International Business School will consider the responses at its meeting of 25th February 2009: 2.4.1 2.4.2 2.4.3 2.5 Details of Recommendation Expand upon the international dimension of the MA International Entrepreneurship through its content. The outline of the learning and teaching strategies within the PSF and the Student Handbook may be the most appropriate vehicles for this (paragraph 4.3); Expand Section 12 of the MDFs to outline the foci of assessments and the marking and moderation process for group assessments (paragraph 5.1 and Appendix 2); Consider the way in which the MSc International Finance will be marketed in relation to the links with the CFA (paragraphs 4.6, 7.1 and 8.2). Deadline 23rd January 2009 23rd January 2009 23rd January 2009 Issues Referred to the Senate (or appropriate standing committee) The Panel did not identify any institution-wide issues as requiring the attention of the Senate or an appropriate standing committee of the Senate. Quality Assurance Division 3 Confirmed SECTION B – DETAIL OF DISCUSSION AND PANEL CONCLUSIONS 3 RATIONALE 3.1 The two pathways are part of a developing suite of internationally-orientated Masters pathways to be delivered on the Cambridge campus and making full use of the extensive range of Research Centres, Visiting Fellows and Visiting Professors, consistent with the Faculty’s mission statement to become a leading practice-based international business school. 3.2 The MA International Entrepreneurship proposal builds upon the Faculty’s rapidly-growing reputation in entrepreneurship and related strategic developments and on the flagship BA (Hons) Enterprise & Entrepreneurial Management, which was approved last academic year and recruited twelve students in September 2008, and is delivered in liaison with St John’s Innovation Centre in Cambridge University. Over many years the Faculty’s Centre for International Business has established robust and sustainable relationships with entrepreneurs which have developed into a Entrepreneur in Residence network with Walter Herriot as Director. Our University’s CMT had awarded £300,000 to a Faculty team to deliver entrepreneurial skills across Faculties. 3.3 Whilst ‘entrepreneurship’ is widely used in both academic and business discourse it is a rather loosely defined term. In a narrow send it is often used in the context of business start-ups with the emphasis on the attributes needed to successfully negotiate the many obstacles and uncertainties encountered. While this perspective is catered for within the pathway a broader-based approach more accurately characterises the learning experiences which the pathway is intended to provide. The broader approach can better be defined as ‘enterprise learning’ or ‘enterprise capability’. 3.4 The MSc International Finance proposal also builds upon the Faculty’s research centres and Visiting Fellows and Professors. Visiting Professors Stefan Vieweg, who is also Global Head of IT Controlling for Vodafone plc, and Lawrence Murray, who is also Professor of Finance & International Business at the University of San Francisco, have been particularly involved in the development of the pathway and will continue in the delivery of the pathway. The pathway has been developed to embed over 70% of the Chartered Financial Analyst Institute’s (CFA) Candidate Body of Knowledge (CBOK). The CFA has been established for forty-seven years and now operates in over one hundred and fifty countries with more than 110,000 candidates enrolling annually. The intended involvement of ‘cutting edge’ analysts and practitioners to the delivery and development of the pathway will provide a sound basis for its continued relevance in a rapidly-changing global setting. 4 CURRICULUM DESIGN, CONTENT AND DELIVERY 4.1 The Panel noted that the curriculum planning approval granted by our University’s Corporate Management Team was for an MA International Entrepreneurship but that the proposal documentation was for an MSc. The Proposal Team confirmed that the Deputy Vice-Chancellors (Academic) and (Research), together with the Vice-Chancellor, encouraged the Faculty to develop Science pathways at the Faculty’s strategic meeting. The Panel agreed that Science awards have a stronger marketability. The Proposal Team were advised to pursue a change of award through our University’s Academic Standards, Quality & Regulations Subcommittee. 4.2 The Panel considered the Pathway Learning Outcomes (PLOs) for the MA International Entrepreneurship. The Panel suggested that the PLOs defined on the PSF did not articulate fully the intentions or delivery style of the pathway as outlined by the Proposal Team at the approval event. The Proposal Team explained that it had been difficult to fit the pathway within the confines of the QAA’s subject benchmark statements. The Panel Quality Assurance Division 4 Confirmed felt that PLOs A1-6 on the PSF were very traditional management objectives although the pathway was commendably innovative. The Proposal Team were advised that they were required ‘to engage with’ the QAA’s Subject Benchmark Statements. If they failed to define the proposal adequately Proposal Teams were encouraged to go beyond the lexicon of the Statements to articulate the objectives of the pathway. In subsequent years the pathway will be assessed against its PLOs and if these fail to capture the (original) aspirations the pathway will be deemed to have failed while being what it was always intended to be. The Proposal Team was strongly encouraged to rewrite the PSF to detail the pathway accurately, even if this required a departure from the QAA’s Statements. The Panel suggested that the Proposal Team could go further by cross-referencing the learning outcomes with those proposed in the recent report by the Council for Industry and Higher Education. 4.3 The Panel enquired why the existing module International Business Environment had been included in both pathways. The Proposal Team explained that small-to-medium enterprise (SME), from which many of the students would be recruited from, are affected, probably most acutely, by international business trends and issues. The Panel suggested that the pathways were West-centric although the pathway titles suggested a strong international focus. The Proposal Team explained that all students need to learn about American capitalism and Western economies. However the Enterprising Futures and Foresighting module has been developed around emerging industries. The pathways will identify the interconnections between Western constructs for Asian businesses and vice versa taking the three-zone model of South-East Asia/Australasia, Europe/Arabic states, and the United States of America. 4.4 The Panel continued their enquiries about the use of Research Methods for Managers in an International Context. The pathway diagrams suggested that this module would be delivered alongside the Postgraduate Major Project concluding at the same time. If the Research Methods module was intended to introduce students to research skills and tools and conclude with a major project proposal this would not be possible. The Proposal Team confirmed that the module could be delivered across twelve weeks or intensively over three weeks. This latter delivery pattern would be used ensuring that students submit their proposal in Week 4. The remainder of the semester would be concentrated upon the Postgraduate Major Project. 4.5 The Panel noted that the Postgraduate Major Project included in both pathways was the Faculty’s standard module. The Panel enquired whether a traditionally-academic dissertation would be required therefore. The Proposal Team confirmed that an applied project would be expected. The Panel recommended that a pathway-specific Module Guide be developed for the Major Project module to ensure that this innovative project and the integrative and applied nature of this culminating module is made clear to students. 4.6 The Panel considered the PSF for the MSc International Finance and noted that it was an aim of the pathway to provide the knowledge contained with a major part of the CFA’s CBOF. The Panel queried the appropriateness of this, as formal accreditation had not been sought from the CFA, and that the pathway was intended to be a postgraduate award in its own right. While the potential benefits of the CFA articulation for future employment was clear to the Panel, the Proposal Team was strongly recommended to remove its reference within the PSF and articulate the curriculum overlap within the module descriptions on each MDF. 4.7 The Faculty’s Centre for International Business has been active within the local region and globally since 1996 working with organisations such as EEDA to influence policy and support mechanisms and with businesses to achieve their international growth ambitions. The Centre is currently working in the Philippines to support small-to-medium enterprises (SMEs) and with CapGemini bringing access to a wide range of global networks. The pathways were developed for the modules to be delivered jointly by entrepreneurs as Quality Assurance Division 5 Confirmed Visiting Professors or Fellows and the Faculty’s full-time staff. The Visitors would be involved in mentoring on project work and would sometimes be involved in students’ assessment. 4.8 The Cambridge Department had secured a contract with Boffins, which would provide various learning materials which would be embedded within the modules. Additionally, Virgin Money had provided their market intelligence to the Faculty for students to undertake live projects on their behalf. The successful team would be invited to work alongside Virgin Money to complete the project, and would receive 10% of any profits gained. The Panel felt that the Student Handbooks submitted omitted much of this innovation and the interconnected teaching styles from full-time academics and Visitors from industry. 5 ASSESSMENT STRATEGY 5.1 The Panel noted the considerable level of group assessment within the pathways. There was discussion regarding the strengths of this in developing teamwork, a valuable preparation for the workplace, and the disadvantages in imbalanced input from individual team members. The opportunity for disenfranchisement within students if marks are deemed to be unfairly awarded to a weak or less-dedicated team member was discussed. The Proposal Team confirmed that the individual assessment elements enabled students to reflect upon their individual contribution which enabled tutors to disaggregate marks. The Panel suggested that to emphasise the value of group work the Proposal Team consider awarding it greater weighting in the modules’ assessment. The Panel strongly recommended that the Proposal Team consider introducing peer review within their moderation process of group assessment. 6 STAFFING, LEARNING RESOURCES AND STUDENT SUPPORT 6.1 The Panel noted that Visiting Professors were identified as Module Leaders for several of the new modules. The Proposal Team confirmed that Module Leaders did not need to be a full-time member of staff. Acknowledging this and aware of the recent publication of our University’s Student Charter, the Panel advised the Proposal Team to be cogniscent of the management responsibilities the post held and to be certain that students’ expectations were well-managed where a Module Leader would not be available on-campus throughout much of the week. Alternative, reliable contact mechanisms would need to be put into place. 6.2 The Panel noted that the student-managed learning activities as detailed on the MDFs were brief. To ensure that students were aware of their own responsibilities within modules’ study hours the Panel recommended that the Proposal Team expand upon these. 7 NATIONAL, PROFESSIONAL AND STATUTORY BODY REQUIREMENTS 7.1 The Panel queried the embedding of the CFA’s CBOK within the pathway and whether this should or could be pursued to a more formal arrangement. The Proposal Team confirmed that there was potential to be a partner of the CFA and this may be an aspiration to be pursued in due course by the Faculty. Until such time, the Panel strongly recommended that the accurate nature of the articulation with the CFA be explained upfront to students [c.f. paragraph 9.2]. Quality Assurance Division 6 Confirmed 8 DOCUMENTATION 8.1 The Panel commended the International Entrepreneurship Proposal Team for a novel and innovative pathway which was not captured within the Student Handbook. Both Student Handbooks fulfilled the requirements of our University’s template, and the Panel was impressed with the use of photos to identify key members of staff, but felt that the Student Handbook could be a valuable tool in outlining the learning and teaching strategy, the interconnections between the modules, the potential of the Boffins material and the Faculty’s initiatives with companies such as Virgin Money. The integration of Visitors within the teaching team should be expanded upon within the Student Handbook and the opportunity taken at this early point to manage student expectations as the availability of Visitors. The applied potential of the Postgraduate Major Project should also be outlined in the Student Handbook. 8.2 In addition, the MSc International Finance Student Handbook should articulate clearly the status of the CFA within the financial sector and the embedding of its CBOK within the pathway. It should also be clearly stated that this pathway is not accredited by the CFA and CFA designation is not conferred upon successful completion of the pathway [c.f. paragraph 8.1]. 9 CONFIRMATION OF STANDARDS OF AWARDS 9.1 The Panel confirmed that the proposed MA International Entrepreneurship and MSc International Finance pathways satisfied the University’s Academic Regulations with regard to the definitions and academic standards of Anglia Ruskin awards and, hence, the QAA’s Framework for Higher Education Qualifications. DRAFT UNCONFIRMED CONFIRMED FILE REF OFFICE FILE REF Quality Assurance Division 7 15th October 2008 15th October 2008 14th November 2008 J:\Administration\Academic Office\Quality Assurance Division\Events\2008-09\AIBS\BU03 MSc International Entrepreneurship & MSc International Finance\Reports\MA International Entrepreneurship-MSc International Finance report.doc AIBS/PG/89/MA International EntrepreneurshipMSc International Finance Confirmed SECTION C – DETAILS OF PANEL MEMBERSHIP AND PROPOSAL TEAM Internal Panel Members: Mike Smith (Chair) Department of Digital Sciences & Technology Faculty of Science & Technology Colleen Moore Deputy Head of Humanities & Social Sciences Department Faculty of Arts, Law & Social Sciences External Panel Members: Geoff Black MBA Course Manager Business Management & Marketing Group Harper Adams University College Keith Herrmann Deputy Chief Executive Council for Industry and Higher Education Executive Officer: Claire Moorey Faculty Quality Assurance Officer (Ashcroft International Business School) Quality Assurance Division, Academic Office Members of Proposal Team: Prof. Stuart Wall Head of Department (Cambridge) Ashcroft International Business School Mahmoud Al-Kilani Programme Leader (On-campus – Cambridge) Ashcroft International Business School Prof. Lester Lloyd-Reason Professor of International Enterprise Strategy and Director, Centre for International Business Ashcroft International Business School Prof. Roger Jeynes Professor of Management Practice Ashcroft International Business School Quality Assurance Division 8 Confirmed SECTION D – OUTCOME DATA Programme Department Faculty Collaborative Partner New/amended Awards Approved (nb intended awards On-campus - Cambridge Cambridge Ashcroft International Business School Not applicable Title(s) of Named Pathway(s) Attendance mode and duration only, not intermediate awards) MA International Entrepreneurship MSc International Finance Validating body (if not Anglia Ruskin University) Professional body accreditation Proposal Team Leader Month and Year of the first intake Standard intake points Maximum and minimum student numbers Date of first Conferment of Award(s) Any additional/specialised wording to appear on transcript and/or award certificate Date of next scheduled Periodic Review Awards and Titles to be deleted (with month/year of last regular conferment) Part-time – two years Full-time – one year Not applicable Not applicable Prof. Stuart Wall February 2009 September and February 10 min.; 50 max. February 2010 Not applicable To be confirmed None NEW MODULES APPROVED BC430006S BC430007S BC415058S BC415061S BC415059S BC415060S BC415062S BC415063S Entrepreneurship and New Venture Creation Enterprising Futures and Foresighting Small Business Management and Value Creation in Practice Contexts of International Finance International Financial Markets International Corporate Finance Portfolio, Foreign Exchange & Interest Rate Management Private Equity and Venture Capital Quality Assurance Division 9 Confirmed Appendix 1 Award MA Pathway Title International Entrepreneurship MSc International Finance Claire Moorey & Richard Monk Executive Officers Quality Assurance Division, Academic Office 16th October 2008 Quality Assurance Division Required amendments 1. Should read ‘February 2009’; 4. Should read ‘not applicable’; 5. Should read ‘MA’ until amendment to MSc is approved by the Academic Standards, Quality & Regulations Committee [c.f. Condition 2.3.1]; 8. Should read ‘On-campus - Cambridge’; 9. Should read ‘Mahmoud Al-Kilani’; 10. Should read ‘Cambridge’ until formal names for the Departments have been agreed formally; 16. Revisit the Pathway Learning Outcomes (PLOs) to encapsulate better the content, aspirations and philosophy of the pathway. Proposal Team are required to ‘engage’ with the QAA’s subject benchmark statements. If the statements are restrictive the Proposal Team is encouraged to go beyond the statements to encapsulate the pathway in its own terminology; 16. Review and enhance the learning & teaching and assessment methods and strategies as articulated currently elaborating upon the distinctive teaching style incorporating Visiting Professors and Fellows in the teaching team bringing recent industrial experience into the classroom, etc; 16. Learning outcomes are almost identical to those for the MSc International Finance. Should there not be more differentiation between the two pathways given the different focus of the individual modules? Also, a number of the learning outcomes in Section A (Knowledge and Understanding) appear more skillsbased and therefore more appropriately placed in Section B (see A2, A4 and A6 in particular) 24.1 Insert new modules’ codes once published; 26. Amend the diagram to illustrate that Research Methods for Managers in an International Context is delivered within the first few weeks of the third semester. 26. The guidelines on module selection should specify the rules on students taking an ILM. Does AIBS only allow an ILM to be taken once during an MA pathway? If so this should be clarified. Also, the Research Methods module is effectively compulsory as there is no other choice offered in Sem 3, should it therefore be classified as such in Section 24.1? 1. Should read ‘September 2009’; 4. Should read ‘not applicable’; 8. Should read ‘On-campus - Cambridge’; 9. Should read ‘Mahmoud Al-Kilani’; 10. Should read ‘Cambridge’ until formal names for the Departments have been agreed formally; 15. Review the Pathway’s aims with a view to removing the Aim 2 and in particular its explicit reference to the Chartered Financial Analyst Institute (CFA); 24.1 Insert new modules’ codes once published. Appendix 2 New or Existing Module Code New BC430006S Approved Y/N Y Conditionally New BC430007S Y Conditionally New BC415058S Y Conditionally Quality Assurance Division Module Title Required Amendments Entrepreneurship & New Venture Creation 2b. Enterprising Futures & Foresighting Small Business Management & Value Creation in Practice Should read ‘International Business & Strategy’ until the issue of recoding of modules has been resolved; 6a. Amend the typographic error in paragraph 2, sentence 2; 6a. Module description does not contain any details of the assessment methods; 6c. Consider reducing the list of texts to key texts only and detailing additional texts in the Module Guide only; 7. Consider rewriting LO 5 to enable it to be evidenced more easily for assessment; 7. Conflate LOs 1 and 2; 8 & 9. If LOs 1 and 2 are conflated amend the Learning Outcomes listed in these sections; 9 & 12. Specify only one assessment method as recommended by the LOs. 10.1 Should read ‘Semester 1 or ’ and ‘Semester 2’; 10.2 Should read ‘N’; 11. Provide greater details on the use of student managed learning hours and indicative activities. 2b. Should read ‘International Business & Strategy’ until the issue of recoding of modules has been resolved; 5. Insert ‘None’ in each row; 6a. Module description does not contain any details of the assessment methods; 6c. Insert the publisher for Fuller & Moran’s text; 6c. Consider reducing the list of texts to key texts only and detailing additional texts in the Module Guide only; 6d. Expand upon the various on-line software required; 10.1 Should read ‘Semester 1 or ’ and ‘Semester 2’; 10.2 Should read ‘N’; 10.3 Should read ‘N’; 10.4 Should read ‘N’; 10.5 Should read ‘N’; 11. Provide greater details on the use of student managed learning hours and indicative activities. 2a. Identify one Module Leader. The recommendation at the approval event was for Roger Jeynes to fulfil the role; 2b. Should read ‘International Business & Strategy’ until the issue of recoding of modules has been resolved; 6a. Amend typographic error in paragraph 2; 6a. Module description does not contain any details of the assessment methods; 6c. Consider reducing the list of texts to key texts only and detailing additional texts in Approval of MA International Entrepreneurship and MSc International Finance Appendix 2 the Module Guide only; Consider defining a reflective aspect to the assignment/portfolio; 9. Consider recalibrating the weightings of the two assessment elements to attribute greater value [in students’ minds] to group work; 10.7 Insert ‘Block teaching’; 11. Provide greater details on the use of student managed learning hours and indicative activities; 12. Include details of the word length of the group report; 12. Consider assessing the group work through a moderation process which includes peer review. This should be detailed in the Comments column; 13. Insert ‘N1 Business & Management Studies’. 2b. Should read ‘International Business & Strategy’ until the issue of recoding of modules has been resolved; 6a. Module description does not contain any details of the assessment methods; 6b. Consider providing greater detail under the broad headlines currently provided; 6c. Consider reducing the list of texts to key texts only and detailing additional texts in the Module Guide only; 8. Detail where LO4 is covered; 9. Detail where LO4 is assessed; 9 & 12. Reconcile the assessment methods; 10.1 Insert ‘or Semester 2’; 11. Provide greater details on the use of student managed learning hours and indicative activities; 13. Insert ‘N3 Financial Management’. 2a. Consider appointing a full-time member of academic staff to fulfil the role of Module Leader; 2b. Should read ‘International Business & Strategy’ until the issue of recoding of modules has been resolved; 3b. Insert ‘Standard’; 5. Insert ‘None’ in each row; 6a. Amend the typographic error in paragraph 1, sentence 2; 6a. Rewrite paragraph 2 for grammatical sense; 6a. Module description does not contain any details of the assessment methods; 6c. Consider reducing the list of texts to key texts only and detailing additional texts in the Module Guide only; 6d. Microsoft Excel is not a specialist resource and should be removed from this section; 9 & 12. Reconcile the assessment methods; 12. A 3 hour exam is notionally equivalent to 3000 words. The University maximum for a 15 credit module is 4000. Proposal teams are required to provide a rationale 9. New BC415061S Y Conditionally New BC415060S Y Conditionally Contexts of International Finance International Corporate Finance Approval of MA International Entrepreneurship and MSc International Finance New BC415059S Y Conditionally New BC415062S Y Conditionally New BC415063S Y Conditionally International Financial Markets Portfolio, Foreign Exchange & Interest Rate Management Venture Capital & Private Equity Appendix 2 where word limits which are less than 80% of this maxima are proposed; 11. Provide greater details on the use of student managed learning hours and indicative activities; 13. Should read ‘N3 Financial Management’. 2a. Consider appointing a full-time member of academic staff to fulfil the role of Module Leader; 2b. Should read ‘International Business & Strategy’ until the issue of recoding of modules has been resolved; 6a. Module description does not contain any details of the assessment methods; 6c. Consider reducing the list of texts to key texts only and detailing additional texts in the Module Guide only; 10.1 Insert ‘Semester 1 or’; 11. Provide greater details on the use of student managed learning hours and indicative activities; 12. Consider assessing the group presentation through a moderation process which includes peer review. This should be detailed in the Comments column; 13. Insert ‘N3 Financial Management’. 2b. Should read ‘International Business & Strategy’ until the issue of recoding of modules has been resolved; 6a. Module description does not contain any details of the assessment methods; 7. LOs 2 & 3 are similar. Consider conflating these; 7. LO1 is quite complex. Consider breaking this down; 8 & 9. If LOs are disaggregated and conflated respectively amend the Learning Outcomes listed in these sections; 10.1 Insert ‘Semester 1 or’; 11. Provide greater details on the use of student managed learning hours and indicative activities; 12. Provide greater detail on the content/focus of the assessment; 13. Insert ‘N3 Financial Management’. 3b. Insert ‘Standard’; 5. Insert ‘None’ in each row; 6a. Amend the typographic error in the final paragraph; 6a. Consider moving the final paragraph to the beginning of the section as a strength of the module delivery; 6a. Module description does not contain any details of the assessment methods; 6c. Consider reducing the list of texts to key texts only and detailing additional texts in the Module Guide only; 7. Rewrite LO3 to enable it to be evidenced and thus assessed; 10.1 Insert ‘Semester 1 or’; 11. Provide greater details on the use of Approval of MA International Entrepreneurship and MSc International Finance Appendix 2 13. Claire Moorey & Richard Monk Lucy Gray Executive Officers Technical Officer Quality Assurance Division, Academic Office 17th November 2008 student managed learning hours and indicative activities; Insert ‘N3 Financial Management’.